Down, But Not Out: The Future of Community Banks

On a street corner in a suburb of St. Louis sits a local grocery store called Freddie's Market, where older residents recall shopping as children. Nothing is particularly unusual about the small store, except that it is still in business. Unusual because down the street about a mile is a regional chain store that dominates the St. Louis grocery market. The chain's better selection and cheaper prices have driven nearly every other independent grocery store in town out of business.

Fast-forward 30 years. On another street corner in a St. Louis suburb sits a community bank. Nobody banks there anymore except the older folks. Younger residents frequent the mega-bank branches and ATMs located conveniently in the discount and grocery stores, where customers' auto loans are electronically approved while their groceries are bagged.1

In 1999, community banks are hardly a dying breed. Of the 8,567 U.S. commercial banks in business during the first quarter of 1999, 6,984 (or 82 percent) were community banks—those that both have less than $300 million in assets and are not owned by a large bank holding company.2 The United States is unique among industrial countries for the ubiquity and vitality of its community banks. Recent changes in the U.S. banking environment, however, threaten the long-run viability of these institutions. Will community banks retain their current place in the banking industry of the future, or will they go the way of the mom and pop grocery store?

A Breed Apart

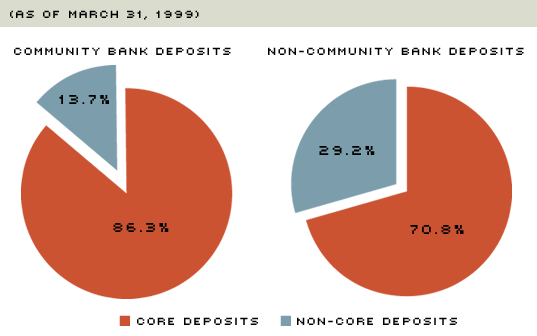

Community banks differ from other banks in that their business depends on personal relationships with depositors and creditors. Core deposits—checking, savings and small-time deposits—are the primary funding sources of community banks. These banks develop relationships with their customers that help to attract and retain core deposits. In contrast, larger banks rely more heavily on "hot money" to fund their loans. Unlike core deposits, hot money is a relatively more expensive funding source because banks nationwide bid for those funds. Hot money moves in and out of banks quickly, fleeing to the highest bidder, whereas core deposits are rooted in a given community and are not as likely to be withdrawn unexpectedly. As Figure 1 illustrates, 86.3 percent of community bank deposits are core deposits, compared with 70.8 percent at other banks.

Small Banks Rely On Home-Grown Funding

NOTE: Core deposits include checking, savings, and small-time deposits. Non-core deposits are all other deposits.

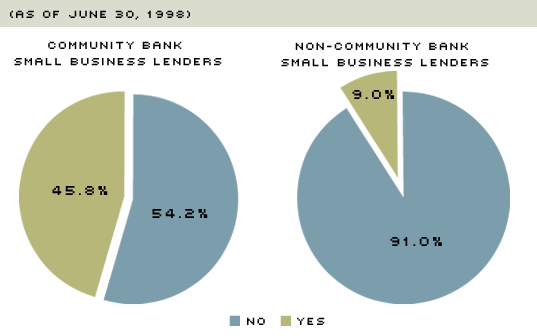

Small Banks Like Small Businesses

NOTE: Banks identify themselves as small business lenders if most of their business loans have original amounts of $100,000 or less.

SOURCE: FFIEC Reports of Condition and Income for Insured U.S. Commercial Banks

Personal customer relationships with borrowers give community banks an edge over other banks in small business lending since local banks can gather information about the borrower from several sources not available to other banks. Intangible information, such as an entrepreneur's reputation in the community or co-workers' assessments of the managerial talent of the loan applicant, are obtained more easily by a community banker. In contrast, larger banks typically focus on firms for which credit information is more readily available. As Figure 2 shows, 45.8 percent of community banks identify themselves as small business lenders, compared with only 9 percent of non-community banks. Community banks are also more likely to extend small business loans based on limited information since they can monitor these loans better than larger institutions can. Information advantages are greatest when the borrowing firm has its deposit accounts with the local bank originating the loan; in this case, the loan officer can track cash flows more quickly and accurately.3 Deposit account flows also provide the bank with information that cannot be obtained publicly. In addition, the borrower is more likely to be honest with the banker about the condition of the firm if he or she knows that the banker has "inside" information.

Community banks are also usually more flexible in tailoring their loan policies to small business customers. Because loan officers at small banks are closer in the chain of command to senior managers, they generally deal with less bureaucracy and, therefore, have more discretion in lending with "exceptions." The short chain of command also gives senior managers better oversight over credit performance, which makes it more difficult for loan officers to hide problem loans. At larger banks, on the other hand, loan officers follow more rigid rules because senior managers do not have the same oversight. This sort of flexibility gives community banks an advantage in small business lending.

Community banks can use their edge in originating and monitoring small business loans by exploiting economies of scope—the ability to produce two or more related products more cheaply than producing each of them individually. A bank might develop a relationship with a large depositor, for example, and leverage that relationship to provide business loans and trust services to the depositor. Although any bank can exploit economies of scope, community banks are in a better position to cross-sell products to small business customers because of the greater breadth of information they have on those customers.

For large banks, providing the sort of personal attention that community banks provide is impractical since larger banks have geographically dispersed depositors and borrowers, making relationships difficult to establish. Moreover, larger banks usually deal with businesses for which good information is publicly available, so investing time in establishing a personal relationship to better determine credit-worthiness is unnecessary. In addition, personnel turnover at larger banks and firms is higher, making the process of establishing personal relationships more difficult and less rewarding. In fact, some large banks restrict person-to-person meetings altogether for certain depositors, insisting that they use ATMs to keep bank personnel costs down.

Threats to Community Banking

Increased competition, improved technology and deregulation have reduced some of the advantages that community banks have historically enjoyed in this country.

Core deposits are more difficult for community banks to attract and retain because regional and national banks, credit unions and capital markets are competing more aggressively for these deposits. Thanks to mergers, acquisitions and interstate branching, a depositor at Bank of America, for example, can withdraw funds from North Carolina to California without paying ATM fees. Such convenience is difficult for community banks to match. Recent rules have also made it easier for customers to join local credit unions, which often pay higher deposit rates than community banks due in part to their nonprofit status.4

Brokerage firms have also competed aggressively for deposits. The current level of stock market returns has prompted many depositors to exchange their certificates of deposit for higher-yielding cash management accounts and mutual funds. And with larger banks now selling mutual funds, bank sales of these instruments have grown by an average of 24 percent a year over the past four years, while bank deposits have increased just 6 percent per year.5 Perhaps even more telling, traditional NOW deposits (interest-bearing checking deposits) shrunk by an average of 15 percent a year during the same time period.

Community banks are also beginning to lose their information edge. Innovations in information technology have reduced large banks' costs of evaluating potential small business borrowers. One such innovation is credit scoring—a process in which computer models quickly process credit information and assign the borrower a rating. Hence, large banks are now able to penetrate lending markets that community banks had dominated in the past.

The most significant challenge to the viability of community banks, however, is the consolidation of the banking industry, which enables banks to exploit economies of scale and, thus, operate at lower average costs (see below). Branching restrictions that previously limited larger banks' encroachment in the community bank market have since been eliminated. Just two decades ago, most banks were severely restricted from opening branches both within and across state lines. One way around this was to form a bank holding company (BHC), which then became the parent company of separately owned banks. In the 1980s, most states loosened restrictions to allow interstate banking through BHCs. The Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 allowed BHCs to acquire and merge with banks in other states. A BHC can now easily expand across state lines by acquiring a community bank, for example, and converting it into a bank branch.

As larger banks with lower average costs expand into community bank markets via acquisitions and mergers, they will be able to price their products more competitively than smaller banks. Except for the eroding advantage that community banks have in originating and monitoring small business loans, the basic products that small and large banks offer are similar. If community banks do not offer something different, deposits will flow to the highest bidder, and loan demand will go to those institutions offering the lowest rates. More often than not, these will be large banks.

Mom and Pop Provided Personal Service, Too

Banking expansion restrictions kept banks artificially small; removal of those restrictions has led to a great deal of consolidation. Because the grocery industry also has significant economies of scale—yet had no history of expansion restrictions—we may be able to learn something about banking's future by studying the grocery industry's past.

In the 1930s, a typical grocery store was small, family-owned and offered produce, dairy and meat under one roof. The supermarket drastically changed the grocery industry. Innovators like The Great Atlantic and Pacific Tea Company (A&P) introduced the concept of buying products in bulk to reduce per-unit costs. Founded in 1859, A&P initially sold only tea on the docks in New York City. In the 1920s, the company adapted its bulk-buying strategy to the grocery market and became the largest grocery chain in the nation for most of this century.6 Later improvements in technology, such as computer scanners and electronic cash registers, have further facilitated the growth of large supermarkets. Today, supermarkets are often huge retail outlets that include bank branches, florists, delis and bakeries, in addition to the "traditional" grocery offerings of meat, produce and dairy.7

Since World War II, rapid consolidation and growth in grocery chains—those with 10 or more stores—has radically altered the grocery industry. Chain stores' market share of total grocery sales increased from 34 percent in 1948 to more than 66 percent in 1992. The largest 63 grocery firms—those with 100 or more stores—increased their market share over the same period from 27 percent to 47 percent. Smaller chains—those with 10 to 99 stores—also grew rapidly, increasing from 7 percent to 19 percent of total grocery sales. The tremendous growth of chain stores has come at the expense of small, single-store firms. Such firms' market share has shrunk from nearly 60 percent in 1948 to just 21 percent in 1992.8 Despite the relative decline in single-unit store sales, however, these stores remain the most common type of grocery store. Of the 133,263 total grocery stores in the nation in 1992, nearly 84,000 (or 63 percent) were single-unit stores.9

Why have so many small grocery stores survived? Some grocery stores—particularly specialty stores that offer, for example, ethnic or organic foods—have a limited demand for many of their items. Large grocery chains are unable to reap economies of scale from such products and choose not to offer them. While specialty stores have survived by filling a niche in the grocery industry, other small stores have survived because they are either located in remote areas that face less competition from the larger chains or because consumers are willing to pay a premium to receive more personal service.

Community banks occupy a similar niche position in the banking industry: Their specialty products are the small business loans that require significant costs to originate and monitor; their presence in rural areas often gives them a locational advantage; and customers who frequent them often do so because of the personal service they offer.

A Glimpse into the Crystal Ball

Elimination of branching restrictions, competition for deposits and improved information flows will disproportionately reduce the number of—and the share of assets at—community banks over the next several decades. As larger banks exploit economies of scale through mergers, acquisitions and rapid growth, they will offer standard products at prices that community banks will not be able to match.

Community bank customers will, therefore, increasingly become those who are willing to pay a premium to receive personal service, rather than just be another anonymous face at a growing regional or national chain. In fact, anecdotal evidence suggests that business loan demand at community banks actually increases after a national chain buys out a regional bank in the area. This appears to be due to many businesses' preference for dealing with community banks that have a track record in the community. Time will tell whether this is a short-lived effect as larger banks gain ground, or if these businesses will remain loyal to their community banks over the long haul.

Community banks outside of metropolitan areas are likely to fare better than those in urban areas. Although competition is intense in nearly every corner of the U.S. banking market, the degree of competition is less severe in rural areas. More important, community ties are generally tighter in smaller areas, and more customers will be willing to pay a premium to bank with the known and trusted institution, rather than switching to a regional bank branch.

Community banks will play a role in the future banking environment because they provide personal customer service and cater to small businesses. Like mom and pop grocery stores, however, their market share will decline over time as larger banks exploit their economies of scale.

Endnotes

- See Williams (1997). [back to text]

- No single, agreed-upon definition of community banks exists. The $300 million bank size cutoff is employed to differentiate banks that cannot effectively exploit economies of scale. Large bank holding companies are those with more than $1 billion in assets. Data are from the FFIEC Reports of Condition and Income for Insured U.S. Commercial Banks. [back to text]

- See Nakamura (1994). [back to text]

- See Barancik (1998 and 1999). [back to text]

- See Clark (1993). [back to text]

- See Mayo (1993). [back to text]

- See Walsh (1993). [back to text]

- See U.S. Bureau of the Census (1966 and 1992). [back to text]

- See U.S. Bureau of the Census (1992). [back to text]

- See Berger and Humphrey (1994). [back to text]

- See Stigler (1958). [back to text]

- Output is measured by bank assets. However, bank assets understate output growth because they exclude off-balance-sheet items (unused funding commitments by banks), which have grown significantly in recent years. Because larger banks have increased their off-balance-sheet items more than small banks have, the bias reduces the chances of uncovering significant economies of scale. [back to text]

References

Barancik, Scott. "Credit Union Eligibility Is Extended to People Who Live With Members," American Banker (December 18, 1998).

________. "Trade Group Experts Debate the Extent of Credit Unions' Edge," American Banker (January 26, 1999).

Berger, Allen N., and David B. Humphrey. "Bank Scale Economies, Mergers, Concentration, and Efficiency: The U.S. Experience," Finance and Economics Discussion Series, Federal Reserve Board, Washington D.C., (August 1994).

Clark, Michelle A. "Banks and Investment Funds: No Longer Mutually Exclusive," The Regional Economist, Federal Reserve Bank of St. Louis (October 1993), pp. 5-9.

Mayo, James M. The American Grocery Store: The Business Evolution of an Architectural Space (Westport, CT: Greenwood Press, 1993).

Nakamura, Leonard. "Small Borrowers and the Survival of the Small Bank: Is Mouse Bank Mighty or Mickey?" Business Review, Federal Reserve Bank of Philadelphia (November/December 1994), pp. 3-15.

Stigler, George J. "The Economies of Scale," Journal of Law and Economics (October 1958).

United States Department of Commerce, Bureau of the Census. "1963 Census of Business: Retail Trade—Summary Statistics, Part 1." (Washington, D.C.: U.S. Government Printing Office, 1966), pp. 4-4, 4-5.

United States Department of Commerce, Bureau of the Census. "1992 Census of Retail Trade: Establishment and Firm Size." (Washington, D.C.: U.S. Government Printing Office).

Walsh, John P. Supermarkets Transformed: Understanding Organizational and Technological Innovations (New Brunswick, NJ: Rutgers University Press, 1993).

Williams, Christopher A. "Banks Go Shopping for Customers," The Regional Economist, Federal Reserve Bank of St. Louis (October 1997), pp. 12-13.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us