Finance and Development: Evidence from Firm-Level Data

KEY TAKEAWAYS

- Access to financial markets is associated with economic development, but the reasons why aren’t clearly understood.

- An analysis of World Bank data suggests that manufacturing firms’ difficulties in accessing credit and loans distort their long-term investments.

- Further analysis reveals that in countries where manufacturing firms have more difficulty accessing credit, the average firm tends to be smaller.

Income differences between the richest and poorest countries are vast. Understanding the forces that account for these disparities and designing policies to promote economic development are two key goals of development economics.

One channel that receives considerable attention in both the policy world and academic circles is the role of access to financial markets. In aggregate cross-country data, gross domestic product (GDP) per capita—a standard measure of a country’s economic development—is systematically correlated with various measures of financial market development, such as the aggregate credit-to-GDP ratio.

The question, however, remains: To what extent do such correlations reflect the causal impact of financial markets on economic development? In other words, to what extent might differences in financial market development account for differences in income per capita across countries?

In this article, we investigate the relationship between finance and development by using firm-level data from the World Bank Enterprise Surveys. These data allow us to investigate the underlying channels through which differences in financial market development might affect overall economic development. Moreover, shedding light on such channels allows us to learn about their implications for the effective design of policy.

These surveys are firm-level surveys conducted by the World Bank across many countries. The data used in this article are based on surveys conducted over the period 2006-2014 across 141 countries. We restricted our attention to manufacturing firms in order to maximize the comparability across countries at different stages of economic development and, thus, with different sectoral compositions of production.

The surveys ask each firm a large number of questions ranging from firm characteristics—such as the number of workers, the total value of sales and the firm’s age—to the type of issues faced that may hinder their growth—such as corruption, financial markets and access to inputs.

Access to Finance

We began by investigating the relation between economic development and the extent to which firms have access to financial markets. To do so, we plotted the relation between real GDP per capita and the share of firms with a line of credit or loan from a financial institution. (See Figure 1.) We found that countries with higher real GDP per capita have more firms that rely on external finance through a financial institution.

These findings suggest that firms in poorer economies are likely to find the lack of access to finance as a hindrance for their operations and growth. Indeed, the World Bank Enterprise Surveys also asks firms to classify the extent to which this is an obstacle: none, minor, moderate, major and very severe. Consistent with the evidence presented in Figure 1, we found that wealthier countries have considerably lower shares of firms with financing difficulties.These findings are available from the authors upon request.

Short- vs. Long-term Finance

How might differences in access to financial markets affect economic development? One possibility is that financial markets play an important role in paying for short-term working capital expenditures, such as the prepayment of intermediate inputs or wages. It is possible that limits in access to such financing prevent firms from operating and growing successfully.

Another channel through which financial markets might play an important role is the financing of long-term investments such as buildings, machinery, and research and development.

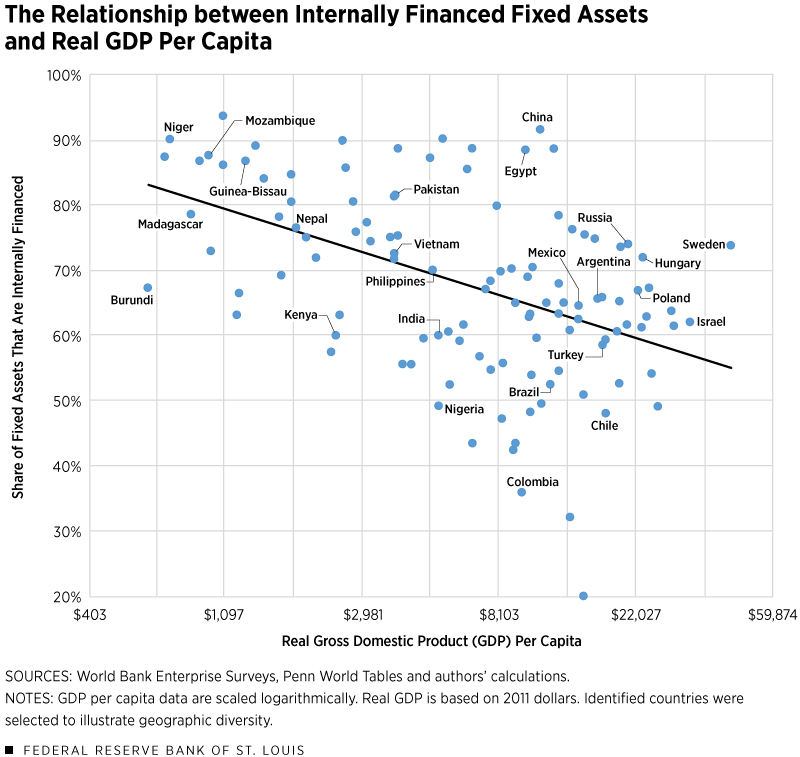

Figure 2 plots the relation between real GDP per capita and the share of fixed assets that are financed internally, such as through firms’ retained earnings or accumulated cash holdings.

We found a negative relationship between these two factors, which is consistent with finance’s role in development. The countries are clustered around a regression line that is relatively steep, indicating a strong correlation. That is, countries with a higher share of fixed assets that are internally financed tend to have lower real GDP per capita.

A similar analysis was performed for the share of working capital financed internally, but we found that the relationship is stronger for fixed assets.

We interpret this finding as evidence that differences in access to finance are likely to affect economic development by distorting firms’ long-term investments. This is intuitive, as fixed assets generally consist of large-scale investment projects that have very high fixed costs, such as structures. In countries with better access to financial markets, one would expect firms to take advantage of credit for these types of investments.

Differences in Firm Size: Access to Finance vs. Real GDP Per Capita

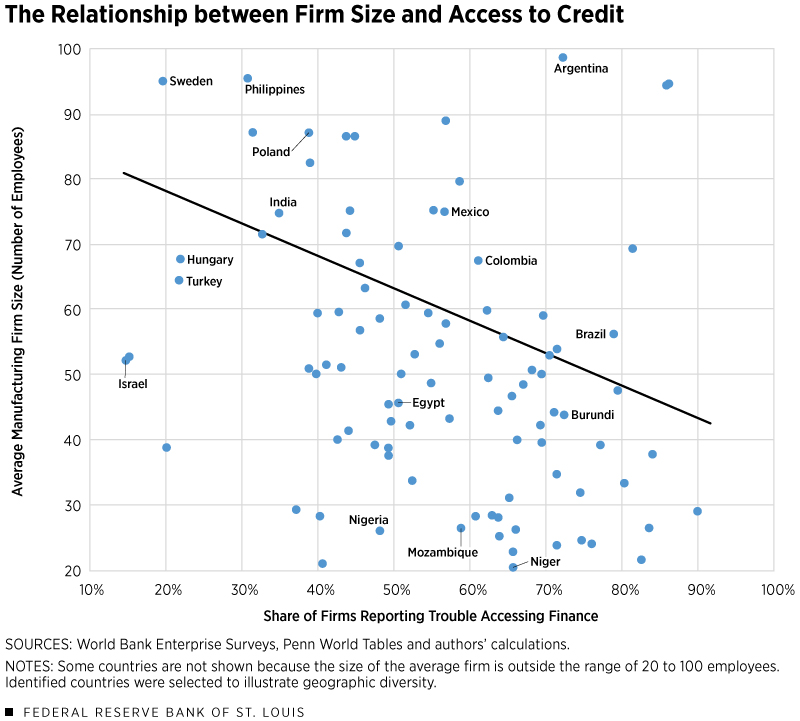

Insofar as differences in financial market development lead to disparities in economic development by distorting firms’ long-term investments, we should expect to observe systematic differences in firm size. In particular, countries with better financial markets should then have relatively larger firms, even controlling for the overall level of economic development.

We examined the extent to which this is the case in Figure 3 by plotting the relation between the average size of manufacturing firms and the share of these firms that report finance to be a problem, as described above. To test the robustness of these results, statistical tests were done to estimate the effect that access to financial markets has on firm size while controlling for GDP per capita; our results were robust along this dimension.

We found that the share of firms that report access to finance as a problem is statistically significant in explaining cross-country differences in firm size. To illustrate the economic significance of this finding, consider a 10 percentage point increase in the share of firms that report access to finance to be a problem. Our findings suggest that such a difference in the share of firms with financial problems would then be associated with close to a five-worker decline in the average number of workers per firm across countries.

Conclusion

The findings documented in this article suggest that differences in financial market development are systematically associated with disparities in economic development. Access to firm-level microdata from the World Bank Enterprise Surveys allowed us to learn more about the underlying nature of this relationship.

In particular, we documented that distortions to long-term investments are a more likely channel through which financial underdevelopment may feed into economic underdevelopment. Moreover, we found evidence consistent with this possibility, as differences in the degree to which firms report difficulties accessing finance are strongly correlated to differences in firm size.

(An earlier version of this article inadvertently appeared online in August. That earlier version lacked final minor revisions, which did not affect the article’s analysis or conclusion.)

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us