National Overview: New Data Elevate Uncertainty about the Outlook on the Economy

Economic analysts and policymakers received a jolt July 29, when the Bureau of Economic Analysis (BEA) announced that real GDP rose by only 1.3 percent at an annual rate in the second quarter (since revised to only 1 percent). Perhaps more startling, the BEA also reported that growth of real GDP in the first quarter was revised markedly lower, to 0.4 percent from 1.9 percent. The new data showed that the U.S. economy was much weaker than forecasters had expected over the first half of the year.

In response, forecasters and policymakers subsequently downgraded their projections for real GDP growth over the second half of this year and for all of next year. According to August's Survey of Professional Forecasters, real GDP is expected to increase by about 1.75 percent this year and by about 2.5 percent next year.

In short, the recovery continues at a disappointing pace with a stubbornly high unemployment rate—currently about 9 percent.

For those seeking some clarity on the strength of the U.S. economy, the latest numbers have merely served to elevate this uncertainty.

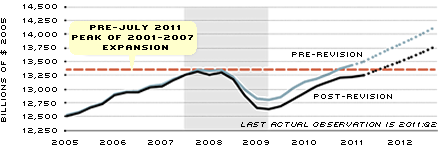

Real Gross Domestic Product Before and After July 29, 2011, GDP Revision

SOURCE: Blue Chip Indicators and Bureau of Economic Analysis.

Many key economic indicators, including GDP, are updated for years after the data were originally reported. The latest revisions showed that the most-recent recession (shaded area) was deeper and the recovery milder than originally estimated. In this chart, the solid lines show actual values of real GDP before and after the July 29, 2011, revision. The dotted lines represent forecasts of GDP that were made before and after that date.

Other Factors: Europe, S&P

A few other developments may have magnified the economic uncertainty, which seems prevalent among many policymakers, investors, households and business leaders. First, worries about slowing growth in Europe, the financial health of several of Europe's banks and an unwillingness of European policymakers to tackle their fiscal problems spilled over into U.S. equity markets in July and August—much like a year earlier. Falling stock prices tend to slow the growth of current and prospective spending by consumers and businesses. Compounding these uncertainties, the drawn-out debate over the extension of the debt ceiling and the decision by Standard & Poor's to reduce its rating on U.S. sovereign debt from AAA to AA+ may have further worsened the erosion in business and consumer confidence.

In early September, the Bureau of Labor Statistics reported that private-sector employment rose by only 17,000 in August, much weaker than forecasters were expecting and well below the gain of 156,000 registered in July. This report added to the worries of those economists who believe that the economy is dangerously close to falling into another recession. A recession coming on the heels of a very weak recovery would be exceedingly bad news for the labor markets because almost 50 percent of the nation's unemployed have been out of work for at least six months.

When assessing the risk of a recession, economists and forecasters tend to use two main approaches. One looks at statistical models that are designed to estimate the probability of the economy being in a recession or expansion by using key data, such as employment. Using data through July, many of these models indicated a very small probability (less than 10 percent) of an impending recession.

Another approach is to continually update the best-guess scenario (a consensus forecast) by using the flow of key economic data, such as real GDP, payroll employment and industrial production. Although the forecasts continue to point toward stronger growth next year, one drawback to this approach is that the data are backward-looking and often are revised significantly—as the most recent GDP revisions attest.

To help minimize the chances of a false recession signal, some economists will also

look at key financial market indicators. Despite their uneven predictive power, popular indicators in the past have been stock prices and money growth. Although stock prices in early September had declined by 13 percent from their early-July peak, the M2 money stock has continued to grow at a brisk rate. Adding to the uncertainty, the St. Louis Financial Stress Index was signaling abnormally high levels of financial stress in early September.

In years past, high and rising inflation often increased the risk of recession. Heading into the second half of 2011, though, oil and commodity prices—the impetus for higher headline inflation rates earlier this year—have retreated in the face of some weakening in the growth of U.S. and global economic activity. Moreover, long-term inflation expectations appear well-anchored, and forecasters see only a small probability of inflation exceeding 3 percent next year.

On the One Hand...

Importantly, then, with short-term interest rates near zero, and with the Federal Open Market Committee indicating that its policy rate is likely to remain near zero "at least through mid-2013," the Fed's accommodative policy stance should help bolster economic conditions going forward. That said, the economy is usually more vulnerable to a recession when output growth is weak than when it is strong.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us