Decentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets

Abstract

The term decentralized finance (DeFi) refers to an alternative financial infrastructure built on top of the Ethereum blockchain. DeFi uses smart contracts to create protocols that replicate existing financial services in a more open, interoperable, and transparent way. This article highlights opportunities and potential risks of the DeFi ecosystem. I propose a multi-layered framework to analyze the implicit architecture and the various DeFi building blocks, including token standards, decentralized exchanges, decentralized debt markets, blockchain derivatives, and on-chain asset management protocols. I conclude that DeFi still is a niche market with certain risks but that it also has interesting properties in terms of efficiency, transparency, accessibility, and composability. As such, DeFi may potentially contribute to a more robust and transparent financial infrastructure.

Introduction

Decentralized finance (DeFi) is a blockchain-based financial infrastructure that has recently gained a lot of traction. The term generally refers to an open, permissionless, and highly interoperable protocol stack built on public smart contract platforms, such as the Ethereum blockchain (see Buterin, 2013). It replicates existing financial services in a more open and transparent way. In particular, DeFi does not rely on intermediaries and centralized institutions. Instead, it is based on open protocols and decentralized applications (DApps). Agreements are enforced by code, transactions are executed in a secure and verifiable way, and legitimate state changes persist on a public blockchain. Thus, this architecture can create an immutable and highly interoperable financial system with unprecedented transparency, equal access rights, and little need for custodians, central clearing houses, or escrow services, as most of these roles can be assumed by "smart contracts."

DeFi already offers a wide variety of applications. For example, one can buy U.S. dollar (USD)-pegged assets (so-called stablecoins) on decentralized exchanges, move these assets to an equally decentralized lending platform to earn interest, and subsequently add the interest-bearing instruments to a decentralized liquidity pool or an on-chain investment fund.

The backbone of all DeFi protocols and applications is smart contracts. Smart contracts generally refer to small applications stored on a blockchain and executed in parallel by a large set of validators. In the context of public blockchains, the network is designed so that each participant can be involved in and verify the correct execution of any operation. As a result, smart contracts are somewhat inefficient compared with traditional centralized computing. However, their advantage is a high level of security: Smart contracts will always be executed as specified and allow anyone to verify the resulting state changes independently. When implemented securely, smart contracts are highly transparent and minimize the risk of manipulation and arbitrary intervention.

To understand the novelty of smart contracts, we first must look at regular server-based web applications. When a user interacts with such an application, they cannot observe the application's internal logic. Moreover, the user is not in control of the execution environment. Either one (or both) could be manipulated. As a result, the user has to trust the application service provider. Smart contracts mitigate both problems and ensure that an application runs as expected. The contract code is stored on the underlying blockchain and can therefore be publicly scrutinized. The contract's behavior is deterministic, and function calls (in the form of transactions) are processed by thousands of network participants in parallel, ensuring the execution's legitimacy. When the execution leads to state changes, for example, the change of account balances, these changes are subject to the blockchain network's consensus rules and will be reflected in and protected by the blockchain's state tree.

Smart contracts have access to a rich instruction set and are therefore quite flexible. Additionally, they can store cryptoassets and thereby assume the role of a custodian, with entirely customizable criteria for how, when, and to whom these assets can be released. This allows for a large variety of novel applications and flourishing ecosystems.

The original concept of a smart contract was coined by Szabo (1994). Szabo (1997) used the example of a vending machine to describe the idea further and argued that many agreements could be "embedded in the hardware and software we deal with, in such a way as to make a breach of contract expensive…for the breacher." Buterin (2013) proposed a decentralized blockchain-based smart contract platform to solve any trust issues regarding the execution environment and to enable secure global states. Additionally, this platform allows the contracts to interact with and build on top of each other (composability). The concept was further formalized by Wood (2015) and implemented under the name Ethereum. Although there are many alternatives, Ethereum is the largest smart contract platform in terms of market cap, available applications, and development activity.

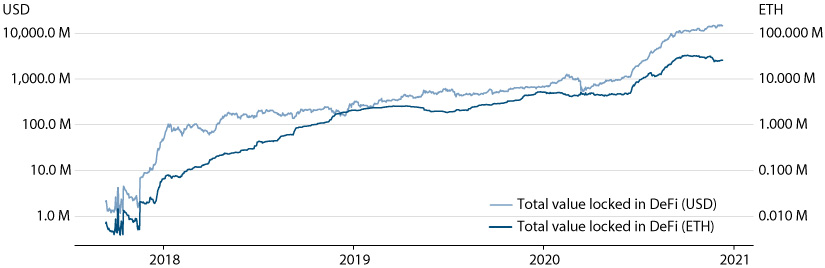

DeFi still is a niche market with relatively low volumes—however, these numbers are growing rapidly. The value of funds that are locked in DeFi-related smart contracts recently crossed 10 billion USD. It is essential to understand that these are not transaction volume or market cap numbers; the value refers to reserves locked in smart contracts for use in various ways that will be explained in the course of this paper. Figure 1 shows the Ether (ETH, the native cryptoasset of Ethereum) and USD values of the assets locked in DeFi applications.

Figure 1: Total Value Locked in DeFi Contracts (USD and ETH)

NOTE: M, million.

SOURCE: DeFi Pulse.

The spectacular growth of these assets alongside some truly innovative protocols suggests that DeFi may become relevant in a much broader context and has sparked interest among policymakers, researchers, and financial institutions. This article is targeted at individuals from these organizations with an economics or legal background and serves as a survey and an introduction to the topic. In particular, it identifies opportunities and risks and should be seen as a foundation for further research.

Citation

Fabian Schär,

ldquoDecentralized Finance: On Blockchain- and Smart Contract-Based Financial Markets,rdquo

Federal Reserve Bank of St. Louis

Review,

Second Quarter 2021, pp. 153-74.

https://doi.org/10.20955/r.103.153-74

Editors in Chief

Michael Owyang and Juan Sanchez

This journal of scholarly research delves into monetary policy, macroeconomics, and more. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System. View the full archive (pre-2018).

Email Us