National Overview: The U.S. Economy Stumbles Out of the Gate—Again

After posting healthy growth over the final three quarters of 2014, real gross domestic product (GDP) contracted slightly in the first quarter of this year. This stumble is remarkably similar to last year's, when the U.S. economy contracted in the first quarter. Like then, the decline this time is viewed as the product of temporary factors, rather than a precursor to a recession or an extended period of below-trend growth. Accordingly, most forecasters and policymakers expect that the economy will regain its footing over the final three quarters of this year.

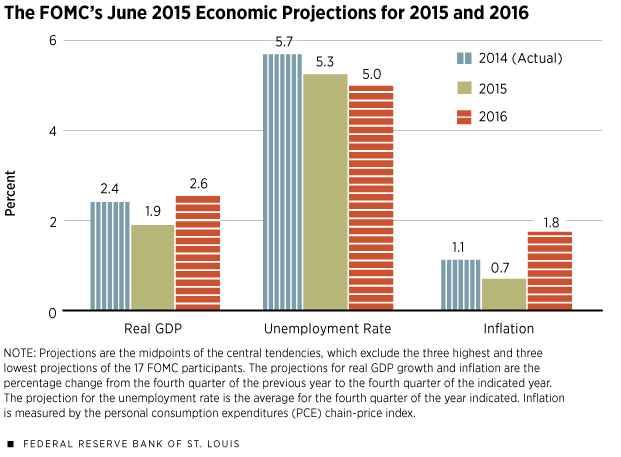

Inflation, by contrast, has been stunted by the plunge in crude oil prices, which began in June 2014. Although the Federal Reserve's preferred measure of consumer prices is little-changed from a year earlier, the modest uptick in crude oil prices since mid-March suggests that headline inflation will eventually return to the Fed's target of 2 percent—though it might take a while.

In short, consensus forecasts support the views of those who believe that the Federal Open Market Committee (FOMC) remains on track to increase its policy (fed funds) rate this year for the first time since June 2006. Ultimately, though, that decision will depend not on the forecasts, but on the actual performance of the economy.

Starting Slow, Picking Up Speed

The U.S. economy finished 2014 on sound footing, registering real GDP growth in excess of 3 percent over the final three quarters of the year. But early this year, the U.S. economy's forward momentum stalled, as real GDP declined at a 0.2 percent annual rate in the first quarter. The swing from positive to negative growth mostly reflected four key developments.

First, real consumer spending slowed dramatically. Despite continued low oil prices, households turned cautious, choosing to save more and spend less; this resulted in a sizable accumulation of unsold goods. This consumer behavior is a bit of a puzzle since several key drivers of consumer spending look solid: rising net wealth, low real interest rates, low gasoline prices and high levels of consumer confidence. Labor market conditions, another key driver of consumer spending, are healthy. Job gains averaged 236,000 per month from December through May, and the unemployment rate—at 5.5 percent in May—is slightly below its long-run average. The slowdown in consumer spending looks to be temporary, however, as auto sales and other retail sales surged in May.

The second key factor that helps explain the first-quarter dip is the decline in business capital spending. This decrease mostly reflected the plunge in crude oil prices, which caused firms in the energy-producing sector to cut back on exploration activity. The slowdown in drilling also adversely affected other industries, such as steel producers. Overall, though, the decline in oil prices has been a net positive for the economy—chiefly by boosting the purchasing power of households.

Third, the increase in the real trade-weighted value of the dollar contributed to a sharp decline in real exports in the first quarter. The decline trimmed real GDP growth in Q1 by about 1 percent. The rising dollar, coupled with the unfolding Greek drama and a weakening Chinese economy, added to the uncertainty facing U.S. manufacturers and other firms with a global footprint.

Finally, it appears that a confluence of some special factors helped to slow the growth of economic activity in the first quarter. These included adverse weather, the West Coast port slowdown and the potential presence of seasonal distortions in the data.

An Upbeat Forecast

After bottoming out in mid-March at a little less than $44 per barrel, spot crude oil prices (West Texas Intermediate) have since rebounded, averaging about $60 per barrel in June. Despite this rebound, headline inflation has been flat (at least into June) and below the Fed's inflation target, and inflation expectations remain relatively low and stable. Most forecasters continue to expect that headline inflation will rise modestly over the remainder of 2015, ending the year with a gain of about 1 percent (compared with 2014). Consumer prices are then expected to rise by about 2 percent in 2016. However, these forecasts are partly conditional on a modest rebound in crude oil prices over the next year or two.

For the economy, the consensus of private-sector forecasters is that it will rebound over the final three quarters of this year—real GDP growth is projected to average about 3 percent, and the unemployment rate is forecast to fall to about 5 percent or less by the end of 2015. Much of this optimism reflects expectations for continued healthy labor markets, a brighter outlook for housing, and modestly faster growth of expenditures by households and businesses.

Lowell Ricketts, a senior research associate at the Federal Reserve Bank, provided research assistance.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us