Job Polarization Leaves Middle-Skilled Workers Out in the Cold

The U.S. economy's slow and jobless recovery from the Great Recession has prompted a variety of explanations for the labor market's weak performance. One common argument suggests that a mismatch exists between the sectors with job openings and the sectors where unemployed workers search. As a result, vacancies go unfilled, and the unemployed do not re-enter the workforce. If sectoral mismatch is the source of the jobless recovery, then the challenge is to equip workers with skills that can help them transition to jobs in growing sectors.

Yet recent research has revealed that this sectoral mismatch hypothesis cannot explain a large fraction of the increase in unemployment.1 In a 2012 paper, economists Nir Jaimovich and Henry Siu offered an alternative explanation for the jobless recovery phenomenon. Building upon work of economist David Autor, the two economists argued that the economy's jobless recovery is due to the growing trend of "job polarization."

Employment Polarization

Autor has published various studies that document the shift in U.S. employment opportunities and wages over the past 30 years. In a 2010 paper, he showed that the economy has increased its demand for high-skilled (high-wage) workers and low-skilled (low-wage) workers, while opportunities for middle-skilled (middle-wage) jobs have declined. The shift toward this U-shaped employment distribution is known as job polarization.

To demonstrate this "hollowing out" of employment opportunities, Autor examined changes in employment shares for different occupational skill levels. He ranked occupations by their skill (wage) level2 and then observed each skill level's change in employment share3 in each of three periods from 1979-2007. His data reveal different behaviors in each of the decades. During the 1980s, occupations below the median skill level lost employment share, while occupations above the median gained share. In the 1990s, the polarization pattern began to appear: The lowest-skilled occupations slightly increased employment share, and the highest-skilled occupations increased employment share significantly; on the other hand, all of the middle-skilled occupations lost employment share. In the last period, from 1999-2007, the low-skilled end of the distribution saw even larger increases in employment share, while the middle-skilled segment again experienced share loss (albeit less than in the previous decade); the high-skilled segment saw no change. Thus, while both low-skilled and high-skilled occupations increased their employment shares over the past two decades, the middle-skilled occupations faced consistent share losses.

Routine versus Nonroutine Labor

What explains this polarization phenomenon? Why is the demand for middle-skilled labor disappearing? To answer these questions, Autor grouped middle-educated and middle-paid occupations into four major job categories: (1) sales; (2) office and administrative; (3) production, craft and repair; and (4) operators, fabricators and laborers. Although he examined a few possible forces, Autor ultimately concluded that the key contributor to the polarization trend was the automation of routine work.4 Routine tasks—which he defines as "procedural, rule-based activities"—characterize the work of many middle-skilled occupations. Whether the routine activities be manual (production, craft and repair; or operators, fabricators and laborers) or abstract/cognitive (sales, office and administrative), they have the common trait of being increasingly performed by machines or computers, goods for which prices have fallen substantially in recent years (both absolutely and relative to labor). Accordingly, the automation process has raised the relative demand for nonroutine labor.

Like routine labor, nonroutine labor can be subdivided into two categories—nonroutine cognitive activities and nonroutine manual activities. Whereas routine cognitive and routine manual tasks embody the work of middle-skilled workers, nonroutine cognitive and nonroutine manual activities characterize jobs at opposite tails of the occupational skill distribution. Nonroutine cognitive activities require workers with analytical and problem-solving skills, intuition and persuasion, and, in many cases, higher levels of education. On the other hand, nonroutine manual activities require little formal education and employ workers with skills like "situational adaptability, visual and language recognition, and in-person interactions," as well as physical ability and, in many cases, oral communication fluency. Many service occupations—such as food service, home health assistance, janitorial and security jobs—require nonroutine manual skills. Given their nonroutine nature, these tasks are often difficult to automate, and they are also difficult to outsource because they usually must be performed in person. As a result, the demand for these workers is generally high; in fact, the U.S. Bureau of Labor Statistics (BLS) projects that low-education service jobs will be a major source of U.S. employment growth through 2018.5,6

In short, the growing demand for both high-skilled and low-skilled (nonroutine) workers, combined with the displacement of routine jobs by technological automation (and, in some cases, labor offshoring), has intensified the polarization of employment opportunities in the U.S. over the past 30 years. As a result, middle-skilled (middle-wage) workers are facing fewer middle-skilled and middle-wage jobs.

Job Polarization, Recessions and Jobless Recoveries

An important point Autor made is that the Great Recession quantitatively reinforced the polarization trends, rather than reversing them. In other words, the degree of polarization across skill levels, both in terms of job growth and wage growth, was more pronounced during the Great Recession.7 Building upon Autor's point, Jaimovich and Siu explored the relationship between the Great Recession and job polarization by incorporating into their analysis a specific element of the recent recessions: the jobless nature of the recoveries.

Seeking to understand the jobless recovery phenomenon, Jaimovich and Siu examined the past six recessions and recoveries (as dated by the National Bureau of Economic Research [NBER]), plotting U.S. aggregate per capita employment centered on the troughs of the recessions. This exercise revealed a distinct change in employment behavior from the 1969-1970, 1973-1975 and 1981-1982 recessions to the 1990-1991, 2001 and 2007-2009 recessions (henceforth referenced by the trough year). For each of the recessions in the former group, aggregate employment began its recovery within six months of the recession trough. This robust recovery time, however, did not exist for the latter group. For the 1991 recession, employment did not turn around until 18 months after the recession reached its lowest point. For the 2001 recession, employment fell for 23 months after the trough before beginning to improve, and it did not return to its prerecession level before the 2009 recession began. For the 2009 recession, employment also took 23 months to turn around.8 Apparently, the jobless recovery phenomenon occurred only in recent recessions.

After studying aggregate employment recoveries for the six most recent recessions, Jaimovich and Siu examined how the employment recovery behaviors change when the employment data are plotted by occupational groups. Like Autor, they disaggregated employment into two main groups and two subgroups: routine versus nonroutine, and manual versus cognitive.9 Plotting routine, nonroutine cognitive and nonroutine manual per capita employment around the same recessions, they again observed a contrast between the employment behavior around the recessions in 1970, 1975 and 1982 and around those that occurred in 1991, 2001 and 2009. For the earlier time period's recessions, the employment of routine occupations recovered alongside employment in nonroutine jobs.10 Yet for the later time period's recessions, the recovery of employment in routine occupations was essentially nonexistent. Furthermore, although these later recessions temporarily stopped the growth in nonroutine employment, the growth trends eventually resumed.11 Jaimovich and Siu's conclusions are novel: First, job polarization is not a gradual process, but rather a phenomenon characterized by job loss in routine occupations during economic downturns;12 second, jobless recoveries are due to job polarization.13

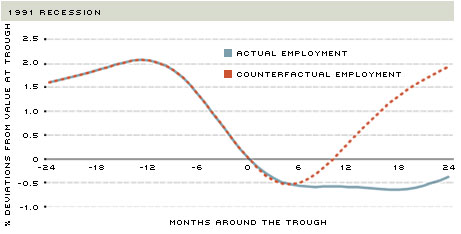

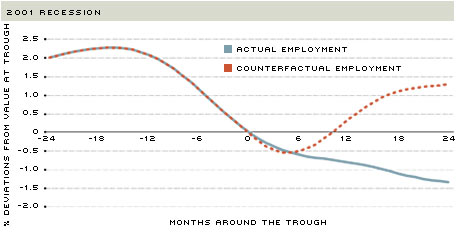

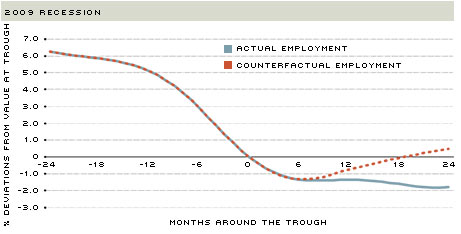

Actual and Counterfactual Employment around Recent NBER Recessions

Click to enlarge all three charts.

SOURCE: Figure constructed by authors using data from Jaimovich and Siu, p. 15.

NOTES: The blue lines show actual employment behavior around the National Bureau of Economic Research (NBER) recession troughs. The red counterfactual lines show how the aggregate employment recoveries would have occurred if routine employment had rebounded as it did during earlier recessions. Actual data from the Bureau of Labor Statistics, Current Population Survey; counterfactual data described in Jaimovich and Siu, Appendix B.

To reaffirm their conclusions, the authors constructed a counterfactual employment series that documents how the recoveries would have occurred during the most recent recessions if the routine employment had recovered as it did during the earlier recessions. The figure shows Jaimovich and Siu's two employment series for the three recent recessions. The series plot the actual and counterfactual employment percent deviations from the value at the NBER recession troughs, for 24 months preceding and 24 months following the trough. To construct the counterfactual aggregate employment series for each recession, they summed the actual employment in nonroutine occupations with their constructed routine-occupation employment.14 As the three charts demonstrate, jobless recoveries would not have been observed without the polarization of routine jobs. Specifically, the counterfactuals show that aggregate employment's recovery period during the 1991, 2001 and 2009 recessions would not have been delayed, but rather would have experienced a turning point five, five and seven months (respectively) after the troughs. Further, employment would have recovered back to the trough levels, which did not occur within 24 months of any of the recent recessions. Given this outcome, they attribute the jobless recovery to job polarization and the decline in routine employment.

Not Just a Manufacturing Phenomenon

Since jobs in the manufacturing sector are more "routine-intensive" than jobs in the economy as a whole,15 it may be tempting to think that "job polarization" and "jobless recovery" are just sophisticated terms to describe job loss in manufacturing. Yet if that were the case, the majority of the polarization (routine job loss) would be isolated to manufacturing. Instead, the manufacturing sector accounts for only 38 percent of job polarization. Accordingly, Jaimovich and Siu emphasized that job polarization is not just a shift in the sectoral composition of the economy, away from routine-intensive industries (like manufacturing) and toward nonroutine-intensive industries.16 Rather, it is a shift in the occupational composition within all industries, away from routine jobs and toward nonroutine jobs. As for the role of manufacturing in jobless recoveries, the authors showed that, due to manufacturing's small share of total employment (9 percent in 2011), eliminating jobless recoveries in manufacturing would have had little impact on the aggregate employment dynamics following the recession.17 Therefore, jobless recoveries in the aggregate cannot be attributed to the manufacturing sector.

Implications

If Jaimovich and Siu's conclusions correctly explain the labor market's recent dynamics, then what are the implications? For one, postrecession policies to stimulate labor market activity may have little effect since the jobless recovery is due to the downturn-induced disappearance of middle-skilled jobs. In addition, the long-term task of equipping American workers for the future economic environment may need to be approached from a different angle. While educational achievement is undoubtedly important as demand continues to increase for college-educated, high-skilled (and high-wage) workers, it also may be useful to emphasize development and training for nonroutine skills since they will grow ever more valuable as technology automates routine work.

Endnotes

- See Sahin, Song, Topa and Violante. [back to text]

- In his analysis, skill level is approximated by average wages in the occupation in 1980. [back to text]

- Calculated as a share of total U.S. employment. [back to text]

- In addition to investigating the role of technology-based automation, Autor also examined how international trade and offshoring, the changing roles of unions, and minimum wage legislation have each contributed to the growing job and wage polarization. Although he concludes that technology-based automation of routine work is the key contributor, Autor notes that similar observations can be made about the consequences of the international integration of labor markets through trade and offshoring. See Autor, pp. 2, 11-15. [back to text]

- See Autor, p. 12. [back to text]

- Simultaneously, downward pressure on wages is likely to result as routine (middle-skilled and middle-wage) jobs disappear and many of these workers are reallocated to lower-wage positions in nonroutine activities. [back to text]

- Qualitatively, the trends continued in the same direction. [back to text]

- A table with measures of recovery following the early and recent recessions can be found in Jaimovich and Siu, p. 6. [back to text]

- Ultimately, they report the data in three groups—nonroutine manual, nonroutine cognitive and routine—because the results are consistent within both of the routine subgroups. See Jaimovich and Siu, p. 8. [back to text]

- Nonroutine manual employment did not recover in the 1970 recession. [back to text]

- For figures on employment by occupational group, 1967-2011, see Jaimovich and Siu, p. 10. [back to text]

- In other words, job polarization is a business cycle phenomenon. See Jaimovich and Siu, pp. 9-11, 14, 31. [back to text]

- Specifically, they state that "jobless recoveries are evident in only the three most recent recessions and they are observed only in routine occupations. In this occupational group, employment never recovers—in the short-, medium- or long-term. These occupations are disappearing. In this sense, the jobless recovery phenomenon is due to job polarization." See Jaimovich and Siu, p. 14. [back to text]

- The counterfactual employment in routine occupations is the average response in routine occupations following the troughs of the 1970, 1975 and 1982 recessions. They follow the time pattern of the early recessions and match the magnitude of the fall in employment after each recession. See Jaimovich and Siu, p. 14. [back to text]

- See Jaimovich and Siu, p. 16 and footnote 10. [back to text]

- See Jaimovich and Siu, footnote 11. [back to text]

- Jaimovich and Siu constructed a counterfactual to demonstrate that if manufacturing in the most recent recessions had recovered as it had (on average) in earlier recessions, the aggregate recovery would not have been improved. See pp. 16-18. [back to text]

References

Autor, David. "The Polarization of Job Opportunities in the U.S. Labor Market." The Hamilton Project and The Center for American Progress, April 2010, pp. 1-40.

Jaimovich, Nir; and Siu, Henry E. "The Trend Is the Cycle: Job Polarization and Jobless Recoveries." NBER Working Paper No. 18334, National Bureau of Economic Research, August 2012, pp. 1-36.

Sahin, Aysegül; Song, Joseph; Topa, Giorgio; and Violante, Giovanni L. "Mismatch Unemployment." Working paper, Federal Reserve Bank of New York, September 2012, pp. 1-76.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us