Economy Improves Quickly but Inflation Increases

KEY TAKEAWAYS

- The U.S. economy is strengthening quickly while facing temporary headwinds such as a shortage of semiconductor chips.

- Forecasters expect continued healthy gross domestic product (GDP) growth in the latter part of 2021 and into 2022.

- Inflation is increasing, but most forecasters view this as temporary.

The U.S. economy is strengthening at an impressive pace, but this is occurring against the backdrop of some temporary, supply-related headwinds. These include shortages of semiconductor chips that have triggered shutdowns at some domestic automotive manufacturing facilities, higher materials prices and labor market shortages in many industries—particularly service-providing industries.

These headwinds could temper the pace of growth in the near term by more than forecasters and policymakers expect. But as headwinds diminish, growth of real GDP and employment over the latter part of 2021 and into 2022 could be stronger than anticipated.

Price pressures have been building alongside the quickening pace of real GDP growth. Many economists and Federal Reserve policymakers expect inflation to exceed the Federal Open Market Committee’s (FOMC’s) 2% inflation target, but only temporarily. Nevertheless, the inflation outlook bears careful watching because price pressures are occurring alongside large increases in government expenditures and a new monetary policy framework that is more permissive about allowing inflation to exceed 2%.

Crosscurrents to Growth

The U.S. economy is gathering steam. Real GDP increased about 6.5% at an annual rate in the first quarter of 2021, which was roughly double the rate expected by the Survey of Professional Forecasters (SPF) in February. The economy’s growth rate in the second quarter should be even stronger. Thereafter, robust—but moderately weaker—growth should continue over the second half of 2021 and into 2022.

Rapid GDP growth is typically associated with strong job gains. And indeed, the May SPF expects job gains to average a little more than 600,000 a month over the final three quarters of 2021. Buoyant labor market conditions will further reduce the unemployment rate—with it most likely dropping from 6.1% in April to below 5% by the end of the year.

The economy’s resurgence stems from several factors, including:

- Relatively fast development and deployment of COVID-19 vaccines, which have triggered an upsurge in consumer outlays, increased business confidence and an easing of virus containment measures

- An exceptionally large amount of federal monetary and fiscal support that has lifted household incomes, corporate profits and stock prices

Other than households, the housing industry and domestic manufacturers have been key beneficiaries of this resurgence in economic growth. But some countervailing forces—or headwinds—have tempered this growth. One of these forces has been a global shortage of microchips used in producing passenger cars and light trucks.

Some domestic manufacturers have been forced to slow or stop production lines. In the short run, automotive output, and thus sales, will be reduced, which will be a modest drag on real GDP growth. But as chip shortages wane, the economy will receive a boost when automotive manufacturers ramp up production and dealers acquire more inventory.

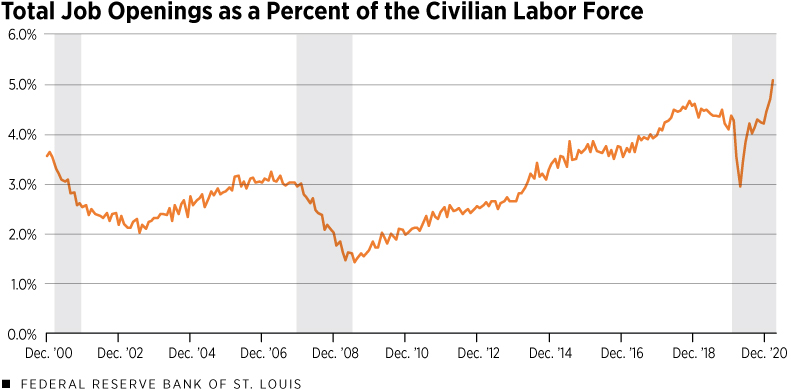

Another headwind has been labor shortages. Many firms, particularly small businesses, have reported increasing difficulty in filling job openings. This has forced some employers to forgo business or sales, or forced others to increase wages and salaries to attract workers. The record-high level of job openings relative to the civilian labor force in March 2021 was one measure of the labor shortages reported by many businesses.

SOURCES: Bureau of Labor Statistics and Haver Analytics.

NOTE: Seasonally adjusted data through March 2021.

Inflation Begins to Stir

Inflation pressures are building—both at the producer level and at the consumer level. At the producer level, the producer price index for final demand—which measures the average change over time in prices received by producers for domestically produced goods, services and construction—rose 6.1% in April from a year earlier. This was the largest 12-month increase in the series’ history (since November 2009). At the consumer level, the 12-month percent change in the consumer price index (CPI) accelerated from 2.6% in March to 4.2% in April—its largest percent change since September 2008.

Several factors explain the recent resurgence in inflation. These include rising energy prices and higher prices of some goods and materials that have been in short supply because of supply chain disruptions or adverse weather in February that hampered petrochemical production in Texas and Louisiana. Another key determinant is the “base effect”—or the magnification of price increases in March and April 2021 because of the decline in prices in March and April 2020, during the depths of the pandemic.

Most forecasters and FOMC participants view this inflation surge as transitory. Consistent with this view, the Federal Reserve Bank of St. Louis’ inflation forecasting model is projecting the personal consumption expenditures price index to increase by 2.8% in 2021, which would be the largest increase since 2007, but then drift back down toward 2% in mid-2022. However, the unexpectedly large increase in the April CPI suggests there is some risk that inflation could exceed 3% in 2021.

The expectations of very strong economic growth in 2021, as well as the FOMC’s new framework that strives to have inflation moderately exceed 2% for some period of time, have also lifted inflation expectations—whether those of consumers or those of financial market participants. The risk of running a hot economy is that inflation may quickly exceed policymakers’ comfort levels. In that case, as previous episodes in history have shown, reining in inflation and inflation expectations tends to lead to reduced growth and higher unemployment.

Devin Werner, a research associate at the Bank, provided research assistance.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us