National Overview: Economic Recovery—Slow and Steady, or Full Steam Ahead?

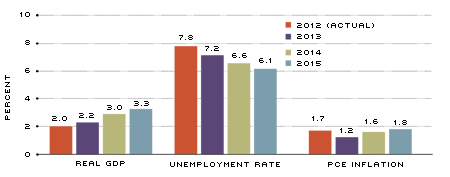

Despite healthy job gains and rising consumer optimism, the pace of economic activity remained rather modest over the first half of 2013. After increasing at a 1.1 percent annual rate in the first quarter, U.S. real gross domestic product (GDP) increased at a 2.5 percent annual rate in the second quarter. The consensus of the Federal Open Market Committee (FOMC) and private forecasters (Survey of Professional Forecasters) is that real GDP growth will remain moderate over the second half of this year. Growth is then expected to accelerate next year and in 2015. (See chart.) In response, the unemployment rate is projected to fall to about 6 percent by the end of 2015. However, for the foreseeable future, inflation is expected to stay close to 2 percent, the target rate of the FOMC. While heartening, the consensus forecasts have been too optimistic during this expansion. Should we expect the economy to finally speed ahead like a hare or continue to plod forward like a tortoise?

FOMC September 2013 Economic Projections for 2013-2015

SOURCES: Board of Governors of the Federal Reserve System.

NOTES: Projections are the midpoints of the central tendencies. The actual and projected unemployment rates are for the fourth quarter. The growth of gross domestic product (GDP) and personal consumption expenditures (PCE) is the percentage change from the fourth quarter of the previous year to the fourth quarter of the indicated year.

The Case for the Hare

The consensus forecast is built on three pillars. The first pillar is exceptionally accommodative monetary policy. The FOMC has eased policy through its large-scale asset purchase program and its "forward guidance" communication policy, stipulating that it expects its interest rate target to remain low for an extended period of time. These policies have helped lower long-term interest rates, like mortgage rates, and, arguably, have helped raise home prices and stock prices. Low-interest rates have probably also helped to boost auto sales, which are nearing their prerecession levels. This pillar, though, is sturdy only as long as inflation is expected to remain near the FOMC's target. Forecasts, surveys of consumers and financial market measures show no erosion in longer-term inflation expectations.

The second pillar stems from the spillover effects generated by the rebound in housing and the rise in household wealth. Increases in house prices lead to increases in household wealth (as do stock prices), some of which is spent. The upturn in home sales has boosted purchases of household durable goods, like appliances, refrigerators and furniture.

The third pillar reflects the unwinding of the economic and policy uncertainties that have worried financial markets and the business community. In this vein, European financial markets have stabilized, and there are signs that Europe's recession is winding down. Japan's economy is on the mend. In China, fears of a hard landing are diminishing. An improving global economy should boost U.S. exports. On the home front, the volume of home foreclosures is dwindling, and debates over tax policy that helped elevate uncertainty have receded. All of these factors should provide firms with a powerful incentive to increase their capital outlays and expand their workforces further.

The Case for the Tortoise

The case for continued modest real GDP growth—what might be called the "new normal"—is straightforward: Persistently one-sided forecast errors (too optimistic) may reflect an evolving change in the underlying growth of the U.S. economy ("potential growth") that forecasters are missing. Prior to the recession, the consensus of forecasters was that the economy's long-term growth potential was about 3 percent per year and that the natural unemployment rate was about 4.5 percent.1 But the current business expansion is now in its fifth year, and real GDP growth has averaged only about 2.25 percent, with an unemployment rate of about 7.5 percent. Is this the best we can expect for the foreseeable future?

One hallmark of the "new normal" hypothesis has been extraordinarily tepid labor productivity growth. For the past three years, such growth has averaged only about 0.75 percent. The difficulty for economists is determining whether the productivity slowdown is temporary or longer-lasting (productivity can be highly volatile); if the latter, what's causing it? Possible explanations include scarring effects from the recession and financial crisis,which have permanently lowered the employment-to-population ratio; more business regulations that have increased the cost of labor and capital to firms; and an aging population. If these impediments are significant, the economy's "new normal" real GDP growth might be 2 to 2.5 percent, with perhaps a natural rate of unemployment of about 6 percent. Thus, attempts to push the unemployment rate below this rate will likely lead to higher inflation rates. However, as mentioned earlier, forecasters and financial markets do not appear worried about this outcome. As the economic theorists would say, the Fed's 2 percent inflation target seems to be anchoring the economy's inflation rate.

Endnotes

- These estimates were reported in the February and August 2008 issues of the Survey of Professional Forecasters. [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us