Disagreement at the FOMC: The Dissenting Votes Are Just Part of the Story

It's safe to say that the past few years have been interesting for the Federal Reserve System, particularly for the members of the Federal Open Market Committee (FOMC). Difficult decisions have been made: The federal funds rate has been lowered to basically zero, and money has been distributed to various financial institutions in order to keep them solvent.

Such dramatic actions have drawn unprecedented levels of attention to the members of the FOMC and to the Federal Reserve System more generally. Some of this attention might have been good for the Fed. Fed Chairman Ben Bernanke was even named Time magazine's "Person of the Year" in 2009 because "he didn't just reshape U.S. monetary policy; he led an effort to save the world economy."

That's some pretty good press.

Most Fed watchers, however, believe that the attention was unwanted. Recall that in the spring of 2010—when the financial reform act was being put together—those who felt the Federal Reserve System was responsible for the financial crisis were calling for a reshuffling of the Federal Reserve's structure and responsibilities. One proposal was to eliminate the supervisory role of the regional Fed banks over the commercial banks within their districts. Another option was to make the regional bank presidents, who are now appointed by their districts' board of directors, political appointees instead. Both of these options were publicly criticized by the regional bank presidents and ultimately did not become part of the new law.

One of the arguments against making the regional bank presidents political appointees was that such a move could ultimately reduce the range of ideas that are debated at each of the FOMC meetings. And since "thinking outside the box" is generally considered a good thing, reducing the range of voices in the FOMC meetings seems unlikely to improve monetary policy. In other words, disagreement among the FOMC members is something we might want to see more of and not less of.

But is there really that much disagreement among members of the FOMC? It certainly seems so. Read on for a simple decomposition of where some of this disagreement might be coming from.

Measuring Disagreement

From the perspective of the public, it may appear that there is little-to-no disagreement among FOMC members. Because it is relatively uncommon for a voting member to dissent, one might conclude that the members are in agreement about the relevant policy actions discussed at that FOMC meeting.

While dissenting votes are an indication of disagreement, they are a very coarse metric for evaluating how much an individual member of the FOMC disagrees with the proposed policy actions. By their nature, dissenting votes are either "yes" or "no." There is no gray area. As such, characterizing FOMC disagreement by whether a member dissents provides very little information about the magnitude of disagreement that an individual member has about a given policy. Perhaps a member is 60 percent in favor of the policy and 40 percent against the policy and, therefore, does not dissent. Should we, therefore, conclude that he or she exhibits no disagreement from the consensus view? Also, at any given FOMC meeting, there are only four regional bank presidents who are able to vote and, thus, convey their opinion via a dissent. The remaining eight regional bank presidents may disagree with the policy, but since they don't have a vote, their disagreement cannot be observed by the public.

Therefore, we take a completely different approach to measuring disagreement—one that is not based on whether an individual casts a dissenting vote regarding a policy action. We measure disagreement using internal forecasts made by each individual FOMC member in preparation for a subset of the FOMC meetings that occurred from 1992 to 1998. By taking this approach, we are able to make much finer measurements about the degree to which a specific member of the FOMC disagrees with other members regarding the state of the economy and, potentially, how much each disagrees with a proposed policy action.

The data are based on those used for the semiannual monetary policy report to Congress, made in February and July of each year since 1979. Before each of these releases, each member of the FOMC makes a forecast of end-of-year nominal and real GDP growth, inflation and the unemployment rate. The February forecasts are for the current calendar year. In July, two sets of forecasts are given: an updated forecast for the current calendar year and a longer-horizon forecast for the next calendar year. Once these forecasts have been collected from each member of the FOMC, the maximum, minimum and a trimmed range (based on dropping the three highest and three lowest values) of each of the four variables are included in the monetary policy report to Congress.

Unfortunately, the individual forecasts are not provided in the report when it is released. However, a newly available data set, published last year by Berkeley economist David Romer, provides those forecasts made by individual members of the FOMC between February 1992 and July 1998.1 Until early summer of 2009, the only publicly available information consisted of the aggregated information (that is, the maximum, minimum and the trimmed range) contained in the report to Congress. In contrast, this new data set provides not only the individual forecasts for each economic variable, but it also associates the forecasts with every member of the FOMC other than the chairman.

Although the data set is the richest source of information on the FOMC forecasts that is available to the public, the data set is limited in its duration. Although FOMC forecasts have been made since 1979, the documentation of the individual forecasts doesn't go back that far. Very recently, the Board of Governors constructed a complete series of the forecasts starting only as far back as February 1992. In addition, a 10-year release window has been enacted, limiting the most recent forecasts publicly available. Our data, therefore, consist of the individual forecasts for each of the four variables, over three distinct forecast horizons, over a seven-year span, made by each regional bank president and each governor other than the chairman.

Before characterizing the magnitude of disagreement and attempting to explain why such disagreement exists, it is important to understand that the forecasts made by the FOMC members are not your typical forecasts. The FOMC forecasts are "conditional" forecasts.2 Specifically, they are constructed conditional on a hypothetical future path of monetary policy (i.e., a future path of the federal funds rate or some other type of monetary policy). In contrast, the typical "unconditional" forecast makes no such assumption about the future path of monetary policy. Federal Reserve Bank of St. Louis President James Bullard made this distinction clear in a speech last year when he said, "The FOMC members' forecasts are made under appropriate monetary policy." In this framework, "appropriate monetary policy" is left to the discretion of the individual FOMC member constructing his or her own forecast. This induces disagreement among the members irrelevant of whether the members are forming their forecasts based upon the same information—such as developments in the economy as a whole. As such, our results on disagreement capture not only variation in the information and models the FOMC members are working with but also the variation in beliefs on what appropriate monetary policy should be, irrespective of those features.

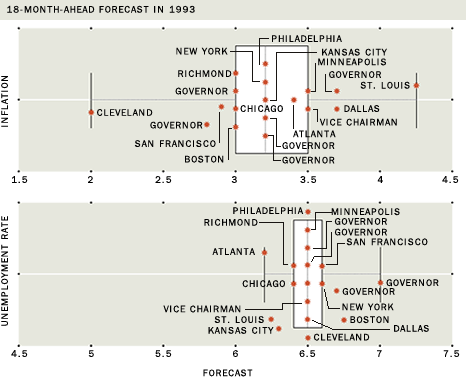

With that caveat in mind, we define an individual's forecast disagreement as the difference between his or her forecast fi and the median forecast M among all FOMC members. Consider Figure 1. Here, we provide two box-and-whisker plots of the 18-month-ahead forecasts made by the 18 members (six governors—one of whom is the vice chairman—and 12 regional bank presidents) of the FOMC at the July 1993 meeting: one for the inflation rate and one for the unemployment rate. The median forecast is indicated by the center line within the box, the first and third quartiles are indicated by the edges of the box, and the "whisker" that stretches to the left and right provides a visual of the entire range of data. Clearly, the inflation forecasts exhibit a much wider range of disagreement than that associated with the unemployment forecasts, but why? And among the inflation forecasts, why do some members, such as the presidents of the St. Louis and Cleveland Feds, have forecasts that differ so drastically despite the fact that, by and large, these members have access to the same data?

In our analysis, we use straightforward regression techniques to try to parse some of the reasons why these differences exist. First, we ask whether the magnitude of the disagreement, measured as the absolute value of the difference between a forecast and the median forecast | fi – M | , can be explained. Second, we ask whether the direction of the disagreement, measured as the sign (plus or minus) of the difference between a forecast and the median forecast, can be explained. In each of these decompositions, we consider four factors: (1) variations in regional information, (2) the state of the national economy, (3) voting status of the member and (4) permanent effects that are specific to the individual.3

We measure variations in regional information as the difference between the unemployment rate for the nation as a whole and the unemployment rate for the region associated with the FOMC member.4 For those members who are governors, we treat the nation as their "region" and, hence, for them, this variable takes the value zero. With this measure, we hope to capture disagreement effects due to differences in region-specific information among the members. Given the number of meetings that regional presidents have with local business leaders, it would not be surprising if they held different views about the economy, based upon such region-specific information.

For ease of comparison, we measure the state of the national economy using the national unemployment rate.

We measure voting status using an indicator variable that takes the value one if the individual is a voting member at the time the forecast is constructed and zero otherwise. With this measure, we hope to capture strategic differences among the regional bank presidents who form their forecasts differently when they are a nonvoting member than when they are a voting member. The reason to consider this predictor is based on the observation that while the four voting regional bank presidents have the ability to express their disagreement by a dissenting vote, nonvoting members can only express their disagreement vocally at the FOMC meeting. And insofar as their forecasts express their views, these forecasts may exhibit more disagreement than when they vote.

Finally, we measure the permanent individual effect by defining 14 distinct indicators: one for each of the regional banks, one for the vice chairman and one for the remaining governors. With these indicators, we hope to capture those disagreement factors that are specific to the individual but not explained by observed economic data. In our decomposition of | fi – M | , these indicators are designed to capture the individual specific "aggressiveness" of their disagreement irrespective of whether they are above or below the median. In the second decomposition, these indicators are designed to capture an effect that is akin to calling someone an inflation hawk (or dove): terms used to characterize whether an individual is seen as wary of increases in inflation (or decreases) at all times irrelevant of the flow of recent economic data.

For brevity, we focus exclusively on the 18-month-ahead forecasts of CPI-based inflation and of the unemployment rates. Results for nominal and real growth are similar in spirit.

The Determinants of Disagreement

We begin by describing our results for predicting the magnitude—rather than the direction—of the disagreement. For the inflation forecasts, nearly all of the predictive content came from the individual-specific permanent effects. Apparently, those individuals who tend to be in greater—or lesser—disagreement with the consensus do so for individual-specific reasons. Voting status, and both the regional and national economic conditions, seemed to play no role in determining the magnitude of forecast disagreement.

Forecast Disagreement among FOMC Members

These box-and-whisker plots show the forecasts made by the members of the FOMC at their July 1993 meeting. The forecasts are for inflation (top) and unemployment for 18 months out. The median forecast is indicated by the center line within the box, the first and third quartiles are indicated by the edges of the box, and the "whisker" that stretches to the left and right provides a visual of the entire range of data.

SOURCE: Economist David Romer's web site: http://elsa.berkeley.edu/~dromer/

Not surprisingly given Figure 1, we find that on average across the available data, the St. Louis, Cleveland and even the Dallas Feds tended to exhibit the largest levels of disagreement on inflation. Quite intuitively, we also find that the vice chairman tended to be one of the most consensus-oriented members of the FOMC.

In contrast, for the unemployment forecasts, there does seem to be a significant effect due to the state of the national economy. As the national unemployment rate rises, the degree of disagreement among the members' unemployment forecasts increases just a bit. At some level, this makes sense. When unemployment is high, there tends to be a great deal of uncertainty in the economy. If there is a great deal of uncertainty in the economy, it is intuitive that there might be greater uncertainty about policy among the FOMC members and, thus, greater disagreement among their forecasts. In addition, as was the case for the inflation forecasts, the St. Louis Fed consistently tends to exhibit one of the largest levels of disagreement and the vice chairman tends to exhibit one of the smallest levels of disagreement.

The results for directional disagreement tend to be a bit more interesting. In particular, the results indicate a clear tendency of the FOMC members to treat their inflation and unemployment forecasts as trading off one another.

For example, those individuals who tended to forecast lower levels of inflation than the consensus also tended to forecast higher levels of the unemployment rate than the consensus. A good example of this is the Minneapolis Fed, which had a tendency to forecast lower inflation than the consensus while simultaneously having a tendency to forecast unemployment to be higher than the consensus.

This tradeoff can also be seen in the regional effects. Apparently, as a given region's unemployment rate rises above the national unemployment rate, the regional bank president tends to have a lower inflation rate forecast than the consensus while simultaneously having a higher unemployment rate forecast than the consensus. Again, the rationale for this regional effect is intuitive. If members observe particularly low unemployment in their region, they would naturally expect inflation pressures in the future as households spend more of their income. Similarly, if members observe higher unemployment in their region, one might conjecture spillover effects to the economy as a whole, implying that the future inflation rate will be lower.

And while not nearly as strong an effect as those already discussed, the tradeoff appears in both the national and the voting effects. As either the national unemployment rate rises or members switch from being nonvoting to voting, their inflation forecast tends to be lower than the consensus and their unemployment forecast tends to be higher than the consensus. Unfortunately, there does not seem to be an obvious reason for why such a tradeoff should exist between the inflation and unemployment forecasts due to voting status or the national unemployment rate.

Conclusion

These historical results beg the question: Do we expect there to be much disagreement among today's FOMC members?

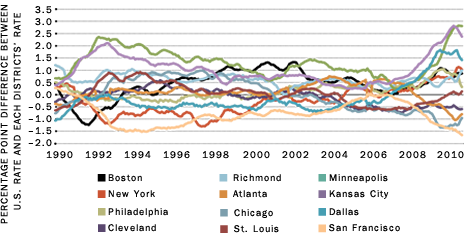

Differences between Regional and National Unemployment

In the study of disagreement on the FOMC during the 1990s, a connection could be seen between a region's unemployment rate and a member's forecasts on the economy. For example, as a given region's unemployment rate rose above the national unemployment rate, the regional bank president tended to have a lower inflation rate forecast than the consensus while simultaneously having a higher unemployment rate forecast than the consensus. If that pattern still holds true today, disagreement among the FOMC members is probably high and on the rise, given that the range of the deviation in the rates across the country (as seen above) is larger than it's been for the past 20 years.

SOURCE: Author's calculations

Because most of today's FOMC members were not members in the mid-'90s, it's hard to say anything definitive. However, even though the individual effects might be very different now, one can conjecture that the regional effects remain similar. If so, then the results indicate that, as regional variation in the unemployment rates increases, one would expect an increase in the directional disagreement of the FOMC members. Specifically, one might expect those regional bank presidents with unemployment rates higher than the national rate may become increasingly dovish and those with rates below the national rate may become increasingly hawkish. As evidence of such, in Figure 2 we plot the deviation of each regional unemployment rate from the national unemployment rate. As of the June 2010 employment figures, the range of these deviations is the largest it has been for the past 20 years, suggesting that not only might there be considerable disagreement among today's FOMC members, it might be increasing.

Hopefully, that's a good thing.

Endnotes

- The data are available at David Romer's web site: http://elsa.berkeley.edu/~dromer/ [back to text]

- See Faust and Wright. [back to text]

- For simplicity, we define an individual by his or her position and not by name. For example, we treat the St. Louis Fed Bank Presidents Thomas Melzer and William Poole as one "individual" because they were both presidents, during this time frame, of the

St. Louis Fed. [back to text] - There are no true measures of regional economic well-being where the region is defined by the Federal Reserve bank divisions. We follow Meade and Sheets and construct our own measure of regional unemployment by using population-based weights of state-level unemployment rates. For some regions, this is trivial because the region definition includes full states. For other regions, like St. Louis', the region includes several partial states. For these divisions, we use county-level population figures taken from the 1990 census. [back to text]

References

Bullard, James. "Discussion of Ellison and Sargent: What Questions Are Staff and FOMC Forecasts Supposed to Answer?" Presented at the European Central Bank conference

10th EABCN Workshop on Uncertainty over the Business Cycle, Frankfurt, March 30, 2009.

Faust, Jon; and Wright, Jonathan H. "Efficient Forecast Tests for Conditional Policy Forecasts." Journal of Econometrics, Vol. 146, 2008, pp. 293-303.

Meade, Ellen E.; and Sheets, D. Nathan. "Regional Influences on FOMC Voting Patterns." Journal of Money, Credit, and Banking, Vol. 37, 2005, pp. 661-77.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us