Despite Weakness, Economic Expansion Marks Seven Years

The U.S. economic expansion is into its eighth year, having registered its seven-year anniversary in June 2016. From a historical perspective, the current expansion is long in the tooth. However, expansions do not typically die of old age. Instead, they end because of some unforeseen disturbance that causes firms and individuals to alter their planned expenditures and expectations of future incomes.

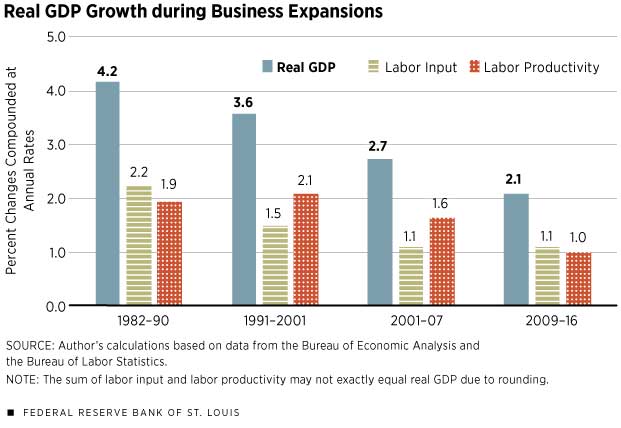

Although the current expansion keeps plugging along, the U.S. economy's pace of growth during the past seven years has been extraordinarily weak. Since the second quarter of 2009 (when the Great Recession officially ended), real growth in gross domestic product (GDP) has averaged 2.1 percent per year. By contrast, growth in the previous three expansions (1982-90, 1991-2001 and 2001-2007) averaged 4.2 percent, 3.6 percent and 2.7 percent, respectively.

Despite the current expansion's low growth rate, the unemployment rate declined from 10 percent to 4.9 percent—a level consistent with full employment—and inflation has stayed quite low. The all-items personal consumption expenditures price index (PCEPI) has increased by an average annual rate of 1.5 percent, which is below the 2-percent inflation target of the Federal Open Market Committee (FOMC).

There are two obvious questions that follow from this narrative. First, what explains the weak real GDP growth during the current expansion? Second, why has inflation remained so low in the face of an extraordinarily easy monetary policy?

Tackling the answer to the first question is reasonably straightforward. Real GDP growth is basically the sum of labor productivity growth and the growth rate of employment. Since mid-2009, productivity has increased at an average annual rate of 1.0 percent. Over the three previous expansions, it increased by an average of 1.9 percent per year, 2.1 percent and 1.6 percent, respectively. Thus, the current expansion's weak performance importantly reflects a significant slowing in the pace of labor productivity growth. But what explains weak productivity growth? There are many hypotheses, including increased government regulations, less economic dynamism and the replacement of retiring, experienced baby boomers with younger, inexperienced workers. The consensus of most forecasters is that productivity growth will eventually rebound and begin rising by about 1.5 percent per year. As yet, there is scant evidence of such an acceleration.

Turning to the second question, low inflation over this period coincided with three rounds of quantitative easing (large-scale asset purchases by the Federal Reserve) and repeated assurances by the FOMC that it would keep the proverbial monetary policy pedal to the metal. Despite the onslaught of a massively easy monetary policy regime, inflation rarely moved above 2 percent. Low inflation, it appears, importantly reflects the FOMC's promise to defend its 2-percent inflation target, which has helped keep inflation expectations low.

But since the second quarter of 2014, inflation has declined sharply, averaging 0.4 percent at an average annual rate. Falling inflation reflects two key developments. The first was the plunge in crude oil prices. The second was the sharp appreciation of the value of the U.S. dollar, which triggered declines in prices of imported goods. However, measures of the underlying inflation rate that attempt to remove these temporary factors, such as the Dallas Fed's trimmed-mean PCEPI inflation rate, show inflation to be much closer to the FOMC's target. As the effects of falling oil prices and a stronger dollar wear off, headline inflation should return to 2 percent.

Monetary policymakers now confront a bevy of mixed signals as they decide how to proceed with their goal of slowly raising the federal funds target rate to its "normal" level. First, crude oil prices have rebounded, and the dollar has retreated modestly from its highs. Both of these developments should put upward pressure on inflation. Second, real GDP growth remained weak in the first quarter, and inflation expectations have edged a bit lower despite the rise in oil prices. Third, real GDP growth was expected to have accelerated in the second quarter, but there are few signs of a pending acceleration in labor productivity growth that could push GDP growth appreciably higher than 2 to 2.5 percent. Fourth, inflation is expected to remain close to 2 percent this year and next, but there are some risks it could move higher. Finally, the unemployment rate is projected to drop a bit further from its 4.9 percent rate in June 2016.

Formulating monetary policy in the current environment appears challenging, given that the economy appears to have settled down to its long-run growth path of roughly 2 percent, with 2-percent inflation the most likely outcome. Of course, if the economy and inflation begin to perk up or asset prices begin rising at worrying rates, then policymakers will need to adjust policy accordingly.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us