Metro Profile: As Owensboro, Ky. Wraps Up Wave of Development, Hiring Slows Down

The Owensboro, Ky., metropolitan statistical area (MSA), in northwestern Kentucky, does not have a major airport, nor is it located along an interstate highway. Being on the Ohio River, however, the area has traditionally attracted large industrial companies, as the river provides a major transportation route. The riverfront, a significant asset for the community, has been the focus of the MSA's economic growth in recent years; its revitalization has spurred investments and job growth in the downtown and neighboring areas.

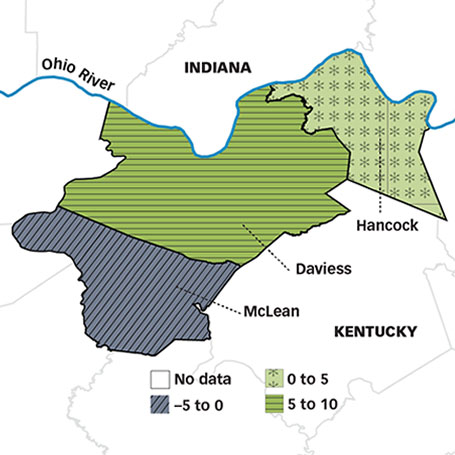

The Owensboro MSA, with a population of about 116,400 people and a labor force of about 59,450, is the smallest MSA in Kentucky. The city of Owensboro, however, is the fourth-largest city in the state, with a population of about 58,400. Henceforth, we will refer to the MSA when talking about Owensboro; the MSA includes Daviess, Hancock and McLean counties.

Between 2003 and 2013, population in the MSA increased 5.1 percent, slower than the growth rates in both Kentucky (6.8 percent) and the nation (9 percent). Daviess County, where 84 percent of the MSA's population resides, registered the fastest population growth during this period (6.2 percent), followed by Hancock County (3.1 percent); on the other hand, McLean County's population declined 3.6 percent. Per capita personal income, although still below the national average, grew 44.2 percent between 2002 and 2012 to $36,641, faster than the 37.5 percent growth seen nationwide.

Economic Drivers

Public and private investments have played a role in Owensboro's economic growth over the past 10 years. A $40 million federal grant that was announced in 2005 to stop the riverfront from eroding any further and to restore downtown's riverbank ignited the recent wave of large investments, which have reinvigorated the region. The local government publicly funded numerous infrastructure improvements and new amenities worth $120 million through a 4 percent tax increase on insurance products starting in 2009. Renovations, expansions and new construction that were funded privately, almost entirely from local sources, are worth nearly as much. Altogether, these investments equal about 7 percent of the region's annual output.

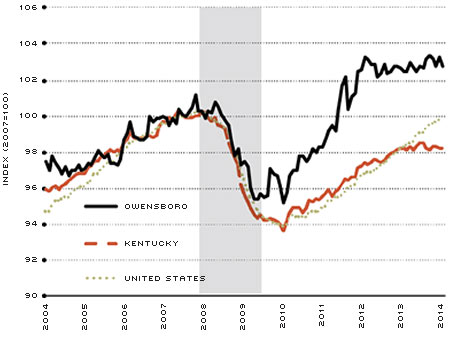

The downtown initiative helped mitigate some of the effects of the Great Recession in the region, attracting new businesses and stimulating employment growth, particularly in the service-providing sectors. Employment in Owensboro declined 4.8 percent during the recession, less than in Kentucky (5.8 percent) and in the nation (5.4 percent). During the four years after the recession, until December 2013, total nonfarm employment in Owensboro grew 6.7 percent, again faring better than both Kentucky and the nation. The fastest growing sectors during this four-year period were professional and business services (33.7 percent growth), financial services (33.5 percent), and natural resources and construction-related jobs (9.7 percent).

Such significant growth in financial services during the years after the crisis is striking, especially when the sector's national employment grew by merely 2 percent during the same four years. About one-third of the sector's workers in the MSA are employed by U.S. Bank's national mortgage servicing center, which has expanded over the past five years.

The MSA's top employer, Owensboro Medical Health System, has also contributed to economic growth with the construction of a 447-bed hospital. A $385 million project, the hospital opened in June 2013 and is expected to employ about 500 additional health care workers by June 2018.

Fueled by the gradual completion of the downtown redevelopment and by new attractions such as the bluegrass music museum and the events center, regional and business-related tourism have recently gained strength, according to anecdotal reports.

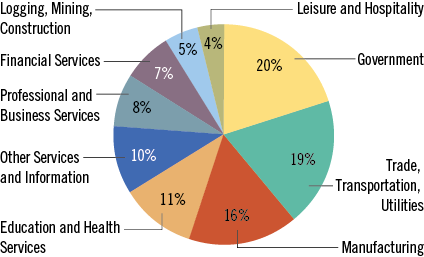

Manufacturing continues to be important in the MSA, even though the MSA's economy has become more diversified and service-oriented. The manufacturing sector accounts for 16 percent of total employment, and it grew 5.5 percent during the four years ending December 2013, driven by overall growth in Hancock County. Aluminum, auto parts, agriculture and food processing, biotechnology, paper products, natural gas transmission, and bourbon are the main industries expanding in the region.

Current Conditions

Owensboro's economy showed resilience through the recession; it quickly expanded during the first two years of the recovery, mainly due to public and private investments in the community, with employment gains twice the national rate. But since the first quarter of 2012, job growth has virtually stopped. Between that quarter and the first quarter of 2014, employment grew by only 0.2 percent, well below the 1 percent growth for the state as a whole and the 3.2 percent for the nation overall.

Looking more closely at the sectors, construction, retail and government employment are the three sectors that showed a slight upward trend as of the first quarter of 2014 when compared with the previous year. Other sectors showed either no growth or declines over the same period. In particular, job growth slowed in both financial services and in education and health care—two of the fast-growing sectors during the early recovery. Growth appears to have slowed once the expansion of U.S. Bank and Owensboro Medical Health System were completed last year. Business contacts in the region also cited external factors, such as increasing regulatory changes and rising labor costs, as reasons why employment has stayed about the same or increased slowly.1

When compared with peer regions—a group of MSAs with similar characteristics—Owensboro continually ranks among the top half in terms of per capita income, output and employment growth.2 In 2012, the last year for which data are available, Owensboro had the third-largest economy, as measured by gross metropolitan product, following Dubuque, Iowa, and Albany, Ga. The Owensboro MSA ranked in the middle on per capita income and on average income growth, both for the 10 years ending in 2012.

Lately, the aluminum industry has seen a surge in demand due to the increased need for high-grade and light-weight aluminum for auto parts, due to the recent rise in auto production. Bourbon distilling is also expanding, not only because of increased demand for the product but also because of government tax incentives to create jobs.

Rising energy costs, however, have become a major challenge for industrial plants and other energy consumers, including several business contacts. Aluminum smelters, which until recently consumed the majority of the power produced and transmitted at local plants, are now allowed to buy energy from the wider wholesale market instead of being restricted to the local grid. As a result, the cost of excess capacity in the local area is being passed on to consumers. One local coal-fired power plant has already been idled, too.3

Going Forward

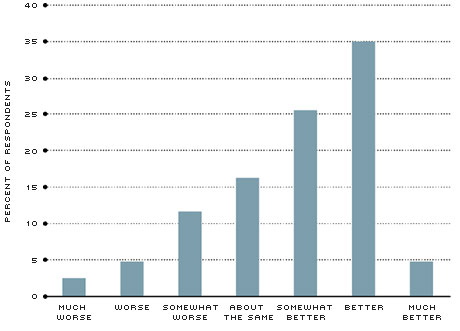

A recent survey of business contacts in Owensboro indicated general optimism about the local economy: 65 percent of contacts expect economic conditions to improve this year, 16 percent expect conditions to remain the same as last year's and 19 percent expect conditions to worsen. Severe winter weather affected many parts of the country, including Owensboro. Just over one-third of the contacts noted that first-quarter sales did not meet their expectations. However, about 60 percent of the contacts expect 2014 sales to be higher or somewhat higher than last year's, with a quarter expecting sales to remain similar to last year's.

While firms' plans on hiring were generally upbeat, they were more or less consistent with the trend seen in the data—slow and stable job growth. Employers' main concerns surrounding their hiring decisions going forward are increasing labor costs and availability of skilled labor; the latter is related to the MSA's low educational attainment rate. The percentage of Owensboro's population with a bachelor's degree or higher is 17.7 percent, compared with 21 percent for Kentucky and 28.5 percent for the nation as a whole.

On the upside, about a quarter of the contacts reported that downtown development had a direct positive effect on their business, typically from increased visibility of the region and higher foot traffic and sales. Notably, about half of contacts reported that development has improved quality of life in the area, helping to retain (and attract) businesses and workers. As a result, anecdotes suggest demand for housing is high, particularly for mid-range housing.

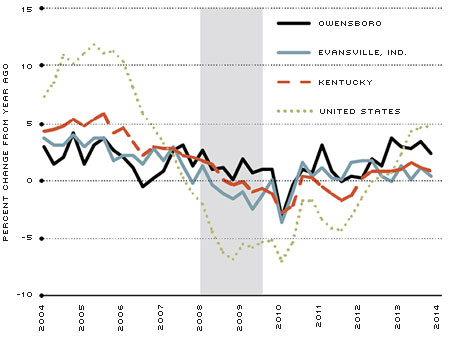

Although some see rising house prices as a positive sign, others are concerned that businesses and consumers will be affected by rising rents. Last year, house prices grew 2.9 percent in Owensboro, compared with 1.1 percent in the state overall and 0.7 percent in nearby Evansville, Ind.

Nonfarm Payroll Employment

SOURCE: Bureau of Labor Statistics.

NOTE: Data can be found in FRED, using these series IDs: Owensboro (OWNNA); Kentucky (KYNA); and U.S. (PAYEMS). To access FRED, go to http://research.stlouisfed.org/fred2. The gray bar represents a recession.

House Price Index

SOURCE: Federal Housing Finance Agency.

NOTE: Data can be found in FRED using these series IDs: Owensboro (ATNHPIUS36980Q); Evansville (ATNHPIUS21780Q); Kentucky (KYSTHPI); and U.S. (USSTHPI). The gray bar represents a recession.

Expectations about Local Economic Conditions in 2014 (Compared with 2013)

SOURCE: Survey of Owensboro business contacts.

NOTE: Data obtained from 45 business contacts surveyed in Owensboro. See Endnote 1 for details about the survey.

MSA Snapshot

Owensboro, Ky.

| POPULATION | 116,401 |

|---|---|

| LABOR FORCE |

59,547

|

| UNEMPLOYMENT RATE |

7.1%

|

| PERSONAL INCOME (PER CAPITA) |

$36,641

|

| GROSS METROPOLITAN PRODUCT | $4.02 BILLION |

| EDUCATIONAL ATTAINMENT (BACHELOR'S DEGREE OR HIGHER) |

17.7%

|

Nonfarm Employment by Sector

Largest Local Employers

1. Owensboro Medical Health System

2. Daviess County Public Schools

3. U.S. Bank Home Mortgage

4. Owensboro Public Schools

5. Audubon Area Community Services Inc.

Owensboro MSA Population Growth by County (Percent; 2003-2013)

NOTES: Population, employment, personal income per capita and gross metropolitan product data are from the Census Bureau, Bureau of Labor Statistics and Bureau of Economic Analysis. These MSA-level data series are accessible in the St. Louis Fed's economic database, FRED (Federal Reserve Economic Data). For the data, see these FRED series (IDs in parentheses): population (OWNPOP); labor force (OWNLF); unemployment rate (OWNUR); personal income (OWNPCPI); government (OWNGOVT); trade, transportation and utilities (OWNTRAD); manufacturing (OWNMFG); education and health services (OWNEDUH); other services (OWNSRVO); information (OWNINFO); professional and business services (OWNPBSV); financial services (OWNFIRE); construction, mining and natural resources (OWNNRMN); and leisure and hospitality (OWNLEIH). Educational attainment data are from the Kentucky Center for Education and Workforce Statistics. To access FRED, go to http://research.stlouisfed.org/fred2.

Endnotes

- Anecdotal information in this report was obtained from a voluntary survey of business contacts in Owensboro between May 5 and May 15. In total, 45 contacts completed the survey conducted by the Federal Reserve Bank of St. Louis. The results should be interpreted with caution, as the sample of respondents may not be fully representative of businesses in Owensboro. [back to text]

- The peer regions were selected by the Greater Owensboro Economic Development Corp. because their population is similar to Owensboro's and they are neither a state capital nor are located on an interstate highway. The peers are: Albany, Ga.; Danville, Va.; Dubuque, Iowa; Elmira, N.Y.; Jonesboro, Ark.; Kokomo, Ind.; Lewiston-Auburn, Maine; Pine Bluff, Ark.; Sumter, S.C.; and Victoria, Texas. See Brake and Coomes for more details. [back to text]

- Big Rivers Electric Corp. idled a power plant in Hancock County at the end of April and postponed idling a second one until early 2015, according to the company's 2013 annual report. [back to text]

References

Brake, Nicholas; and Coomes, Paul. "Owensboro Metropolitan Area among Peers." Winter 2010. Greater Owensboro Economic Development Corp.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us