Does Uncertainty about Oil Prices Slow Down the Economy?

The correlation between increases in the price of oil and downturns in U.S. economic activity is one of the most-studied relationships in macroeconomics. In the January 2001 issue of The Regional Economist, Kevin Kliesen noted that a sharp increase in the price of oil has preceded each economic downturn since World War II.1 When oil prices increased sharply during late 2002, some analysts feared a repeat of this pattern—and, indeed, real GDP increased during the fourth quarter of 2002 and the first quarter of 2003 at a 1.5 percent rate, less than half its 4.0 percent rate during the third quarter of 2002.2

Oil Prices and the Economy

Many goods purchased by consumers and businesses—including motor vehicles, residential and nonresidential structures, and industrial machinery—will use a significant amount of oil-based products during their lifetimes. A jump in the price of oil today doesn't have much impact on the economy if users are convinced that the increase is going to be short-lived. It's the uncertainty regarding future oil prices that takes a toll. Such uncertainty induces consumers and businesses to delay purchases of these big-ticket goods until the future price situation becomes clearer.3

Market analysts and policy-makers infer changes in uncertainty regarding future oil prices from many sources of information, including expert opinion, international political events, changes in the prices of oil futures contracts and previous episodes in which oil prices increased significantly. We review each of these.

Does Expert Opinion Matter?

Prior to the U.S. invasion of Iraq, crude oil prices increased by more than 45 percent between December 2002 and February 2003, ending February at nearly $40 per barrel, including a "war premium" of $5 to $15 per barrel. Besides the threat of war, other events drove up prices. Political disruptions in Venezuela caused its oil production to fall by 90 percent. Violence in Nigeria threatened its oil fields. Worldwide demand was unusually high because of a variety of events, including Tokyo Electric Power's shutting down 13 of its 17 nuclear reactors and unusually cold weather in the United States. Inventories, which were at their lowest level since 1975, could not cushion the demand surge. Uncertainty regarding the size of future price increases was widespread; some analysts predicted that near-term crude oil prices would top $50 per barrel.

The uncertainty induced by contemporary political events was probably reinforced by published expert analyses. Typical was a report from the Center for Strategic and International Studies, widely reported during March 2003, that discussed four scenarios.4 In the "No War" scenario, Saddam disarms or is replaced in an internal coup and oil prices average $24 in 2003 and $18 in 2004. In the "Benign" scenario, Iraqi oil fields are undamaged by war and oil prices average $26 in 2003 and $22 in 2004. In the "Intermediate" scenario, sabotage and guerrilla attacks keep Iraqi oil off world markets for at least six months and oil prices average $37 in 2003 and $30 in 2004. In the "Worst" scenario, oil fields both in Iraq and other Arab countries are sabotaged and prices average $60 in 2003 and $40 in 2004.

Because this report and others in the press offered little guidance regarding the relative likelihood of alternative war outcomes, it seems likely that the reports contributed to, rather than reduced, the public's uncertainty regarding future oil prices.

A Role for Oil Futures Markets?

Beyond "expert" opinion and analysis, one might look to commodity and financial markets for indications of expected future oil prices. Perhaps the best-known of these is the market in exchange-traded oil futures contracts.5 Using futures contracts to predict what the public will pay in the future on the spot market is tricky, however. In the January 2002 issue of The Regional Economist, William Emmons and Timothy Yeager explain that the oil market falls into the category of "storable commodities with modest inventories." In this case, prices on futures contracts are useful predictors of future spot prices if the futures-contract prices are lower than current spot prices (that is, the oil market displays backwardation) but are not useful predictors if futures-contract prices are higher than the spot price (the market displays contango).

During 2002-03, for the longer horizon of three to six months, the prices of oil futures contracts often were below the spot price, suggesting that market participants anticipated an increase in the spot price when war occurred (sometime before the middle of 2003) and a quick reversal later. But the picture is not clear-cut. At the shorter horizon of one month, perhaps more closely related to decisions to postpone purchases, the prices of futures contracts were sometimes above and sometimes below the spot price. This pattern suggests significant uncertainty among market participants regarding the future spot price.

"Saddam Securities"

During 2002-03, unlike the first Gulf War in 1990-91, there was a new financial-market security that allowed the public to bet on the outcome of the war and, implicitly, on the likely future path for oil prices.6 In September 2002, the Irish Internet betting exchange www.tradesports.com offered a web page through which anyone could bet on when Saddam Hussein would be deposed as head of Iraq. Using credit cards as collateral, participants issued (sold) and purchased "Saddam Securities." The seller of a security agreed to pay the buyer $10 on the security's expiration date if Saddam Hussein was not leader of Iraq on that date, and zero otherwise.7 Generally, analyses of this market have concluded that the prices of Saddam Securities accurately predicted later movements in oil prices.

To the extent that large numbers of people participated in this market, the Saddam Securities market might have provided valuable insight regarding the public's anticipated timing of future changes in oil prices. But if few people knew of the security, movements in the security's price might not have reflected a broad range of opinion. To test the likelihood that this market was well-known, we searched the database of a large information services firm for references to either Saddam Securities orwww.tradesports.com beginning February 2002.8 We found no mention of either the Saddam Security nor www.tradesports.com prior to February 2003. As a result, we conclude that movements in the security's price were probably of limited value as a measure of the public's expectations for future oil prices.

Impact of Previous Episodes

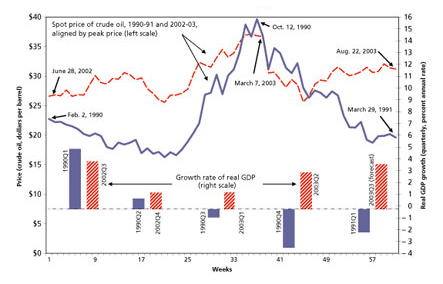

When in a new situation, almost all people use their past experience to guide their actions. During 2002-03, both consumers and businesses probably recalled the pattern of oil-price fluctuations during the first Gulf War of 1990-91. In retrospect, oil price fluctuations during both periods were similar, as shown in the figure. To the extent that the public's anticipations of future oil prices during 2002-03 were guided by their 1990-91 experience, any increase in uncertainty might have been small—and any slowdown in economic activity caused by factors other than oil. But this conclusion must be tempered by differences between the two conflicts. The second Gulf War, when it came, was an invasion of a hostile nation, not the liberation of a friendly one. On the opposite side was the greatly reduced importance during 2002-03 of Iraq and Kuwait as world oil suppliers relative to 1990-91, suggesting that the impact of a second Gulf War on world oil supplies would be smaller than the first. On balance, we find no way to assess the role of previous experience relative to oil price uncertainty during 2002-03.

Conclusions

Economic studies suggest that sharp increases in oil prices can significantly affect the pace of economic activity if they increase uncertainty regarding future oil prices. It seems reasonable that such uncertainty increased during late 2002 and early 2003, but measuring the increase is difficult. We have reviewed several indicators that were available to the public and policy-makers. Unfortunately, none of the indicators provides a clear signal. Although sharp increases in oil prices likely contributed to the economic slowdown during the fourth quarter of 2002 and the first quarter of 2003, confirmation of this effect awaits further research into measuring how changes in oil prices—and increases in political uncertainty—affect consumer and business spending behavior.

Endnotes

- All five major oil shocks to the economy between World War II and 2002 coincided with military conflicts in the Middle East, making it impossible to disentangle uncertainty due to oil prices from uncertainty due to war. The prospect of war itself may cause retrenchment by firms and households, regardless of oil price increases. [back to text]

- On balance, forecasters surveyed by the Blue Chip Economic Indicators during the first week of September anticipated fourth-quarter and first-quarter real GDP growth at 2.9 and 3.4 percent annual rates, respectively. As late as the first week of December, the Blue Chip consensus anticipated first quarter growth at a 2.7 percent pace, rather than the actual 1.4 percent pace. [back to text]

- Hamilton (2003) surveys the links between oil prices and economic activity. [back to text]

- These scenarios were first discussed at a Center for Strategic and International Studies conference on Nov. 12, 2002, and were updated during a press briefing on March 13, 2003. See www.csis.org/features/iraq.htm, "The Cost of War" section. See also "Oil and War," a special report in Business Week, March 17, 2003.[back to text]

- Oil futures contracts are traded on the New York Mercantile Exchange, www.nymex.com. Contract prices are available in major daily newspapers, on the exchange's web site and in this Bank's monthly National Economic Trends. [back to text]

- Leigh, Wolfers and Zitewitz (2003). [back to text]

- The betting exchange allowed issuers to choose a variety of expiration dates; the key dates are December 2002, March 2003 and June 2003. The exchange provided only a forum for the participants, never issued or bought any securities, and debited the losers and credited the winners via their credit cards. [back to text]

- We used the database of a major information services company (Factiva) that indexes more than 8,000 publications. [back to text]

References

Emmons, William R. and Yeager, Timothy J. "The Futures Market as a Forecasting Tool." Federal Reserve Bank of St. Louis The Regional Economist, January 2002, pp. 10-11.

Hamilton, James D. "What Is an Oil Shock?" Journal of Econometrics, May 2003, Vol. 113, pp. 363-98.

Kliesen, Kevin. "Rising Oil Prices and Economic Turmoil: Must They Always Go Hand in Hand?" Federal Reserve Bank of St. Louis The Regional Economist, January 2001, pp. 4-9.

Leigh, Andrew; Wolfers, Justin; and Zitewitz, Eric. "What Do Financial Markets Think of War in Iraq?" National Bureau of Economic Research Working Paper No. 9587, March 2003.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us