Demystifying Derivatives

"Risky Business on Wall Street: High-tech super nerds are playing dangerous games with your money"

—Headline, Time magazine, April 11, 1994

"They are mechanisms that our customers demand to try to make a volatile world appear to be more stable. They are nothing but a form of insurance."

—John S. Reed, Chairman and CEO, Citicorp

Although they've been around in some form since the 1840s; derivatives in recent months have obtained the notoriety usually reserved for drug lords and international terrorists, as the Time headline above suggests. Derivatives' dangerous reputation has been prompted by their growing size and complexity as well as by headline-grabbing losses suffered by companies like Procter & Gamble and mutual funds, like those of Paine Webber and Piper Jaffray.

Participants in the derivatives market, like Citicorp's John Reed, say derivatives are not inherently dangerous, but are important risk-mitigating tools in today's complex business environment. Both users and dealers claim that the risks derivatives pose to financial markets are exaggerated and that further regulation will only impede efficiency in an otherwise healthy market. Who's right? To answer that, it's necessary to examine just what derivatives are, who uses them and why.

The ABCs of Derivatives

Derivatives are financial contracts whose values are linked to either an underlying asset, such as a stock, bond or commodity; a reference rate, such as the interest rate on three-month Treasury bills; or an index, such as the S&P 500. Derivatives developed to meet a variety of financial market participants' needs, the predominant one being the unbundling and efficient management of financial risks. Although derivatives seem complicated, their premise is really very simple: They allow users to pass on an unwanted risk to another party and assume a different risk, or pay cash, in exchange.

A familiar example will illustrate. Suppose company XYZ uses a large amount of oil in its production process. Suppose further that XYZ's customers place orders for its products six months in advance at a predetermined price. Given the volatility of oil prices and XYZ's desire to earn some target profit margin, XYZ would like to protect itself from a potential increase in oil prices. It can do so by entering into a futures contract: XYZ agrees to buy a specific quantity of oil at a predetermined price on some future date.

If the price of oil exceeds the contract price at maturity, XYZ has saved money and protected its profit margin. If the current, or spot, price of oil is less than the contract price, XYZ must pay the contract price, but has still protected its profit margin. In this case, XYZ has used a derivative as a form of insurance.

The futures contract described earlier is a standardized version of the simplest type of derivative, called a forward contract. A forward contract obligates one party to buy, and another party to sell, a specified amount of an underlying asset, rate or index (often called an "underlying") at a specific price, on a specific date.1

The other basic type of derivative contract is an option. An option gives its holder the right but not the obligation to buy or sell an underlying at a price, called the strike price, during a specific period or on a specific date.2 An option holder pays a premium to obtain the contract because it is a one-sided deal: The buyer benefits from favorable movements in the price of the underlying (if he exercises the option) but is not exposed to losses should the price go the other way (because he can let the option expire).

Another way to look at the derivatives market is to divide derivatives into "exchange-traded," or standardized contracts, and "over-the-counter (OTC)," or customized contracts. The oil futures contract described earlier is an example of an exchange-traded derivative. Every feature of the contract—the quality and quantity of the underlying, the time and place of delivery, and the method of payment—is standardized but the price. Futures and many options contracts, which are tied to bonds, equities, currencies and commodities, are the major types of exchange-traded derivatives. These are traded on the Chicago Mercantile Exchange and the New York Stock Exchange, among others. The standardization of these contracts makes them accessible to both retail and wholesale investors, as well as generally less risky.

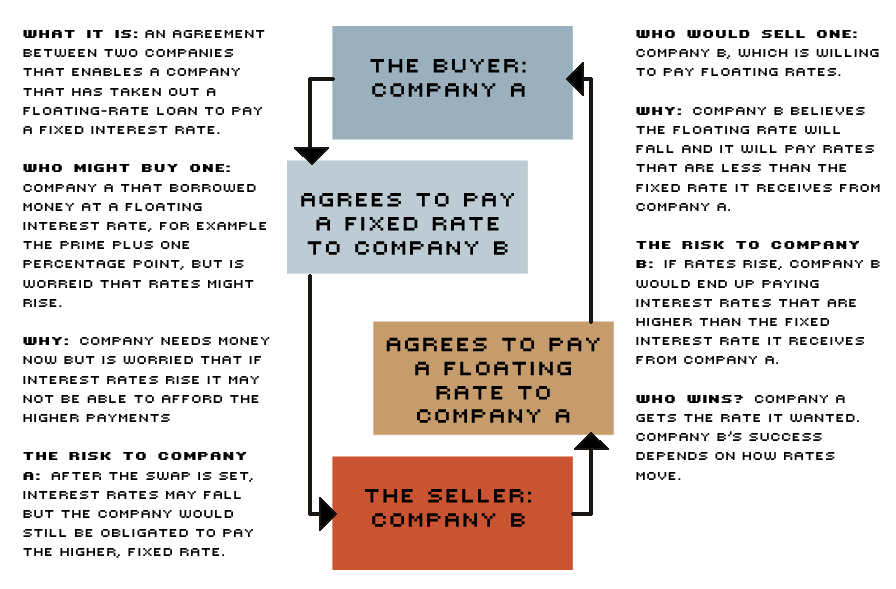

OTC derivatives are another story. Unlike exchange-traded derivatives, all terms of an OTC derivative are negotiated between two counterparties. That makes them more complex, less liquid and more difficult to value. OTC derivatives range from the very simple, such as the basic (or "plain vanilla") interest rate swap described in the chart, to the very complex, with exotic names like inverse floaters and naked call options.3

Plain Vanilla: Anatomy of Basic Interest Rate Swap

SOURCE: Copyright © 1994 by New York Times Company. Reprinted by permission.

Derivatives and Risk Management

How do OTC derivatives help businesses manage financial risks? Corporations can lower funding costs and diversify funding sources through derivatives. An American company, for example, may decide to issue debt in Germany rather than in the United States because of a slight difference in U.S. and German interest rates; by arbitraging the difference in interest rates and using a currency swap (an agreement to exchange one currency for another) to obtain the funding in U.S. dollars, the company lowers its costs.

Another major use of derivatives is to hedge interest rate or exchange rate risk. An issuer of fixed-rate debt who anticipates a general increase in interest rates can enter into a forward swap (an agreement to swap some time in the future) to lock in the level of interest rates at the time the funding decision is made. Similarly an issuer of floating-rate debt can eliminate the risk of rising interest rates by purchasing a cap, essentially fixing an upper bound on the rate the borrower will have to pay, no matter what market rates do.

Importers, exporters and companies that have significant overseas operations may find derivatives an ideal tool to manage exchange rate risk. A U.S. exporter to Mexico who is expecting a fixed payment in pesos could see profits disappear if the peso severely depreciates before the exporter gets paid. Companies facing exchange rate risk can use currency swaps and foreign exchange forwards or options to hedge expected future cash flows from foreign transactions.

Betting the Ranch?

Of course, any instrument that can be used to hedge can also be used to speculate. This aspect of derivatives, combined with the largely unregulated nature of the OTC derivatives market, is what has so many so spooked. Policymakers are concerned, for example, that banks' derivatives activity from either the end-user or dealer side may pose significant risks to the bank insurance fund. On the end-user side, the concern is that banks will be tempted to take large speculatory bets on interest rates that could impair their capital or lead to failures. Because a large proportion of U.S. OTC derivatives dealers are money center banks, some worry that the failure of one bank dealer may have a domino or systemic effect on the whole banking industry and, hence, taxpayers. The prescription for these and other risks, say derivative doomsayers, is tighter regulation.

Derivative proponents like the International Swaps and Derivatives Association counter that the vast majority of end users and dealers are not taking excessive risks and that current risk management guidelines are sufficient to ward off reckless behavior. They are concerned that additional regulatory intervention will eliminate the flexibility and efficiency inherent in this market. A preferred alternative to tighter regulation, then, is increased transparency and better accounting of derivatives activity. Bank advisory organizations like the Basle Committee on Banking Supervision and the Group of Thirty have recommended a variety of management guidelines to mitigate some of the risks inherent in derivatives activity.

Speculators Beware

The principle that appears to be operating in discussions of derivatives is the adage "people fear what they don't understand." As derivatives have evolved from the plain vanilla to the more exotic, the ability of many to get a handle on the risks and rewards of these financial instruments has become much more difficult. Although thousands of firms have successfully used derivatives to protect themselves from adverse shocks, others have made foolish bets that have cost them dearly. At the least, policymakers want to be sure that investors and regulatory authorities know when firms are using derivatives to speculate rather than to hedge. For those wishing to speculate with derivatives, the message from investors and policymakers is pretty clear: We'll be watching you.

Endnotes

- Futures, foreign exchange forwards, forward rate agreements (forwards based on interest rates) and swaps (an agreement to exchange a series of cash flows at specified intervals) are the major types of forward contracts. [back to text]

- An option to buy is called a call option; an option to sell is called a put option. Caps, floors, collars, swaptions (an option to enter into a swap), and options on futures contracts are the major types of option contracts. The mechanics of forward- and option-based derivatives are explained in both the Group of Thirty report and the Federal Reserve Bank of Atlanta (1993) report. [back to text]

- See Federal Reserve Bank of Atlanta (1993) for descriptions of the more exotic derivatives products. [back to text]

References

Abken, Peter A. "Over-the-Counter Financial Derivatives: Risky Business?" Federal Reserve Bank of Atlanta Economic Review (March/April 1994), pp. 1-22.

Basle Committee on Banking Supervision. Risk Management Guidelines for Derivatives (July 1994).

Federal Reserve Bank of Atlanta. Financial Derivatives: New Instruments and Their Uses (December 1993).

Group of Thirty. Derivatives: Practices and Principles (July 1993).

International Swaps and Derivatives Association (ISDA). The GAO Report on Financial Derivatives: Good Facts and Bad Conclusions, An ISDA Position Paper (May 27,1994).

United States General Accounting Office. Financial Derivatives: Actions Needed to Protect the Financial System (May 1994)

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us