Shipping Prices and Import Price Inflation

Abstract

During the pandemic, there have been unprecedented increases in the cost of shipping goods accompanied by delays and backlogs at the ports. At the same time, import price inflation has reached levels unseen since the early 1980s. This has led many to speculate that the two trends are linked. In this article, we use new data on the price of shipping goods between countries to analyze the extent to which increases in the price of shipping can account for the rise in U.S. import price inflation. We find that the pass-through of shipping costs is small. Nevertheless, because the rise in shipping prices has been so extreme, it can account for between 3.60 and 5.87 percentage points per year of the increase in import price inflation during the post-pandemic period.

Introduction

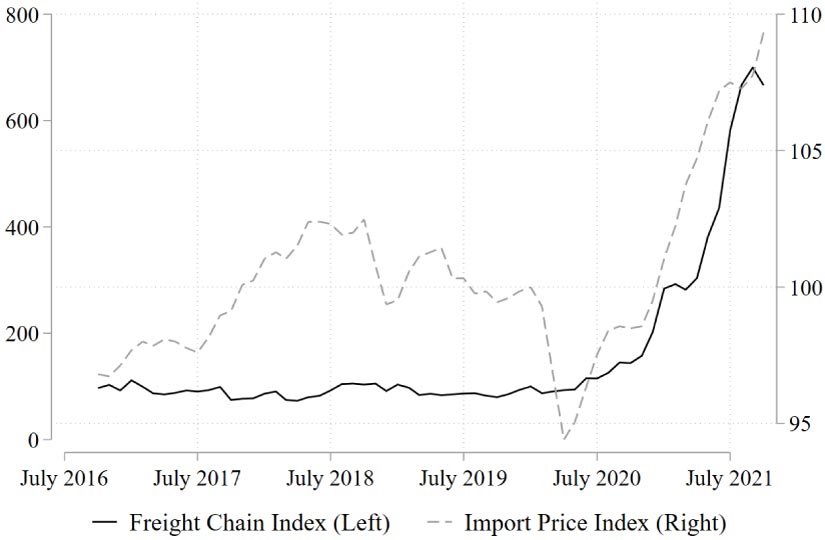

After the first months of the pandemic passed and the economy began to reopen, two things became central to the national discussion—supply chain disruptions and price increases. The supply chain disruptions took many forms, from delays and backlogs at ports (Smialek and Nelson, 2021) to low inventory in key sectors (Leibovici and Dunn, 2021). The 2022 Economic Report of the President featured a chapter on supply chains, stating that "[t]hese highly publicized disruptions and product shortages made the public painfully aware of the many steps involved in getting a product produced, transported, and placed on shelves or doorsteps" (Economic report of the president, April, 2022). Supply chain issues can be seen in the stark increase in the price of shipping goods by sea between countries (Figure 1), which increased almost sevenfold during the pandemic. Meanwhile, the U.S. has experienced some of the highest annual rates of inflation since the 1980s.

Figure 1: Freight Price Index and Import Price Index

NOTE: The figure above displays two chain indexes with January of 2020 as the base month. The solid line, graphed on the left axis, displays the price of freight shipping, and the dotted line, graphed on the right axis, displays the import prices over time.

Figure 1 shows the sharp increase in import prices, as measured by an import price chain index from the Bureau of Labor Statistics (BLS), and the sharp increase in shipping costs, measured with the Freightos-Baltic Freight Chain Index. The simultaneous increase in the price of shipping goods and import prices has led to speculation that the two issues are linked. Pete Buttigieg, secretary of transportation, noted in late 2021 that "[t]here's no question that when you have a scarcity of access to shipping, you're going to see upward pressure on prices, and that's going to be part of our challenge when it comes to inflation" (Swanson, 2022).

In this article, we examine the relationship between shipping costs and prices. The main exercise is an examination of the pass-through of shipping costs to import price inflation using variation across products in exposure to shipping price increases. Our analysis proceeds in two steps. We first create a commodity-level measure of exposure to the increase in shipping prices. To do so, we leverage a new dataset on the cost of shipping goods by sea between the U.S. and its trade partners. We merge the shipping prices with data from the United Nations Commodity Trade Statistics Database (Comtrade), which gives the share of a commodity imported from each partner country. Then, for each commodity, we average shipping price growth across trade partners, weighted by the import share of each trade partner. As a second step, we merge our commodity-level measure of shipping prices with commodity-level import price data from the BLS. Finally, we use our dataset to examine the relationship between import price inflation and our measure of exposure to the increase in shipping prices.

In general, we find a modest amount of pass-through from shipping price growth to import price inflation. After the pandemic, we estimate that a 1-percentage-point increase in shipping price growth leads to an increase in import price inflation of 0.0684 percentage points. While this is a fairly modest number, the increase in shipping prices has been so extreme during the pandemic that the implications for import price inflation are large. On average, shipping price growth increased by 86 percent during the pandemic, which implies an increase in import price inflation of 5.87 percentage points per year.

We then look at the heterogeneity of this pass-through over time and across commodity types. We find a more significant pass-through after 2020 and for product types that ship a higher share of goods by sea than other types of transportation as well as for products with a higher ratio of the cost of shipping by sea to the cost of the good. We also find more pass-through in food and materials goods as opposed to consumer goods and in machines, electronics, and parts. This pattern seems to suggest that whether the type of good is perishable and whether it is an intermediate good versus final good might matter for the pass-through.

Finally, we use our estimates of the pass-through from shipping costs to import prices to create an upper and lower bound on the impact on inflation. We find that the rise in shipping costs during the pandemic can account for between 68 and 111 percent of the increase in import price inflation and 15 and 25 percent of the increase in the producer price index (PPI). The lower impact on PPI is because of the modest impact that import prices have on domestic inflation, as found by Amiti, Heise, Wang, et al. (2021) and Amiti, Redding, and Weinstein (2019). We conclude that while the disruptions in the shipping industry played a large role in import price inflation, other factors such as demand shocks (Guerrieri et al. (2021)), fiscal stimulus (Soyres, Santacreu, and Young (2022)), and other supply shocks (Leibovici and Dunn (2021) and LaBelle and Santacreu (2022)) are necessary to generate the extreme rise in domestic prices.

The literature on the relationship between supply chain disruptions and inflation is small but growing. The theoretical literature shows that trade fluctuations and supply chain disruptions will impact U.S. inflation with important implications for monetary policy. Leibovici and Santacreu (2015) develop a small open economy model with trade and find that policymakers should take trade fluctuations into account when developing monetary policy. Wei and Xie, 2020 find that as supply chain complexity increases over time, monetary policy targeting PPI inflation yields lower welfare losses than monetary policy targeting CPI inflation. Finally, Comin and Johnson (2021), using a New Keynesian model with a small open economy, find that firm-level constraints (e.g., temporary capacity limits for foreign firms) increase import price inflation.

In the empirical strand of the literature, several papers attempt to measure the pass-through from supply chain disruptions to prices. LaBelle and Santacreu, 2022 find that exposure to foreign shocks through global value chains has a negative and significant effect on output and employment—increasing month-over-month backlogs by 1 percent increases the industry inflation rate by 0.24 percentage points, while the same increase for delivery times causes an increase of about 0.26 percentage points. In their report from November 2021, Amiti, Heise, Wang, et al. (2021) find that a 10 percent increase in import prices leads to a 2.6 percent increase in PPI post-COVID versus a 1 percent increase pre-COVID. Finally, using their Global Supply Chain Pressure Index (GSCPI), which combines information on maritime and air freight costs with country-level manufacturing, Abbai et al. (2022) find that there is a correlation between the GSCPI and different international consumer price indexes and PPI. We build on this work by using a novel dataset of shipping prices by source country to build commodity-specific measures of exposure to the increase in shipping costs.

Citation

Maggie Isaacson and Hannah Rubinton,

ldquoShipping Prices and Import Price Inflation,rdquo

Federal Reserve Bank of St. Louis

Review,

Second Quarter 2023, pp. 89-107.

https://doi.org/10.20955/r.105.89-107

Editors in Chief

Michael Owyang and Juan Sanchez

This journal of scholarly research delves into monetary policy, macroeconomics, and more. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System. View the full archive (pre-2018).

Email Us