The Door Is Open, but Banks Are Slow To Enter Insurance and Investment Arenas

More than five years have passed since Congress enacted the Gramm-Leach-Bliley Act, tearing down regulatory barriers that separated commercial banking, investment banking and insurance underwriting. Many thought the new law would create a profusion of "universal banks," whose one-stop shop for financial services would not only make money for them but save money for consumers. Have these benefits come to pass?

The biggest potential benefit of the law is that it allows financial institutions to exploit fully the revenue efficiencies and cost savings that accrue from offering an array of financial services. The concept is similar to a grocery that also houses a pharmacy and a video rental department. The grocery earns additional revenue because the shopper buying a gallon of milk finds it convenient to fill a prescription and rent a movie. The grocery also sheds costs relative to three stand-alone stores because it can use the grocery's back-office functions, such as inventory, accounting and marketing systems, to service the pharmacy and video department. Shoppers benefit from added convenience and lower costs.

Similarly, consumers conceivably can go to their local bank to deposit funds, add the teenage driver to the insurance plan and invest savings in a mutual fund. In addition, business customers may wish to borrow money by taking out a bank loan or by selling corporate bonds. With the same banking organization handling both activities, businesses save time and money by going through the costly process of proving their creditworthiness to only one firm instead of two or more firms. Because of these advantages, supporters of the Gramm-Leach-Bliley Act promised it would save consumers billions of dollars.1

Despite the hype over the act, many analysts argued that it would have only minor effects on the financial industry because the potential revenue gains and cost savings from creating universal banks are small. To the extent that these advantages exist, banking organizations had already found ways to exploit them partly before March 2000-the month that the act took effect-by conducting investment banking activities in so-called Section 20 affiliates. (See "As Memories Fade, So Do Restrictions on Banks' Activities" below.) The legislation simply made it easier for organizations to continue to engage in the activities they had already undertaken.

More than five years have passed since the adoption of the act, enough time to examine the early impact that the legislation has had on the banking industry. The evidence, thus far, suggests that the effects of the law ave been modest; consequently, banking customers should not expect significant price reductions for their primary financial services. Two pieces of evidence lead to this conclusion.2 First, most financial holding companies (FHCs) continue to conduct traditional commercial banking activities; very few firms are also engaged heavily in insurance underwriting and investment banking. Second, FHCs on average are no more profitable or cost-efficient than they were before passage of the legislation.

FHCs Move Slowly

One measure of the impact of the act on the financial services industry is the extent to which financial holding companies have taken advantage of their new powers to conduct insurance and investment banking activities. The larger the cost savings and revenue benefits, the more quickly banks should respond to the legislation.

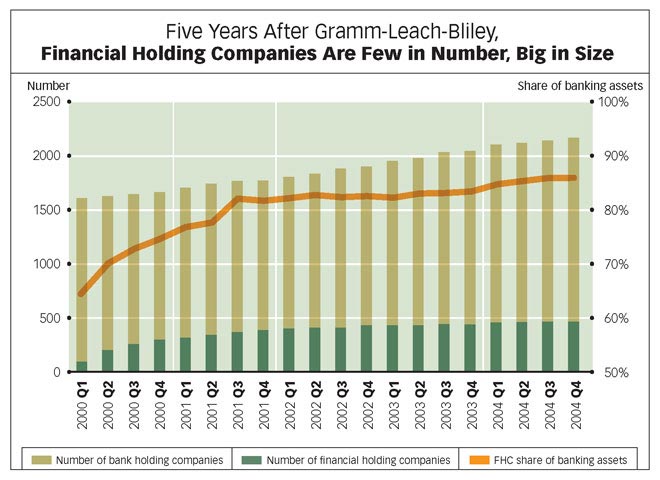

To take advantage of the act, firms must become financial holding companies. The chart above plots the number of FHCs and BHCs-bank holding companies that have not elected to become FHCs-between March 2000 and December 2004.3 The number of FHCs increased rapidly from 94 in March 2000 to 466 in December 2004; nevertheless, FHCs have never accounted for more than 23 percent of all banking organizations. As a percentage of assets, however, FHCs account for a significant share of total banking assets because most large banking organizations elected to become FHCs shortly after passage of Gramm-Leach-Bliley. As the line in the nearby chart shows, in March 2000, FHCs accounted for 65 percent of industry assets; their share in December 2004 was 86 percent.

A firm's designation as an FHC does not necessarily mean that it is engaging in insurance underwriting or investment banking. Indeed, the process to become an FHC is quite simple. To be eligible, each depository institution controlled by the banking organization must be well-capitalized and well-managed as of the date the company submits its declaration, and it must have a satisfactory Community Reinvestment Act (CRA) rating from its primary bank regulator. An election to become an FHC is effective on the 31st day after the date that the declaration was received unless the Federal Reserve's Board of Governors notifies the company prior to that time that the election is ineffective. The organization need not ever conduct the newly permissible activities authorized under Gramm-Leach-Bliley.

One indication of the weak response of the banking industry to the law is that, to date, financial holding companies are involved only modestly in their new universal banking powers to conduct investment banking and insurance underwriting. Moreover, the few that are heavily engaged in these activities are the large money-center banks that dominated the banking industry even before passage of the act. On average, FHCs hold less than 1 percent of assets in investment banking subsidiaries and just 0.24 percent of assets in insurance subsidiaries, and these activities account for just 7 percent of revenue. In fact, investment banking and insurance underwriting are highly concentrated in just a few financial holding companies. As of December 2004, of the 41 FHCs that held any investment banking assets at all, three organizations-Citigroup, Bank of America and JPMorgan Chase-accounted for 72 percent of the total. Moreover, of the 22 FHCs with insurance underwriting assets, just two firms-MetLife and Citigroup-accounted for 96 percent of the total, and the concentration has since increased. In the first quarter of 2005, Citigroup sold the bulk of its life insurance business to Met Life. It had already sold its property and casualty business in 2002. Citigroup's rationale was that the capital could be invested more profitably in other lines of business.

In sum, of the nearly 500 financial holding companies, only a handful of them have significant investment banking and insurance operations. Most FHCs are not that different from more traditional banking organizations. The lack of activity provides circumstantial evidence that the synergies between these activities are relatively weak.

FHC Performance Then and Now

A more direct approach to observing the effects of Gramm-Leach-Bliley on financial institutions is to measure changes to a bank's balance sheet and profitability after it becomes an FHC. Statistical techniques can isolate and measure the average change in performance after banks become FHCs relative to their performance before becoming FHCs.4 We analyzed bank performance between the years 1996 and 2003, assessing the marginal contribution from becoming an FHC. The results are in Table 1.

Three years after becoming an FHC, the average banking organization shows modest changes to its balance sheet. The typical BHC holds $62.30 in loans for every $100 in assets; that amount drops to $58.90 three years after becoming an FHC. The drop in loans is expected because the organization presumably is diversifying into insurance and investment banking assets. As a percent of assets, securities holdings increase by two percentage points, and deposits increase by one percentage point. Equity-the difference between assets and liabilities-increases somewhat after a firm becomes an FHC. The boldfaced font indicates that all of these changes are statistically significant-that is, the changes are not simply the result of chance. Yet, given the relatively wide dispersion of loan, securities, deposit and equity holdings among banking organizations, none of these changes is economically large.

In addition to the balance sheet changes, the typical FHC shows a slight decline in profitability. A banking organization that transitions from loan-making to insurance underwriting and investment banking would expect to see its interest income decline while its non-interest (fee) income increases. After all, insurance and investment banking are fee-driven services. Indeed, the typical FHC experiences these changes. Interest income as a percent of average assets declines by three basis points, while the ratio of noninterest income to average assets jumps by 13 basis points. However, the increase in noninterest income is offset by an even larger increase in noninterest (or overhead) expense. Noninterest expense to average assets surges by 21 basis points. In addition, provision expense-the income set aside to cover future credit losses-increases by nine basis points. Overall profitability, then, as measured by return on assets, slips by nine basis points to 1.19 percent, and return on equity drops by 114 basis points due to the drop in net income and the increase in equity. Only about half of the income ratio changes are statistically significant.

Do the FHCs gain cost advantages relative to BHCs? The increase in noninterest expense noted above suggests that the answer is "no," and another measure-the efficiency ratio-confirms this result. The efficiency ratio is calculated as overhead costs divided by operating income. Intuitively, the efficiency ratio shows how much overhead the organization spends to earn $1 in operating income. Lower values signal better cost efficiency. The average BHC between 1996 and 2003 had an efficiency ratio of 62.6 percent, suggesting that it took 63 cents in expenditures to yield a dollar in operating income. Three years after becoming an FHC, however, that ratio increased to 64.3 percent. In other words, FHCs were less cost-efficient than they were as BHCs. To be sure, part of the increase in costs may reflect one-time expenditures to acquire and absorb investment banking and insurance units into the organization. In the short run, however, FHCs did not gain a cost advantage over BHCs.

Are the Section 20 Banks Different?

As Sidebar 1 notes, Section 20 of the Glass-Steagall Act allowed the Federal Reserve to grant permission to select banking organizations to conduct limited investment banking activities prior to passage of the Gramm-Leach-Bliley Act. Some organizations began underwriting previously ineligible debt and equity issues as early as 1986. It could be the case that only those firms with previous securities activities (through Section 20 exemptions) were in a position to take immediate advantage of the new universal banking powers granted in the Gramm-Leach-Bliley Act. If so, a separate analysis of the so-called Section 20 FHCs—FHCs that had Section 20 affiliates before passage of the act—may reveal synergies between investment banking and commercial banking that are absent in other FHCs.

Indeed, such an analysis shows that three years after becoming Section 20 FHCs, the organizations sharply reduce their loan holdings by 8.2 percentage points and they increase securities holdings by 4.2 percentage points. In addition, the ratio of equity to assets increases by 68 basis points. All of these changes, which can be seen in Table 2, are statistically significant.

Despite the balance sheet changes, there is little evidence to support profit or cost advantages for Section 20 FHCs. Interest income decreases by 38 basis points, although noninterest income increases by just 23 basis points. Return on assets is 14 basis points lower for Section 20 FHCs than for Section 20 BHCs, and return on equity dips by nearly 2.5 percentage points. Finally, the efficiency ratio at Section 20 FHCs is a statistically insignificant 140 basis points higher than the ratio at Section 20 BHCs, suggesting that the Section 20 FHCs did not experience cost advantages after becoming FHCs.

In sum, the effects of the Gramm-Leach-Bliley Act on Section 20 FHCs are modest, but certainly larger than the effects on other FHCs. Although Section 20 FHCs do not appear to be more profitable or cost effective than other FHCs, the former do appear to be repositioning themselves to exploit presumed synergies between investment banking and commercial banking.

Some anecdotal evidence indicates that these synergies are developing. A recent New York Times article documented the relative decline of two stand-alone investment banks-Merrill Lynch and Morgan Stanley-relative to the investment banks that are part of banking organizations such as Citigroup and JPMorgan Chase. 5 An integrated investment bank is able to provide its customers with a broad range of services that stand-alone investment banks cannot match.

Whether Gramm-Leach-Bliley will affect the viability of the stand-alone investment bank in the long run is not clear. What is clear is that the act to date has not caused a financial revolution; rather, it has contributed to the deregulation of financial markets and institutions within the United States with remarkably little impact.

Conclusion

One justification for the Gramm-Leach-Bliley Act of 1999 was to provide new opportunities to financial institutions to exploit revenue opportunities and cost savings by becoming universal banks. We fail to find evidence, however, that FHCs were able to capture significant and immediate benefits from this legislation.

These results should not be construed as evidence that the act was a step in the wrong direction. Rather, the act is a further step in the evolutionary process of financial deregulation that gives financial institutions more flexibility to adapt to their global environment. Indeed, our results are consistent with the view of Philadelphia Fed President Anthony Santomero, who wrote in 2001 that financial modernization is not a single event or law, but rather a relentless process of eroding the constraints placed on the financial marketplace during the Great Depression. Perhaps the short-run synergies between commercial banking, investment banking and insurance are modest, but the long-term synergies may be much larger.

The FHC Metamorphosis

| Before becoming an FHC, the average BHC had these ratios: | Three years after becoming an FHC, the average FHC would have these ratios: | |

|---|---|---|

| Balance sheet ratios (percent of total assets) | ||

| Loans |

62.30

|

58.90

|

| Securities |

25.80

|

27.80

|

| Deposits |

79.40

|

80.40

|

| Equity |

9.21

|

9.59

|

| Income ratios (percent of average assets) | ||

| Interest income |

7.49

|

7.46

|

| Interest expense |

3.47

|

3.39

|

| Net interest income |

4.02

|

4.07

|

| Noninterest income |

1.58

|

1.71

|

| Noninterest expense |

3.55

|

3.76

|

| Provision expense |

.023

|

0.32

|

| Net income (ROA) |

1.28

|

1.19

|

| Return on equity |

13.92

|

12.78

|

| Performance ratios (percent) Efficiency ratio | ||

| 62.60 | 64.30 | |

NOTE: Bold ratios indicate statistically significant changes.

The Section 20 FHC Metamorphosis

| Before becoming an FHC, the average Section 20 BHC had these ratios: | Three years after becoming an FHC, the average Section 20 FHC would have these ratios: | |

|---|---|---|

| Balance sheet ratios (percent of total assets) | ||

| Loans |

60.30

|

52.10

|

| Securities |

18.10

|

22.30

|

| Deposits |

64.00

|

65.50

|

| Equity |

7.75

|

8.43

|

| Income ratios (percent of average assets) | ||

| Interest income |

7.04

|

6.66

|

| Interest expense |

3.49

|

3.21

|

| Net interest income |

3.55

|

3.45

|

| Noninterest income |

2.77

|

3.00

|

| Noninterest expense |

3.89

|

4.06

|

| Provision expense |

0.36

|

0.49

|

| Net income (ROA) |

1.38

|

1.24

|

| Return on equity |

17.38

|

14.91

|

| Performance ratios (percent) Efficiency ratio | ||

| 62.60 | 63.20 | |

NOTE: Ratios in bold indicate statistically significant changes.

Endnotes

- See Anason (1999) and Zaretsky (2000). [back to text]

- This article summarizes research by Yeager et. al (2005). Refer to the full paper for more details. [back to text]

- Although FHCs are technically also BHCs, we treat these groups as mutually exclusive. The data include all top-tier domestic banking organizations that file the Federal Reserve's FR Y-9C-the Consolidated Financial Statements for Bank Holding Companies. By including only top-tier organizations, we avoid double counting parent companies and their subsidiaries. Mandatory Y-9C reporters include all domestic BHCs and FHCs with total consolidated assets of at least $150 million. Smaller organizations are omitted from this sample. [back to text]

- The statistical technique employed is a fixed-effects panel regression. [back to text]

- See Thomas (2004). The animation studio DreamWorks proved a specific example of how JPMorgan Chase was able to use its bank relationship with the firm to win the investment banking business. [back to text]

References

Anason, Dean. "Clinton Enacts Glass-Steagall Repeal," American Banker, Vol. 164, No. 219, Nov. 15, 1999, p. 2.

Ang, James S. and Richardson, Terry. "The Underwriting Experience of Commercial Bank Affiliates Prior to the Glass-Steagall Act: A Re-examination of Evidence for Passage of the Act," Journal of Banking and Finance, March 1994, Vol. 18, pp. 351-95.

Benston, George J. "Discussion of the Hunt Commission Report," Journal of Money, Credit & Banking, November 1972, Vol. 4, No. 4. pp. 985-89.

Kroszner, Randall S. and Rajan, Raghuram G. "Is the Glass-Steagall Act Justified? A Study of the U.S. Experience with Universal Banking before 1933," American Economic Review, September 1994, Vol. 84, No. 4, pp. 810-32.

McLean, Bethany and Elkind, Peter. "Partners in Crime," Fortune, October 2003, Vol. 148, Issue 9, pp. 78-100.

Santomero, Anthony. "The Causes and Effects of Financial Modernization," speech to Pennsylvania Bankers Association, meeting in Charleston, S.C., May 7, 2001. See www.philadelphiafed.org/publications/speeches/santomero/2001/05-07-01_pennsylvania-bankers-assoc.

Simon, Carol. "The Effect of the 1933 Securities Act on Investor Information and the Performance of New Issues," American Economic Review, June 1989, Vol. 79, No. 3, pp. 295-318.

Thomas, Landon. "The Incredible Shrinking Investment Bank," New York Times, Oct. 17, 2004, section 3, p. 1.

White, Eugene. "Before the Glass-Steagall Act: An Analysis of the Investment Banking Activities of National Banks," Explorations in Economic History, January 1986, Vol. 23, pp. 33-55.

Yeager, Timothy J.; Yeager, Fred C.; and Harshman, Ellen. "The Financial Services Modernization Act: Evolution or Revolution?" Working Paper No. 2004-05, Federal Reserve Bank of St. Louis, June 2005.

Zaretsky, Adam. "A New Universe in Banking after Financial Modernization," The Regional Economist, Federal Reserve Bank of St. Louis, April 2000, pp. 5-9.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us