Does More Financial Development Lead to More or Less Volatility?

For a long time in the history of economic thought, financial development has been viewed as a pivotal force for fostering economic growth.1 Lately, though, some people have suggested that too much financial development can lead to excessive economic volatility.

Financial development is a broad concept that describes the degree to which an economy's financial sector is developed. The concept includes the strength and stability of financial institutions and their effectiveness in easing transaction costs to enable smoother trade of goods and services.

Moreover, financial development encompasses the depth and extent of access to credit and other financial services, as well as access to resources and information. So, along with legal and regulatory institutions, financial development promotes enforceable contracts and effective transactions.

In general, by furthering access to credit, financial development enables firms and individuals to smooth their investment and consumption over time. It does this by allowing them to finance projects (such as production, purchases, and research and development activities) or to save when they need to, thus optimizing the allocation of resources now and in the future.

Along these lines, financial development may also provide firms and individuals with a better buffer against aggregate shocks, thus promoting economic stability. Since economic volatility is negatively correlated with economic growth,2 this buffer is an additional channel through which financial development can promote long-run growth.

Considering the wide-reaching consequences of the financial crisis of 2008, however, many economists and policymakers may think that excessive financial development can instead lead to systemic risks and generate excess aggregate volatility.

In this article, we explore the relationship between financial development and overall economic volatility. We show that the more-pessimistic perception of financial development is not supported by the data.

The Relationship to Volatility

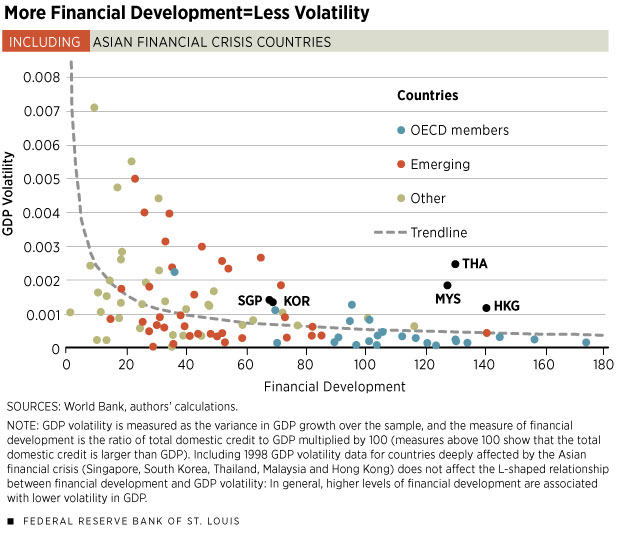

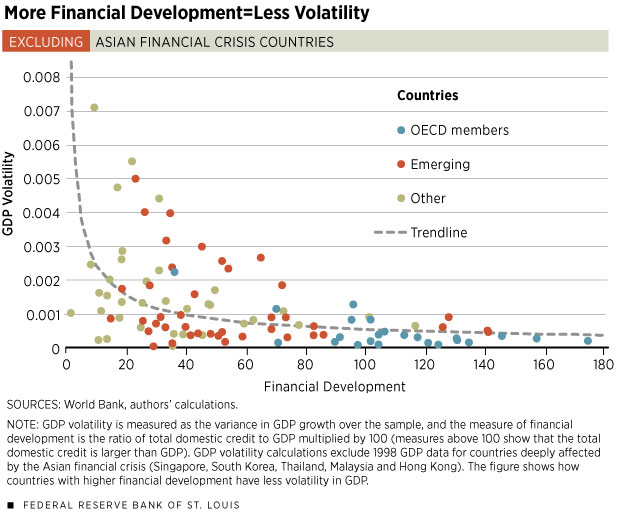

With data from more than 100 countries, Figure 1 shows that financial development is strongly negatively correlated with economic volatility, as measured by changes in real economic activity. In other words, countries with better financial development and deeper financial markets tend to have less volatility in gross domestic product (GDP).3

In addition, Figure 1 shows that this negative relationship is highly nonlinear: When financial development is low, an increase in the level of financial development will lead to a higher reduction in aggregate volatility than if financial development is already high.

More specifically, Figure 1 shows an L-shaped negative relationship between financial development and aggregate volatility. This pattern holds true across developed and developing economies. For example, countries that belong to the Organization for Economic Cooperation and Development (OECD)—countries that are generally more financially developed and less volatile—cluster around the bottom right of the chart. Emerging and newly industrialized economies are further spread out in the chart, showing higher levels of aggregate volatility and in most cases less financial development than OECD countries do. Finally, the “other” group of less-developed economies clusters around the bend and shows even higher levels of volatility and less financial development.

Figure 1 excludes 1998 data for the emerging Asian economies of Singapore, South Korea, Thailand, Malaysia and Hong Kong to avoid the volatility that emerged from that year's Asian financial crisis. Including these data in Figure 2, we can see that the L-shaped relationship remains strong even though aggregate volatility in these five Asian economies is higher.

Economists Pengfei Wang, Yi Wen and Zhiwei Xu studied this relationship further by looking at alternative measures of financial development and even using investment volatility instead of GDP to measure the relationship.4 They found that the relationship holds even when you study each country group independently and that the nonlinear relationship is even sharper with aggregate investment volatility: The decline in investment volatility is much larger than the decline in GDP volatility when financial development increases, especially for those economies with less-developed financial markets.

In addition, the authors found that the L-shaped relationship is robust even when controlling for other factors, such as interest rates, trade volume, international capital flows, money supply, government spending, per capita GDP level and inflation.

More than a Coincidence

Having found a strong correlation does not quite explain the relationship between financial development and aggregate volatility. Is the relationship merely a coincidental one, or is it a causal one? If the latter, in what direction does the causation go?

Perhaps financial development reduces aggregate volatility. If it does, how does it do it? Investigating this question further can not only improve our understanding of the business cycle but also can shed new light on the longstanding Schumpeterian question of why financial development promotes long-run growth itself.5

A well-known empirical study by economists Garey Ramey and Valerie Ramey tackled this question and showed that faster economic growth leads to lower aggregate volatility.6 But further research is needed to identify the sources of economic growth and if there are other ways in which financial development reduces aggregate volatility.

Economists Wang, Wen and Xu took a different approach when trying to answer this question, by studying it from the point of view of firms with different borrowing constraints. To do so, they built a general equilibrium model in which firms have access to credit markets and have the ability to accumulate savings and invest in assets.

They showed that by relaxing firms’ borrowing constraints in the model, firms are able to borrow from the market when they need it most—when their investment demand is high but they don't necessarily have enough savings to cover the investment. In other words, credit is better allocated across firms because when one firm wants to invest but does not have enough saved to cover that investment, it can much more easily borrow through the market from a second firm that wishes to save instead, benefiting both firms.

Since credit is better allocated across firms, each firm can base its investment decisions on its own needs, therefore dampening the effect of aggregate nonfinancial shocks to total firm-level investment and better insulating the overall economy. In addition, the authors showed that this volatility-reducing effect diminishes with continuing financial development. In other words, increasing the level of financial development will reduce volatility much more when the initial level of it is smaller than when it is high to begin with.

By providing a causal interpretation to the empirical pattern shown in Figure 1, Wang, Wen and Xu's work has important policy implications.

One of the main goals for governments and central banks in both developed and developing nations alike is to maintain economic stability. As such, policymakers must work toward maintaining and promoting aggregate stability when looking for optimal fiscal, monetary and exchange-rate policies. That is, their aim should be centered on insulating the economy from external shocks or responding to such shocks to dampen the aggregate fluctuations in the business cycle without overcorrecting.

Therefore, we believe that a barely regarded yet important factor to consider when trying to reduce aggregate real volatility in the long term is financial development.

Yi Wen is an economist and Maria A. Arias is a senior research associate, both at the Federal Reserve Bank of St. Louis. For more on Wen’s work, see https://research.stlouisfed.org/econ/wen.

Endnotes

- See Levine for a literature review. [back to text]

- See Ramey and Ramey. [back to text]

- We measured financial development by the size of the credit market relative to GDP using total domestic credit, and we measured overall volatility in each country as the variance of GDP growth, obtained from the World Bank’s World Development Indicators. We used data between 1989 and 2006 to avoid the period during the global financial crisis. See Wang, Wen and Xu for further analysis on financial versus nonfinancial shocks and for an analysis of the negative relationship between financial development and aggregate volatility even when including data of the financial crisis period. [back to text]

- See Wang, Wen and Xu. [back to text]

- See Schumpeter. [back to text]

- See Ramey and Ramey. [back to text]

References

Levine, Ross. Finance and Growth: Theory and Evidence. In: Philippe Aghion and Steven Durlauf, eds., Handbook of Economic Growth, First Edition, Vol. 1. Elsevier, 2005, pp. 865-934.

Ramey, Garey; and Ramey, Valerie A. Cross-Country Evidence on the Link between Volatility and Growth. American Economic Review, December 1995, Vol. 85, No. 5, pp. 1,138-51.

Schumpeter, Joseph A. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle. Translated by Redvers Opie, Cambridge, Mass: Harvard University Press, 1934.

Wang, Pengfei; Wen, Yi; and Xu, Zhiwei. Financial Development and Long-Run Volatility Trends. Federal Reserve Bank of St. Louis Working Paper No. 2013-003B, Sept. 21, 2016.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us