Regulating Carbon Emissions: The Cap-and-Trade Program

Increased concentrations of greenhouse gases have heightened concern throughout the world about climate change and global warming. One manifestation of this concern in the United States is reflected in a market-based approach termed "cap and trade" to regulate carbon dioxide emissions; this is contained in the proposed American Clean Energy and Security Act of 2009.1 This legislation requires a 17 percent reduction in emissions of carbon dioxide by 2020 from 2005 levels.2 While there are numerous controversial provisions in this legislation, this article focuses on the economic principles underlying the cap-and-trade proposal.3

Reducing Carbon Emissions Efficiently

Various regulatory approaches exist for controlling pollution. A common one is "command and control." One example in the context of carbon emissions is the Corporate Average Fuel Efficiency (CAFE) standards, which mandate minimum fleet mileage standards for motor vehicles sold in the United States. Generally speaking, economists tend to prefer market-based approaches, such as a cap-and-trade program, to other regulatory approaches for reducing carbon emissions.

Various economic reasons exist for preferring market-based approaches. First, all polluters face the same marginal cost of reducing pollution, which is a necessary condition for reducing pollution in the most cost-effective way. For example, say that a polluter is either taxed $15 for each ton of carbon emissions or must have a permit that costs $15 per ton of carbon emissions. In either case, $15 is the price that the polluter must pay to emit one ton of additional carbon emissions. Then, each firm must compare this $15 per ton with its own cost of reducing carbon emissions. As long as the firm's incremental costs stay less than or equal to $15, then it will reduce its emissions; if not, assuming it is profitable to do so, then the firm will pay the tax or buy the permit. (Note that part of a firm's adjustment to the higher price to pollute might entail a cut in its production of goods.)

Second, incentives are provided so that pollution is reduced relatively more by firms with relatively lower costs of doing so. In other words, if firms must pay $15 per ton of carbon emissions, then firms that can reduce pollution at relatively lower cost will undertake relatively more abatement than will higher-cost firms.

Third, market-based approaches provide incentives for innovative activity that can lower the cost of reducing pollution. Simply put, firms can increase their profits by finding ways to lower the cost of reducing pollution.

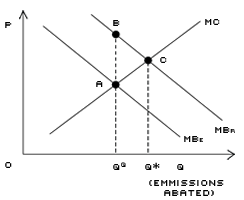

Under a cap-and-trade program, the quantity of carbon emissions is capped. Given an upper limit on the quantity of carbon emissions, market participants will determine the price of these emissions. The supply and demand diagram in Figure 1 can be used to illustrate the basics of a cap-and-trade program. The horizontal axis measures the quantity (Q) of carbon dioxide emissions abated, while the vertical axis measures the value (benefits or costs) per unit (P) of carbon abated. Note that by capping emissions at some level, an abatement quantity is set as well. The marginal benefit (MB) curve is sloped negatively to reflect that the additional benefit to society of abating more carbon declines. This marginal benefit curve reflects the social benefits of reducing pollution. From the perspective of a polluter, the (private) benefit of abatement is zero. Meanwhile, the marginal cost (MC) curve is sloped positively to reflect the assumption of increasing marginal abatement costs. In other words, as a firm attempts to abate more and more carbon emissions, incremental costs to the firm of additional abatement increase.

Given the curves in Figure 1, the ideal quantity of abatement is indicated by Q*. This quantity of abatement will result in a price of carbon emissions of P* per unit. This efficient outcome reflects the fact that emissions abatement should continue until the point at which the marginal benefits equal the marginal costs. Additional abatement beyond Q* is inefficient because the marginal costs exceed the marginal benefits.

In the preceding example, the marginal benefit and cost curves were assumed to be known with certainty. This is highly unlikely as it is very difficult to pin down either the benefits or the costs of reducing carbon emissions. For example, the benefits of reducing the atmospheric concentration of carbon dioxide from 380 to 325 parts per million are not easily calculated. Not surprisingly, widely divergent views are held.4 A more realistic assumption is one of uncertainty, which allows for one's expectations to differ from what actually occurs. Assume that the expected and realized marginal cost curves are identical, but that the realized marginal benefit exceeds the expected marginal benefit. In other words, the benefits of reducing carbon emissions are higher than originally anticipated. In Figure 2, this is represented by a realized marginal benefit (MBR) curve that lies above the expected marginal benefit (MBE).

Under a cap-and-trade program, regulators, basing their decision on expected costs and benefits, would require abatement of QQ of carbon emissions. In Figure 2, the ideal level of abatement is Q*; so, the cap-and-trade program would result in too little abatement because QQ is less than Q*. Of course, if the realized marginal benefit curve was at a lower level than the expected marginal benefit curve, too much abatement would occur. The key point in this illustration is that, because of uncertainty, the cap-and trade program is unlikely to produce an ideal outcome all the time.5 Excessive volatility in the price of pollution is also a possibility. When unintended, large adverse consequences result, specifics of the cap-and-trade program will probably need to be modified. Unfortunately, uncertainty comes into play with all regulatory approaches.

Who Receives the Permits?

After the amount of allowable carbon dioxide emissions is determined, decisions must be made as to who is allowed to emit and how much they are allowed to emit. One approach, which is favored by the Obama administration, is to have the government auction off permits that allow the holder to engage in actions that emit carbon. A fixed number of permits would be auctioned that would be purchased by those who placed the highest value on them. Subsequently, as time passes and circumstances change, those with excess permits could sell them to those who desired more permits.

Government sales of the permits would generate revenue, which could be returned to taxpayers or used for other projects, some of which might be directly related to energy and climate change issues. Currently, auctioning all the permits does not appear to be acceptable politically. A House-passed version of the American Clean Energy and Security Act of 2009 would allow 85 percent of the permits to be allocated administratively, while 15 percent would be auctioned.6 Electricity distributors would receive the largest share, while the rest would be divided among energy-intensive manufacturers, carmakers, natural-gas distributors, states with renewable energy programs and others. This compromise was viewed as necessary for passage. Such an allocation would mean that the government would receive little revenue because only 15 percent of the permits would be auctioned and that the initial allocation would probably not go to those who value the permits the most. However, this does not necessarily mean that the permits would not eventually be used by those who value them the most. After the initial allocation of permits, subsequent trading might lead to an allocation of the permits to those who value them the most. Of course, the sellers of the permits rather than the federal government would receive the money from these sales.

Economics vs. Politics

The cap-and-trade legislation illustrates the interplay between economics and politics. Uncertainty about the benefits and costs guarantees that any proposal to regulate carbon emissions will be controversial. While the cap-and-trade program working its way through Congress contains desirable economic features, the prospects for an auction process covering all permits for carbon emissions does not seem to be a viable option politically.

Endnotes

- The largest active cap-and-trade program for greenhouse gases is the European Union's Emission Trading Scheme. In the United States, the Regional Greenhouse Gas Initiative has implemented a cap-and-trade program for greenhouse gas emissions from power plants. [back to text]

- Details on this legislation can be found at: www.govtrack.us/congress/bills/111/hr2454. [back to text]

- See Economist. [back to text]

- See Krueger and Laitin (2007). [back to text]

- Those well-versed in economics will recognize that the welfare loss associated with the cap-and-trade program in the present example is represented by the triangle ABC. [back to text]

- This allocation is to last until 2030, at which time all permits are to be auctioned. [back to text]

References

Economist. "Cap and Trade, with Handouts and Loopholes." May 23, 2009, pp. 33-34

Metcalf, Gilbert E. "Market-based Policy Options to Control U.S. Greenhouse Gas Emissions." Journal of Economic Perspectives, Spring 2009, Vol. 23, No. 2, pp. 5-27.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us