District Jobs: Have They Been Gearing Up?

Last year's economy did not end on a strong note. Although the year, overall, posted average growth in real output, it was only because of one strong quarter. The picture was still pretty grim at the beginning of 1996, due in part to the federal government shutdown and a fierce winter storm that struck most of the Midwest, Southeast and Eastern Seaboard. Many analysts and policymakers believed a recession was looming.

Then came the surprise. Payroll employment grew phenomenally in February, and real output rebounded to its average annual growth rate in the first quarter. Output growth accelerated further in the spring, making the first half of this year one of the strongest in the decade. Payroll employment growth did not keep up its pace, however, slowing somewhat during the spring.

How did the Eighth District fare over this period? Although output growth is hard to determine because the data are not timely enough to be useful, District employment growth slowed somewhat through the spring.1 However, the effects of the slowdown differed from region to region.

St. Louis

Nonagricultural employment growth in the St. Louis MSA slowed in 1995, then saw a mild resurgence in the first quarter of this year. This rebound mirrored that of the region's nonmanufacturing sector, which represents about 84 percent of all area employment. Manufacturing employment growth in the region, on the other hand, has been slowing since the second quarter of 1995, and, at the beginning of this year, turned negative. That is, manufacturing employment levels have actually been declining since the beginning of this year.

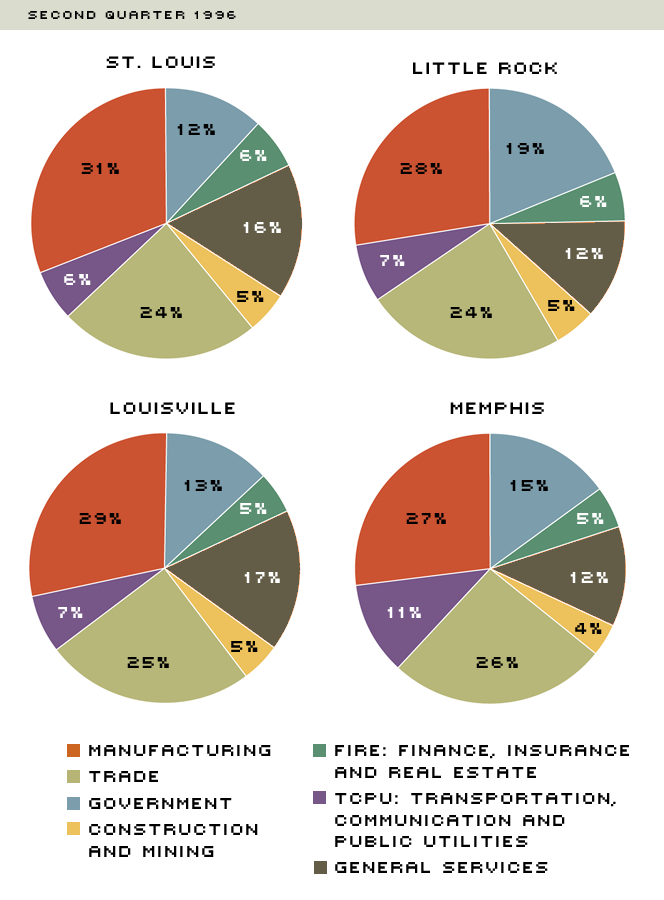

Over the past four years, St. Louis' list of leading employment sectors has not changed. In the second quarters of both 1992 and 1996, general services represented the largest employment sector. This sector includes health, legal, educational and entertainment services. Retail and wholesale trade, which includes department and discount stores and supermarkets, was the second largest employment sector in the region in both years. This sector has recently experienced some slowing in its growth rate, however.

Manufacturing is the third most important sector in the MSA, although its employment share has fallen almost two percentage points since 1992. The transportation equipment industry employed more manufacturing workers in the second quarters of 1992 and 1996 than any other such industry. It share of employment is roughly double that of any other manufacturing industry in the St. Louis MSA.

Food processing and production, and industrial machinery and computer equipment share the second manufacturing spot in the region. Although the latter wasn't even near the top of the list four years ago, it moved up the ranks because of losses in other industries like food processing, which has seen its growth rates decline. And although its rate of decline has ebbed recently, there are no signs yet of a coming resurgence.

Little Rock

The growth rate of nonagricultural payroll employment in the Little Rock MSA has declined since the first quarter of last year. By the end of the year, though, the decline had eased, reflecting moderation in the region's nonmanufacturing sector, which accounts for about 88 percent of area employment. The region's manufacturing sector, on the other hand, has seen its employment growth rate decline since the last quarter of 1994. By the third quarter of last year, growth became negative and has continued to fall by about 3 percent a year.

Over the past few years, Little Rock's list of leading employment sectors has remained unchanged. General services represented the largest employment sector in the second quarters of 1992 and 1996, and, while there has been some recent slowing in the growth of this sector, it is still experiencing an almost 3 percent annual gain. Retail and wholesale trade was the second largest employment sector in both years, and, for the past three quarters now, has seen an acceleration in its growth rate.

Unlike the St. Louis MSA, manufacturing does not hold the No. 3 spot in the Little Rock region; rather, government employment—federal, state and local—does. In fact, as the accompanying chart shows, government's share of total employment in the Little Rock region is greater than that in any other major metropolitan area in the District. This is understandable, however, since Little Rock is the state's capital.

Manufacturing currently accounts for less than 12 percent of all employment in the region. While fabricated metal production is the largest manufacturing industry, its yearly growth rate, which just recently turned negative, is down dramatically from its high of more than 25 percent about a year ago. Electrical equipment, and printing and publishing share the No. 2 spot. Although a surge in employment at electrical equipment firms in 1994 helped boost the industry, its employment levels have been declining rapidly in recent quarters.

Louisville

Nonagricultural employment growth in the Louisville MSA also declined in 1995, but most of the drop occurred in the second quarter. Since then, growth has been relatively stable—around a 2 percent annualized rate. This also mimics the movements of the region's nonmanufacturing sector, which accounts for about 83 percent of total employment. Manufacturing employment growth has been declining since the second quarter of 1994 and turned negative a year later. It has remained so since. This downward trend reversed in the third quarter of last year, however, and, while still negative, has been moving toward renewed positive growth.

The three leading employment sectors in the Louisville region have remained unchanged since 1992. General services represented the largest sector in the second quarters of 1992 and 1996. Spurred on by the region's health care industry, growth in general services has been accelerating recently, and employment is more than 5 percent above its level of a year ago. While ranking as the second largest employment sector in the area, retail and wholesale trade has seen a recent decline in its growth rate, which now stands at slightly less than 2 percent per year.

Manufacturing is the third largest employment sector in the region. In fact, the Louisville area employs a larger share of its workers in manufacturing jobs than any other District MSA. And as in the St. Louis area, transportation equipment is the dominant industry in the sector, when only four years ago, it was not even near the top of the list. Transportation equipment gained the pole position by undergoing phenomenal year-over-year employment growth rates—none below 12 percent—during the past few quarters. Much of this growth can be tagged to the additional shift the local Ford plant has added to its production schedule.

Memphis

The growth rate of nonagricultural employment in the Memphis MSA fell through 1995, followed by a one-quarter rebound at the beginning of this year. Once again, these movements matched those of the region's nonmanufacturing sector, which accounts for about 88 percent of all employment. Manufacturing employment growth began to slide in the beginning of 1994, then moderated for two quarters late in 1994, before resuming its downward trend. Currently, manufacturing employment is declining at almost 3 percent a year.

General services is the leading employment sector in the Memphis region. Retail and wholesale trade, which was the leading employment sector in 1992, is now second. Although the area has some major players in this field, growth in retail and wholesale trade has been slowing since the fourth quarter of 1994. Like Little Rock, government employment holds the third spot in Memphis, representing about 15 percent of total employment.

Manufacturing firms employ less than 12 percent of all payroll workers. At its current rate of decline, manufacturing will soon fall behind the transportation, communication and public utilities industry in its share of total employment. Industrial machinery and computer equipment, food processing and production, and chemicals all tie as the leading manufacturing industries.

Regional Flavors

The District's major metropolitan areas have not necessarily followed the nation's employment pattern in recent years. All of the four MSAs discussed saw employment growth decline during 1995—as did the nation—but most saw a mild rebound earlier this year, which the nation did not. Manufacturing industries, which, at best, account for less than one-fifth of total employment, continue to be the crosswinds blowing the trends off-track. Ultimately, the picture that emerges is one of diverse regional strengths and weaknesses, all acting to determine the final outcome.

Endnotes

- Gross state product, the output measure that is the state equivalent of GDP, is available only with a two-year lag. [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us