Q&A with President Bullard on New Approach to Projections

Federal Reserve Bank of St. Louis President James Bullard discussed the St. Louis Fed’s new narrative regarding the outlook for the U.S. economy and monetary policy during an interview with Jeremy Schwartz and Jeremy Siegel on “Behind the Markets” on Aug. 12. The content originally aired on Business Radio Powered by The Wharton School, SiriusXM Channel 111.

The following excerpts are from the interview. They have been edited for clarity and length. More information on this topic, including the entire interview, is available on President Bullard’s webpage and in his Aug. 25 blog post. Links can be found in the endnotes.

Siegel: Why don’t you … spend a few minutes setting out what you think is the future for interest rates and why you think this way.

Bullard: [The St. Louis Fed] put out … what we called a new narrative on June 17. 1 … The basic idea is that there’s an old narrative that we were using really over the last five years. We think it’s time to switch now to a new narrative.

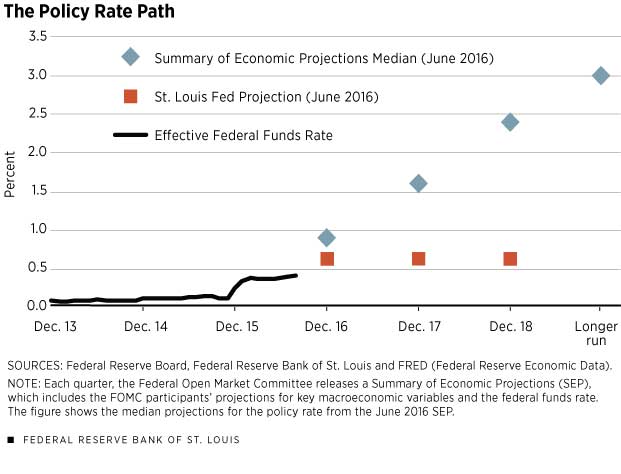

The old narrative had a long-run steady state, which is very common in macroeconomics, and then the idea was that you’re converging toward this steady state, so all the variables [e.g., real GDP growth, unemployment, inflation] are going to go back to their long-run values. And, you know, gaps [between current values and goals] are getting to be zero, or we think they’re basically zero as far as output gaps, and the distance of inflation from target is not very large. Therefore, you would get this idea that the policy rate [i.e., the federal funds rate target] has to rise, and we certainly had that for quite a while in our narrative. And so you get this rising dot picture from the Fed. [See the figure.]

In the June announcement, we abandoned that narrative and we went to a new narrative, partly because we think parts of the old narrative were not working and probably were not going to work going forward. In the new narrative, you get rid of this idea of a long-run steady state and you go to the idea of regimes instead. … And these regimes are very persistent. Once you’re in one of these regimes, what you want to do is make the best monetary policy that you can based on that regime.

Policy is regime-dependent, and it’s unpredictable. You can switch out of these regimes to something else, but it’s unpredictable when that will happen. Once you’re in a regime, you just predict that you’re going to stay there for the forecast horizon, which is about two to two-and-a-half years for the Fed. The current regime is characterized by low growth, low productivity and especially by very low real rates of return on government debt, what we’re calling r-dagger [r†].

We think this regime is going to persist, so the policy rate can stay about flat over the forecast horizon with just one increase to get to the right level of the policy rate for this regime. We’ve got the policy rate at only 63 basis points [0.63 percent] over the forecast horizon. [The target range for the federal funds rate has been at 0.25 to 0.50 percent since December 2015.] …

Another important thing … is that the cyclical dynamics in the economy, I think, are pretty much over. You’ve got unemployment down basically at what the [Federal Open Market] Committee thinks is the natural rate of unemployment. … So, this is a good time to think about a new narrative.

[The table and figure show the forecasts based on the new narrative.]

Siegel: R[-dagger] is just, for clarification, a short-term equilibrium real rate on top-quality short-term instruments.

Bullard: Right. If you look at the ex-post real rate of return on one-year U.S. Treasuries, so you take the Treasury yield and you subtract off the Dallas Fed trimmed mean inflation rate over the last three years, you’re going to get about a minus 140 basis points. We took that to heart as part of the regime. It hasn’t changed much in the last three years. We don’t see any reason for that to really change over the forecast horizon of two to two-and-a-half years.

We think we should just accept that as an input to monetary policy for now and then try to make monetary policy as best we can, given that value. One way to justify the 63 basis point recommendation is to think of a Taylor rule. … The Taylor rule would produce a recommendation for the policy rate. It’s a formula … that depends on gaps, and we’re already saying let’s just take the gaps to be about zero. [For example, there is almost no gap between the current unemployment rate and the FOMC’s estimate of the longer-run unemployment rate in the Summary of Economic Projections, and inflation as measured by the Dallas Fed trimmed mean PCE inflation rate is close to 2 percent.]

Then you’ve got this r-dagger at minus 140 basis points, and then you’ve got an inflation target in there of 2 percent. If you … add the r-dagger to the inflation target, you get a 60 basis point policy rate. That’s really where the thinking behind the level of the policy rate comes from.

Siegel: Could you kind of comment on how you feel other members [of the FOMC]—and I know you can’t speak for them, certainly, but the general reaction that you got?

Bullard: I can’t speak for other members. You’ll have to talk to them. But one reason we threw out this old narrative is it was getting very hard to work with it in this environment. You had to keep adjusting your long-run steady state down to lower and lower levels, and you had to keep stretching out the length of time it was going to take to actually get to that steady state. Now we’re in a situation where the market expects us to move only once this year. We only moved once last year.

If you’re only moving once a year and you’ve got 200 or 250 basis points to go [to reach the steady state value of the policy rate], it’s going to take a heck of a long time. It’s going to take years and years to get there. That’s way outside of normal business cycle dynamics and what we would think about in terms of macroeconomics. That got me thinking that you can’t continue with this same kind of concept. That’s why you have to go to this regime concept, which breaks down the idea of a steady state. It says that you’re in a regime for now.

You could switch to a new regime in the future. And if you switch to a new regime, then you’re going to have to adjust policy for that new regime. But, in the meantime, there’s really no reason to expect that this very low real rate on government paper is going to go away. There’s really no reason to think that the very low productivity that we have right now is all of a sudden going to snap back up to higher levels.

For those reasons, you should make monetary policy for this regime and then be aware that, you know, there are certainly other possibilities out there. … But for now, we should make policy based on this regime.

Schwartz: Any closing thoughts?

Bullard: I do think there’s some upside risk. We’ve said 63 basis points over two to two-and-a-half years. But we know where the other productivity growth regime is, and it’s higher.2 We also know that there have been times in the past where investors around the world have not been so fond of government paper as they are right now.

[For] both of those things, if they do switch, they’re likely to switch in a way that would lead to higher rates. So there’s some upside risk if that would happen or start to happen during the next two to two-and-a-half years, and then we’d have to react appropriately. But our idea is that that kind of thing is unpredictable, and we’ll believe it when we see it.

Schwartz: Upside risk is higher than the downside risk probability?

Bullard: I think so. We think recession probabilities are actually quite low right now. You always live with recession risk, but we just don’t see that as very likely over the near term.

Forecast Based on the St. Louis Fed’s New Narrative

(As of June 2016)

| Macroeconomic variable | Forecast over the next 2.5 years |

|---|---|

| Real GDP growth | 2 percent |

| Unemployment | 4.7 percent |

| Dallas Fed trimmed mean PCE inflation | 2 percent |

| Policy rate (federal funds rate target) | 0.63 percent |

SOURCE: Federal Reserve Bank of St. Louis.

NOTE: GDP refers to gross domestic product, and PCE refers to the personal consumption expenditures price index. The 12-month Dallas Fed trimmed mean PCE inflation rate is President Bullard’s preferred measure for assessing underlying inflation.

Endnotes

- The June 17 statement and related public remarks can be found on President Bullard’s Key Policy Topics webpage under the New Characterization header. His St. Louis Fed On the Economy blog post on Aug. 25 can be found here: “The St. Louis Fed’s New Approach to Near-Term Projections.” [ back to text ]

- For a discussion on what might improve productivity growth over time, see the President’s Message in this issue of The Regional Economist. [ back to text ]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us