Metro Profile: Jonesboro Outperforming Arkansas and Nation in Some Key Categories

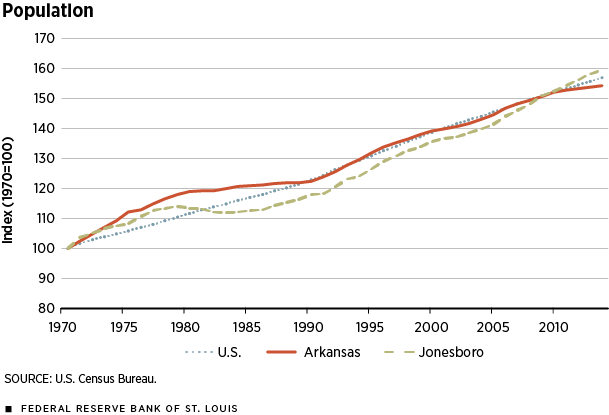

Economic growth and population growth have gone hand in hand in the Jonesboro region. After growing relatively slowly during the 1970s and 1980s, Jonesboro's population has expanded faster than has the rest of Arkansas' over the past couple of decades. Population growth has been supported by robust job growth and economic development, with new retail making Jonesboro a retail anchor for northeastern Arkansas. With new malls, shopping centers and restaurants opening at a dizzying pace, some areas of Jonesboro are nearly unrecognizable from what they looked like just a few years ago. Although many parts of the nation have struggled in the aftermath of the Great Recession, this region has generally thrived.

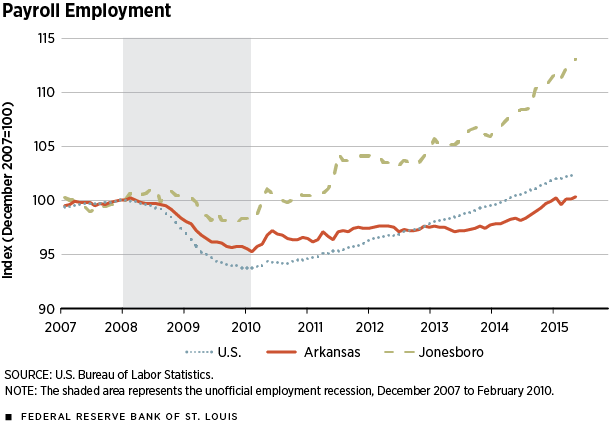

The resilience of the Jonesboro economy is illustrated clearly in the chart comparing payroll employment for Jonesboro, Arkansas and the U.S. From the onset of the recession in December 2007 through the national employment trough of February 2010, the cumulative decline in payroll employment in Jonesboro was only 2.0 percent, compared with 4.8 percent for the state of Arkansas and 6.3 percent for the nation.

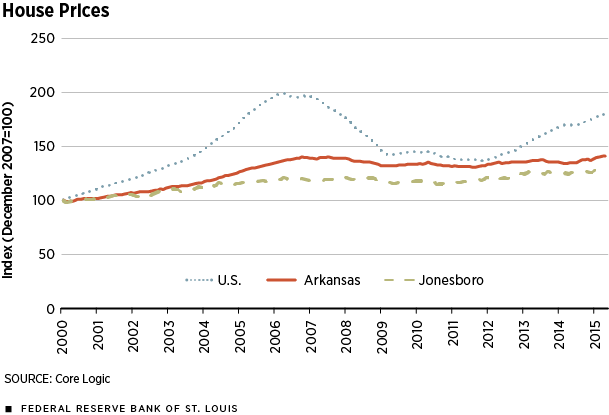

Evidence of stability can be seen in the regional housing market. The nation experienced a housing price boom from 2000 through 2006, with the average house price essentially doubling. In Jonesboro, however, housing prices increased a modest 22 percent. During the subsequent housing collapse, national prices lost about half of the 2000-2006 gains, while prices in Jonesboro remained stable.

Although manufacturing has recently shown relatively weak growth both nationwide and statewide, even that sector has shown resilience in Jonesboro. In part, this is due to the area's historic importance of agriculture, which, in turn, has drawn food processors to the area. The region has long benefited from the presence of Riceland Foods. Frito-Lay has a major manufacturing facility here, too. Consumer-products manufacturer Unilever joined the mix not too long ago. From 2009 to 2013, manufacturing output increased 14.9 percent in Jonesboro, compared with 11.3 percent statewide.

Diverse Employers

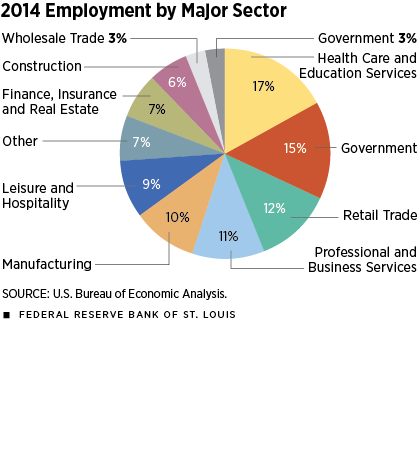

Because Jonesboro is the home of a major state university, employment in the area is partly buffered from cyclical downturns (since college enrollments tend to rise during recessions). With more than 2,000 employees, Arkansas State University is the region's second-largest employer. The university is a much-needed source by business for skilled workers. Its presence also brings cultural and entertainment opportunities that are uncommon for metropolitan areas of Jonesboro's size (about 126,000 people).

Jonesboro also has a high concentration of workers in health care, a sector that does not generally follow the business cycle. St. Bernards Healthcare and NEA Baptist Health System are two of the region's largest employers, with about 4,000 employees combined. Other health care-related companies employ about 7,000 additional people. All totaled, nearly one in four private-sector workers are employed in health care or social assistance (day care, personal aides, social workers and the like). With the “baby boom” generation at retirement age, health service has been a growth industry for several years—a trend that is expected to continue.

Strong Recovery

Even more impressive than the region's stability during the recession has been its growth during the recovery. Relative to prerecession levels, employment in Jonesboro is up 13 percent, compared with only 0.3 percent for Arkansas and 2.5 percent for the nation. Jonesboro has outperformed the state by other measures, as well. From 2009 through 2013, growth in real gross domestic product (GDP) in Jonesboro averaged 2.3 percent, compared with 2.1 percent for Arkansas. Over the same period, real personal income growth in Jonesboro averaged 2.8 percent, compared with 2.2 percent for Arkansas.

Despite the steady gains in income, average income per capita in Jonesboro is about $35,000, which is well below the national average of $46,000 and slightly below the Arkansas average of $37,000. Although income remains lower in Jonesboro, so is the cost of living: 18 percent below the national average. (The state's average cost of living is 12.5 percent below the nation's.) Adjusting for cost of living implies a “real” income of about $42,000 in both Jonesboro and statewide.

Outlook

Looking forward, prospects for further economic growth and development are positive. Of the more than 90 businesses that responded to our survey, half noted that their sales since Jan. 1 were higher than one year earlier. Only five contacts reported lower sales, and just three respondents expected local economic conditions to worsen during the remainder of this year.

One important factor is the recent enhancement of transportation infrastructure. Jonesboro has historically been somewhat off the beaten path when it comes to highway access. The recent expansion of U.S. 63—which will soon have the designation of Interstate 555—has provided better access to Memphis to the southeast. And the widening of a state highway will soon provide four-lane access to the southwest, to Little Rock and beyond. These developments have been spurred by economic growth in the area and will serve as catalysts for additional growth in the future.

Ongoing economic growth is not without challenges. Many businesses said they had problems finding qualified workers. Despite the presence of the state university, only about 21 percent of the population 25 and older has a college degree, which is below the national average of 28.8 percent. Educational attainment is notably below that in the Fayetteville MSA in Northwest Arkansas, where almost 45 percent of the population has a college degree.

In a rapidly growing economy, keeping up with infrastructure development can be problematic. An increasing population requires additional housing, schools, roads and other public services. These are challenges that a region in economic decline would probably welcome, but they are challenges, nonetheless, even for a thriving region.

Michael Pakko is an economist at the University of Arkansas at Little Rock.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us