Business Opportunities and Challenges for the U.S. in Latin America

For a technologically advanced and capital-abundant country like the U.S., Latin America should be a fertile source of business opportunities. Latin America is not only geographically close but is rich in natural resources, has a relatively young population and possesses political institutions that are becoming increasingly democratic and stable. The conditions appear to be conducive for ample trade and international investment opportunities.1

This article explores some of these business opportunities, which are not without significant challenges.

E Pluribus, Plures

From the Rio Grande in the north to Tierra del Fuego in the south, Latin America is made up of countries with commonalities in history and language but also remarkable differences in ethnic makeup, size and cultural traits. Differences also abound in the countries' levels of income and in their investment and commercial relationships with the U.S. and the rest of the world. Understanding these large differences—with the U.S. and among fellow Latin American countries—is vital to understanding the challenges and opportunities for the U.S. south of its border.

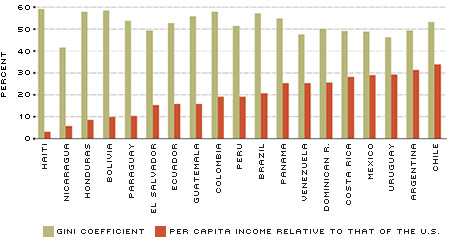

Figure 1 shows the large per capita income differences in the region. The red bars indicate the income per capita (adjusted for purchasing power differences) relative to that of the U.S. Clearly, all countries are lagging behind the U.S., with Chile the highest at 34 percent of U.S. income and Haiti the lowest at 3 percent.

We might divide Latin America into three groups of countries: the very poor, with roughly 10 percent or less of the per capita income in the U.S. (this group would include Haiti, Nicaragua, Bolivia and Paraguay); a group in the middle, with less than 20 percent of U.S. income (El Salvador, Ecuador, Guatemala, Colombia and Peru, among others); and a group with relatively higher income—more than 20 percent of U.S. per capita income. The third group includes Panama, the Dominican Republic, Costa Rica, Mexico and Chile, countries that are aggressively pursuing international trade and foreign investment. This group also includes Uruguay and Argentina, countries that have historically been richer than other Latin American countries. Also notable in this group are Brazil and Venezuela, the first for its sheer size and the second for its abundance of oil.

Notice that the differences within the region can easily dwarf the differences between the region and the U.S. While Argentines and Chileans earn just one-third of the U.S. per capita income, they earn 10 times as much as Haitians, five times as much as Nicaraguans and three times as much as Hondurans, Bolivians and Paraguayans. Those differences have remained relatively consistent over the years.

Within each country, inequality is large, too. The gold bars in Figure 1 show the average of the Gini coefficient, an indicator of inequality, for years between 2000 and 2010 for the countries in the region.2 The higher the value of the coefficient, the higher the degree of inequality: A value of zero means perfect equality, while a value of 100 means perfect inequality, i.e., all the income accrues to just a single individual. Notice that more than half of the countries have a Gini coefficient above 50 percent, with Haiti, Bolivia, Guatemala, Colombia and Brazil closer to 60 percent. Not a single country is less unequal than the U.S., which has a Gini coefficient of 40.8 percent—not even Uruguay, Argentina or Costa Rica, traditionally singled out in the region for having a middle class. Another indicator of the inequality in the region comes from the fact that Mexico and Brazil have a disproportionate number of billionaires. These two countries are consistently in the top of Forbes magazine's annual ranking of billionaires, alongside countries that are much richer.3

For U.S. businesses, the large degree of inequality within and between countries presents opportunities and challenges. On the one hand, the well-off, well-educated elites are natural markets for goods and services from the U.S.; these people can also provide business partners and contacts in the region. In principle (unfortunately, not so much in practice), these elites could also provide well-trained political leaders and policymakers in their countries to develop and implement policies promoting growth and development. Moreover, inequality could also mean low wages in those countries, which could be attractive for U.S. businesses producing in the region. Regarding challenges, inequality—especially if it is rooted in the lack of social mobility—can lead to political instability, which can cause disruptions, expropriation risk and other problems for business. Furthermore, lower wages are often accompanied by lack of skills and productivity.

Latin America: Average Income and Inequality, 2000-2010

SOURCES: World Bank's World Development Indicators (series names: GNI [gross national income] per capita, PPP [current international $] and Gini index). Penn World Table 7.1.

NOTE: The red bars plot the relative value of gross national income per person in a particular country to that of the U.S., adjusting for purchasing power differences of money in each country. The gold bars plot the Gini Index, which provides a measure of equality in the distribution of income in a country, with 0 indicating perfect equality (all people have an equal share of the nation's income) and 100 indicating perfect inequality (all of the nation's income goes to one individual).

The Gini coefficient for the U.S. is 40.8.

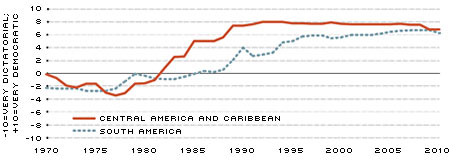

Latin America: Democratization Index

SOURCE: Polity IV database: Polity 2 index.

NOTE: This index of democratization provides a measure of a nation's level of democracy, with ranges from –10 for complete dictatorship to +10 for complete democracy.

Aside from wide inequality, another long-held characteristic of Latin American countries has been the pervasiveness of authoritarian regimes—at least in the past. Among the most remarkable changes in the region is the transition to democratic regimes in the past 30 years. Figure 2 displays the average of an index of democratization, the Polity 2 index from the Polity IV database,4 for South American countries and for Central American and Caribbean countries. The range of the index is –10 for complete dictatorship to +10 for complete democracy. The trends are obvious and self-explanatory, and they indicate that the proverbial Latin American dictator (e.g., Somoza, Trujillo, Banzer, Stroessner, Castro and Videla) is not the norm but a rarity these days.

The political remake of the region may change the way that the U.S. does business with it. Some of the authoritarian regimes in the past served as key contacts, providing access and stability to U.S. investors. Democratic regimes may be more bureaucratic, and the electoral process may introduce risks and volatility, as every new administration may change the policy orientation of a country. In the long term, however, investments carried out under democratic regimes can claim more legitimacy and support (e.g., legal) inside each country, as well as outside.

Remaining in the region are elements of the once-ubiquitous populism, which led countries to large fiscal and international imbalances and extensive interventionism. However, the macroeconomic stability exhibited by Latin America during the Great Recession bears witness to the overall policy progress made by the region. In the past, Latin American countries consistently crashed in every global recession. Economic policy, however, is an aspect in which there is still progress to be made.

Protectionism vs. Openness

After macroeconomic and balance-of-payments crises in the 1980s, the countries in the region started abandoning the inward model of import substitutions and began adopting openness to international trade and foreign direct investment (FDI) as backbones of their development strategies. A study in 2011 conducted by economists Francisco Buera, Alexander Monge-Naranjo and Giorgio E. Primiceri found that policy reversals of this type can be explained by rational learning models, whereby policymakers learn from the experience of their own countries and from those of nearby countries. The economists' results also imply that openness can be sustained only if the countries are successful in growing; if not, at least some of the countries will revert to protectionist policies. Such propositions will be useful in examining the recent policy choices in Latin America.

Given the failure of a comprehensive, global, multilateral free-trade framework, i.e., the Doha or Uruguay rounds of the World Trade Organization (WTO) negotiations, countries around the world have sought bilateral trade agreements. Latin American countries have been part of this strategy, and a free-trade agreement (FTA) with the U.S. has been a major issue of contention. The table lists the different Latin American countries, different measures of their size and whether they have an FTA with the U.S.

Out of the 20 countries in the group, the U.S. has FTAs with 12, or 60 percent of them. Weighted by GDP, however, the fraction is smaller—47 percent; weighted by population, it's 46 percent. The percentage drops even further—to 29 percent—when land mass, with all its natural resources, is used to define the weights. An additional 60 percent of the land mass would be added if the U.S. signed an FTA with MERCOSUR (Brazil, Argentina, Uruguay and Paraguay). Such a pact has proved to be very elusive, however.

Trade numbers indicate that Latin America is both an important source of imports (almost 20 percent) and an important destination of U.S. exports (almost 25 percent).5 For FDI, the results are different. The region provides a negligible amount of FDI in the U.S., but this is somewhat expected, since sources of FDI tend to be firms in developed countries that have a technological or marketing edge with respect to the host economy. More surprising, Latin America receives only 6 percent of all FDI from the U.S. This is precisely the margin in which FTAs could make the biggest impact as they provide the credibility that markets will remain open for the multinational firms. If so, there could be considerably more FDI in Latin America from the U.S. as a result of FTAs.6

Clearly, for the U.S. there is ample room to extend the commercial links with Latin American countries, especially with MERCOSUR, a group of countries with high productivity in agricultural sectors. Unfortunately, doing so is particularly challenging as each side accuses (correctly) the other of protectionism. On one side, Brazil and Argentina, along with other emerging countries, have pushed for developed countries, including the U.S., to dismantle the widespread use of subsidies for agriculture. On the other hand, the U.S. has pushed for openness in manufacturing and services, which has been rejected by Brazil and Argentina. Indeed, a new challenge for Americans doing business in Latin America is the emergence of the Bolivarian Alliance for Latin America (ALBA for its Spanish initials). Founded by Venezuela and Cuba in 2004 to advance free trade in the region but excluding the U.S., the organization now includes Bolivia, Ecuador and Nicaragua, and it has some influence in Brazil and Argentina.7

In addition to being excluded from ALBA, the U.S. also faces the challenge that the Chinese have become a competitor for the U.S. as a source of investment in most of Latin America, not only in ALBA countries. In the past few years, the Chinese have provided the financing and technological support for infrastructure and for the development and extraction of natural resources, all of which could have been of strategic value for the U.S.

FTAs would not correct all the problems of doing business in the region. With or without them, international trade in the region remains on average a long and costly endeavor, partly because of bureaucracy and partly because of subpar infrastructure. These problems affect not only international business but domestic business transactions, too.

Doing Business in Latin America: Not Easy

Explaining why some countries are poorer than others is not a simple task, as multiple elements are typically entangled. In the case of Latin American countries, however, several economists have argued that barriers to conducting business are the culprits for remaining underdeveloped.8 In that vein, in this section I will explore the Doing Business9 survey of the World Bank, which regularly collects information from entrepreneurs and managers operating in a large set of countries about the costs of doing business there.

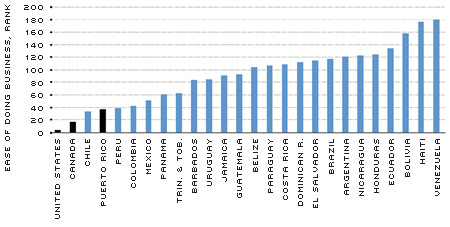

Doing Business in Latin America, World Rankings 2013

SOURCE: Doing Business Survey: Ease of Doing Business Rank, 2013.

NOTE: The graph represents the relative position of all Latin American countries (blue bars) to all other countries in the world. For example, a ranking of 40 indicates 39 countries are better and 149 countries worse in terms of ease of doing business. The black bars, corresponding to the U.S., Canada and Puerto Rico, have been included as points of reference.

Figure 3 shows overall country rankings for 2013 for a number of countries in the region; the figure includes the U.S., Canada and Puerto Rico for comparison. The graph shows very clearly that the bulk of Latin American countries fare poorly in terms of business climate. The best-ranking countries in Latin America are Chile, Peru and Colombia, all of which are placed in the high 30s or low 40s of all countries in the world. Mexico and Panama are next, and then most of the Latin American countries have rankings between 80 and 130, putting them behind many developed and developing countries in the world. The worst places to conduct business in the region—and also very badly ranked in the world as a whole—are Bolivia, Haiti and Venezuela.

A closer look at the data reveals many reasons why doing business in Latin America is challenging, not only for domestic entrepreneurs but also for foreign ones, including those coming from the U.S. Relative to the U.S. and Canada, starting up a new business in the region takes many more days and is much more costly. It takes more time and other real costs to get construction permits and electricity and to enforce the repayment of a debt. Moreover, the expected recovery of debt from legal procedures is much lower. Some of these countries, most notably Chile and Panama, have begun addressing these problems and have significantly improved their business climates in the past few years. Moreover, from the perspective of foreign investors, some of these problems can be ameliorated by the implementation of an export-processing zone (EPZ), which is a legal mechanism that insulates foreign export-oriented firms from the host country's business-climate weaknesses. EPZs and other more-discretionary benefits have been credited with the success that some countries have had in attracting FDI. Yet, concern remains about the fiscal sustainability of those schemes. Moreover, EPZs can be incompatible with the regulations of the WTO, which seeks to provide equal treatment for firms of the different trade partners.

Demographics and Human Capital

For U.S. businesses considering a presence in Latin America, the demographics of the region are an opportunity, and the formation of human capital is a challenge.

The table shows that, as of 2010, Latin America had less than twice the population but more than twice the land of the U.S. In each square kilometer in the U.S., there are 32 people; in Latin America, there are fewer than 30. It is true that the population in the region is growing faster than that of the U.S., but there are two additional considerations to put this trend in perspective for the U.S. First, since the 1980s, the relative growth of the Latin American population has slowed down, most drastically since 1990. Second, and more important, the population in Latin American countries is much younger than in the U.S. As of 2012, Latin America had practically the same number of seniors (older than 65) as did the U.S. but about 2.2 times the number of inhabitants younger than 65.

All of this presents the U.S. with a number of opportunities. Most obvious, the U.S. could continue using migration to maintain a much younger population than all other developed countries have. Among other payoffs, young migrants could in principle help alleviate the pressures on the pension system. A related challenge would be in controlling immigration flows that are undesired for both parties. A similar opportunity is the use of temporary workers, not only in agricultural sectors but also in industry and especially in services. Finally, and related to the issues discussed in the previous sector, an ample supply of younger workers in Latin America can provide U.S. business with the opportunities to keep some production operations in the region.

The formation of human capital, in particular education, in the region is another important source of opportunities and challenges. On the one hand, enrollment and attainment rates have improved significantly in primary education (where enrollment is almost universal) and also in secondary education (where enrollment rates are getting close to those in the U.S.). There also has been growth in enrollment at the college level; as of 2010, almost 40 percent of the relevant-age cohorts of the region were enrolled or had been enrolled in some form of postsecondary education.

Some scholars10 are skeptical about such rapid growth in the quantity of education, however, saying that the quality of education in these situations is often low and that students don't learn productive skills. Those concerns are valid. The 2009 outcomes of the Organization for Economic Cooperation and Development's Program for International Student Assessment (PISA) indicate that the region lags in reading, math and science.11 Even Chile, which outperforms the rest of the region, is way behind the U.S., the OECD average and even the world average. The results are particularly bad for countries such as Panama and Peru; such a poor educational climate could cancel out those countries' good business environments in the eyes of U.S. executives.

For U.S. businesses, the lack of an extensive well-trained labor force is a two-fold limitation. First, the lack of skilled workers can make it difficult for producers to find suitable workers. Second, until Latin America finds a way to extend the acquisition of skills to a higher fraction of its workers, the region's people will not have the income to become one of the major consumer markets for the goods produced by U.S. businesses.

Taking Stock

For the U.S., Latin America is a rich source of opportunities and challenges. To recap, the opportunities include: a strong and solid move toward democratization, macro stability, growing consumer markets, improving schooling achievements and a young population—all in the context of an enhanced incidence of free-trade agreements. Among the challenges: dealing with a subpar business climate, subpar infrastructure and a labor force that still struggles because of poor training and schooling—all of these amid a growing skepticism in some countries of the benefits of trade with the U.S.

The outlook is much better than a few decades ago, but there is still a long way to go before the business of the U.S. is to do business with Latin America.

Endnotes

- For instance, for standard models of international trade, see the undergraduate textbook by Feenstra and Taylor; for models of foreign direct investment, see the paper by Burstein and Monge-Naranjo. [back to text]

- These data were taken from the World Bank's World Development Indicators. The numbers reported are derived by averaging the different years for which the Gini coefficient was available for each country. Data are available at http://data.worldbank.org/data-catalog/world-development-indicators.[back to text]

- An infographic of these data is available at http://b-i.forbesimg.com/ricardogeromel/files/2013/03/billionaire-map.jpg. [back to text]

- The Polity IV is a widely used database in political sciences to measure a country's state of democracy. It includes measures on the competitiveness, openness and level of participation in elections. The database is available at www.systemicpeace.org/inscrdata.html. [back to text]

- The data were taken from the Bureau of Economic Analysis, www.bea.gov. [back to text]

- Within the import substitution schemes of the '50s, '60s and '70s, Latin American countries used trade barriers as an incentive to induce "jumping tariff FDI," i.e., the establishment of operations within the Latin American country by multinational firms to circumvent trade barriers and thereby serve the local market. On the contrary, nowadays, FTAs can be useful for FDI that is motivated to serve multiple markets, including the source country. [back to text]

- Trade policies, interestingly, differ between countries along the Atlantic coast and those along the Pacific. [back to text]

- See the paper by Cole, Ohanian, Riascos and Schmitz. [back to text]

- Data and the description of information for the Doing Business surveys can be found at www.doingbusiness.org. [back to text]

- See Pritchett for a notable example of skepticism concerning the quantity/quality dichotomy in education growth. [back to text]

- The data from PISA are available at http://www.oecd.org/pisa/. [back to text]

References

Buera, Francisco J.; Monge-Naranjo, Alexander; and Primiceri, Giorgio E. "Learning the Wealth of Nations." Econometrica, January 2011, Vol. 79, No. 1, pp. 1-45.

Burstein, Ariel T.; and Monge-Naranjo, Alexander. "Foreign Know-How, Firm Control, and the Income of Developing Countries." Quarterly Journal of Economics, February 2009, Vol. 124, No. 1, pp. 149-95.

Cole, Harold L.; Ohanian, Lee E.; Riascos, Alvaro; and Schmitz, James Jr. "Latin America in the Rearview Mirror." Journal of Monetary Economics, January 2005, Vol. 52, No. 1, pp. 69-107.

Feenstra, Robert C.; and Taylor, Alan M. International Trade. Second Edition. New York, N.Y.: Worth Publishers, 2011.

Pritchett, Lant. "Where Has All the Education Gone?" World Bank Economic Review, October 2001, Vol. 15, No. 3, pp. 367-92.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us