Higher-Than-Expected Inflation, Delta Variant Could Slow Real GDP Growth

KEY TAKEAWAYS

- The country’s current economic expansion has been characterized by rapid growth, solid job gains and falling unemployment.

- Rising price pressures are a cause for concern, although monetary policymakers still consider them to be temporary.

- If inflation expectations continue to rise or the COVID-19 Delta variant’s effects worsen, policymakers might need to change tactics.

On July 19, 2021, the National Bureau of Economic Research (NBER) Business Cycle Dating Committee announced that the U.S. recession, which began in February 2020, ended in April 2020. This recession was not only the deepest in U.S. history, but also the shortest.

Over the second half of 2020 and into the first quarter of 2021, the economy recovered at a brisk pace, once the severe business disruptions stemming from the COVID-19 pandemic began to ease. However, the supply of labor and many material inputs lagged the strong demand for goods and services. As a result, price pressures began to build.

A little more than a week after the NBER announcement, the Bureau of Economic Analysis reported that real gross domestic product (GDP) finally surpassed its pre-pandemic peak in the second quarter of 2021; the peak occurred in the fourth quarter of 2019.

In business cycle analysis, the transition from economic recovery to economic expansion occurs when real GDP surpasses its previous peak. The start of the business expansion in the second quarter of 2021 is important because economic expansions tend to last several years. Of course, some expansions last longer than others, and there are many reasons why economic expansions end.

A Troublesome Rise in Inflation Confronts Forecasters

The current expansion is unique because it has some qualities that mimic what often occurs in the latter stages of an expansion: healthy economic growth, solid job gains and a falling unemployment rate, but intensifying inflationary pressures. Indeed, the quickening pace of economic activity and the intensification of price pressures have surprised most forecasters.

Since the end of 2020, forecasters have significantly boosted their estimates for real GDP growth in 2021 (from 3.6% to 6.4%) and lowered their forecast for the average unemployment rate in the fourth quarter of 2021 (from 5.7% to 4.9%). At the same time, forecasters have dramatically increased their consumer price index inflation forecast for 2021 (from 2%* to 4.9%), according to Blue Chip forecasters.

The marked acceleration in inflation is troublesome because—from an historical standpoint—many expansions end because Federal Reserve policymakers raise their interest rate target to combat higher-than-desired inflation. Given the economy’s profile thus far in 2021, the Federal Open Market Committee (FOMC)—based on past policy responses—would thus be expected to begin raising its federal funds target rate from its current range of 0% to 0.25%.

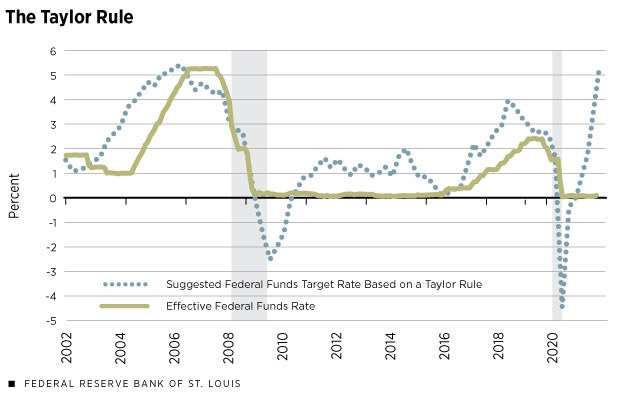

Often, in setting the current and prospective policy rates, monetary policymakers would closely monitor—though not necessarily act upon—a policy rule, such as a Taylor rule. There are many versions of this rule, but one rule estimates where the FOMC’s policy rate should be set based on (1) the economy’s current inflation rate, as measured by the four-quarter change in the GDP implicit price deflator, (2) where inflation is relative to the FOMC’s 2% target rate, (3) where the current level of real GDP is relative to the estimated level of real potential GDP and (4) the estimate of the economy’s natural rate of interest (r*). As seen in the chart below, this particular rule (using r*=1%) suggests that the federal funds interest rate target should be about 5% in the second quarter of 2021.

SOURCES: Bureau of Economic Analysis, Congressional Budget Office, Federal Reserve Board of Governors and Federal Reserve Economic Data (FRED).

NOTES: Shaded areas indicate U.S. recessions. For this chart, the formula for the federal funds target rate based on a Taylor rule is: % change from a year ago in the GDP implicit price deflator + 1 + (0.5 * (% change from a year ago in the GDP implicit price deflator – 2)) + (0.5 * ((real GDP / real potential GDP – 1) * 100)).

Policymakers Expect Continued GDP Growth but Watch Inflation Expectations

However, today’s Federal Reserve policymakers have signaled that they are content to keep the federal funds target rate at its current level well into 2023, given the economic outlook. In effect, Fed policymakers believe that they should not adjust the policy rate to combat rising inflation pressures for two main reasons.

The first is the belief that this year’s inflation surge will be transitory. Although inflation is on pace to be the highest since 1990, the June FOMC economic projections, as well as the August Survey of Professional Forecasters, have the personal consumption expenditures price index inflation rate falling back very close to the 2% target by the end of 2022. Forecasters also expect continued strong (above-trend) real GDP growth next year and an unemployment rate that is forecast to fall to 4% or less by the end of 2022.

The second reason for the FOMC’s reticence to raise its federal funds target rate is its commitment to the new monetary policy framework that was announced in August 2020. Under the new framework, the FOMC is willing to accept inflation moderately above its 2% inflation target to help make up for previous years when inflation was below the 2% target.

In conjunction with this strategy, the FOMC is now targeting maximum employment. Although not defined, the term is generally interpreted to mean an unemployment rate close to the FOMC’s long-run projection of 4%.

However, an important caveat to this new framework is that long-term inflation expectations must remain anchored at 2%. Thus far, inflation expectations have begun to drift modestly above 2%—and much higher, according to the expectations of consumers—but policymakers have not viewed this development as a permanent increase. For the former, see: https://www.federalreserve.gov/econres/notes/feds-notes/research-data-series-index-of-common-inflation-expectations-20210305.htm. For the latter, see: https://www.newyorkfed.org/microeconomics/topics/inflation. Should inflation expectations continue to rise, the FOMC will probably need to pivot.

In sum, there is uncertainty surrounding the outlook for the economy and inflation. The current forecasts for the rest of 2021 and 2022 appear bright. However, as history teaches, forecasts are often wrong. Accordingly, policymakers must continually strive to identify key risks (such as the emergence of the Delta variant), and then decide whether to adjust their strategy to ensure their desired outcomes. It can be a difficult task.

* The article has been updated to correct this forecast percentage.

Devin Werner, a research associate at the Bank, provided research assistance.

Endnote

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us