European Sovereign Debt Remains Largely a European Problem

European sovereign debt concerns took global policymakers by surprise early this year. The markets panicked, fearful of a financial contagion throughout the eurozone.1 The pressure triggered a concerted policy action, culminating in an unprecedented European Union/International Monetary Fund pre-emptive financial aid package worth €750 billion ($975 billion), announced May 9.2 The root source of the debt problem can be traced historically—to quote one of the main conclusions from the recent book by economists Carmen Reinhart and Kenneth Rogoff—to the rapid explosion of sovereign debt experienced by countries following a financial crisis that includes a banking crisis.3

Roots of the Crisis

After the members of the EU entered into a monetary union (common currency) in 1999, yields on government (sovereign) debt issued by the individual countries began to converge.4 This development was viewed positively by the EU members since it meant that financial markets perceived the risk of lending to individual countries like Greece (never known in modern times as an economic powerhouse) as nearly the same as lending to Germany (which has had that reputation for decades).5 By 2007, though, it was becoming clear that some countries had used this financial market credibility to greatly expand their borrowing.6 This directly led to the development of sovereign debt concerns in several countries that had to rescue their banking sector in the aftermath of the 2008 and 2009 global financial crises.7

In the eurozone economies, government budget deficits moved from 2 percent of GDP in 2008 to 6.3 percent of GDP last year. This deterioration is responsible for increasing the gross debt-to-GDP ratio from 69.4 percent in 2008 to an estimated 84.7 percent this year, a trajectory that has yet to stabilize. Although these numbers are smaller than the deterioration seen in some other advanced economies—the U.S. gross federal debt to GDP increased from 69.2 percent in 2008 to an estimated 90.9 percent this year—they still pose particular challenges to countries inside a monetary union; that's because such countries don't have their own currencies to devalue, and any competitive gains require wage cuts and deflation in order to export their way out of a recession.8

These numbers also mask strong differences among EU countries. While nearly all eurozone economies were in violation of the union's own deficit-to-GDP requirement at some point, some of the countries, such as Portugal, Ireland, Greece and Spain (the so-called PIGS), lacked credibility with the financial markets to correct the problem on their own.9 In response, yields on debt issued by the PIGS rose sharply against the yield on German debt (perceived by markets as a benchmark for fiscal credibility), which not only made financing the PIGS' existing budget deficits more expensive, but limited their ability to issue new debt. The European sovereign debt scare, to a large extent, was triggered when the Greek government could no longer find investors to purchase its debt, forcing Greece to ask for emergency financial assistance from the IMF on April 23, 2010.

Markets Broaden Their Focus beyond Greece

Greece was not perceived to be an isolated case. Markets quickly focused on Portugal, Ireland, Spain and even Italy (now PIIGS), and the yields on these nations' sovereign bonds rose sharply. In some cases, the bonds' term structures inverted, meaning that short-term rates rose above their longer-term rates. Economists and financial market analysts often view this development as a clear sign of financial distress. Fear spread quickly throughout the bond market and then hit the European banking sector, which held large quantities of sovereign debt issued by the PIIGS on their balance sheets.

As the U.S. financial crisis demonstrated, concerns about the health of many large banks can rattle financial market participants. In Europe, this situation forced European fiscal and monetary policymakers to take concerted action to reduce current and prospective budget deficits (and hence stabilize debt-to-GDP by 2013). These actions also afforded the European banking sector some time to improve bank capital ratios—an important buttress against any future isolated debt restructurings.

During the European market scare, it became apparent that financial markets had underestimated two types of risk: (1) the sheer size of the sovereign debt problem of some European countries; and (2) the sizable exposure of the European banking system to this debt. These two factors (the latter reflecting a lack of accounting transparency) drove up counterparty risk, which increases as trust among financial market operators diminishes. Cross-border exposures to particular nations are reported in the Bank of International Settlements' (BIS) consolidated foreign claims data.10 The BIS data ultimately explain why contagion risk, though serious, has been limited to the European banking sector and did not expand globally.

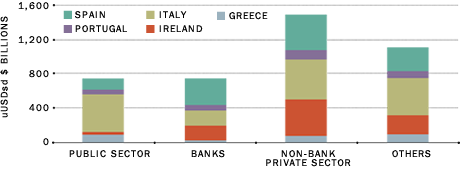

Consolidated Cross-Border Exposure to PIIGS' Debt

This chart shows aggregate exposure from 24 reporting BIS member central banks to the debts of the PIIGS countries—Portugal, Ireland, Italy, Greece and Spain. Exposure to public sector debt (sovereign debt) is rather small compared with exposure to other kinds of debt.

SOURCE: Bank of International Settlements

According to the BIS data, total global cross-border exposures to the five PIIGS countries totaled $4.1 trillion at the end of the first quarter of 2010. As seen in the chart, sovereign debt exposure (public sector) is rather small compared with the other categories of debt, such as nonbank private sector debt and other indirect exposures, including derivatives (financial insurance contracts), guarantees extended and credit commitments. Importantly, though, the European banking sector held 89 percent of the PIIGS' direct exposure ($2.7 trillion). However, the banking sector in some European countries is much more exposed than the banking sector in other European countries to debt issued by the PIIGS.

According to the BIS, the countries with the most total foreign claims to the PIIGS' debt were France ($843 billion) and Germany ($652 billion), followed by the United Kingdom ($380 billion), the Netherlands ($208 billion) and the U.S. ($195 billion) in absolute terms by the end of the first quarter in 2010. To get a better sense of the risks, economists often express these amounts as a percent of the creditor country's GDP. By this metric, French banks had the most exposure (32 percent), followed by Dutch banks (26 percent) and then German banks (20 percent). The exposure of U.K. banks was 17 percent, and the exposure of U.S. banks was only 1 percent. These data, thus, show why the contagion risk remained in Europe.

Endnotes

- There are currently 16 European countries using the euro as their national currency, bound into monetary union by European treaties. The countries are: Austria, Belgium, Cyprus, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain. Estonia will join in January. [back to text]

- Not to be confused with a separate €110 billion EU/IMF package to Greece alone, formally approved by the IMF executive board and Economic and Financial Affairs Council (ECOFIN, which is comprised of economic and financial ministers of the 27 European Union member countries) simultaneously on May 9. [back to text]

- See Reinhart and Rogoff, pp. 169-171. [back to text]

- The euro was introduced as an accounting unit in January 1999 and entered into circulation in January 2002. [back to text]

- The convergence of European bond markets in terms of interest rate levels mainly reflected the anchoring of long-term inflation expectations. [back to text]

- "The majority of countries (61 percent) register a higher propensity to experience a banking crisis around bonanza periods. …These findings on capital flow bonanzas are also consistent with other identified empirical regularities surrounding credit cycles."

See Reinhart and Rogoff, p. 157. [back to text] - One such example is Ireland, where debt-to-GDP jumped from 24.9 percent at the end of 2007 to 78.8 percent of GDP this year due to a banking crisis being mopped up by increasing sovereign debt. [back to text]

- This makes any fiscal adjustment far more painful to implement, as well as politically difficult to sustain. [back to text]

- The Maastricht Treaty allows for monetary union without fiscal union under an agreement called the Stability and Growth Pact. The pact restricts fiscal deficits to 3 percent of GDP and debt to 60 percent of GDP. Such rules have been systematically violated (even by Germany and France) without triggering any sanctions to the offending countries to date. [back to text]

- By contrast, individual bank exposure to debt issued by the PIIGS was addressed during the EU-wide banking sector stress test released by the Committee of European Banking Supervisors (CEBS) on July 23, 2010. [back to text]

References

European Central Bank. Financial Stability Review. June 2010. See www.ecb.europa.eu/pub/fsr/html/index.en.html

Reinhart, Carmen M.; and Rogoff, Kenneth S. This Time Is Different. Princeton, N.J.; Princeton University Press, 2009.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us