IOUs from the Edge: Should We Worry about the Budget Deficit?

It's difficult to imagine an economic issue that has generated more public discussion in recent years as has the federal budget deficit.1 The deficit has been blamed for a myriad of our economic ills, from high real interest rates and a low national saving rate to inflation, reduced public and private investment, inadequate job creation and the trade deficit.

Is such concern warranted? Maybe not. Despite its galvanizing effects on public and political opinion, there remains considerable disagreement among economists about the economic effects of budget deficits and about whether their measurement is so faulty that we should ignore them.

Some confuse the deficit with the debt, assuming incorrectly that they are one and the same. The amount of debt issued by the Treasury Department each year to make up for a budget shortfall is called the deficit; the accumulation of these deficits over time becomes the national debt.

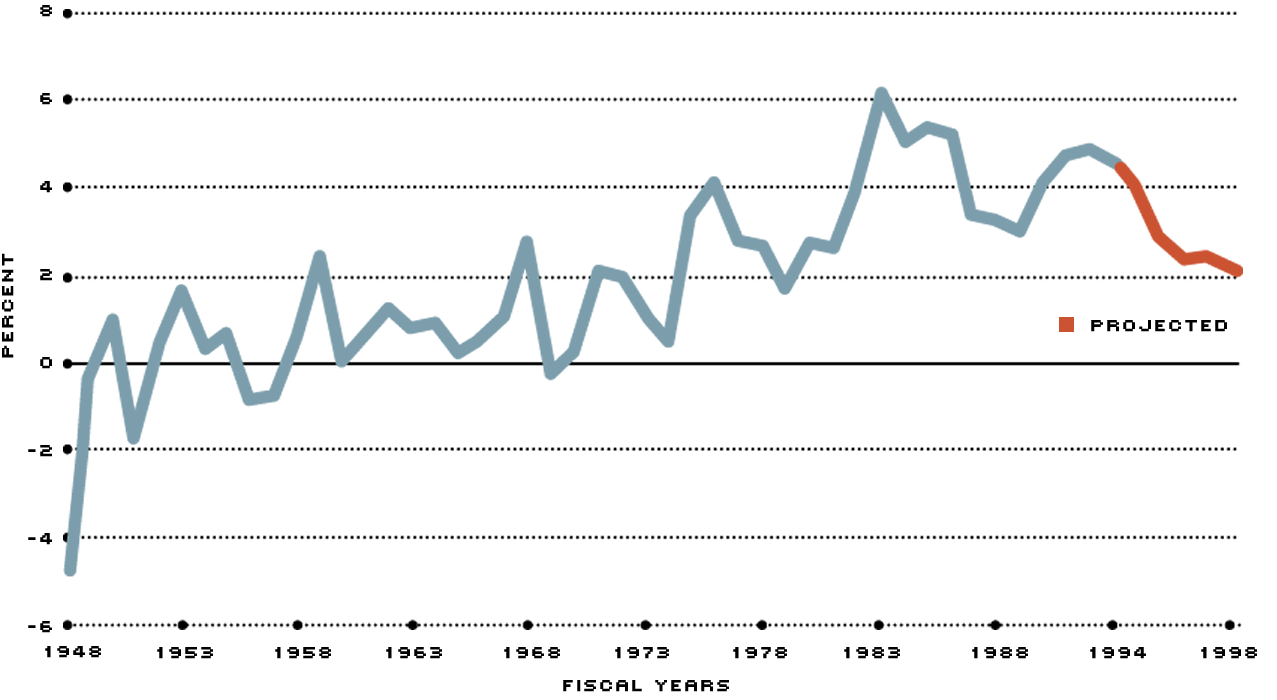

An instructive way to look at the budget deficit is as a percentage of gross domestic product (see Figure 1). Using this yardstick, there are two general points we can make. First, the size of the deficit is heavily influenced by the state of the economy. When the economy is growing, tax receipts tend to rise faster than government spending, and the deficit declines as a percent of gross domestic product (GDP); when the economy slows, the opposite usually holds. Second, for most of the post-World War II period, the budget deficit averaged less than 2 percent of GDP. Since 1974, however, the deficit as a share of GDP has trended upward, except for a brief period in the mid-to late 1980s. Last year it registered about 4.9 percent of GDP in fiscal year (FY) 1992. Government projections forecast this share falling to 2.4 percent by 1996 (a deficit of $179 billion).2 Such projections, however, often miss the mark by a wide margin.

The Deficit's Rising Share of GDP

From the end of World War II to about 1974, the deficit was seldom more than 2 percent of GDP. Since then, it has seldom been less than 2 percent of GDP.

SOURCE: Office of Management and Budget.

Two Competing Views

Economists are a divided lot concerning the effects of budget deficits on the economy.3 Most, however, subscribe to one of two main views: the traditional, or Keynesian, view and the alternative, or Ricardian, view. The traditional view has been accepted widely by the press and policymakers; its acceptance by economists, however, is much less ironclad.

The Keynesian view emphasizes the link between interest rates and budget deficits, arguing that budget deficits cause interest rates to be higher than what they would normally be. Whenever the government must borrow funds to meet its obligations, it "crowds out" the private sector. In other words, government borrowing leaves fewer funds available to finance investment in machinery or equipment or purchases of consumer durables. As a result, firms and individuals must compete more aggressively for a smaller share of resources. This increased competition, so the theory goes, causes interest rates to be bid up higher, thereby causing the nation's economy to grow more slowly and reducing our standard of living.

The Ricardian view is the antithesis of this view. According to this approach, budget deficits do not influence interest rates or economic activity in the usual sense. When the government borrows to finance its current spending, individuals increase their present level of saving in anticipation of an increase in future taxes. These future tax increases are necessary to pay off the debt that the government is acquiring today. If individuals are saving more, they must be consuming (spending) less. Thus, the reduction in demand from savers offsets the government's increased demand for goods and services that results from deficit spending.

Ricardian economists do recognize that budget deficits can be harmful to the economy. They argue, however, that these effects occur primarily because of the distortions and uncertainties created by future tax increases.

In economics, as in other social sciences, sorting out rhetoric from reality is sometimes difficult. This difficulty is magnified when one considers the divergent predictions offered by competing economic models and economists. Although real interest rates have been relatively high in the 1980s, lending support to the Keynesian view, they are influenced by additional factors that have little to do with government financing, such as monetary policy and international developments. On the other hand, although many mainstream economists consider some of the assumptions underlying the Ricardian hypothesis unrealistic, several studies have failed to reject it score predictions. Thus, the economic profession remains divided on the significance of the deficit/interest rate linkage.

Other Issues

In addition to asking if budget deficits affect interest rates and economic activity, we might more appropriately ask whether the budget deficit is measured correctly in the first place. Some economists believe that it is not. Those that hold this view argue that the government should keep its books in the same manner as private corporations do.4 What is the difference? Essentially, private corporations treat operating expenses differently than investment outlays. Thus, to a private business, money spent on employee wages and input supplies should be accounted for in a different manner than outlays for a computer or other piece of equipment. In accounting terms, this means separating the budget into a current account, which measures the firm's operating expenses, and a capital account, which measures its outlays for investment. If private corporations used the same accounting methods as the government, many would also be operating in the red.

In FY 1992, the federal government spent $102.6 billion on capital outlays. By excluding such items, the FY 1992 budget deficit declines from $290.4 billion to $187.8 billion, or 3.2 percent of GDP. One problem with this view, however, is that one can reduce the deficit merely by defining "investment" more broadly. The economist Robert Eisner, for example, believes investment should also include spending on education, worker training and research and development.

Given the ongoing disputes between the Keynesian and Ricardian camps (as well as others) and the lack of definitive statistical support for their prognoses, some economists are beginning to wonder whether we should really be paying attention to the size and composition of government spending. In other words, is the government spending its money on the correct things?5 Proponents of this view believe that the government's primary function is to ensure long-term economic growth and security. Such a result could be achieved, in this view, by redirecting government expenditures toward those defense and nondefense endeavors that boost the nation's level of physical and human capital stock. To do otherwise risks increasing the burden of government intervention in the private economy, which tends to lower economic efficiency.

However one comes down on these issues, it seems clear that they will all come into play in the ongoing deficit reduction debate.

Endnotes

- Unless noted otherwise, the term budget deficit will broadly refer to the budget deficit of the federal government, which excludes state and local government budgets. [back to text]

- These numbers are estimated by the Office of Management and Budget. The Congressional Budget Office, on the other hand, forecasts the deficit to fall to 2.6 percent of GDP by 1996, or $190 billion. [back to text]

- See the "Symposium on the Budget Deficit" published in the Spring 1989 issue of The Journal of Economic Perspectives for a readable summary of the various arguments. [back to text]

- See Robert Eisner, How Real is the Federal Deficit? (The Free Press, 1986). [back to text]

- See Owen F. Humpage, "Do Deficits Matter?" Economic Commentary, Federal Reserve Bank of Cleveland (June 15, 1993); and Harvey S. Rosen, "Perspectives on 'Is the Deficit a Friendly Giant After All?'" Harvard Business Review (July-August 1993), pp. 140-48. [back to text]

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us