Banking Crises around the World: Different Governments, Different Responses

The latest U.S. financial crisis is one of many in the recent economic history of both advanced and emerging economies. Each crisis is somewhat unique and is triggered by different processes and events. However, some common elements can be identified in the way different governments intervene to help financial sectors return to health and to soften the economy-wide impact of the crisis.

Central banks tend to adopt measures that provide liquidity to the system and that can be considered as part of a broader mandate to carry out monetary policy. In contrast, governments and parliaments tend to design and implement programs that provide more direct support to specific industries and occasionally to specific institutions; these programs are more properly associated with fiscal policy intervention. This article will focus on the latter: direct support to commercial banks, shadow banks and savings institutions. The article will compare the United States' Capital Purchase Program (part of the Troubled Asset Relief Program) with capital-injection programs enacted by other countries around the world during banking crises.

Most of these programs are often justified politically by the objective of preventing or reducing lending declines and recapitalizing financial institutions, with the ultimate goal of alleviating strains in financial markets and restoring their functioning. But instead of providing general liquidity to the financial system, they target specific financial institutions. Perhaps this is one of the reasons why—even when they are necessary and eventually prove useful—they frequently face vocal opposition from the public. Taxpayers worry that the costs of the support programs may outweigh their benefits and may eventually lead to higher taxes. Economists worry that government intervention may plant the seed of future crisis by exacerbating moral hazard problems.1

It is fair to say that there is no consensus among economists and policymakers on

the optimal resolution mechanisms of banking crises.

How To Define a Banking Crisis

Thanks to its expertise in monitoring and analyzing a large number of countries, the International Monetary Fund (IMF) is particularly well-positioned to collect, study and disseminate information about banking crises in a comparative perspective. IMF economists Luc Laeven and Fabian Valencia analyzed crises between 1970 and 2007 among a large set of countries, and much of what follows derives from their work.

Banking crises can occur either independently or concurrently with a currency crisis (a so-called twin crisis) or with a sovereign debt crisis, or both.

How are these crises defined? In a systemic banking crisis, a country's financial and banking industry experiences a significant number of defaults while financial entities face vast problems fulfilling financial contracts on time. As a consequence, a country experiences a large increase in nonperforming loans, and a large part of the capital in the banking system is reduced. Sometimes, these events follow a fall in asset prices (for example, in the real estate market) and sometimes overlap with runs on banks, but in order to be defined as "systemic," such crises must involve a large number of institutions or cover a large portion of the banking system. Sweden and Latvia experienced such crises in the 1990s. (A more detailed account of the mechanisms involved is provided later in this article.)

A currency crisis is often defined as a situation in which a country experiences a nominal depreciation of its currency of at least 30 percent, while at the same time the rate of depreciation increases by at least 10 percent compared with one year earlier. The collapse of the Thai baht during the Asian Crisis of 1997-98 is a prime example of a large currency crisis: The currency had depreciated by more than 30 percent less than two months after the fixed exchange rate was abandoned in the summer of 1997.

In a sovereign debt crisis, a government fails to pay its own debt, either in part or in full. For example, in 1998 Russia defaulted on its Soviet-era debt and began restructuring the components of its sovereign debt. Notice that at least partial default is required to meet the definition of "sovereign debt crisis" used by the IMF. That means the current difficulties experienced by some European countries would not qualify as a "sovereign debt crisis."

During the recent financial crisis, no twin or triple crisis (as just defined) has occurred so far. Some European countries have experienced difficulties in managing and refinancing their debt, but so far none has defaulted.

Many countries have experienced combinations of these types of crises in recent history. Economists Laeven and Valencia identified 124 systemic banking crises, 208 currency crises and 63 sovereign debt crises; the two economists observed that some countries were repeatedly affected by these events between 1970 and 2007. One such country is Argentina. Its prosperity rivaled that of the United States in the beginning of the 20th century. Yet in the past 30 years, Argentina has experienced four banking crises (1980, 1989, 1995 and 2001). All but the 1995 crisis were also currency crises, and one (2001) was contemporaneous to a sovereign debt crisis.

Argentina is not an isolated case. The IMF study identifies 26 twin crises (banking and currency) and eight triple crises. Overall, banking and currency crises were more frequent in the 1990s, while sovereign debt crises were more frequent in the 1980s.

The recent global financial crisis witnessed many countries experiencing banking crises. After 2007, there were 13 cases of systemic banking crises in which all countries experienced extensive liquidity support, increases in guarantees on liabilities and significant nationalizations. In some cases, the countries also experienced significant asset purchases (as in the United Kingdom and United States) and sizable restructuring costs.2 During the same period, a smaller group of 10 countries experienced serious problems in its banking sectors that entailed extensive liquidity support and increases in guarantees on liabilities; in these 10 countries, there was only one case of asset purchases (Switzerland) and there were no cases of significant nationalization.3

Luckily, none of these countries has experienced either a currency crisis or a sovereign debt default since 2007.

Options for Direct Support in Banking Crises

Commonly adopted resolution policies include various types of large-scale government intervention, such as bank closures, nationalizations, mergers, sales to foreigners, the creation of a bank restructuring agency and/or an asset-management company, and recapitalization. Sometimes, these actions are accompanied by forbearance that allows the suspension or reduction of loan payments under certain circumstances and for specified lengths of time; sometimes, changes in loan classification and loan-loss provisioning are also allowed.

Often, direct government support to ailing financial institutions takes the form of recapitalization, a process in which the amount of debt and assets of a particular entity are reorganized in order to meet a financial goal. The goal may be an attempt to limit the amount of tax owed on assets in hand or, as part of a reorganization, to avoid bankruptcy.

Financial institutions can be recapitalized using a variety of measures: cash transfer, government bonds, issuance of subordinated debt, issuance of preferred shares, government purchase of bad loans, assumption of bank liabilities or the purchase of ordinary shares by the government.

Governments intervened with some form of recapitalization or capital injection in 32 of the 42 banking crises identified by the IMF economists between 1970 and 2007 for which detailed comparable information could be gathered. Recovery programs during the global financial and banking crisis of 2007-09 were no different: 16 countries opted for outright recapitalization, with some combining a wide variety of asset guarantees and liquidity programs similar to some of the programs implemented in the United States.

A Sample of Past Crises Abroad

Sweden

Various economic policies adopted by Sweden in the 1970s and 1980s encouraged

a sizable credit and real estate boom, in which house prices more than doubled between 1981 and 1991. At the same time, the economy was becoming much more exposed to exchange rate risk.

Because of Sweden's exchange rate tie with Germany, when interest rates in Germany increased in 1990 as a result of unification, Sweden's interest rates also experienced a rapid increase. This tipped Sweden's economy into crisis. Real estate prices dropped dramatically, with commercial real estate prices dropping 42 percent in five years and nonperforming loans increasing to as high as 11 percent of GDP in 1993.4

Sweden's largest banks were unable to meet capital requirements and required assistance from the state. Instead of maintaining private large banks and injecting capital through a direct support program, the Swedish government nationalized two of Sweden's largest banks and supported a third by providing it with a loan guarantee. The ownership of these banks allowed the government to provide equity to ailing borrowers and restructure defaulting companies. Liquidating bad assets took the government less than six years and ended up costing Sweden less than 2 percent of its GDP (with some estimates close to zero).

Latvia

In 1991, Latvia gained independence from the Soviet Union and transitioned from a centrally planned economy to a market economy. Within four years of its independence, Latvia had more than 60 licensed banks for a population of 2.3 million.5 As government policy established the right for any person or entity to establish a bank, the motivation for founding a bank quickly became the ability to access cheaper funding rather than go through more-established channels. These private banks continued to grow with little supervision from the Central Bank of Latvia and, as a result, much bad lending took place.

The precipitating factor of the crisis occurred in early 1995 when the Central Bank of Latvia requested that all banks present their audited financial statements. The largest Latvian bank in terms of assets and deposits—Bank Baltija—failed to present its statements, revealing its potential insolvency. The central bank took control of Bank Baltija in July 1995, and a liquidator took control in 1996. Other mid-size and smaller banks also faced difficulties during this time, and several were categorized as insolvent. About 40 percent of the banking system's assets and liabilities were impacted.6

During the transition period, nonperforming loans increased throughout the banking sector as banks granted loans even to high-risk borrowers, and collections were made difficult by a lack of laws governing loan collateral. However, a swift stabilization policy helped restore viability to the banking system with the liquidation of certain banks, foreign help from the European Bank for Reconstruction and Development, and a new banking law strengthening the central bank's regulatory powers. The country also established a deposit insurance system, and the government decided to refund lost deposits to depositors up to a certain amount and conditioned on the existence of proceeds from the bank liquidation process.

Argentina

Argentina has experienced four banking crises since the 1980s, with one triple crisis in 2001. During the 1990s, the government transformed the banking sector through privatization and consolidation and allowed for increased entry by foreign institutions, all of which improved the banking system's efficiency. However, bank profitability remained low, and more than 20 percent of total assets in 2000 were represented by government debt, which left banks vulnerable in the case of government default.7

The triple crisis broke in 2001 when, out of fear from the deteriorating economic climate, people rushed to withdraw their pesos from the banks in order to convert them into dollars and ship them abroad. The already ailing banks were further devastated when the government defaulted on its debt in December 2001.

As a result of the financial distress, the country was forced to exit its currency board regime, a convertibility program that tied the peso to the dollar at parity. At the same time, the government responded to the bank runs by restricting withdrawals, essentially freezing all accounts. In addition, private deposits and credit to the private sector declined dramatically, which further weakened the ailing economy. The resolution of the banking crisis was part of a larger set of policies that had to deal with the economy-wide crisis. The government ended the currency board regime in early 2002 (allowing a massive devaluation of the peso) and eventually restructured its debt.

Besides freezing bank accounts, the government intervention took several additional forms, including converting dollar-denominated loans and deposits from dollars to pesos at different rates, authorizing regulatory forbearance and a temporary decrease in banks' capital, and nationalizing three banks and closing another.

The U.S. Experience

In the United States, the main instrument of direct support to banks by the U.S. Treasury is within the Troubled Asset Relief Program. TARP was established at the peak of the crisis in the fall of 2008, a bit more than one year after the initial problems in the financial system had emerged. For the first year of the crisis (which began in August 2007), there were no significant legislative changes, perhaps because the risk of a major crisis seemed minimal or because sufficient institutional flexibility seemed to guarantee the ability to intervene with existing instruments.

However, the existing toolkit of support programs was substantially expanded soon enough. By October 2008, in the midst of the panic that ensued after the failure of Lehman Bros., the Treasury proposed to Congress the idea of purchasing troubled assets to stabilize the financial system, through TARP, an essential component of the Emergency Economic Stabilization Act. Within a week of approving the legislation, the core support was refocused toward buying equity in financial institutions, using a new instrument of support, the Capital Purchase Program (CPP), which fell under the big umbrella provided by TARP. Within weeks, nine major banks received a capital injection of $145 billion, and the idea of purchasing troubled assets was temporarily set aside in favor of buying equity.

In November 2008, one of the beneficiaries of the CPP, Citigroup, received a second round of government assistance, under another program of the TARP, and in January 2009, Bank of America also was given additional government support. The new administration defined a set of criteria for "stress tests" aimed at determining the capital adequacy of the largest banks and presented a new program aimed at purchasing assets (the Public-Private Investment Program), which makes up a small percentage of TARP funds.

Similar to other countries, U.S. authorities adopted a complex strategy to support the economy during the financial crisis; almost all of the policy options deployed in the U.S. were attempted in Japan during the 1990-2003 period.8

TARP-CPP Disbursement

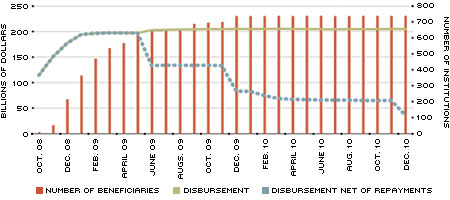

SOURCE: Authors' own calculation based on data from the Treasury's transaction reports. The Capital Purchase Program (CPP) fell under the umbrella of the Troubled Asset Relief Program (TARP).

TARP eventually included 13 programs implemented by the U.S. Treasury. The Treasury allocated $250 billion for CPP, which represents a large part of the total allocation of government funds under TARP ($700 billion). Of the $250 billion allocated, approximately $205 billion was distributed to 707 institutions, largely toward the end of 2008 and the beginning of 2009, with the last disbursements occurring Dec. 29, 2009. Figure 1 plots the monthly number of beneficiaries (red bar), the total amount of gross disbursements (gold line) and the value of outstanding disbursements (gross payment net of repayment, blue dots) until the end of 2010. It should be noted that some financial institutions—Citigroup, Bank of America, GMAC and Chrysler Financial—were supported with other TARP programs, as well.

The pool of eligible institutions that could apply for CPP funds included more than 8,000 commercial banks, savings and loan institutions, and some other financial intermediaries. However, only qualified financial institutions, those deemed strong enough to survive the crisis, were considered for direct support. As later events showed, very few of the CPP beneficiaries failed in the period between 2008 and 2010.9

The application process for the CPP involved several stages, which involved consultations with primary regulators, analysis of their regulatory ratings and final approval by the Treasury. Investment amounts initially varied from 1 percent to 3 percent of the institution's risk-weighted assets (up to a maximum of $25 billion).

After May 2009, some financial institutions volunteered to return their capital injections earlier than expected. The position of repayments is clear in Figure 1. By the end of 2010, only one-fifth of the original pledged funds had yet to be returned by the beneficiaries.

Comparing U.S., Other Countries

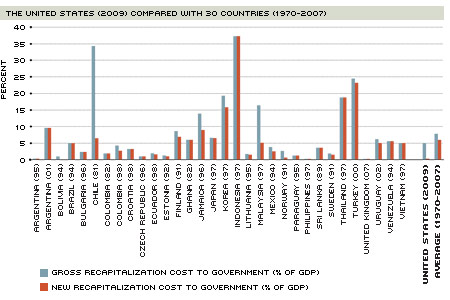

In the 42 aforementioned banking crises between 1970 and 2007, the estimated cost of direct support recapitalization varies substantially, with gross costs (not accounting for repayments) ranging from an estimated 0.28 percent of GDP in Argentina during the 1995 crisis to 37 percent in Indonesia during the 1997-98 crisis.

Initial estimates for the 2007-09 financial crises, available in another study by economists Laeven and Valencia, place gross disbursements of fiscal outlays in a range between 0.7 percent of GDP (Sweden) to 13 percent of GDP (Iceland). As some of these crises are still unfolding, it is possible that these figures will be revised upward in the future.10

The study also provides interesting details about the median costs of a banking crisis to governments. While pre-2007 crises entailed a smaller median fiscal cost in advanced economies relative to emerging markets (3.7 percent of GDP compared with 11.5 percent of GDP), they also increased the ratio of public debt to GDP more in advanced economies (36.2 percent versus 12.7 percent of GDP). Output losses—the percentage deviation of actual output from its trend—associated to crises in advanced economies were also larger than in emerging economies (32.9 percent of GDP versus 29.4 percent of GDP), although output losses are notoriously difficult to measure.

The gross direct fiscal cost of financial sector restructuring during the recent financial crisis has been estimated at roughly 5 percent of GDP for the U.S. (counting the $700 billion that was the total budget for TARP), close to the median across advanced countries that implemented similar programs during this crisis. While countries like the Netherlands and Iceland had sizable direct fiscal costs (reaching between 12 and 13 percent of GDP), some other advanced economies had substantially smaller outlays because they had fewer troubles in their banking systems. France, Germany and Sweden, for example, had direct fiscal costs of less than 2 percent of their GDP. If only the CPP were considered for the U.S., the ratio for the U.S. would fall to approximately 1.4 percent of 2009 GDP.

A more-informative measure of the cost of direct support programs looks at the net costs, calculated as the difference between the amount of funds disbursed and those repaid to the government. The median net cost across 42 banking crises between 1970 and 2007 was 3.4 percent of GDP. Its distribution across some of these countries for which data are available is plotted in Figure 2. In the U.S., in the unlikely case that no more funds are returned, the net cost of the CPP will remain at most 0.266 percent of 2009 GDP, substantially lower than in previous banking crises.11

Governments' Gross and Net Costs of Restructuring the Financial Sector

SOURCE: Authors' own calculation based on data from the Treasury's transaction reports. The Capital Purchase Program (CPP) fell under the umbrella of the Troubled Asset Relief Program (TARP).

Compared with Japan (the only other large economy that has experienced a widespread banking crisis following a housing crisis), the United States appears to be transitioning out of the crisis relatively quickly. Although the U.S. has had more bank failures (mostly small institutions), banks have more swiftly repaid the majority of their CPP funds than have banks in Japan and other countries affected by banking crises.

Endnotes

- Moral hazard is when an individual or a company does not entirely bear the consequences of its decisions and, therefore, acts less carefully than it otherwise would, leaving another party (e.g., the government) to bear part or all of the cost of the effects of those decisions [back to text].

- The 13 countries are Austria, Belgium, Denmark, Germany, Iceland, Ireland, Latvia, Luxembourg, Mongolia, Netherlands, Ukraine, United Kingdom and the United States. [back to text]

- The 10 countries are France, Greece, Hungary, Kazakhstan, Portugal, Russia, Slovenia, Spain, Sweden and Switzerland. [back to text]

- See Ergungor. [back to text]

- See Bank of Latvia. [back to text]

- See Fleming and Talley. [back to text]

- See IMF. [back to text]

- See Hoshi and Kashyap. [back to text]

- See Aubuchon and Wheelock. [back to text]

- See the 2010 study by Laeven and Valencia [back to text].

- This figure is computed using the 1-4-11 Transaction Report for the period ending

Dec. 31, 2010, which we accessed on Jan. 18, 2011. The report computes the total purchase amount ($204.9 billion), the total repaid ($167.9 billion), the losses ($2.6 billion) and the total outstanding CPP investment ($34.4 billion). [back to text]

References

Aubuchon, Craig P.; and Wheelock, David C. "The Geographic Distribution and Characteristics of U.S. Bank Failures, 2007-2010: Do Bank Failures Still Reflect Local Economic Conditions?" Federal Reserve Bank of St. Louis Review, September-October 2010, Vol. 92, No. 5, pp. 395-415.

Bank of Latvia. "Origins of the Banking Crisis." The Annual Report. 1995. See www.bank.lv/images/stories/pielikumi/publikacijas/gp/LB_AR_1995-eng.pdf

Congressional Oversight Panel. April Oversight Report, April 2009.

Contessi, Silvio; and Francis, Johanna. "TARP Beneficiaries and Their Lending Patterns during the Financial Crisis." Federal Reserve Bank of St. Louis Review, March/April 2011, Vol. 93, No. 2, pp. 105-25.

Ergungor, O. Emre. "On the Resolution of Financial Crises: The Swedish Experience." Federal Reserve Bank of Cleveland Policy Discussion Papers, No. 21, June 2007.

Fleming, Alex; and Talley, Samuel. "Latvian Banking Crisis: Stakes and Mistakes." The World Bank Beyond Transition, 2001.

Hoshi, Takeo; Kashyap, Anil K. "Will the U.S. Bank Recapitalization Succeed? Eight Lessons from Japan." Journal of Financial Economics, September 2010, Vol. 97, No. 3, pp. 398-417.

International Monetary Fund. "Lessons from the Crisis in Argentina." Oct. 8, 2003. See www.imf.org/external/np/pdr/lessons/100803.pdf

Laeven, Luc; and Valencia, Fabian. "Systemic Banking Crises: A New Database." International Monetary Fund (IMF) Working Paper 08/224, November 2008.

Laeven, Luc; and Valencia, Fabian. "Resolution of Banking Crises: The Good, the Bad, and the Ugly." International Monetary Fund (IMF) Working Paper 10/146, June 2010.

Office of the Special Inspector General for the Troubled Asset Relief Program. Quarterly Report to Congress, Jan. 26, 2011.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us