Financial Markets: An Engine for Economic Growth

In the aftermath of the 2008 financial crisis, it is natural to wonder about the roles that the highly developed financial sector plays in our economy. Some might wonder whether this sector causes more harm than it does good. In this article, I examine data from countries with varying degrees of economic development and argue that developed financial markets are an essential ingredient of long-run economic growth.

Before I begin, let me clarify two things. First, it is not my contention that all financial market activities have a positive impact on economic growth. To the contrary, excesses and abuses in financial markets can be detrimental to economic growth in the long run. Second, developed financial markets provide useful services that do not directly contribute to economic growth. For example, most insurance policies are designed to enhance economic welfare through better allocation of risk, not through the promotion of economic growth. More broadly, the purpose of this article is not to list all the pros and cons of financial market development. Rather, I show the importance of financial markets to economic growth. Knowing the important contributions of well-functioning financial markets will help us figure out (1) which financial market activities to promote and (2) where to direct our regulatory and supervisory efforts.

The Schumpeterian Hypothesis

The nexus of finance and economic growth was first emphasized by Joseph Schumpeter in 1911. In Schumpeter's theory, widely known as the theory of "creative destruction," innovation and entrepreneurship are the driving forces of economic growth. He viewed finance as an essential element of this process. Innovation and entrepreneurship will thrive when the economy can successfully mobilize productive savings, allocate resources efficiently, reduce problems of information asymmetry and improve risk management, all of which are services provided by a developed financial sector.

The surest way to test such a hypothesis would be to perform a randomized, controlled experiment, in which we would improve financial markets in a randomly chosen group of countries and shut down financial markets in the others. Since it is not possible (or desirable) to conduct such experiments on national economies, economists have tried to infer the importance of finance for economic growth from observations on countries with varying degrees of financial and economic development.

The first attempts at empirical evaluations of Schumpeter's hypothesis came in the late 1960s and the early 1970s; these attempts documented close relationships between financial development and economic development across countries.[1] However, critics refuted this evidence, rightly, since correlation does not imply causation. Many prominent economists argued that finance simply follows economic development.[2]

More recently, researchers have responded to this criticism. I highlight three different approaches in this article.

Empirical Patterns across Countries

First, in a 1993 paper, Robert King and Ross Levine addressed the correlation-not-causation issue by showing that countries with higher levels of financial development in 1960 experienced higher rates of economic growth in the following three decades. King and Levine measured a country's financial development in terms of the levels of credit (e.g., bank loans and bonds issued) and stock market capitalization, a metric that is still widely used. Based on their findings, they rejected the idea that finance merely follows economic growth. But their results did not prove—for at least two reasons—that finance causes economic growth.

First, even though a country's financial development in 1960 is a predetermined variable relative to the economic growth in the next three decades, both financial and economic development may still be mere consequences of a common omitted factor. Second, because financial markets are forward-looking, financial development in 1960 may be the consequence of anticipated economic growth of the next few decades. In this "reverse causality" view, financial development may be a mere leading indicator of economic growth rather than a cause.

Industry-Level Evidence

Researchers then tried to come up with ways of testing Schumpeter's hypothesis that could surmount the above criticisms and clearly determine causality. In an influential paper in 1998, Raghuram Rajan and Luigi Zingales worked with detailed firm-level data that had not been used in the literature until then to test Schumpeter's hypothesis. Their theory is that, if Schumpeter were correct, industries that are more dependent on external financing would grow faster in countries with more-developed financial markets.

Using a database of publicly traded firms in the United States (Compustat), they ranked industries in terms of "external dependence," which is a measure of how dependent an industry is on external financing. Roughly speaking, it is the fraction of a firm's investment in a given year that is financed with debt and equity, rather than the year's cash flow.[3] There is a large variation in external dependence across industries, with pharmaceuticals having the highest (1.49) and tobacco the lowest (–0.45).[4]

Rajan and Zingales found that industries that are more dependent on external financing grew faster than those industries that are less dependent on external financing in countries with developed financial markets,[5] but it is the other way around in countries with underdeveloped financial markets. They concluded that their result is consistent with the view of finance as a lubricant, just as Schumpeter hypothesized.

While their test result is not a proof of finance as a causal factor of economic growth, many economists count it as the most convincing evidence. The reason is that it is much harder, albeit not impossible, to come up with a plausible omitted-variable argument or reverse-causality argument on the relative performance of industries across countries.

Building an Economic Laboratory: A Model with Two Sectors

One weakness of the above empirical approaches is that the findings do not shed much light on the exact mechanism through which finance affects economic growth. To answer this question, the third and final approach that I discuss here takes a different tack. Indeed, it turns the previous approaches on their head. It starts by building an economic model whereby financial markets do have an impact on the long-run economic growth. The question is not whether finance is a causal factor for economic development (which is true by assumption) but how big an impact financial development has on economic development. We can also determine the exact channels through which finance affects economic development.

For a representative and concrete example of this modeling approach, I rely heavily on a study that I conducted with Francisco Buera and Joseph Kaboski in 2011, in which we built a model with multiple industrial sectors and with frictions in financial markets that interfere with efficient allocation of resources. The modeling of multiple industrial sectors was partly motivated by the findings of Rajan and Zingales.

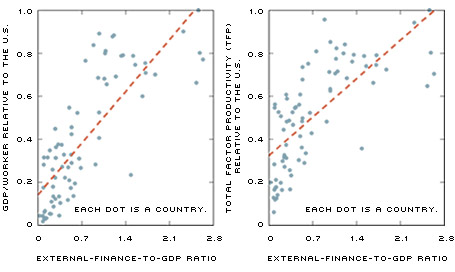

We started by establishing important empirical facts on cross-country differences in economic development. First, countries' levels of financial development are closely correlated with their levels of economic development measured by output per worker. Second, poor countries' low levels of output per worker are primarily explained by their low levels of total factor productivity (TFP). TFP measures the level of the technology that combines capital and labor to produce output. A country with a high TFP produces more with a given amount of capital and labor than a country with a low TFP. Finally, the TFP gap between rich and poor countries varies systematically across industrial sectors of the economy. For instance, less-developed countries are particularly unproductive in producing manufactured goods, including equipment and machinery. These facts synthesize the findings of the two empirical studies discussed above and shift the focus onto an economy's TFP rather than income or output levels.

Relationship between Financial Development and Economic Development

SOURCE: Buera, Kaboski and Shin.

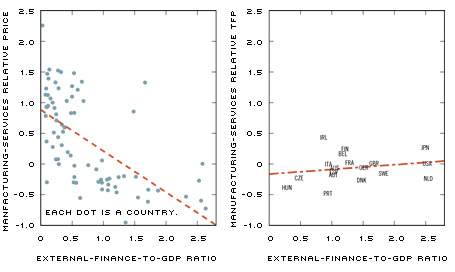

Relationship between Financial Development and Manufacturing-Services Relative Productivity

SOURCE: Buera, Kaboski and Shin.

NOTE: In the right panel, the 18 countries are: Australia (AUS), Austria (AUT), Belgium (BEL), Czech Republic (CZE), Denmark (DNK), Finland (FIN), France (FRA), Germany (GER), Hungary (HUN), Ireland (IRL), Italy (ITA), Japan (JPN), the Netherlands (NLD), Portugal (PRT), Spain (ESP), Sweden (SWE), the United Kingdom (GBR) and the United States (USA).

The left panel of Figure 1 shows the relationship between a country's financial development, measured by the ratio of private credit to gross domestic product (following the metric of King and Levine), and its level of economic development, measured by output per worker.[6] Each dot is a country, and the fitted straight line shows the average relationship between the two variables. The output per worker is relative to the output per U.S. worker. The figure confirms that more-developed economies also have more-developed financial markets.

The right panel of Figure 1 shows the relationship between a country's financial development and its level of aggregate TFP. The figure is a reflection of the fact that the difference across countries in terms of economic development, measured in terms of output per worker, is primarily explained by the difference in their TFP levels.

To have a clear analysis, we consider the simplest multisector economy: an economy with two sectors—manufacturing and services. We focus on the scale differences between manufacturing production and services production. On average, manufacturing operates at larger scales, which translates into more dependence on external financing.[7]

Sector-level TFP data are not available for most countries. We take advantage of the standard economic theory which implies that the relative price between the output of two sectors is the reciprocal of their relative productivity. In the left panel of Figure 2, we show the positive correlation between a country's relative price of manufactured goods to services and its level of financial development. This can be interpreted as lower relative TFP of manufacturing to services in countries that are less financially developed.

In the right panel of Figure 2, we only look at countries with sector-level TFP data and show their relative manufacturing-services TFP against their level of financial development. We verify that, for these countries, the relative sector-level TFP data are consistent with the sector-level relative prices.

The primary goal of our 2011 study was to present a rich quantitative framework and analyze the role of financial frictions in explaining the above empirical regularities in economic development.

In our theory, a firm's productivity changes over time, generating the need to reallocate capital from previously productive firms to currently productive ones. Financial frictions hinder this reallocation process by limiting the amount of credit required for the expansion of newly productive firms. The degree of financial frictions is different across countries because countries differ in terms of the effectiveness with which credit contracts are enforced. In countries with ineffective contract enforceability, creditors are likely to have trouble recovering their loans. Knowing this, they will reduce the size of loans and demand larger collateral.

We discovered that financial frictions explain a substantial part of the above development regularities. Essentially, financial frictions distort the allocation of capital across firms and also their entry and exit decisions, lowering aggregate and sector-level TFP. While the use of internal funds or self-financing can alleviate the resulting misallocation, it is inherently more difficult to do so in sectors with larger scale and larger financing needs. Thus, sectors with larger scale (i.e., manufacturing) are affected disproportionately more by financial frictions. This explains the empirical findings of Rajan and Zingales.

The variation in financial development across countries can explain a factor-of-two difference in output per worker across economies, which is equivalent to almost 80 percent of the difference in output per worker between Mexico and the U.S. Consistent with the consensus view in the literature, the differences in output per worker in our model are mostly accounted for by the low TFP in economies with underdeveloped financial markets.

In our model economy, the impact of financial frictions is particularly large in the large-scale, manufacturing sector. While the sector-level TFP declines by less than 30 percent in services, it declines by more than 50 percent in manufacturing, a result broadly in line with the available sector-level productivity data shown in the right panel of Figure 2. The differential impacts of financial frictions on sector-level productivity are reflected on the higher relative prices of manufactured goods to services in financially underdeveloped economies.

Our analysis provides a clear decomposition of the main margins distorted by financial frictions. First, for a given set of firms in operation, financial frictions distort the allocation of capital among them (misallocation of capital). Second, for a given number of firms in operation, financial frictions distort firms' entry decisions, with productive-but-undercapitalized firms delaying their entry and unproductive-but-cash-rich firms remaining in business (misallocation of entrepreneurial talent). Third, financial frictions distort the number of firms operating in each sector. In our model economy, whereas the misallocation of capital is responsible for 90 percent of the effect of financial frictions on the service-sector TFP, it is the misallocation of entrepreneurial talent that accounts for more than 50 percent of the effect on the manufacturing-sector TFP.

The differential impacts of financial frictions across sectors in our model economy produce an interesting testable implication on the firm size distribution of each sector. Financial frictions, together with the resulting higher relative price of manufactured goods, lead to too few firms and too large firms in manufacturing, and too many firms and too small firms in services. To evaluate this implication, we perform a detailed case study of Mexico and the U.S., and find empirical support for it.

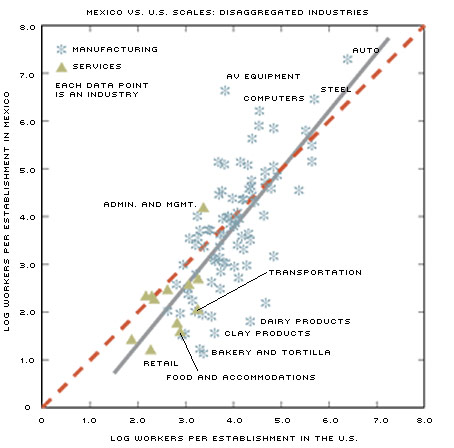

Average Establishment Size of Industries in the U.S. and Mexico

SOURCE: Buera, Kaboski and Shin.

Figure 3 plots the average plant size in Mexico (defined as the number of employees, vertical axis) against the average plant size in the U.S. (horizontal axis) for 86 manufacturing industries and 12 service industries. The overall average plant size is substantially smaller in Mexico than in the U.S., almost by a factor of three. However, many industries (those lying above the 45-degree dashed line) have an average plant that is larger in Mexico than in the U.S. Indeed, the data have a slope (solid line)

that is significantly steeper than the 45-degree line. That means that the industries that are large scale in the U.S. have an even larger scale in Mexico, while those that are small scale in the U.S. have an even smaller scale in Mexico. With the exception of administration/management services, those above the 45-degree line are manufacturing industries.

In summary, we developed a theory linking financial development to output per worker, aggregate TFP and sector-level relative productivity. Financial frictions distort the allocation of capital and entrepreneurial talent and have sizable adverse effects on macroeconomic outcomes. Based on these findings, we concluded that financial development, so long as it removes or alleviates such frictions, promotes economic growth in the long run.

Legal Origins and Financial Development

Empirical and theoretical analyses of finance and economic development across countries naturally raise the following questions. Why are some countries more financially developed than others? Why don't less developed countries adopt or import more-advanced financial markets? Recent research on this topic finds answers in countries' institutions, especially their legal framework and rule of law.

For most countries, their overarching legal framework was either shaped long before the emergence of the modern finance-growth nexus or imposed on them through colonial rule. Legal scholars have categorized the laws that pertain to economic and financial contracts into four traditions: (English) common law, French civil law, German civil law and Scandinavian civil law. The scholars have found that common-law countries generally have the strongest, and French-civil-law countries the weakest, legal protections for investors, with German- and Scandinavian-civil-law countries in the middle. The strength of investor protection explains, in turn, a significant fraction of the differences in financial development across countries.[8]

This finding also explains why it may be difficult for countries to improve their financial markets, at least in the short term. Financial markets are governed by rules that are embedded into the institutional foundations of an economy, and such rules are persistent and sluggish by nature. A reform of financial markets, thus, likely presupposes an all-reaching, large-scale reform of the whole economy.

Policy Implications

Our analysis shows that, when the financial markets are not functioning properly, there is room for a government to intervene and improve upon the allocation of capital across firms. Indeed, this is one of the most cited justifications for industrial policy.

There are two important caveats. First, to repeat the popular refrain against industrial policy, governments cannot pick winners—that is, it is not clear whether governments, even with the best of intentions, can better identify who deserves more capital than can the market. Economic history shows that the odds are not in governments' favor. Second, it is hard to change policies that favor particular groups once those policies are instituted. A firm may well deserve the government's directed credit initially, but the firm will become over time either unproductive or sufficiently capitalized on its own. If the government cannot wean such undeserving beneficiaries from directed credit, the government's efforts only worsen the misallocation of capital in the long run.

The studies reviewed in this article suggest that governments aiming for financial development should focus on reforming bureaucratic and judicial procedures of

the enforcement of economic contracts. With transparent and effective contract enforcement in place, financial development will follow.

Concluding Remarks

This article is not intended to be a wholesale defense of the financial sector. Rather, my goal is to remind us of the essential services that a developed financial sector provides for technological innovation and economic growth—mobilizing savings, evaluating projects, managing risk, monitoring managers and facilitating transactions, just as Schumpeter envisioned. We need to keep these essential services in mind as we rethink our regulatory and supervisory approaches in the wake of the financial crisis.

Endnotes

- The Schumpeterian hypothesis had been much debated before then, but the relevant data required for an empirical analysis were not available before the late 1960s. [back to text]

- Joan Robinson argued, "By and large, it seems to be the case that where enterprise leads, finance follows." See p. 86 of her book in the references. [back to text]

- A firm's external dependence is defined as capital expenditures (investment) minus cash flow from operations, divided by capital expenditures. This reveals what fraction of a firm's investment is financed with internal funds (cash flow) and external funds. An industry's external dependence is then defined as the median value of the firm-level external dependence of all the firms in that industry. Rajan and Zingales further assume that an industry's external dependence is a technological feature of the industry and, hence, the external dependence of an industry computed from the U.S. data is common across all countries. [back to text]

- The external dependence in the data primarily depends on two factors. First, industry-level technologies are different in the lag between investment and revenue generation. It is longer in pharmaceuticals, in which it takes years of research and development to produce marketable new drugs. Tobacco firms, on the other hand, have a stable revenue stream that can more than pay for new investments. Second, in all industries, young firms have higher external dependence than mature firms, which can use the proceeds from their past investment to pay for current investment. It turns out that most pharmaceutical firms are young, and most tobacco firms are old. [back to text]

- Rajan and Zingales measured a country's financial development first in terms of the metric of King and Levine and then in terms of the degree of disclosure prescribed by each country's accounting standards. [back to text]

- Gross domestic product (GDP) is computed in international prices to account for the fact that the same goods and services are often cheaper in poor countries than in rich countries. Economists call this procedure "purchasing-power parity" (or PPP) adjustment. The data are for 1996 and come from Penn World Tables Version 6.1. [back to text]

- In the U.S., the average number of employees for a manufacturing establishment is 47, while it is 17 for a service establishment. Across all the Organisation for Economic Co-operation and Development member countries, the average manufacturing firm hires 28 employees and the average service firm 8. [back to text]

- See La Porta et al. [back to text]

References

Buera, Francisco J.; Kaboski, Joseph P.; and Shin, Yongseok. "Finance and Development: A Tale of Two Sectors." The American Economic Review, 2011, Vol. 101, No. 5, pp. 1,964-2,002.

King, Robert G.; and Levine, Ross. "Finance and Growth:Schumpeter Might Be Right." The Quarterly Journal of Economics, 1993, Vol. 108, No. 3, pp. 717-37.

La Porta, Rafael; Lopez-de-Silanes, Florencio; Shleifer, Andrei; and Vishny, Robert W. "Law and Finance." Journal of Political Economy, 1998, Vol. 106, No. 6, pp. 1,113-55.

Rajan, Raghuram G.; and Zingales, Luigi. "Financial Dependence and Growth." The American Economic Review, 1998, Vol. 88, No. 3, pp. 559-86.

Robinson, Joan. "The Generalisation of the General Theory," in The Rate of Interest and Other Essays. London: Macmillan, 1952.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us