Evansville, Ind., Adapts As Manufacturing, Population Growth Slide

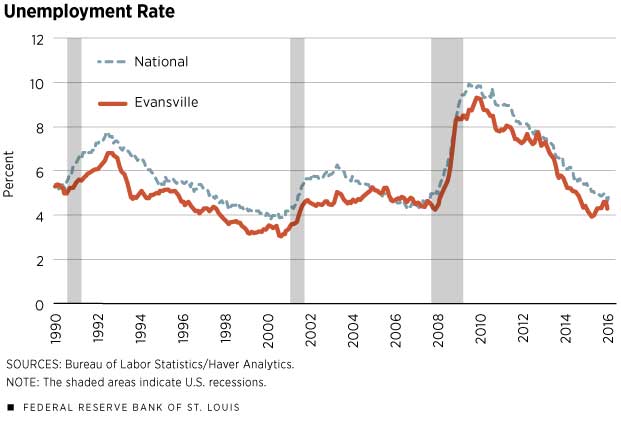

Evansville serves as the headquarters for seven publicly traded companies and is accessible via the river, two interstates, four freight rail lines and a regional airport. Over the past five years, the economy has shifted into a recovery from the Great Recession. The unemployment rate reached as low as 3.9 percent in August 2015, Evansville’s best mark since 2001 and well below the national average that month.

The Evansville metropolitan statistical area (MSA) consists of Vanderburgh, Posey and Warrick counties in Indiana and Henderson County in Kentucky. The MSA is emblematic of many Midwestern metro areas. With a population topping 315,000, the Evansville MSA ranks 158th of 382 MSAs in the country. Both median household income, at $48,000, and median house value, at $120,000, are consistent with the Indiana state averages. Rent is 5 percent cheaper than it is statewide, contributing to a relatively low cost of living. The workforce is about as educated as the rest of the state, as 23 percent of the population over 25 has a bachelor’s degree. Although that number is only about half a percentage point lower than the Indiana average, it is 6 percentage points below the national average.

Key Sectors

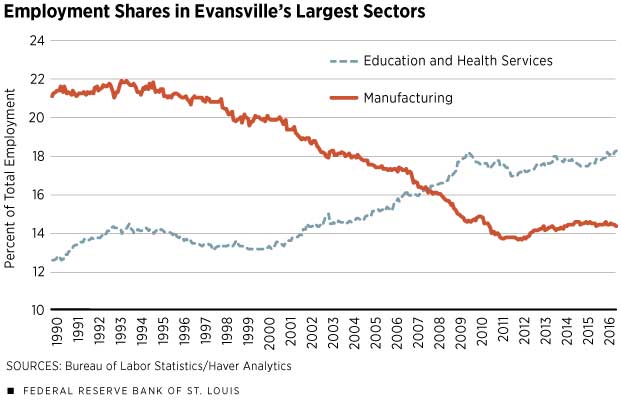

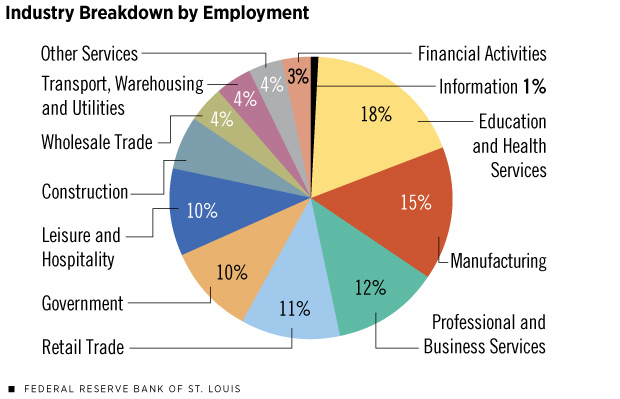

The sector that employs the largest number of people these days is education and health services. Although manufacturing has slipped to No. 2, the region’s workforce is still thought of as more blue-collar than white-collar.

The manufacturing sector employs 23,000 people, or 15 percent of the total workforce, a percentage that is nearly twice the national average. However, that share has diminished since 2000, when it was 20 percent.

Automotive manufacturing lays the foundation for the sector, as five firms with at least 500 employees each are involved with auto manufacturing. These include Skanska, a construction firm that provides support for auto manufacturers in the region. Gibson County, to the north, is home to Toyota Motor Manufacturing and Toyota Boshoku, which employ almost 6,000 people combined. Though Gibson County is not within the MSA, about 4,000 Evansville residents commute daily to work there.

Plastics manufacturing is also noteworthy, employing one-fifth of area manufacturing workers. Berry Plastics is headquartered in Evansville and employs 2,700 people locally.

Although manufacturing is key to the MSA’s history and today’s economy, it has not been the area’s principal driver of job growth over the past decade. (Figure 1) The education and health services sector provides 18 percent of Evansville’s jobs, a slightly greater portion than nationally. About three-quarters of these 26,500 workers come from the health services side. Evansville’s two largest employers, Deaconess Health System and St. Mary’s Health System, together account for approximately 9,000 workers. Each operates at multiple locations throughout the MSA and in nearby rural communities, showing the region’s widespread connectivity.

Even though manufacturing, not education and health services, has historically been the top employer, it has dwindled over time. Whirlpool Corp., once the largest employer in Evansville, best exemplifies the sector’s long-term trend. The company employed almost 10,000 manufacturing workers in its prime during the 1970s before shrinking. It ultimately had just 1,200 employees in 2010 before the company left the region entirely.

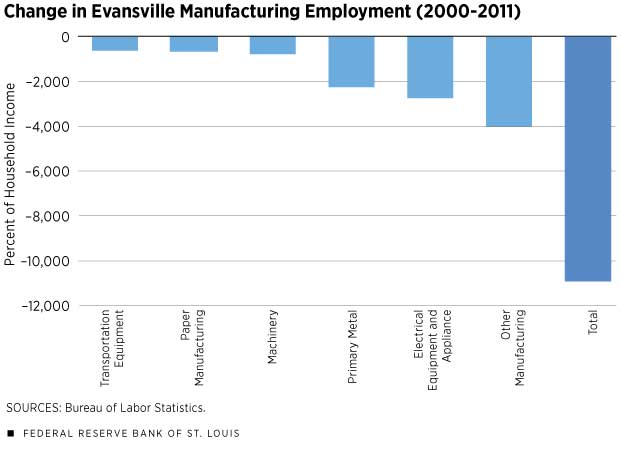

While manufacturing’s decline began decades ago, it was still the top sector in 2000 by a wide margin, employing 32,000. But from 2000 until 2011, the downturn worsened considerably. Close to 11,000 manufacturing jobs were lost on net, leaving Evansville at a 30-year low in 2011 for manufacturing employment. (Figure 2) Inflation-adjusted (real) manufacturing wages declined during the Great Recession (2007-09) by 0.1 percent annually and continued to decrease for a couple more years afterward.

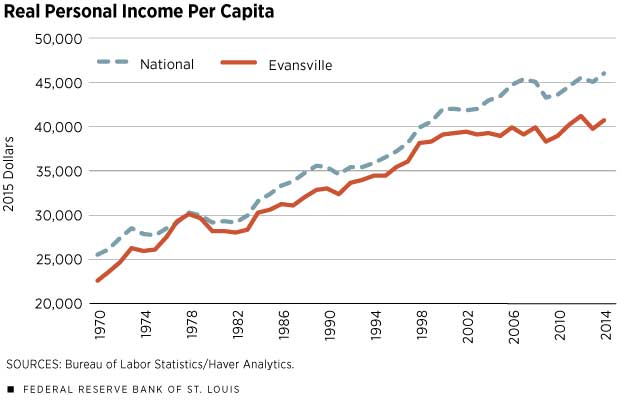

Though the overall economy did not experience long-term decline on the same scale as the manufacturing sector, the recession’s impact on the rest of the MSA was significant. (Figure 3) From 2007 to 2009, Evansville’s employment declined nearly 2.5 percent annually. As a whole, the economy lost more than 7,000 jobs on net. Plus, real wages for the entire MSA continually declined during a five-year period that began with the start of the recession in 2007. Because wages on average comprise 50 percent of real personal income per capita in the U.S.,1 that measure of income dropped 1.2 percent annually during the recession, compared with a decrease of 0.2 percent nationally in that period.

Helping to make up for some of the losses, education and health services expanded rapidly, adding 5,000 jobs on net from 2000 to 2011, including 1,300 during the recession. The surge amid tough business conditions is to be expected, given that demographics drive the sector’s growth, making it less susceptible to economic downturns. Evansville’s aging population has led to an increase in demand for health care.

Recovery and Outlook

In spite of a prolonged decline, the economy has made modest gains since 2011. For starters, the manufacturing sector has added approximately 800 jobs since reaching its historic trough. Additionally, real-wage growth has turned upward for manufacturing and the region as a whole. From 2011 to 2015, real wages increased by 0.7 percent and 0.6 percent annually for manufacturing and the overall MSA, respectively. Largely due to the stock market’s recovery in 2009, real personal income per capita began to rebound earlier than wages, rising by over 1 percent annually for the region from 2009 to 2014. (Figure 5)

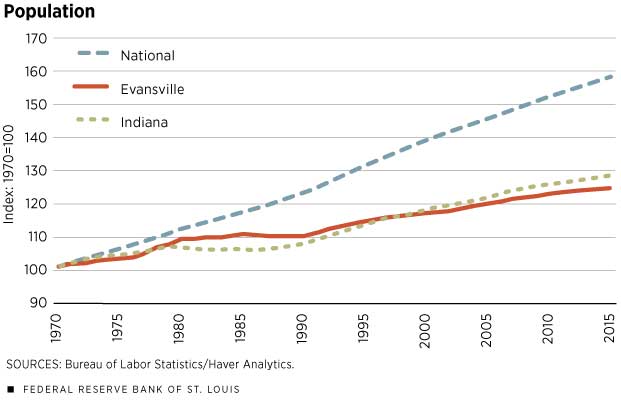

One of the most difficult challenges facing the region is expanding its population. (Figure 4) Since 2000, the population has grown a meager 6.5 percent, less than half of the 14 percent growth nationally in the same time frame. One key driver of population growth elsewhere is the inward migration of households—from within the country but also from overseas. Only 2.2 percent of the Evansville area’s population is foreign-born, compared with 14.2 percent nationally. Since new immigrants tend to move to areas in which foreign-born residents already have a significant presence,2 it may be difficult for Evansville to bring in more immigrants in order to drive expansion. Absent immigration, population growth must depend on local residents’ having more children. But 15 percent of the MSA’s population is at least 65 years old, over a percentage point higher than the national average. An older population implies that fewer people are having children and raising families, slowing down population growth. Economists also have found that having a higher percentage of elderly residents in an area slows down economic growth.3 Consequently, efforts to attract more immigrants and millennials to the region are underway.

In order to encourage economic growth, several development projects are in the works. A health science research center and a new local orthopedic and neuroscience facility will fuel the continued growth of the education and health services sector. Additionally, there is a renewed emphasis on revitalizing downtown Evansville, especially with regard to bringing in tourists. Major investments include a new hotel and adjacent convention center, as well as renovations to the local casino. Finally, while 85 percent of the population currently lives on the Indiana side of the river, an ongoing project to build a bridge between Indiana and Kentucky aims to further unite the MSA’s four counties.

Andrew Spewak is a research associate at the Federal Reserve Bank of St. Louis.

MSA Snapshot

Evansville, Ind.

| POPULATION |

315,693

|

| POPULATION GROWTH (2010-2015) |

1.2%

|

| PERCENTAGE WITH BACHELOR'S DEGREE OR HIGHER | 23% |

| PERCENTAGE WITH A HS DEGREE OR HIGHER |

90%

|

| PER CAPITA PERSONAL INCOME |

$40,816

|

| MEDIAN HOUSEHOLD INCOME |

$47,988

|

| UNEMPLOYMENT RATE (MAY 2016) | 4.3% |

| GROSS METROPOLITAN PRODUCT | $14.9 BILLION |

Largest Employers

| Deaconess Health System |

5,600

|

| St. Mary's Health System |

3,529

|

| Berry Plastics |

2,699

|

| Skanska |

2,460

|

| T.J. Maxx Distribution Center |

1,500

|

Endnotes

- Supplements to wages and salaries make up an additional 20 percent of personal income. [back to text]

- Bandyopadhyay, Subhayu; and Guerrero, Rodrigo. “Immigration Patterns in the District Differ in Some Ways from the Nation’s.” The Regional Economist, April 2016, pp. 18-19. [back to text]

- Maestas, Nicole; Mullen, Kathleen J.; and Powell, David. “The Effect of Population Aging on Economic Growth, the Labor Force and Productivity.” National Bureau of Economic Research Working Paper Series, No. 22452, July 2016. [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us