Momentum Appears to Have Swung Upward for Economy

Following a rather tepid showing in the first quarter of 2017, the U.S. economy expanded at a modestly faster rate of growth in the second quarter. Although data indicated a springtime lull in housing construction and slower truck and auto sales, these slowdowns are likely temporary in view of other developments:

First, the manufacturing sector is strengthening—new and unfilled orders for new manufactured capital goods are increasing from year-earlier levels.

Second, job growth and real income growth remain robust, and the unemployment rate fell to its lowest level in a little more than a decade in the second quarter.

Third, household net worth rose sharply over the first half of the year, powered by rising house prices and sharp increases in stock prices.

Finally, inflation pressures eased in the second quarter, which financial markets assume will slow the pace of future Fed rate hikes. Despite the Fed’s three tightening moves since late 2016, long-term nominal interest rates fell slightly in the second quarter and measures of financial market stress remain low.

Looking Past the Headlines

Swings in private inventory investment are volatile and can sometimes mask the underlying pace of growth in sales of goods and services. For example, the change in private inventories (goods produced but not sold) added 1 percentage point to real gross domestic product (GDP) growth in the fourth quarter of 2016, but then subtracted 1.5 percentage points from real GDP growth in the first quarter of 2017.

Accordingly, to gauge the underlying strength of the economy, economists sometimes pay more attention to real final sales (GDP less inventory investment). When viewed from this standpoint, the economy exhibited an upswing in growth over the first half of 2017, as real final sales advanced at a 2.6 percent annual rate in the first and second quarters. By contrast, growth of real final sales increased at only a 0.7 percent rate in the fourth quarter of 2016.

Professional forecasters expect both real GDP and real final sales to increase at about a 2.25 percent annual rate over the second half of 2017, similar to their averages seen during this expansion. For comparison purposes, real GDP increased at a 1.9 percent rate over the first half of the year, while real final sales increased at a 2.7 percent rate.

One of the keys to faster real GDP growth is a sustained rebound in nonresidential fixed investment (business capital expenditures, or capex), which grew very slowly in 2015 and then declined slightly in 2016. In the first quarter of 2017, capex rose at a brisk 7.1 percent annual rate.

Although capex growth slowed moderately in the second quarter to 5.2 percent, several developments suggest that business investment is on the upswing. These include a strengthening manufacturing sector, an improving global economic outlook, a rebound in corporate earnings and profits, and a modest retreat in economic uncertainty. If these trends continue, firms may soon scramble to keep up with rising demand; that’s because many have delayed capital expenditure projects in the previous two years, when U.S. and global economic conditions were weaker and uncertainty was higher.

Inflation’s Disappearing Act

Inflation slowed sharply in the second quarter. After increasing at a 2.2 percent rate in the first quarter, the personal consumption expenditures price index (PCEPI) rose at a tepid 0.3 percent rate in the second quarter; the index was up 1.6 percent from a year earlier.

Double-digit declines in prices of energy goods and wireless telephone services accounted for the bulk of the slowing in inflation during the second quarter. In July, though, crude oil prices began to tack higher in response to a rebound in the demand for energy, driven by faster global growth.

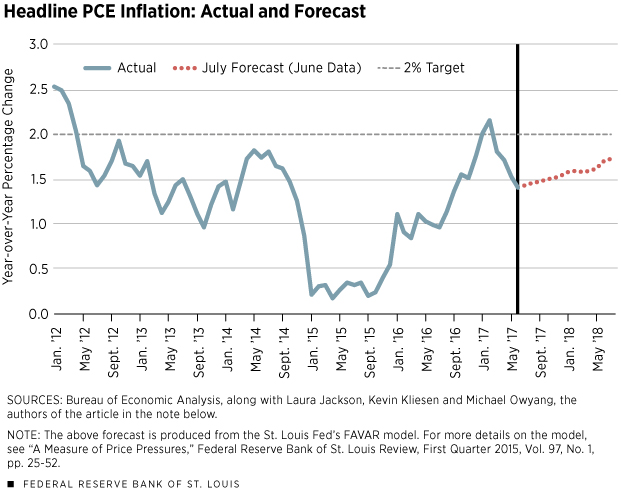

Although rising oil prices will help push inflation higher, there is little evidence to suggest that inflation is poised to breach the Federal Open Market Committee’s 2 percent inflation target over the short term. Indeed, the St. Louis Fed’s FAVAR (factor-augmented vector autoregression) model predicts that the 12-month percent change in the PCEPI will slowly rise from 1.4 percent in June 2017 to 1.7 percent in July 2018, as can be seen in the figure.

Inflation expectations from financial markets and professional forecasters portray a similar inflation outlook. As always, though, this outlook is conditioned upon Fed policymakers’ remaining committed to defending their inflation target, should upside risks to the inflation outlook arise.

Overall, real GDP growth over the second half of the year will probably be stronger than in the first half, but inflation should remain modestly below 2 percent. Thus, healthy labor market conditions should remain.

Kevin L. Kliesen is an economist at the Federal Reserve Bank of St. Louis. Brian Levine, a research associate at the Bank, provided research assistance. See http://research.stlouisfed.org/econ/kliesen for more on Kliesen’s work.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us