Unsecured Personal Loans Get a Boost from Fintech Lenders

KEY TAKEAWAYS

- In recent years, Americans have sharply increased their use of unsecured personal loans because of the growing presence of fintech lenders.

- Consumers are attracted to the convenience and speed offered by online lenders.

- Traditional banks are embracing fintech innovations to meet changing consumer expectations.

A record-breaking number of American consumers—19.3 million—had at least one outstanding unsecured personal loan at the end of the first quarter of 2019.In this article, the term "unsecured personal loans" refers to cash loans that are used by individuals for nonbusiness purposes and that are not collateralized by real estate or specific financial assets like stocks and bonds. This is an addition of more than two million consumers when compared to 2017. Nationwide, by the end of 2018, the total of unsecured personal loan balances reached $138 billion, up $21 billion from 2017; that total had climbed to $143 billion by the end of the first quarter of 2019. For comparison, 180 million Americans have at least one credit card, and the nation’s total outstanding balance on credit cards is about $772 billion.Data on aggregate levels of unsecured personal loan originations are from TransUnion’s Industry Insights Report (2019:Q1). The average personal loan is determined by dividing the total unsecured personal loan balances by the number of loans originated in the U.S.

In the last two years, the rate of growth in unsecured personal lending has been significantly faster than in other types of consumer credit, including auto, credit card, mortgage and student debt—all of which have climbed, thanks to favorable economic factors. The growing trend in unsecured personal loans—or personal loans, as they are more commonly called—is expected to continue, with total personal loan balances expected to reach an all-time high of $156 billion by the end of this year.

Traditionally, the majority of unsecured personal loans were offered by banks and credit unions, with a smaller share provided by specialized finance firms. They were often considered the last option for consumers trying to manage debt. But that changed in 2007, with the advent of financial technology, or fintech.

Today, the average personal loan issued by a bank or a fintech lender is around $10,000, while a personal loan extended by a credit union averages $5,300. Across all risk tiers—from subprime to super prime—and lender types, the average unsecured personal loan debt per borrower is a little less than $8,500. In the last two years, the increase in personal loans has been recorded in every risk tier, averaging year-over-year growth above 15%.

The Role of Fintech

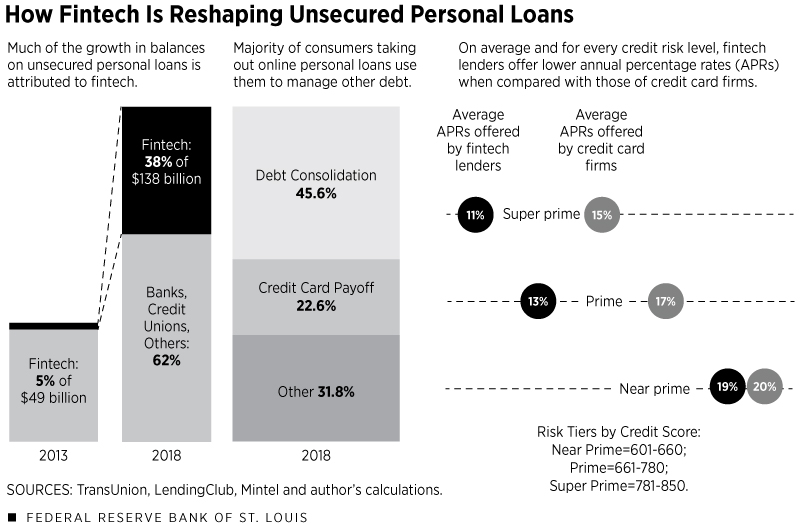

The rapid growth in unsecured personal loans in recent years can be attributed to the arrival of a new type of player—the fintech lender. Since 2013, much of the growth in personal lending is driven by loans originated by fintech firms. Still, traditional banks continue to play an important role in personal lending. (See Figure 1.) Some traditional banks have partnered with fintech firms, while others have adopted new technologies and methods, whose developments are discussed later in this article.

TransUnion estimates that fintech lenders now originate 38% of all unsecured personal loans. What is especially remarkable is that back in 2013, fintech lenders generated just 5% of personal loans.

The fintech share now exceeds that of traditional players like banks and credit unions: The banks’ share of these loan balances is currently 28%, down from 40% in 2013, and the credit unions’ share is 21%, compared with 31% in 2013.

Increasing Awareness and Acceptance

In 2016, a nationally representative survey conducted by the Consumer Payments Research Center, together with the Federal Reserve Board's Division of Research and Statistics, found that a quarter of U.S. consumers recognized the names of the largest fintech lenders, such as LendingClub, Prosper, SoFi and Avant. Of consumers who have heard of an online lender by name, nearly 12% had applied for a personal loan.

Today, thanks in no small part to the marketing efforts of fintech firms, consumers recognize online lending as a convenient, fast and simple way to obtain a loan. An online loan application form can be completed in minutes, and in the majority of cases, the decision is provided within 24 to 72 hours. A qualified consumer typically has access to the funds in less than a week.

Increasingly, U.S. customers turn to a personal loan when they need to repay higher-interest credit cards, consolidate debt or finance home improvement projects. Researchers matched fintech borrower profiles with corresponding profiles of credit card borrowers and found evidence that fintech firms tend to deliver lower interest rates compared with those of credit card companies.Robert Adams uses data from Mintel Comperemedia to compare average APRs offered by credit cards, LendingClub and Prosper by credit risk tier. Credit card and other debt consolidation through online lenders can offer real financial benefits to some consumers.

Consumers’ apparent and growing appetite for personal loans and the rapid rise of fintech lending have not gone unnoticed by traditional financial firms. Both banks and credit unions are revisiting and enriching their lending products

Credit Risk Insight from Alternative Data

Fintech firms have streamlined the loan decision process through the heavy use of the latest analytics techniques and reliance on alternative data. A loan applicant’s payment and billing history (including cable, utilities, phone, insurance and even alimony) is used to predict the likelihood that the loan will be repaid. Other data points carrying predictive value include transaction and cash-flow data reflected in bank account statements. Here, recurring deposits can be used to get a more accurate picture of income, including supplementary income, while recurring cash outflows and payments help paint a portrait of financial commitments. Fintech lenders also obtain records of credit card transactions. Access to these types of data requires the applicant’s approval and authorization. Furthermore, the person’s level of education and the choice of college major help impart relevant information.

Fintech firms also pioneered the use of internet "breadcrumbs" in credit decisions: These include traces of the borrower’s activity on social and professional networking websites and that person’s online shopping habits. Even incidental information with seemingly limited relevance—such as the time of day or night that the online loan application is made, computer IP address or geographic location—is recorded and could contribute to making a more accurate assessment of creditworthiness. An email address provided by a borrower is checked against a list of known fraudulent email addresses. Fintech companies rely on the services of data aggregation firms to gain access to alternative data.

Ten years ago, fintech firms depended heavily on traditional credit scores in assigning risk levels to loan applications; for instance, the correlation between credit scores and LendingClub’s rating grades was 80% in 2007. Over the years, as the amount of data grew and forecasting models improved in accuracy, fintech firms have become less reliant on FICO scores; the correlation between FICO scores and LendingClub’s credit grades for loans issued in the last two years fell to near 30%.Calculations are based on LendingClub’s loan-level data on loans originated in 2007 and 2018. See Jagtiani and Lemieux for a detailed assessment of the correlation between LendingClub risk stripes and FICO scores. Some fintech lenders disclose historic and current loan-level data to investors on their platform, which allows for evaluation of their credit risk modeling.

Issues with Use of Alternative Data

Much like traditional firms, fintech lenders must comply with a number of legal and regulatory requirements. Online lenders are subject to a number of consumer protection laws, including the Truth in Lending Act, the Electronic Fund Transfer Act, the Fair Credit Reporting Act and the Telephone Consumer Protection Act.

Consumer advocates also warn that the use of alternative data in loan underwriting, such as information derived from activities on social networks, should be conducted with extra care. Unless carefully managed, certain alternative data can be correlated with protected attributes, such as race and ethnicity, while individuals who choose not to participate on social media sites may be inadvertently discriminated against.

Innovation at Traditional Banks

As digital innovation proceeds apace, traditional banks have embraced new technologies and the use of alternative data. Banks, both big and small, have streamlined and enriched their online and mobile offerings in an effort to satisfy consumers’ demand for convenience and speed.For a concise review of how fintech is affecting the banking industry, see Stackhouse. Also, see Bowman for a review of opportunities for community banks to innovate through collaboration with fintech firms. Some traditional banks have partnered with technology firms and now use fintech lending platforms to originate loans using the bank’s name, while other banks clear and settle lending transactions on behalf of fintech firms. According to the results of a survey of community bank respondents,The 2018 Conference of State Bank Supervisors (CSBS) Community Bank Survey, "Community Banking in the 21st Century," includes a number of fintech-related questions. despite facing competition from fintech newcomers, bankers increasingly see fintech innovations as an opportunity to diversify their products, extend their reach and offer more-efficient services to customers.

Endnotes

- In this article, the term "unsecured personal loans" refers to cash loans that are used by individuals for nonbusiness purposes and that are not collateralized by real estate or specific financial assets like stocks and bonds.

- Data on aggregate levels of unsecured personal loan originations are from TransUnion’s Industry Insights Report (2019:Q1). The average personal loan is determined by dividing the total unsecured personal loan balances by the number of loans originated in the U.S.

- Robert Adams uses data from Mintel Comperemedia to compare average APRs offered by credit cards, LendingClub and Prosper by credit risk tier.

- Calculations are based on LendingClub’s loan-level data on loans originated in 2007 and 2018. See Jagtiani and Lemieux for a detailed assessment of the correlation between LendingClub risk stripes and FICO scores.

- For a concise review of how fintech is affecting the banking industry, see Stackhouse. Also, see Bowman for a review of opportunities for community banks to innovate through collaboration with fintech firms.

- The 2018 Conference of State Bank Supervisors (CSBS) Community Bank Survey, "Community Banking in the 21st Century," includes a number of fintech-related questions.

References

Adams, Robert. "Do Marketplace Lending Platforms Offer Lower Rates to Consumers?" FEDS Notes, Board of Governors of the Federal Reserve System, Oct. 22, 2018.

Bowman, Michelle W. "Community Banking in the Age of Innovation.” Speech given at the "Fed Family" luncheon held at the Federal Reserve Bank of San Francisco, April 11, 2019.

Jagtiani, Julapa; and Lemieux, Catharine. "The Roles of Alternative Data and Machine Learning in Fintech Lending: Evidence from the LendingClub Consumer Platform." Working Paper 18-15, Federal Reserve Bank of Philadelphia, January 2019.

Stackhouse, Julie. "Fintech: How Technology Is Changing Consumer and Small Business Lending." St. Louis Fed On the Economy Blog, May 23, 2019.

Wang, J. Christina. "Technology, the Nature of Information, and FinTech Marketplace Lending." Federal Reserve Bank of Boston Current Policy Perspectives, No. 18-3.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us