Central Bank Independence and Inflation

One of macroeconomics' key axioms is that sustained high growth rates of a nation's money stock in excess of its production of goods and services eventually produces high and rising inflation rates. This axiom was nicely phrased by Milton Friedman when he said that "inflation is always and everywhere a monetary phenomenon." Economic history is littered with countries that ran afoul of this axiom. A recent example is Zimbabwe, which saw its annual inflation rate rise from 24,411 percent in 2007 to an estimated 89.7 sextillion percent in mid-November 2008.See Hanke and Kwok. That's 89,700,000,000,000,000,000,000 percent.

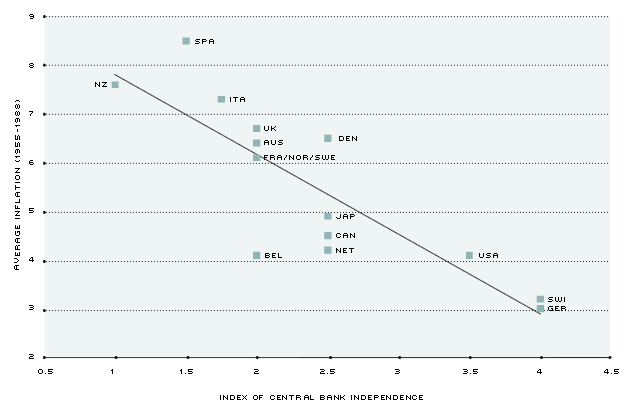

The willingness of governments to force their central banks to print excessive amounts of money, or put in place policies that lead to higher inflation rates over time, has been termed the "inflation bias" of discretionary monetary policymaking.See Walsh. To minimize this bias, many governments have decided to give their central bank legal independence (CBI). But do countries with independent central banks also have lower inflation? To answer this question properly requires a country-specific measure of central bank independence. Many economists have constructed measures of CBI from a variety of legal indicators, many of which are discussed in this essay. In a now famous article that was published in 1993, Alesina and Summers found that developed (advanced) countries with high levels of central bank independence also experienced lower average levels of inflation from 1955-1988. Figure 1 reprints the chart from their paper, which clearly shows this negative relationship.

Figure 1: Central Bank Independence versus Average Inflation

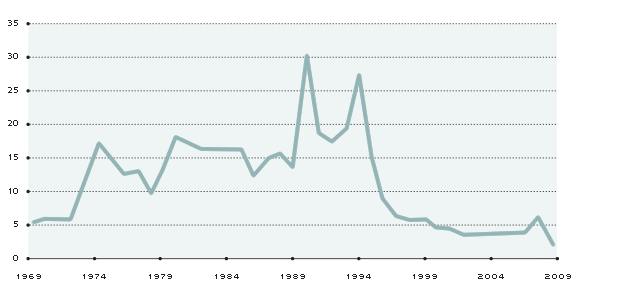

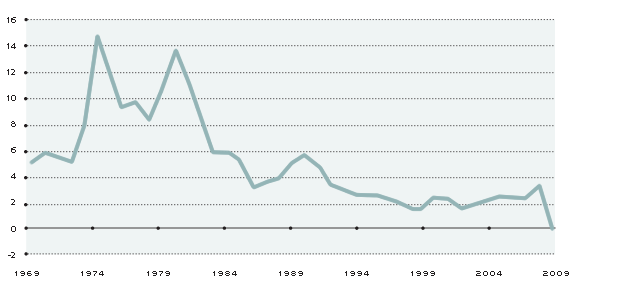

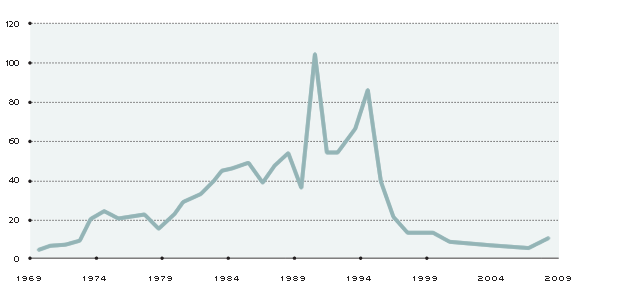

More recently, as the top chart in Figure 2 shows, global inflation has slowed sharply since the mid-1990s. However, as the bottom two charts indicate, the rapid descent in global inflation was due primarily to developments in emerging market and developing countries. In the advanced countries, the slowing occurred much earlier, in the early 1980s. There were many reasons for the global decline in inflation since the late 1980s, including stronger commitments to price stability (better monetary policies), higher rates of productivity growth and the forces of globalization that increased competition and enhanced the flexibility of labor and product markets.See Rogoff. As suggested by Alesina and Summers, increased central bank independence appears to be another key reason for the decline in inflation worldwide.

Figure 2

World CPI Inflation

CPI Inflation in the Advanced Countries

CPI Inflation in Emerging and Developing Countries

SOURCE: International Monetary Fund

As shown in the table below, there was a marked increase in central bank independence between the period 1980-89 and 2003. Although this trend was apparent among advanced countries, it was especially apparent among emerging market and developing countries.The data are published in Crowe and Meade. Indeed, many of the reforms that enhanced central bank independence occurred during the 1990s and were in response to high rates of inflation.See Cukierman. The movement toward greater central bank independence undoubtedly helps to explain the sharp slowing in inflation in many countries.

There was also an increase in CBI in advanced countries. However, the movement from weak and moderate independence to strong independence stemmed mostly from those countries that joined the European Union, and thus became members of the European Central Bank (ECB). Because of the Maastricht Treaty, the ECB is deemed to be strongly independent. Interestingly, while the trend over the past 20 years or so is toward increasing CBI, the Federal Reserve has not become more independent, according to the measure shown in the table. Still, the U.S. inflation rate has slowed markedly since the 1970s and 1980s. This suggests that CBI may be necessary but not sufficient to produce good inflation performance over time—a result that seems to hold for other advanced countries as well. However, central bank independence seems to have been much more important for helping to explain the sharp decline in inflation rates since the 1980s for emerging market and developing economies.

| Advanced Economies | Emerging & Developing Economies | |||||

|---|---|---|---|---|---|---|

| 1980-89 | 2003 | Net Change | 1980-89 | 2003 | Net Change | |

| Weak Independence | 13 | 8 | -5 | 32 | 6 | -26 |

| Moderate Independence | 8 | 5 | -3 | 19 | 49 | 30 |

| Strong Independence | 0 | 13 | 13 | 0 | 15 | 15 |

Endnotes

- See Hanke and Kwok.

- See Walsh.

- See Rogoff.

- The data are published in Crowe and Meade.

- See Cukierman.

References

Alesina, Alberto; and Summers, Lawrence H. "Central Bank Independence and Macroeconomic Performance: Some Comparative Evidence. Journal of Money, Credit, and Banking, Vol. 25, No. 2, May 1993, pp. 151-62.

Crowe, Christopher; and Meade, Ellen E. "The Evolution of Central Bank Governance around the World." Journal of Economic Perspectives, Vol. 21, No. 4, Fall 2007, pp. 69-90.

Cukierman, Alex. "Central Bank Independence and Monetary Policymaking Institutions—Past, Present and Future." European Journal of Political Economy, Vol. 24, 2008, pp. 722-36.

Hanke, Steve H.; and Kwok, Alex K.F. "On the Measurement of Zimbabwe's Hyperinflation." Cato Journal, Vol. 29, No. 2, Spring/Summer 2009, pp. 353-64.

Rogoff, Kenneth. "Globalization and Global Disinflation." Proceedings from the Federal Reserve Bank of Kansas City Economic Symposium, 2003, pp. 77-112.

Walsh, Carl E. "Central Bank Independence." The New Palgrave Dictionary of Economics. Second Edition. Eds. Steven N. Durlauf and Lawrence E. Blume. Palgrave Macmillan, 2008. The New Palgrave Dictionary of Economics Online. Palgrave Macmillan. 16 March 2010.

Part 1: The Power of Money

Governments have a great power that no one else in the economy has—the ability to print money. This power, however, brings with it a dangerous temptation.

Part 2: Central Bank Independence and Inflation

To minimize the "inflation bias" of of discretionary monetary policymaking, many governments have decided to give their central bank legal independence.

Part 3: A Series of Checks and Balances

While the Federal Reserve was created to run monetary policy, it was given a complicated system of checks and balances.

Part 4: Will the Financial Crisis Further Limit the Fed's Independence? Should It?

As part of the Fed's accountability to the public, senior Federal Reserve officials testify regularly before Congress.

Part 5: A Well-Designed Institution

Over the years, there have been changes in the Fed's structure to improve its independence, credibility, accountability and transparency.

Credits

- Christopher J. Waller, Author

- Kevin L. Kliesen, Contributor

- Steve Greene, Editor

- Brian Ebert, Designer

- Barb Passiglia, Production

- Harry Campbell, Illustrator