Europe May Provide Lessons on Preventing Mortgage Defaults

It is well-known that house prices declined sharply and mortgage defaults increased abruptly from 2006 to 2010 in the U.S. In Europe, where mortgage regulations are significantly different, the behavior of house prices and mortgage defaults displays somewhat different dynamics. Comparing the experiences in these two regions sheds light on the impact of alternative regulations.

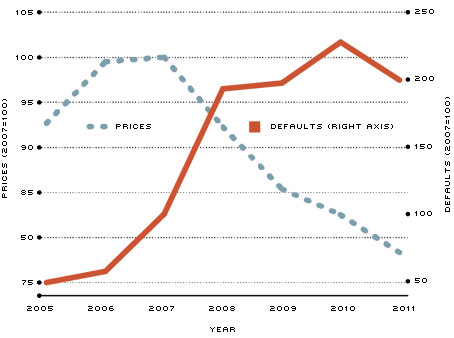

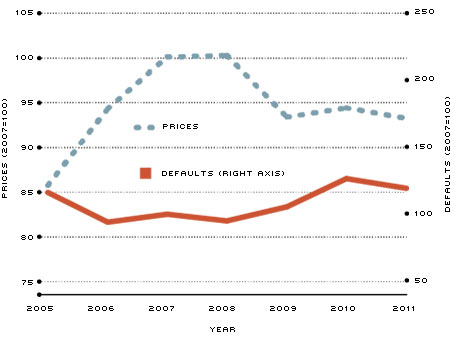

Figures 1 and 2 show the evolution of house prices and mortgage defaults in the U.S. and Europe, respectively. To facilitate the comparison, both series are normalized to 100 in 2007. In the U.S., house prices declined about 20 percent during this period, and defaults increased by about 300 percent.[1] In Europe, house prices declined much less, slightly more than 5 percent, while mortgage defaults increased little, about 26 percent from trough to peak, 2007-2010.[2] Given that changes in prices and defaults are different, it is hard to compare the experiences in Europe and the U.S. directly. Here, this problem is dealt with by comparing changes in defaults for periods in which the changes in prices were similar in the two regions.

Prices vs. Default Europe

SOURCES: Prices from International House Price Database provided by the Federal Reserve Bank of Dallas. Defaults from Eurostat.

The first panel of the table compares changes in mortgage defaults in Europe and the U.S. for periods when the change in prices was similar. From 2008 to 2009, prices declined almost 7 percent on average in Europe. As a response, default rates increased, but only by 11 percent. In the U.S., from 2007 to 2008, house prices declined on average by almost 8 percent. The corresponding increase in mortgage defaults was much larger: more than 93 percent.

Why would there be such a difference in the response of mortgage defaults to almost-equal changes in house prices? A 2011 report by the International Monetary Fund (IMF)points to two regulations used in Europe to prevent mortgage defaults, one implemented to a limited extent in only some states of the U.S. and the other implemented on a much less restrictive basis across the U.S.

The first regulation gives homeowners in Europe more responsibilities after default than most U.S. homeowners face. In Europe, mortgages are recourse loans, meaning that, after default, borrowers are responsible for the difference between the value of the outstanding debt and the value of the house. Consider this hypothetical case: If Jaime bought a house in Spain for €500,000 in 2007 and defaulted in 2010 when he still owed €450,000 but the house was worth only €400,000 then, under recourse laws he is responsible for €50,000.

This policy increases the cost of default, which makes it less appealing to the homeowner. In most of the states in the U.S., mortgages are, in practice, nonrecourse. Even when recourse is allowed, the deficiency judgment (the difference between the loan and house value) could be discharged in bankruptcy.

The second policy in Europe limits the amount that households can borrow using their house as collateral. Some European countries have limits on loan-to-value (LTV) ratios of 80, 85 or 90 percent. For example, if the LTV limit is 80 percent, an owner of a house worth €500,000 cannot borrow (using the house as collateral) more than €400,000. As a result of this policy, households have more home equity. More equity means that fewer mortgages end up underwater when house prices drop. As a result, the default rate is lower in Europe. In the U.S., LTV policies are much less restrictive.

The impact of the recourse and LTV policies is illustrated in the rest of the table.

The second panel of the table compares the dynamics of house prices and defaults in states with recourse laws to those in states without recourse laws.[3] We compare different periods to evaluate the change in mortgage defaults given similar changes in house prices. From 2007 to 2010, house prices declined by about 9 percent in recourse states, while the default rate increased by about 217 percent. A very similar change in prices—about 10 percent—is observed for nonrecourse states between 2007 and 2008; for that group, defaults rose about 186 percent, similar to what was observed in recourse states. The lesson here is that recourse as designed and implemented in the U.S. has little effect on the default rate on mortgages.[4]

As mentioned above, to understand why recourse does not have as much effect on default rates in the U.S. as it does in Europe, one has to look at the interaction of recourse laws in the U.S. with Chapter 7 bankruptcy. In a 2009 paper, economists Wenli Li and Michelle White estimated the probability of bankruptcy for homeowners with mortgages and found that the probability of filing bankruptcy was about 25 times greater if the mortgage creditor had begun foreclosure within the previous three months than if the mortgage creditor had not done so.[5]

The third panel of the table illustrates that recourse in Europe does play an important role in preventing defaults. The panel compares a group of U.S. states with a group of European countries; both groups have recourse policies but no LTV policies.[6] The main difference between these two regions is how recourse regulations are actually implemented, in particular, the fact that Chapter 7 bankruptcy restricts the role of recourse in the U.S. because a U.S. household can usually discharge that obligation in bankruptcy. Over roughly the same time period, house prices in each group declined about the same amount, but the increase in default rates was very different: about 14 percent in Europe and about 217 percent in the U.S. This suggests that recourse, when designed and implemented as in Europe, plays an important role in preventing defaults.

Limiting the amount of debt taken by homeowners seems important, too. The last panel of the table compares European countries with and without LTV limits. Over the same period, each group experienced roughly the same decline in house prices (about 10 percent). However, the default rate increased only slightly in countries with an LTV limit, while it increased by more than 14 percent in countries without such a limit.

At the Federal Reserve Bank of St. Louis, a life-cycle model in which households make housing and financial decisions is being built.[7] The model reproduces many features of U.S. mortgage and housing markets. That artificial economy can be used to simulate the effect of implementing limits on LTV and recourse in the U.S. economy. Hopefully, the results will shed light on the pros and cons of implementing these policies.

Endnotes

- For prices and defaults for the U.S., we used data provided by Zillow Real Estate Research. "Prices" are from the Zillow Home Value Index for all homes, and "defaults" are foreclosures per 10,000 homes. [back to text]

- These data are an average of prices and defaults for seven European countries with available data from 2005 to 2010. Prices were obtained from the International House Price Database provided by the Globalization and Monetary Policy Institute of the Federal Reserve Bank of Dallas. Defaults are actually "arrears on mortgage or rent payment" provided by Eurostat. A more comparable concept in the U.S. is "mortgage delinquencies." Growth rates of mortgage delinquencies and foreclosures in the U.S. were similar during this period. [back to text]

- States are grouped according to their recourse policies, using the recourse classification from the 2011 paper by Andra C. Ghent and Marianna Kudlyak. The states without recourse policies for which we also have price and default data are Arizona, California, Minnesota, Oregon, Washington and Wisconsin. The states with recourse policies that we used are Alabama, Arkansas, D.C., Maryland, Massachusetts and Missouri. These are the recourse states that take the shortest time to resolve a foreclosure. [back to text]

- See Clauretie. This view, however, is challenged by Ghent and Kudlyak, using household-level data on mortgage characteristics. [back to text]

- In a related 2011 paper, Kurt Mitman models differences in bankruptcy and nonrecourse laws across U.S. states. [back to text]

- The countries that are considered in Europe are Denmark, France, Ireland, Italy, the Netherlands, Spain and the United Kingdom. The data on loan-to-value ratio limits are obtained from the IMF report mentioned above. Countries with maximum LTV on new loans smaller than 100 percent are considered as countries with LTV limits. In our sample, only Denmark and Italy belong to this group. [back to text]

- See Hatchondo, Martinez and Sánchez (2011). [back to text]

References

Clauretie, Terrence. "The Impact of Interstate Foreclosure Cost Differences and the Value of Mortgages on Default Rates." Journal of the American Real Estate and Urban Economics Association, September 1987, Vol. 15, No. 3, pp. 152-67.

Ghent, Andra C.; Kudlyak, Marianna. "Recourse and Residential Mortgage Default: Theory and Evidence from U.S. States." The Review of Financial Studies, 2011, Vol. 24, No. 9, pp. 3,139-86.

Hatchondo, Juan Carlos; Martinez, Leonardo; and Sánchez, Juan M. "Mortgage Defaults." Working Paper 2011-019, Federal Reserve Bank of St. Louis, 2011. See http://research.stlouisfed.org/wp/more/2011-019.

International Monetary Fund, "Global Financial Stability Report." April 2011.

Li, Wenli; White, Michelle J. "Mortgage Default, Foreclosure and Bankruptcy." Working Paper 15472, National Bureau of Economic Research, 2009.

Mitman, Kurt. "Macroeconomic Effects of Bankruptcy & Foreclosure Policies." Working Paper 11-015, Penn Institute for Economic Research, Department of Economics, University of Pennsylvania, 2011.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us