Too Big To Fail: The Pros and Cons of Breaking Up Big Banks

Are the nation's biggest banks too big? Many people think so. Some economists and policymakers have called for breaking up the largest banks and strictly limiting how large banks can become.1

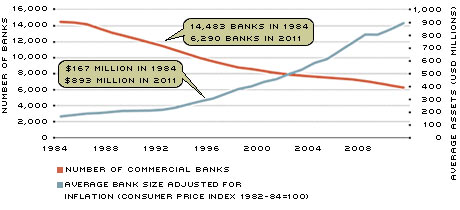

U.S. banks, on average, have grown increasingly larger over time, while the total number of banks has declined. As the chart shows, the average inflation-adjusted total assets of U.S. commercial banks rose from $167 million in 1984 to $893 million in 2011, while the number of banks fell by more than 50 percent.2 (The number of banks reached its post-World War II peak in 1984.) Moreover, the share of total banking system assets held by the very largest banks has continued to rise. For example, in 2001, the five largest commercial banks held 30 percent of total U.S. banking system assets, topped by Bank of America, which had $552 billion of assets. By contrast, in 2011, the five largest banks held 48 percent of total system assets. Four banks had total assets in excess of $1 trillion, and the largest commercial bank—JPMorgan Chase Bank—had $1.8 trillion of assets, equal to 14 percent of the total assets of all U.S. commercial banks.

Number of Banks Falls as Average Assets Rise

SOURCE: Historical Statistics on Banking, from the Federal Deposit Insurance Corp.

Proponents of limiting the size of banks argue that large banks—and the government policies that have implicitly backstopped these banks—pose serious risks to the financial system and potentially catastrophic consequences for the broader economy. On the surface, the latest financial crisis and recession seemed to bear this out, as four of the nation's 10 largest depository institutions—Bank of America, Citibank, Wachovia Bank and Washington Mutual Bank—either failed or received government assistance to stay afloat, while only about 6 percent of smaller banks failed.3

Systemic Risk and Too Big To Fail

The financial crisis revealed how closely connected many of the world's largest financial institutions are through a web of short-term loans, credit guarantees and other financial contracts. These connections pose systemic risk in that the failure of one large, complex financial institution could bring down others and threaten the broader financial system. Indeed, as the latest financial crisis developed, doubts about the ability of individual financial firms to repay their loans or meet other contractual obligations caused a widespread pullback in lending as banks and other financial firms sought to protect themselves by moving their funds into safe assets, such as U.S. Treasury securities and cash reserves. The bankruptcy of Lehman Brothers, a medium-sized investment bank, in September 2008 reinforced these fears; the bank's collapse intensified the rush for safe, liquid assets while increasing pressures on money market mutual funds, the commercial paper market and other segments of the financial system that depend on a continuous flow of credit.

The potential for the collapse of a large bank to impose significant losses on other firms or seriously impede the functioning of the financial system, and the consequent risks to the broader economy, have made governments generally unwilling to let large banks fail. As a result, governments have often treated large banks as too big to fail (TBTF) and have committed public funds to ensure payment of a large bank's debts when it would otherwise default. Although treating large banks as TBTF mitigates systemic risk, TBTF has a dark side, known as moral hazard. Moral hazard is the tendency for insurance to encourage risk-taking and, thereby, make an insurance payout more likely. For example, a government guarantee that protects a bank's creditors from loss enables the bank to borrow on more favorable terms and operate with greater leverage—and, thereby, have a greater chance of failing—than it would without the government backstop. Federal deposit insurance is one example of a guarantee that can encourage greater risk-taking. However, coverage limits, risk-based insurance premiums, minimum capital requirements and government supervision all discourage or prevent excessive risk-taking.

Treating a bank as TBTF extends unlimited protection to all of the bank's creditors, not just depositors, which gives the bank a funding advantage and more incentive to take on risk than other banks have. The Dodd-Frank Act of 2010 imposes new rules and oversight over banks and other financial firms in an effort to control risk-taking. It also aims to end TBTF by creating a new process for resolving failures of large financial firms in a way that subjects the creditors of such firms to losses. However, critics contend that the only definitive way to end TBTF and the associated moral hazard problem is to enforce strict limits on the size of individual financial institutions.

But Size Limits Might Be Costly

Although size limits could, in principle, end TBTF, some research suggests that they could also raise the cost of providing banking services by preventing banks from exploiting economies of scale. A production process is characterized by economies of scale if the cost of producing one unit of output falls with an increase in the amount produced. By contrast, there are diseconomies of scale if the cost of producing one unit of output rises with an increase in production. There are neither economies nor diseconomies of scale if the cost of producing one unit of output does not change with an increase in production.

Bankers often point to scale economies to justify bank acquisitions and mergers,

though policymakers have expressed doubts.4 Most research published before 2000 found that banks exhaust scale economies at roughly $300-$500 million of assets. However, some newer studies have detected potential scale economies for banks with $1 trillion of assets or more.5

As in many industries, recent advances in information processing and communications technologies have revolutionized banking. For example, small and medium-size banks traditionally enjoyed an advantage in lending to small businesses and other borrowers where close proximity and personal relationships were important for evaluating credit risks and monitoring borrowers. However, new information-processing technologies have reduced the costs of acquiring quantifiable information about potential borrowers and eroded some of the benefits of close proximity and personal relationships for small-business lending and, thereby, have tilted the pendulum more in favor of large banks.

The same technological changes have likely increased the fixed costs of providing banking services, costs that larger banks can spread over more customers. Furthermore, recent changes in regulation, such as a loosening of branching restrictions, and the fixed costs of complying with new consumer protection and other regulations have also likely given larger banks a cost advantage over their smaller competitors. Thus, technological advances and changes in regulation might explain why some newer studies find evidence of economies of scale for large banks when older studies did not.6

Conceivably, the treatment of large banks as TBTF could also generate scale economies by lowering the risk premiums demanded by creditors of large banks, thereby giving them a funding advantage over smaller banks. The case for mandating limits on bank size might be stronger if TBTF policies, rather than the fundamental technology of banking, are the source of scale economies for very large banks.7 More research is needed to identify the sources of scale economies in banking, to the extent they exist. Nonetheless, research to date suggests that size limits could increase the resource costs of providing banking services and, thus, supports the conclusion of researchers Gary Stern and Ron Feldman, authors of the book Too Big To Fail: The Hazards of Bank Bailouts, that "policymakers will have to consider the loss of scale benefits when they determine the net benefits of breaking up firms in the first place."8

Endnotes

- See Fisher, Rosenblum, Reich and O'Driscoll for examples. [back to text]

- In nominal terms, that is, without adjustment for inflation, average bank assets increased from $173 million in 1984 to $2 billion in 2011. [back to text]

- See DeYoung for more information. [back to text]

- See Haldane and Greenspan for examples. [back to text]

- These studies include Hughes, Mester and Moon (2001), Feng and Serletis, and Wheelock and Wilson. [back to text]

- Not all recent studies find significant scale economies in banking. See Mester (2005) and DeYoung for discussion. [back to text]

- However, at least one study (Hughes and Mester, 2011) concludes that TBTF policies do not explain economies of scale for large banks. [back to text]

- See Stern and Feldman. [back to text]

References

DeYoung, Robert. "How Big Should a Bank Be?" American Banker, April 17, 2012. See www.americanbanker.com/bankthink/how-big-should-a-bank-be-community-scale-1048454-1.html

Feng, Guohua; and Serletis, Apostolos. "Efficiency, Technical Change, and Returns to Scale in Large U.S. Banks: Panel Data Evidence from an Output Distance Function Satisfying Theoretical Regularity." Journal of Banking and Finance, January 2010, Vol. 34, No. 1, pp. 127-38.

Fisher, Richard W. "Taming the Too-Big-to-Fails: Will Dodd-Frank Be the Ticket or Is Lap-Band Surgery Required?" At Columbia University's Politics and Business Club, Nov. 15, 2011.

Greenspan, Alan. Testimony before the Financial Crisis Inquiry Commission on April 7, 2010.

Haldane, Andrew G. "The $100 Billion Question." At the Institute of Regulation and Risk, Hong Kong, March 30, 2010.

Hughes, Joseph P.; and Mester, Loretta J. "Who Said Large Banks Don't Experience Scale Economies? Evidence from a Risk-Return-Driven Cost Function." Federal Reserve Bank of Philadelphia Working Paper No. 11-27, 2011.

Hughes, Joseph P.; Mester, Loretta J.; and Moon, Choon-Geol. "Are Scale Economies in Banking Elusive or Illusive? Evidence Obtained by Incorporating Capital Structure and Risk-Taking into Models of Bank Production." Journal of Banking and Finance, December 2001, Vol. 25, No. 12, pp. 2,169-2,208.

Mester, Loretta J. "Optimal Industrial Structure in Banking." Federal Reserve Bank of Philadelphia Working Paper No. 08-2, 2005.

O'Driscoll Jr., Gerald P. "The Problem with ‘Nationalization.' " The Wall Street Journal, Feb. 23, 2009. See www.wsj.com/articles/SB123535183265845013

Reich, Robert B. "If They're Too Big to Fail, They're Too Big Period." See http://robertreich.org/post/257309894

Rosenblum, Harvey. "Choosing the Road to Prosperity: Why We Must End Too Big to Fail—Now." Annual Report 2011, Federal Reserve Bank of Dallas, 2012.

Stern, Gary H.; and Feldman, Ron J. "Addressing TBTF by Shrinking Financial Institutions: An Initial Assessment." Federal Reserve Bank of Minneapolis The Region, June 2009, pp. 8-13.

Wheelock, David C.; and Wilson, Paul W. "Do Large Banks Have Lower Costs? New Estimates of Returns to Scale for U.S. Banks." Journal of Money, Credit and Banking, February 2012, Vol. 44, No. 1, pp. 171-99.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us