Forecasts Point to Cautious Optimism for Near-term Rebound

KEY TAKEAWAYS

- The U.S. economy went into recession in February because of the COVID-19 pandemic.

- Gross domestic product, consumer spending and employment were all affected as people began spending more time at home.

- The economy is already showing signs of a rebound because of aggressive stimulus actions and a return to growth determined by fundamentals.

The U.S. economy plunged into a recession in February, and it will probably turn out to be the deepest and the shortest in recorded U.S. economic history. But in this most unusual of years, this assessment must be viewed cautiously. The economy is on the mend because of two factors:

- Aggressive actions by monetary and fiscal policymakers that have stabilized financial markets and the economy

- The economy’s natural tendency to return to its normal state of growth, which is determined by its fundamentals

Throttled

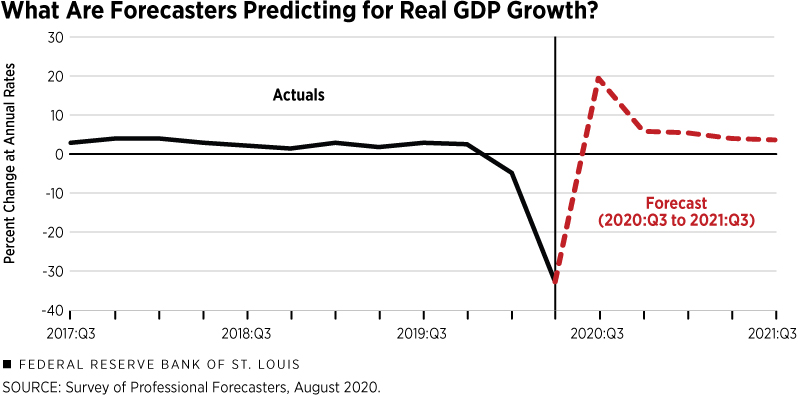

The pandemic-related decline in economic activity in the second quarter was historic. U.S. real gross domestic product (GDP) fell about 33% at an annualized rate. (See Figure 1.) This decline in real GDP was bad, but not as bad as in some other countries. For example, real GDP fell at a nearly 60% rate in the United Kingdom during this period.

The economic effects of pandemics are easily understood for one simple reason: Human beings are social animals who thrive on interaction and engagement with others. These interactions often occur in a business setting, in which economic transactions occur. So, when restrictions are placed on human interaction—whether by government-mandated social distancing measures or voluntary disassociation—the pace of economic activity subsides sharply.

If the demand for goods and services contracts quickly, there is no reason to produce the volume of goods and services that existed prior to the pandemic—and thus no reason to employ workers to the same extent as before. Thus, the first-round effect of a collapse in economic activity is a collapse in employment.

Job losses were particularly severe for many labor-intensive service industries that cater to human interaction—restaurants, air travel, and tourism and leisure. Many firms went out of business. However, some firms, particularly those in the e-commerce sphere, saw the demand for their services skyrocket as many consumers spent more time at home or shifted to a work-from-home environment.

But for most firms that survived, their revenues were dramatically cut; by necessity, they responded by cutting costs. And the largest cost for most firms is labor. The resulting increase in the number of individuals drawing unemployment insurance benefits in the U.S. reached a peak of a little more than 32 million—roughly 20% of the civilian labor force—the week ending June 20.

Throttling Back Up

The economy appeared to hit bottom in April with the easing of social distancing protocols. Helped by a massive amount of monetary and economic support, the U.S. economy has started roaring back. Key monthly indicators—such as payroll employment, personal consumption expenditures, new home sales and industrial production—have registered extremely rapid growth over the three months ending in July.

But climbing out of a deep hole takes time. In the second quarter of 2020, real GDP was 10.6% below the peak registered in the fourth quarter of 2019. To return to the previous peak, real GDP would have to increase by 12% (not annualized). Returning in 2020 to the previous peak would be a herculean task—it would require real GDP to increase at a 56.8% annual rate in the third quarter, or at a 25.2% annual rate over the second half of 2020.

Either scenario seems highly unlikely, since professional forecasters expect real GDP to increase at about a 19% annual rate in the third quarter of 2020 and at a 5.8% rate in the fourth quarter. In fact, the consensus of professional forecasters is that real GDP will not return to its pre-pandemic level until sometime in 2022.

Jobs and Joblessness

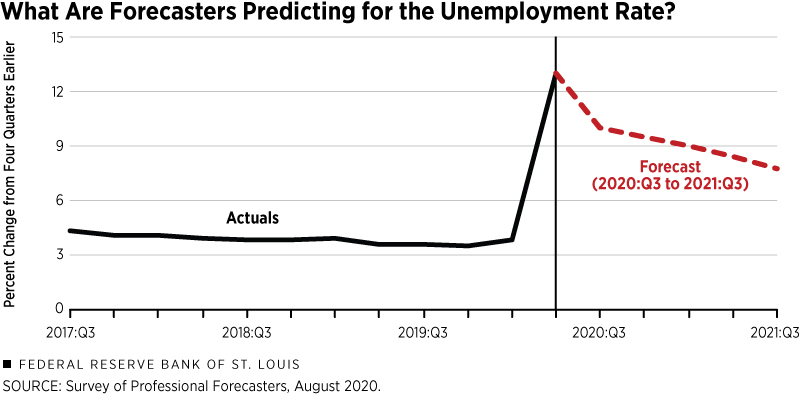

What about labor markets? Labor market conditions were vibrant before the pandemic. The unemployment rate was effectively at a 50-year low of 3.5%, and strong demand for labor was benefiting those at the lower end of the income spectrum. (For analyst estimates of quarterly unemployment, see Figure 2.)

It will also take time for the labor market to return to its pre-pandemic levels. To see this, consider that total payroll employment fell by 22.2 million from February to April. For comparison, payroll employment rose by 22.8 million between February 2010 and February 2020, or by about 190,000 per month.

Despite the rapid gains registered over the four months ending in July (9.3 million), payroll employment remains more than 12 million below its peak. Depending on the strength of the recovery, it could take several years before the labor market returns to its pre-pandemic levels.

Prices Fall and Then Rebound

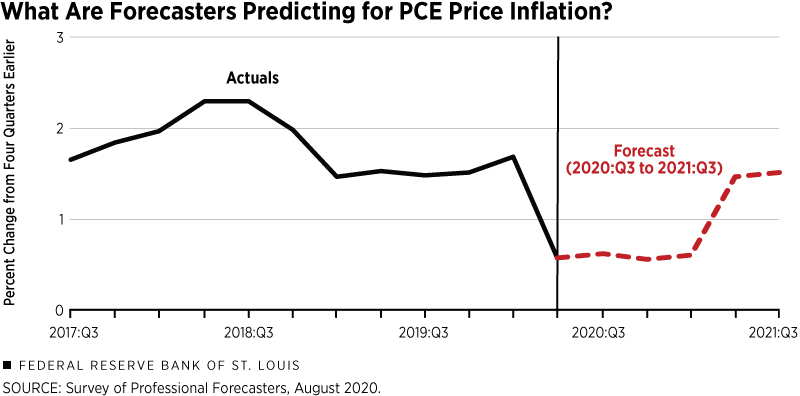

What about inflation? The contraction in economic activity during the pandemic resulted in a temporary drop in the price level. The personal consumption expenditures price index (PCEPI) fell by 0.7% between February and May. But as the economy rebounded, the index rose 0.9% from May to July.

Given the amount of monetary stimulus put in place, there is some concern in financial markets that a sharp rebound in economic activity could lead to much higher inflation rates. The inflation forecasting model at the Federal Reserve Bank of St. Louis is currently predicting the 12-month percent change in the PCEPI will increase from 1% in July 2020 to 2.5% in February 2021. However, the model also predicts that PCEPI inflation will fall back below 2% by the middle of 2021. (For analyst estimates of quarterly inflation, see Figure 3.)

Similarly, a key Treasury bond market inflation barometer—the yield on the 30-year Treasury security—is not signaling an imminent threat of higher inflation. The 30-year bond yield is currently about 1.5%, modestly above an all-time low.

The 2020 recession is one for the record books—both in terms of its depth and duration. Hearteningly, the latest data and forecasts suggest the economy is on the road to recovery, although it could take a year or more to return to the level of activity that existed prior to the recession.

Kathryn Bokun, a research associate at the Bank, provided research assistance for this article.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us