Banks And Investment Funds: No Longer Mutually Exclusive

Pick up a business or general interest publication these days and it's difficult not to see something on mutual funds. In addition to the listings of investment results, which appear daily alongside the money, bond and stock market reports in most newspapers, articles on the "who, what, where, when and why" of mutual funds are appearing with increasing frequency.

Although they have been around for almost 70 years, mutual fund popularity is at an all-time high: In the first half of 1993, investors poured $130 billion into stock, income and bond mutual funds alone. Mutual funds—which recently topped $1.8 trillion in assets—now rank third among financial intermediaries, behind commercial banks and life insurance companies. By mid-1993, they outnumbered companies listed on the New York Stock Exchange by a margin of nearly two to one.

One of the most noteworthy aspects of the mutual fund surge is the participation of institutions that traditionally have competed with mutual funds for investment customers. Commercial banks, for example, are entering the mutual fund industry in droves. The American Bankers Association (ABA) estimates that 3,500 banks—almost one-third of all U.S. banks—now sell mutual funds. Some merely refer customers to outside brokerage houses; others manage their own mutual funds.

Because these products offer many positives for banks and their customers, much of the industry views the provision of mutual funds as a win-win activity. Congressional leaders and federal and state regulators are not so sure. They are concerned that some banking customers won't understand the risks inherent in mutual fund investments, especially their uninsured status and the potential loss of principal. Such customer confusion could turn a winning combination into a losing proposition.

What Is a Mutual Fund, Anyway?

A mutual fund is a company that pools funds and makes investments on behalf of individuals and institutions with similar investment goals; these individuals and institutions are the fund's shareholders as well as its customers. Mutual funds are ideal for small investors who want diversified risk and professional money management. A mutual fund investor can choose from some combination of money market, bond, income and equity funds to meet investment goals.

Mutual funds provide earnings to shareholders in three ways: through dividends, through capital gains if fund securities are sold at a profit, and through share appreciation if the value of securities held in the fund increases. Mutual fund shares are easily redeemed, and many funds offer conveniences such as check writing, purchase through payroll deduction and exchange features within a family of funds.

Recent Trends in the Industry

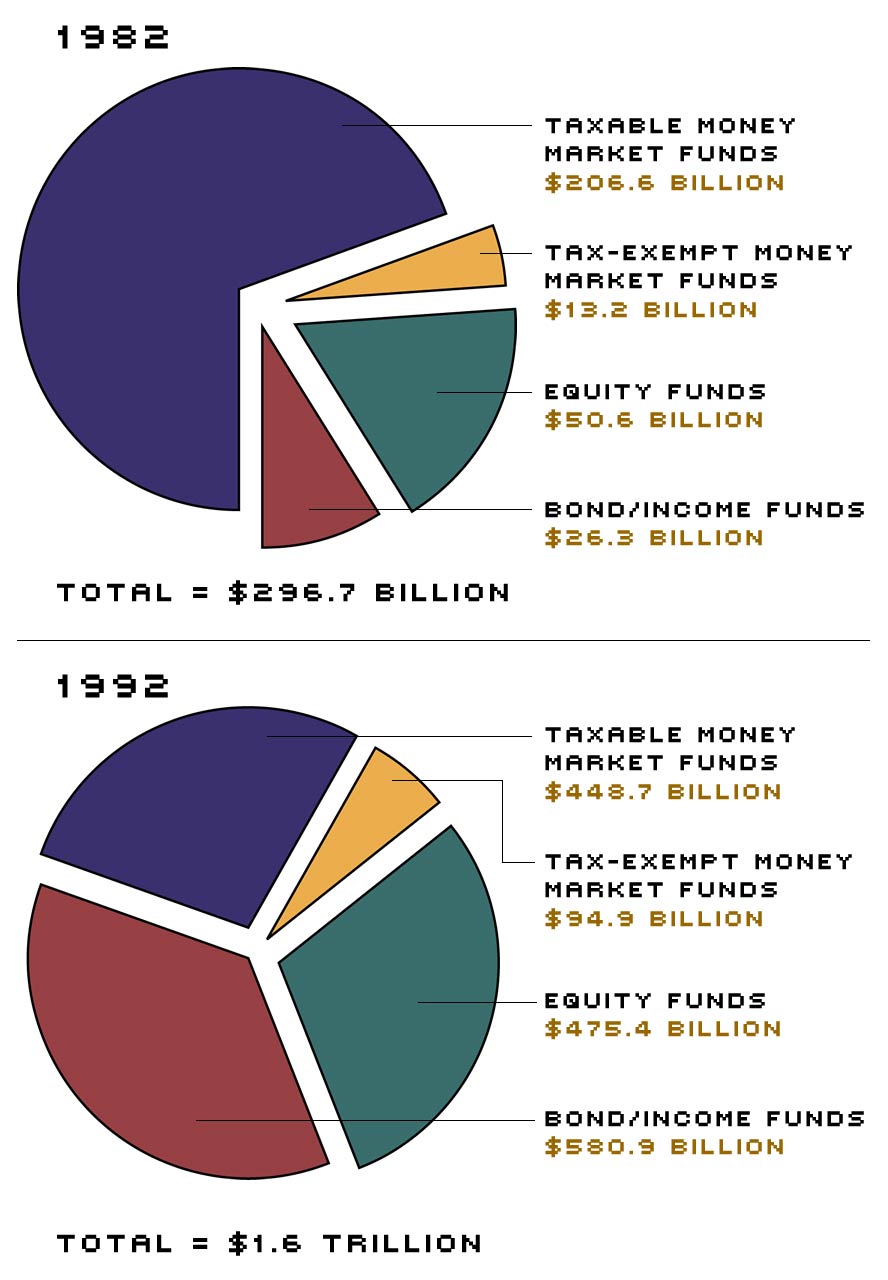

Prior to the early 1970s, the fortunes—and the market share—of mutual funds rose and fell with the bond and stock markets. A big impetus to the industry arrived in the 1970s with the introduction of money market mutual funds (MMMFs).1 MMMFs are short-term funds invested in high-grade, highly liquid assets like Treasury bills, large certificates of deposit (CDs) and commercial paper. The development of these funds opened up the money market, which had been dominated by wealthy individuals and large institutions, to small, often first-time investors, allowing them to earn better returns than they could get on deposit products.2 By year-end 1982, taxable and tax-exempt MMMFs had captured almost three-fourths of the mutual fund market (see Figure 1).

Composition of Mutual Fund Net Assets

NOTE: All figures are as of year-end.

SOURCE: Investment Company Institute

As short-term rates fell and stock and bond markets rose during the 1980s, investors began putting proportionately more money in long-term funds—equity, bond and income funds. Individual investors apparently felt comfortable with the increasing capital risk they were assuming. The move by U.S. companies away from defined-benefit retirement plans and toward defined-contribution retirement plans also helped feed the mutual fund frenzy. Defined-contribution retirement plans (such as 401 (k) plans) allow companies to pass the control of retirement benefits on to their employees. Most 401 (k) participants invest their plan contributions in mutual funds offered by their employers.

The popularity of long-term funds has only accelerated in the 1990s: In 1992, net sales (sales less redemptions) of bond, income and equity funds hit an all-time high of $197 billion, up 66 percent from 1991. At the end of 1992, long-term funds made up two-thirds of mutual fund assets (see Figure 1), compared with about one-fourth a decade ago.

These trends have made mutual funds an integral part of Americans' savings and retirement programs. According to the Investment Company Institute (ICI), the mutual fund industry's trade group, just 6 percent of U.S. households owned mutual funds in 1980; by 1992, about 26 million households, or 27 percent of all households, were mutual fund owners, either directly or through IRA or Keogh plans. In a 1992 telephone survey of investors, the ICI found that the typical mutual fund investor is married, middle-aged (46 years old) and employed, with an annual household income of $50,000. Mutual fund assets—mostly stock and bond fund shares—make up about 38 percent of this average household's financial assets.3

Why are mutual funds so popular today? Three interrelated factors come to bear. First, low interest rates offered on CDs and other traditional savings products combined with the relatively high yields posted in the stock and bond markets over the last several years have prompted savers to trade some risk for reward. Second, baby boomers are in their prime earning years and are looking for well-diversified, long-term investments to help finance their retirements. And third, the products are being distributed through a wider network of providers, including depository institutions.

Banks and Mutual Funds

So why are banks encouraging their customers to do business with a competing industry? Faced with increasing competition on both the loan and deposit sides of the business, banks are now offering mutual funds to earn fee income. But, perhaps more importantly, banks want to keep customers coming in the door. "Maintaining long-term customer relationships" has become a banking industry buzz phrase, and the sale of mutual funds is one way bankers are trying to do just that.

Banks essentially received the regulatory go-ahead to begin competing directly with the mutual fund industry in December 1982, when money market deposit accounts (MMDAs) were authorized. MMDAs are insured deposit accounts with floating rate yields; the rates paid on them are related to the return banks receive on their investments in Treasury bills, commercial paper and jumbo CDs—essentially the same assets in which MMMFs are invested. From the start, MMDAs proved extremely popular, at the expense of their competitors: The assets of MMMFs and the dollar value of depository institution time and savings deposits declined for five consecutive months after MMDAs were introduced.4

In recent years, banks have made further inroads into the mutual fund business. One low-cost, easy way for a bank to offer mutual funds to customers is to invite an independent vendor, such as Fidelity or Kemper, to set up shop in a banking office or affiliate and sell their funds. The fund group provides most or all of the sales support and the bank receives a fee or brokerage commission proportional to the value of the third-party funds sold. Another option is to offer "private-label" funds. These funds carry a name designated by the bank, but the funds themselves are distributed by an unaffiliated company. The vast majority of banks that offer mutual funds do so via the third-party or private-label route.

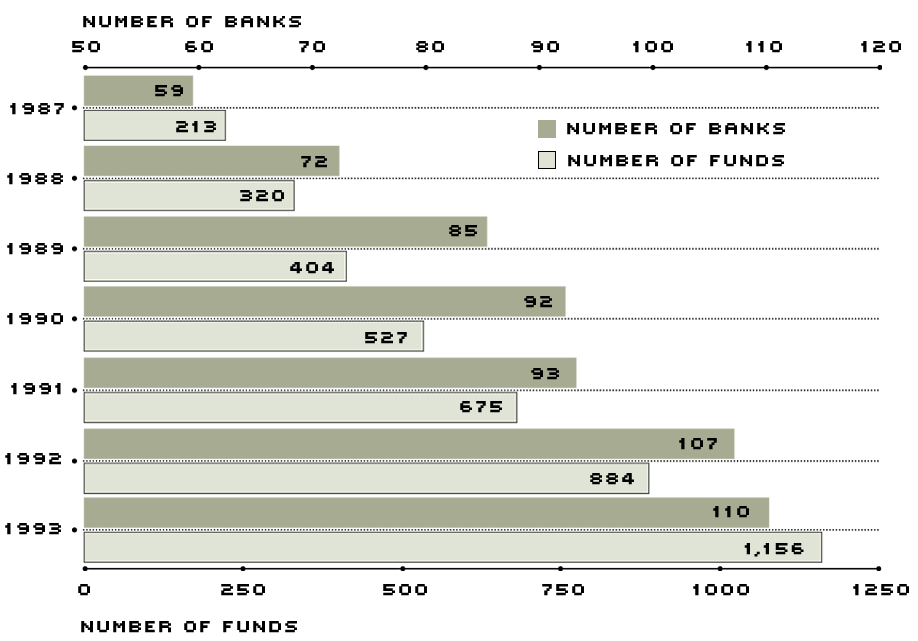

The most direct way for banks to enter the mutual fund business is to offer their own funds—called "proprietary funds." Because banks that sell proprietary funds provide management and advisory services, they are able to generate more fee income than they can under the other two sales options. A special exemption from the Glass-Steagall Act, a 1933 law that separates commercial from investment banking, permits banks to provide management and advisory services, but not fund underwriting or distribution services (see below). More than 100 banks currently offer proprietary funds; since year-end 1990, the combined assets of these funds have more than doubled (see Figure 2).

Banks Are Starting Up Their Own Funds In Increasing Numbers

Bank Proprietary Funds

| Assets (billions of dollars) | |||

|---|---|---|---|

| Fund Type | Year-End 1990 | Mid-1993 | Percent Change |

| Money Market | $66.8 | $128.7 | 92.7% |

| Equity | 6.4 | 31.0 | 384.4 |

| Bond/Fixed Income | 3.9 | 25.3 | 548.7 |

| Municipal Debt | 2.8 | 9.7 | 246.4 |

| TOTAL | $79.9 | $194.7 | 143.7% |

The number of banks that offer their own funds has more than doubled since the end of 1986, while the number of funds offered increased more than five-fold. At mid-year 1993, a total of 1,156 funds were being offered by 100 banks, and commercial banks had $194.7 billion in mutual funds under management. Eighth District banks accounted for $4.1 billion of the total.

SOURCE: Lipper Analytical Services, Inc.

They May Be Giants

Thus far, money center and large regional banks have dominated the industry's sale of mutual funds, especially proprietary funds. It's estimated that more than 90 percent of banks with assets greater than $1 billion sell mutual funds. But smaller banks are getting into the act too. The ABA recently endorsed Wall Street Investor Services, a mutual fund marketing company, to offer mutual fund sales and other brokerage programs for its 10,000 member banks; similarly, the Independent Bankers Association of America—a trade group that represents about 5,800 community banks—tapped Massachusetts Financial Services, the nation's oldest mutual fund company, to provide similar programs for its members. The ICI estimates that about one-third of the more than 4,000 mutual funds in existence are available to bank customers through one of the three bank sales channels.

Whether banks are making any money from their entry into the mutual fund business is difficult to discern, especially for those that choose the third-party or private-label route. Mutual fund profitability depends in part on whether the money to purchase fund shares is coming from inside or outside the bank. Bank mutual funds may be largely "poaching" funds from internal deposit accounts. In a March 1993 survey by the Federal Reserve, financial officers—at least those confident they could measure it—estimated that between one- and two-thirds of mutual fund inflows were from deposits at their own institutions. This could hurt banks if loan demand were to accelerate and they would need low-cost funds.

Lipper Analytical Services estimates that the 110 banks that offer proprietary funds generated about $350 million in advisory and administrative revenue in the first quarter of 1993. Data that measure the costs of providing these services are not available, but industry observers believe the costs—especially personnel training costs—are quite high. Despite the uncertain net proceeds from mutual fund sales, however, many bankers feel that offering mutual funds is crucial to keeping customer relationships.

How successful have banks been in gaining market share in this booming industry? Although hard numbers are lacking, the ICI has estimated that banks accounted for about one-third of new sales of money market mutual funds and about 14 percent of new sales of bond and equity funds in the first half of 1992, the latest figures available. That was enough to push the banking industry's share of the mutual fund business to $175.5 billion, or 12 percent of the mutual fund shares outstanding at that time. Lipper Analytical estimates that the assets of bank proprietary funds rose by 36 percent from mid-1992 to mid-1993, outpacing the 23 percent growth posted by the mutual fund industry as a whole.5 According to Lipper, 29 banks had $2 billion or more in mutual fund assets under management, placing each of them squarely in the top 100 mutual fund companies in the country. Bank sales of private label and third-party funds have no doubt risen significantly as well.

Meanwhile, Washington Watches...And Worries

This financial flurry has not escaped the attention of policymakers and regulators at either the national or state level. Indeed, since the beginning of 1993, a number of legislative and regulatory bodies have issued statements, reports and guidelines on bank sales of mutual funds to consumers. Although each player has a slightly different stake in the matter, they all seem concerned that consumers know: (1) that these funds are not FDIC- or government-insured, like deposits; (2) that they often fluctuate in value and they run the risk of losing principal; and (3) that mutual fund shares are not obligations of the banks nor are they guaranteed by banks. Survey data suggests these concerns have merit. The Columbia Business School recently found that two-thirds of mutual fund investors could not distinguish between load and no-load funds or between stock and bond funds.

Two of the three federal regulatory agencies—the Federal Reserve and the Office of the Comptroller of the Currency (OCC)—recently issued guidelines indicating what safeguards should be in place for banks that sell mutual funds. In June, the Fed instructed examiners to insist that mutual fund sales and deposit-taking activities take place in physically separate areas of the bank to avoid customer confusion over insured and uninsured products. The Fed also made it clear it does not want bank tellers giving investment advice and that tellers should be limited to directing potential mutual fund customers to the proper sales personnel in the bank, whether they are third-party vendors or specially trained bank employees. The Fed reiterated its position that promotional and sales materials contain clear disclosures about mutual funds' uninsured status and the fluctuating nature of the investment's value; the agency further recommended that state member banks have customers sign statements acknowledging they understand the risks they are assuming.

In its July guidelines to national banks, the OCC echoed much of what the Fed said and offered additional guidance on such matters as acceptable names for bank funds, compensation incentives for mutual fund sales staff, and suitability of funds for bank customers. One of the few areas about which the Fed and the OCC disagree concerns the naming of funds. The Fed does not want bank-sponsored mutual funds to have bank-affiliated names, while the OCC finds similar sounding names—like Nations Fund offered by Nations Bank Corp.—acceptable. The OCC has also adopted a more lenient position about which employees can sell mutual funds; the OCC does not prohibit personnel who sell deposit products from selling investment products.

In response to regulatory and Congressional concerns, banks are stepping up their self-policing efforts. In early September, six national bank and thrift trade groups released a jointly prepared draft of industry guidelines on mutual fund sales. These guidelines, which are very similar to the ones issued by federal regulators, are designed to help banks protect customers as well as themselves.

Despite these efforts, some members of Congress want stronger action. Congressional leaders have asked the General Accounting Office (GAO) to study the adequacy of banks' mutual fund disclosures and regulatory supervision; House Banking Committee Chair Henry Gonzalez has requested that the study include an analysis of the effects bank mutual fund sales are having on the availability of credit. Hearings are expected this fall, and the GAO expects to release its study next spring. Congress has also urged the Securities and Exchange Commission and the National Association of Securities Dealers to take a closer look at banks' sales practices.

Washington is particularly concerned about first-time investors. The ICI estimates that 10 percent of households that own mutual funds made their first purchase since January 1991. No one knows what proportion of those first-time buyers purchased mutual funds through a bank, but some observers believe it is substantial. First-time investors, of course, are less likely than other investors to fully understand the risks associated with equity and bond funds. If the stock market turns down, equity funds will likely go down in value and if interest rates go up, bond funds will likely—and equity funds could—decline in value. Though two-thirds of banks' mutual fund assets still consist of relatively risk-free money market funds, thus mitigating the potential effects of a market turndown on the industry, the stakes may be high for banks selling riskier stock and bond funds.

Bank customers accustomed to fixed CD yields could be in for a rude shock if the value of their mutual fund investments—their principal—goes down. And the more closely associated banks are to mutual funds, especially through a private-label or proprietary relationship, the more likely they are to suffer customer backlash if market prices take a big plunge.

Will Banks Win or Lose?

Because bank sales of mutual funds are a fairly recent phenomenon, it is premature to assess whether it's a winning strategy for the banking industry. For most banks, mutual funds will probably not do much for the bottom line, especially when compared with the profits available from traditional products, such as loans. But in today's competitive financial services marketplace, most bankers feel they have no choice where investment products are concerned: If you can't beat 'em, join 'em.

Timing is important too. Much of the run-up in bank mutual fund activity has taken place in a bull stock market. No one knows what will happen if the market takes a big dip as it did in October 1987. Most bankers realize they can ill afford to be caught in the cross-fire if customers feel they've been misled or uninformed about the investments they've made. And it's not just fee income that's at stake. Because the value of a bank's franchise is largely related to its reputation for safety and soundness, it's in banks' best interests to exercise considerable care in selling mutual funds to their customers.

Endnotes

- Taxable MMMFs were introduced in 1972; tax-exempt MMMFs were introduced in 1979. The other major development during the 1970s was the introduction of tax-exempt municipal bond funds in 1976. [back to text]

- See Gilbert (1986) for a discussion of economic conditions and bank regulatory constraints that fostered the growth of money market funds and other new financial instruments. [back to text]

- A detailed description of the workings of the mutual fund industry is contained in the ICI's annual Mutual Fund Fact Book. [back to text]

- Source: Federal Reserve Board data bank. [back to text]

- Much of the growth in bank proprietary funds is the result of conversions of bank collective investment funds, e.g., trusts made up of qualified investments from Keogh and employee benefit plans, to mutual funds. Common (personal) trust accounts may be converted too, although current tax law discourages such conversions because of the tax liability that would be incurred on any unrealized appreciation. Congress is considering legislation that would make conversions of common trust funds tax-free. [back to text]

- An investment adviser is an organization employed by a mutual fund to give professional advice on the fund's investments and asset management practices. A transfer agent prepares and maintains records relating to the accounts of a fund's shareholders. A custodian (which is usually a bank) is responsible for keeping custody of the securities and other assets of a mutual fund. [back to text]

References

"Bank Funds Outpaced Stock Market in '92." American Banker, News Roundup (January 27, 1993).

Bureau of National Affairs. "Fed Letter Spells Out Interim Guidance to Examiners for Bank Mutual Fund Sales," BNA's Banking Report (July 5, 1993), pp. 3-4.

Cope, Debra. "Proprietary Funds' Assets Up 36% in Year," American Banker (August 11, 1993).

Federal Reserve System. "Senior Financial Officer Survey on Retail Mutual Funds" (May 12, 1993).

Fein, Melanie L. "OCC, Fed Actions Reinforce Mutual Fund Authority of Banks," Banking Policy Report, Vol. 12, No. 11 (June 7, 1993).

_______. Securities Activities of Banks (Prentice Hall Law & Business, 1991).

Gilbert, R. Alton. "Requiem for Regulation Q: What It Did and Why It Passed Away," Federal Reserve Bank of St. Louis Review (February 1986), pp. 22-37.

Investment Company Institute. Mutual Fund Fact Book (1993).

________. "Mutual Fund Statistics for the Bank Distribution Channel" (May 1993).

Lipper Analytical Services, Inc. "Lipper-Bank-Related Fund Analysis" (1993).

Lunt, Penny. "How Are Mutual Funds Changing Banks?" ABA Banking Journal (American Bankers Association, June 1993), pp. 31-40.

Radigan, Joseph. "Mutual Funds Clamor Awakens the Watchdogs," United States Banker (July 1993), pp. 42-44, 63.

Rehm, Barbara A. "OCC Issues Guidelines on Selling Investments," American Banker (July 20, 1993).

Svare, J. Christopher. "Mutual Fund Rules and Options," Bank Management (Bank Administration Institute, September 1992), pp. 71-73.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us