National Overview: Optimism Prevails as GDP Snaps Back from Q1 Decline

The U.S. economy rebounded smartly in the second quarter, following an unexpected decline in the first quarter. Increasingly, it appears that the first-quarter decline in real gross domestic product (GDP) reflected temporary disturbances rather than a longer-lasting erosion of economic activity. Although persistently weak growth in labor productivity remains a blight on the longer-term outlook, other developments suggest that the economy is building some healthy momentum over the second half of 2014 that should carry forward into 2015. Importantly, inflation continues to be low and stable.

Momentum Restored

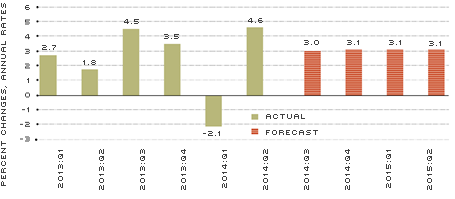

According to the third estimate published by the Bureau of Economic Analysis, U.S. real GDP increased at a 4.6 percent annual rate in the second quarter of 2014. This increase more than offset the 2.1 percent rate of decline in the first quarter of this year; Q2 growth also was more than 1 percentage point stronger than the consensus of professional forecasters. The second-quarter rebound reflected solid growth in real consumer outlays, a significant pickup in the pace of capital expenditures by businesses, brisk growth of real residential fixed investment and the largest increase in exports since late 2010. Although inventory investment (goods produced but not sold) contributed 1.4 percentage points to second-quarter real GDP growth, this buildup followed two consecutive quarters of falling inventories of about equal magnitude, on net.

Undoubtedly, some of the rebound in the second quarter reflected a snapback in activity that occurred in the aftermath of the weather-related slowdown in the first quarter (in addition to other temporary factors). However, given that real GDP had registered a 4 percent rate of growth over the second half of 2013, it is conceivable that only a relatively small portion of the rebound in activity in the second quarter of 2014 reflected a weather-related snapback. If so, third-quarter data flows and forecasts should point to healthy growth over the second half of 2014. Professional forecasters see real GDP growth averaging 3 percent over the second half of 2014 and most of 2015. What accounts for this optimism?

First, consumer and business optimism is improving. The Conference Board's consumer confidence measure in August 2014 rose to its highest level during this expansion; sales of new autos, an indicator of consumer willingness to spend on big-ticket items, are on pace to be the highest since 2006. Also, corporate profits and earnings are healthy, and financial market conditions reveal few signs of impending distress. Accordingly, surveys and forecasts point to solid growth of real consumer outlays and business capital spending over the second half of this year.

Second, other than the weakness in labor productivity, labor market conditions have been vibrant, helping to underpin the improving outlook for the consumer and businesses. Average monthly job gains thus far in 2014 have exceeded 200,000, the unemployment rate is on pace to end the year below 6 percent and the number of job openings reported by private-sector employers in July 2014 was at its highest level in over seven years.

Third, housing activity is on the upswing after struggling over the second half of 2013. In July, total home sales (new plus existing) were at their highest level since October 2013. Housing should also continue to benefit from strong job growth and the expectation of relatively low mortgage interest rates over the near term.

As always, there are cross currents in the data and risks to the outlook that are difficult to quantify. First, real consumer outlays fell unexpectedly in July. Although real consumption spending rebounded sharply in August, a pullback by consumers in the fourth quarter would cause forecasters to temper their near-term expectations for growth.

Second, economic activity appears to be weakening in Europe and Japan, which are important U.S. trading partners. Third, a further escalation of hostilities in the Middle East and Eastern Europe would undoubtedly harm business confidence and financial market sentiment. As the 2011 European banking and sovereign debt crisis showed, this development could impair global economic conditions.

Inflation Remains Moderate

After posting larger-than-expected gains over the first half of 2014, inflation pressures appear poised to moderate over the second half of the year. Notably, increases in food and energy prices have moderated. Expectations of a record U.S. corn and soybean harvest have reduced commodity prices. Likewise, oil prices have trended lower since mid-June, pushing retail gasoline prices in late August to their lowest levels since February. Finally, inflation and inflation expectations remain relatively low and stable. Stable inflation expectations help to reduce uncertainty among businesses and financial market participants, and these expectations afford the Federal Reserve some flexibility in its implementation of monetary policy over the short term.

Real GDP Growth: Actual and Forecast

NOTE: Actual GDP data as of Sept. 26, 2014. Forecast is from the Survey of Professional Forecasters, Federal Reserve Bank of Philadelphia, Aug. 15, 2014.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us