Government Spending Might Not Create Jobs Even during Recessions

Countercyclical economic policy refers to the actions taken by governments to soften or neutralize the detrimental effects of business cycles. Governments have two main tools at their disposal to conduct such actions: fiscal policy and monetary policy. In a time when it has become infeasible for the monetary policymakers at the Federal Reserve to reduce interest rates much further, if at all, the effectiveness of fiscal policy has moved into the spotlight for macroeconomists. Fiscal policy consists of adjustments in tax rates and government spending levels; in this article, we focus on the latter, specifically on the effects of government spending on employment, particularly during recessions.

The Intricacies of Fiscal Policy

The effectiveness of fiscal policy is often questioned because its positive impact on employment and output may be dampened by secondary effects that "crowd out" economic activity in the private sector. For instance, if the expenditure is financed by borrowing, then this borrowing might exert upward pressure on interest rates, which, in turn, would cause a reduction in private investment. Similarly, a surge in fiscal spending may bid up wages, thereby reducing the demand for labor in the private sector.

Times of high unemployment usually see an uptick in calls for increased government spending from politicians, pundits and economists. These observers appeal to a logic for government intervention that might not be valid during normal economic times; they argue that the detrimental secondary effects of fiscal spending are not as prominent when the economy is slack.

The simple thinking is that because the government's demand for goods and services can be met with otherwise idle workers, additional public spending need not bid up wages significantly or crowd out private demand. There's also a natural and undeniable urge for political leaders to "do something" during a downturn. As economist Robert Lucas wrote during the 2007-2009 recession, "I guess everyone is a Keynesian in a foxhole."

Instincts and gut reactions notwithstanding, whether government spending is particularly effective at increasing economic activity during times of high unemployment is an empirical question. A large amount of research has been conducted on the effects of government purchases on output (or gross domestic product) during recessions; relatively less research has focused on these purchases' employment effects. Understanding the employment effects of government intervention during recessions is crucial—much of the brunt from downturns, such as the 2007-2009 recession, is likely felt by people losing their jobs.

Public Spending and Employment

A researcher ideally would like to see macroeconomic experiments with government spending changing over time for reasons unrelated to business cycle fluctuations and also to have these experiments occur during both high- and low-unemployment times. These exogenous changes would generate natural experiments akin to the controlled experiments used to test, for example, the efficacy of new drugs.

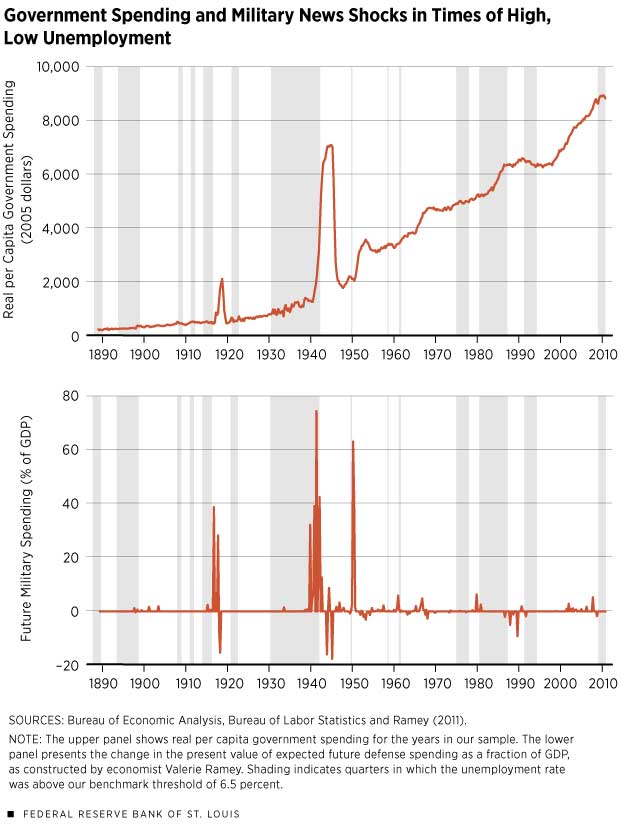

Although truly exogenous large changes in government spending do not exist in the U.S. (or probably anywhere else), we in the U.S. have something close in the form of defense spending. Defense spending can be used because changes in it are mostly determined by international geopolitical factors rather than macroeconomic conditions. In our new research, we employed a recently created data set containing more than 120 years' worth of data on government purchases; the data set was introduced in a series of papers by economists Michael Owyang, Valerie Ramey and Sarah Zubairy.1 These data appear in the upper panel of the figure. They include episodes of large variation in government spending during both low-unemployment times, such as World War I and the Korean War, and high-unemployment times, such as World War II.

The spending data also include a time series of "defense news shocks." Using historical documents, such as Business Week magazine, Ramey constructed a time series of changes in the values of future military spending. These data appear in the lower panel of the figure. Note, for example, the large upward spikes near the start of World War II and the downward spikes as that war neared its end. Since this series is based on military purchases that were not motivated by business cycle conditions, the data help to identify the exogenous component of the government spending shocks. Moreover, it is important to use news about military spending to tease out exogenous changes rather than military spending itself because households and businesses may change their behavior in response to new information even if the actual defense spending is months to years away. For instance, a military contractor might react to news about future government purchases by increasing its workforce in anticipation of higher demand.

The upper panel of the figure plots real (inflation-adjusted) per capita government spending between 1890 and 2010. The shaded bars indicate years when, according to our measure, the labor market was slack, i.e., the unemployment rate was greater than 6.5 percent. In addition to a general upward trend, there are spikes in government spending. The most notable ones result from World War I and World War II. The lower panel of the figure plots the military news variable. At each quarter, it gives the change in the present value of expected future defense spending as a fraction of gross domestic product (GDP). For many periods, its values are zero, which indicate periods where beliefs about future defense spending are unchanged. Not surprisingly, there are major positive spikes around the times of World War I and World War II.

Specifically, our research aims to answer the following two questions: (1) By how much does national civilian employment change when government spending increases? (2) Is this estimate dependent on the unemployment level at the time in which the spending occurs?2 We used the news about military spending to infer the quantitative response of employment to exogenous changes in government spending.

Small Employment Effects

We found that, in the short and intermediate run, there are only small employment effects of government spending in both high- and low-unemployment times. We quantified the effects of government spending over a four-year horizon following exogenous news about future U.S. defense spending.

Following a policy change that begins when the unemployment rate is high, if government spending increases by 1 percent of GDP, then total employment increases by between 0 percent and 0.15 percent. Following a policy change that begins when the unemployment rate is low, the same government spending increase causes total employment to change by –0.4 percent and 0 percent.3 Although the effect is larger during times of high unemployment, even then, the employment effect of government spending is low.

In the longer run (e.g., seven or eight years), we also found almost no effect on employment from government spending. The estimated effects are not statistically different from zero. The main difference is that in the long run we cannot reject the possibility that the effect of public spending on employment is the same during times of high and low unemployment. This is due to the fact that we lose precision in the estimation at longer horizons.

Conclusion

The question of the efficacy of countercyclical fiscal policy during downturns is far from settled. It is important that macroeconomists continue to study the issue. As horse racing fans say, there is a lot of money riding on it. For example, the total budget impact of the most recent U.S. stimulus ($840 billion for the American Recovery and Reinvestment Act of 2009) was larger than U.S. defense spending in Iraq since 9/11.4, 5

Endnotes

- Our paper largely follows the approach of a 2013 study by Michael Owyang, Valerie Ramey and Sarah Zubairy. [back to text]

- In answering these questions, we used two econometric adjustment procedures. First, we estimated the dynamic effects using the local projections method to allow the effect of spending to vary depending upon whether the unemployment rate is high or low. Second, we used instrumental variables with defense news shocks to correct for the possibility that government spending is endogenous to local business-cycle conditions. [back to text]

- These ranges are based on 90 percent confidence intervals. [back to text]

- According to a 2014 study by Amy Belasco, between the 9/11 attacks and the end of 2014, congressional appropriations for military operations in Iraq totaled $815 billion. [back to text]

- Our findings suggest that the drop in unemployment since 2009 was probably not a result of the Recovery Act's spending component. Understanding the reasons for the decline in unemployment is a topic that warrants further exploration. [back to text]

References

Belasco, Amy. "The Cost of Iraq, Afghanistan, and Other Global War on Terror Operations since 9/11." Congressional Research Service, Dec. 8, 2014.

Dupor, William; and Guerrero, Rodrigo. "Robust Inference about Fiscal Multipliers." Unfinished manuscript.

Fox, Justin. "The Comeback Keynes." Time, Vol. 172, No. 18, Nov. 3, 2008, p. 60.

Owyang, Michael; Ramey, Valerie; and Zubairy, Sarah. "Are Government Spending Multipliers Greater During Periods of Slack? Evidence from 20th Century Historical Data." American Economic Review, Vol. 103, No. 3, 2013, pp. 129-34.

Ramey, Valerie. "Identifying Government Spending Shocks: It's All in the Timing." Quarterly Journal of Economics, Vol. 126, No. 1, 2011, pp. 1-50.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us