President's Message: “Core” or “Total” Inflation—Which Is the Fed's Focus?

Some analysts assert that the Fed, in its role of maintaining price stability, mistakenly ignores the prices of certain items that are rising the fastest, such as today’s energy prices. Here are the critical questions: Does the Fed focus on core inflation, which excludes food and energy prices, because policymakers do not care about these particular prices? Even worse, are policymakers cherry-picking the data to paint a prettier picture? Conversely, is the Fed’s view a consequence of the fact that, historically, food and energy prices have been so volatile that they give a misleading signal about inflation fundamentals?

I believe the answer is clearly that policymakers concerned with low, stable long-run inflation have to attempt to see through short-run ebbs and flows of inflation in specific commodities. Food and energy prices are the most vexing. For me, the ultimate goal of policy is stability of the general price level, including all prices. The focus on core prices is an element of an effective strategy to achieve the ultimate goal.

Those who support the Fed’s position argue that the Fed is right to ignore food and energy prices when forming policy because increases and decreases in these prices can be temporarily large compared with other price changes. Monetary policy has no direct influence over particular prices anyhow, these people add. Monetary policy affects the general level of prices over time and has no permanent effect on relative prices—the price of one good relative to prices of other goods. Moreover, they argue, the Fed would be in danger of pushing its federal funds target rate too high if it failed to allow for the fact that interest rate increases affect the economy with a lag. Policy that is too tight for too long might jeopardize the sustainability of the economic expansion without contributing constructively to greater price stability.

Market-based economies operate best when consumers and producers are not routinely surprised by changes in prices. Sometimes, these shocks are the unavoidable result of large changes in relative prices that are unanticipated. The hurricanes that disabled energy infrastructure in Louisiana and the Gulf of Mexico were a notable example of such shocks. Although unexpected energy price increases that arise from these events can harm the economy in the short run (by reducing the purchasing power of households), energy prices typically fall and overall inflation retreats as soon as production is restored and inventories are rebuilt.

In these and other instances, monetary policymakers are correct to focus on core inflation because the temporary rise in energy prices would not be expected to flow through into the prices of nonfood and nonenergy goods and services, what economists call second-round effects. Moreover, any reasonable offsetting action that policymakers take would have no direct, short-run effect on energy prices and, if anything, would raise the risk of further destabilizing the economy. This was one of the key lessons learned from the 1970s. Energy price increases and a lack of market confidence in price stability led to the severe recessions of 1973-75 and 1981-82.

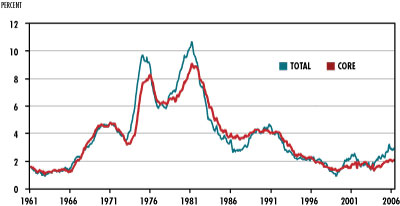

The difficulty arises when energy price increases persist, as they have over the past few years. When this happens, total and core inflation can diverge, as the chart shows. Over time, though, the two price measures tend to increase at the same rate because energy prices cannot forever rise much more rapidly than other prices. If the Fed does its job right, any second-round effects will be modest and temporary so that both total and core inflation will retreat as energy prices stabilize or fall.

Thus, even though the Fed is focusing on core inflation as an essential element of its strategy of inflation control, market confidence in this strategy will stabilize expectations concerning overall inflation. As we can see in the chart, overall inflation and core inflation have diverged during certain periods; sharp energy price increases in the mid- and late 1970s and sharp energy price decreases in the mid-1980s left a clear imprint in the data, creating gaps between core and overall inflation. Thus, recent experience is not new. Moreover, currently the magnitude of the overall inflation and of the size of the discrepancy between overall and core inflation is below that experienced on several occasions in the 1970s. We should not let recent experience of a string of years of major energy price increases deflect us from a sensible and time-proven strategy.

Inflation Rates Over 24-Month Periods

NOTE: Total and core inflation calculated from the price index for personal consumption expenditures, which is published by the Bureau of Economic analysis. Each observation is the annualized rate of change in the price index over the previous 24 months.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us