Ask An Economist

Stephen D. Williamson has been an economist and vice president at the Federal Reserve Bank of St. Louis since June 2014. Previously, he held academic positions at Washington University in St. Louis, the University of Iowa, the University of Western Ontario and Queen's University. He also worked at the Minneapolis Federal Reserve Bank and the Bank of Canada, and he was an adviser at several Federal Reserve banks, including the St. Louis Fed. Williamson's research focuses on monetary economics, macroeconomics and financial economics. His roots are in Canada, where he attended all levels of school. Williamson and his family enjoy outdoor activities, particularly hiking, and music.

Q. How is normalization of monetary policy going to work?

A: Monetary policy normalization refers to the steps the Federal Open Market Committee (FOMC)—the Federal Reserve's monetary policymaking body—will take to remove the substantial monetary accommodation that it has provided to the economy since the financial crisis began in 2007. The committee has made it very clear that normalization is going to be data-driven. In other words, policy decisions will be based on the future performance of inflation, labor markets and gross domestic product (GDP), among other things.

In its "Policy Normalization Principles and Plans," announced in September 2014, the FOMC laid out a program that would ultimately allow the Fed to conduct monetary policy in essentially the same way it did before the beginning of the financial crisis. The principles and plans outline a sequence of actions by which normalization will be achieved:

1. "Liftoff"—The FOMC will raise its interest rate target when it deems there is no longer as great a need for monetary accommodation. Liftoff is expected to happen sometime later in 2015, but, again, the timing of liftoff will be data-driven, not calendar-dependent.

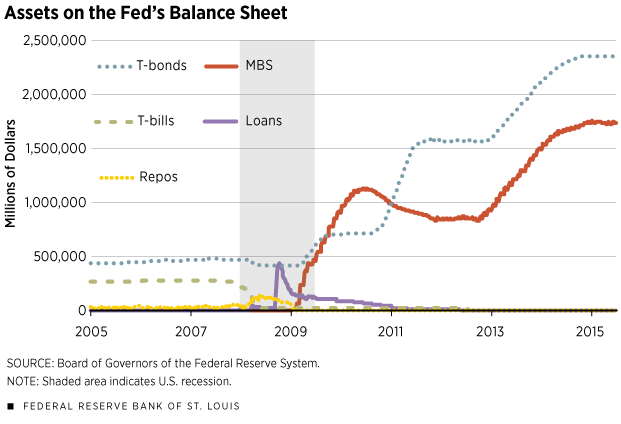

2. End "reinvestment"—The FOMC wishes to ultimately reduce the Fed's balance sheet to a size such that the quantity of interest-earning liabilities (including bank reserves) is small, as was the case before the financial crisis. Reinvestment is the process of replacing assets on the Fed's balance sheet as they mature; so, when reinvestment ends, the balance sheet will begin to shrink.

3. Shrink balance sheet—Balance-sheet reduction will occur slowly, with no plans to sell assets, though this option has not been ruled out. The Fed's assets will decline as Treasury securities and mortgage-backed securities (MBS) mature. While Treasuries mature at a predictable rate, MBS do not, as this depends on the rate at which the mortgages backing the MBS are refinanced and on mortgage defaults.

Federal Reserve Board economists estimate that the normalization process will take about seven years once it starts.

For more information, read "Monetary Policy Normalization in the United States," an article by Williamson in the latest issue of the St. Louis Fed's Review at https://research.stlouisfed.org/publications/review/article/10381 or watch a video of Williamson's recent Dialogue with the Fed on "Monetary Policy Normalization: What's New? What's Old? How Does It Matter?" at https://www.stlouisfed.org/dialogue-with-the-fed/monetary-policy-normalization-whats-new-whats-old-how-does-it-matter.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us