Recovery from the Great Recession Has Varied around the World

Since the Great Recession and the subsequent global financial crisis, world output has grown moderately, yet the path of economic recovery has been fragile and uneven. Several countries have grown continuously since the end of 2008; for example, the U.S. and China grew by 12 percent and 65 percent, respectively, between the fourth quarter of 2008 and the fourth quarter of 2014. Yet others, such as Italy and Greece, have seen their economies grow and then shrink again, with their total gross domestic product (GDP) declining by 6 percent and 24 percent, respectively, since the recession started.1

The recovery continues to look weak. According to the International Monetary Fund (IMF), global output growth is projected to be 3.3 percent this year, slightly lower than last year. The IMF expects economic growth in developing economies to slow down and growth in advanced economies to strengthen, with risks to global growth—such as financial market volatility and low commodity prices—remaining on the horizon.2

Exploring Regional Outcomes

For this article, we used data from the IMF's World Economic Outlook (WEO) database to explore the effect of the Great Recession around the world. We grouped 165 countries into broad geographical regions and then looked at how each region's GDP grew (or shrank) during the recession and since then.3 (See the table.)

The regions that experienced the largest declines in aggregate GDP in the recession period were Europe and the Middle East, where the declines in total GDP ranged from 10 percent to 20 percent. Latin America was also greatly affected by the downturn, with GDP falling by almost 8 percent, followed by Oceania, North America and Africa. It is interesting to note that output in Asia did not decline at all during the recession—growth merely slowed to an average of 5 percent, despite a sharp drop in exports.

Mirroring the performance during the recession, the regions that grew the most since 2009 were Asia and Africa; in both regions, GDP grew by about 50 percent. The region to grow the least was Europe, with GDP growing by just below 10 percent on average, followed by North America, where average growth was just above 20 percent since 2009.

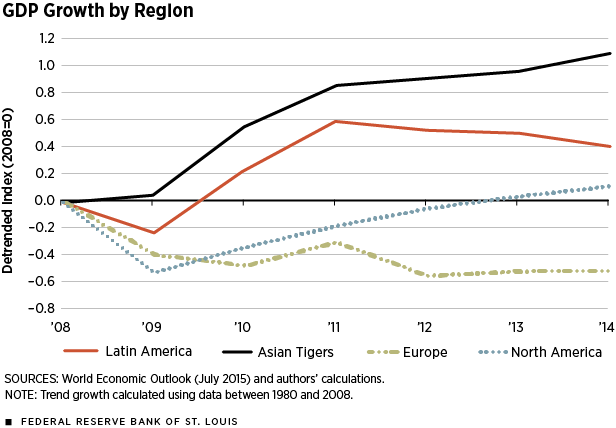

The figure shows aggregate GDP growth in several regions since 2008 after having removed the long-term trend growth (average growth between 1980 and 2008), highlighting some of the trends seen in the table. (Removing long-term growth lets us identify the direct effects of the recession on regional GDP.) The Asian Tigers (Hong Kong, Singapore, South Korea and Taiwan) together with Japan and China, for example, have seen continuous substantial growth without experiencing a sharp decline in GDP growth during the recession period. Both Latin America and North America have grown past their prerecession peaks, though output in Latin America has not grown above the long-term trend since 2011. Most strikingly, Europe has not recovered from the crisis and has shown almost no growth since 2012, with output still below its prerecession peak.

Why was Europe so heavily affected by the Great Recession and financial crisis? Why did it take so long for North America to recover? What explains strong growth in Latin America until 2012 and the stall in its output since?

Connecting the Dots

The crisis started in the U.S. financial sector (the subprime mortgage market) and propagated to the entire financial system through mortgage-backed securities and highly leveraged debt structures; so, the crisis infected the global economy through the international financial networks. Hence, those nations with an advanced and open financial system (such as Europe) got hit directly and most severely by the shock, whereas those less connected to the international financial system or with less- sophisticated financial structures got hit only indirectly through the link of international trade. Empirical evidence shows that the financial crisis caused the greatest international trade collapse since the Great Depression.4 Hence, areas that rely heavily on oil, or exports of goods or raw materials—areas such as Russia and the Middle East—saw big drops in GDP.

Getting hit hard was the first blow; an onerous recovery period was the second for many areas of the world. The biggest puzzle is that the advanced or industrialized regions (for example, the U.S. and Europe) had the slowest pace of recovery. One plausible explanation is that it is harder to recover from a severe financial shock if it triggers a debt crisis (as in Europe). Another explanation is that monetary policies (such as quantitative easing) were ineffective or much less effective than fiscal policies in ending the Great Recession.5

Europe as a whole did not adopt strict fiscal stimulus programs during the Great Recession. Hence, the most long-lasting effects from the downturn were suffered by this region, particularly the nations where fiscal ability was limited due to the government debt crisis. In contrast, the U.S. initiated several fiscal stimulus packages, but they failed to stimulate job creation and infrastructure buildup because they were focused on consumer transfer programs instead. Although the U.S. performed better than Europe, the U.S. was not the best performer. China, on the other hand, not only adopted a serious fiscal stimulus package but was also successful in spurring job creation and infrastructure buildup; as a result, it recovered the fastest.6

Because of China's rapid and strong recovery, regions that exported in large volumes to China (such as Southeast Asia) or that supplied raw materials to power China's industrial engine (such as Africa, Australia, the Middle East and Latin America) also recovered reasonably well from the crisis.7 However, when China started to experience a series of structural changes in 2011 (the so-called new norm), its long-run growth rate declined from its long-run average of 10 percent in early 2011 to 7 percent in 2014. Consequently, nations that relied on trade with China, particularly meeting its demand for raw materials and oil, also experienced economic slowdowns. Indeed, imports of goods from Latin America and Oceania to China slowed and stagnated after increasing at a constant pace between 2009 and 2010. This decline in trade flows might help explain the slower pace of growth in Latin America and Oceania since 2012.

Endnotes

- In this article, we divided the 2008-2014 period into two subperiods: the recession period of 2008-2009 and the recovery period of 2009-2014. Since we used annual data aggregated by region, we considered the Great Recession to span 2008-2009 even though the National Bureau of Economic Research said the recession in the U.S. started in December 2007 and ended in June 2009. [back to text]

- See the World Economic Outlook update of July 2015 at www.imf.org/external/pubs/ft/weo/2015/update/02/. [back to text]

- The World Economic Outlook database is available on the International Monetary Fund's website at www.imf.org/external/ns/cs.aspx?id=29. When dividing the Asian countries, China and Japan were included among the Asian Tigers to separate them from the smaller economies in Asia. [back to text]

- Jiao and Wen further discuss this trade collapse. [back to text]

- Eggertsson and Krugman provide further insight on the effectiveness of quantitative easing, as do Wen and Wu. [back to text]

- See Wen and Wu. [back to text]

- According to the IMF's estimation of world output, China contributed about 12 percent of global output in 2008 (in current international dollars) and about 50 percent of global growth during the Great Recession. See www.voxeu.org/article/can-china-be-world-s-growth-engine. [back to text]

References

Eggertsson, Gauti; and Krugman, Paul. "Debt, Deleveraging, and the Liquidity Trap: A Fisher-Minsky-Koo Approach." Quarterly Journal of Economics, 2012, Vol. 127, No. 3, pp. 1,469-1,513.

Jiao, Yang; and Wen, Yi. "Capital, Finance, and Trade Collapse." Working Paper 2012-003A, Federal Reserve Bank of St. Louis, February 2012. See https://research.stlouisfed.org/wp/more/2012-003.

Wen, Yi; and Wu, Jing. "Withstanding Great Recession like China." Working Paper 2014-007A, Federal Reserve Bank of St. Louis, March 2014. See https://research.stlouisfed.org/wp/more/2014-007.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us