Quantitative Easing: Lessons We've Learned

This summer marks five years since the U.S. real estate bubble popped. The ensuing recession was deeper than any since WWII, and full recovery remains slow, fragile and incomplete. Throughout the crisis and recovery, numerous central banks were forced to pursue unconventional monetary policies, including quantitative easing (QE). Understanding how QE affects long-term interest rates is crucial for assessing its long-run viability as an effective monetary policy instrument.

Why Was This Policy Necessary?

The primary policy instrument of most central banks is the overnight interbank interest rate, the rate at which banks lend money to one another. For the U.S., this is the federal funds rate, for which the Federal Open Market Committee (FOMC) of the Federal Reserve System sets a target. When slack emerges in the economy, the FOMC usually cuts the target for the fed funds rate in order to stimulate lending, investment and consumption. But the FOMC cannot move this rate lower than zero percent: At a negative interest rate, banks get a higher return from stashing cash under their mattress than from lending it. Hence, conventional monetary policy ran out of tools in December 2008, when the target for the fed funds rate was set at a range of 0-0.25 percent.

Concerned that deflationary expectations and sharp contractions in credit would stifle recovery, and with short-term policy rates already at zero, the FOMC chose to pursue unconventional monetary policy.

What Is QE?

Traditionally speaking, QE is when a central bank goes from targeting interest rates to targeting the amount of excess reserves held by banks, i.e., the quantity of currency in the banking system. Central banks do this by buying financial assets in exchange for reserves. Conventional monetary policy also requires buying and selling assets, namely short-term debt, to influence the desired interest rate, but the difference with QE is that the level of purchases—and not the interest rate—becomes the target.

In November 2008, the Fed announced that it would buy the debt of government-sponsored enterprises (GSEs), such as Fannie Mae and Freddie Mac, as well as the mortgage-backed securities (MBS) that these enterprises sponsored. The goals were to lower borrowing costs and to directly ease credit conditions in the housing market. In March 2009, the Fed committed to buying additional GSE debt and MBS, as well as longer-term U.S. Treasury bonds. These purchases, known collectively as QE1, or the first large-scale asset purchase program (LSAP), accounted for roughly 22 percent of the market for such assets.1 The Fed announced additional purchases of longer-term Treasuries in November 2010 and September 2011 as part of QE2 and Operation Twist, respectively. The goal was to further support economic recovery and to anchor inflation expectations at levels that the FOMC viewed as consistent with its dual mandate (price stability and maximum sustainable employment).

How Does QE Work?

Most economists agree that the interest rate that matters for stimulating investment and consumption is the medium- to long-term expected real interest rate. Medium- to long-term expected real interest rates are a function of three components: average expected overnight interest rates, a term and/or risk premium, and expected inflation. All else equal, the expected return from buying a U.S. Treasury or other bond must equal the expected average overnight interest rate over the lifetime of the bond; otherwise, the investor would be better off rolling over daily loans. But since all else is not equal, the investor also demands premiums for holding the risk that the value of the bond will decrease due to unexpectedly high interest rates (the term premium) and for holding the risk that the bond issuer will default (default risk premium). Finally, since investors are ultimately not concerned with the dollars that their investment will yield but only with the quantity of goods that those dollars will buy, the expected real return on the bond subtracts expected inflation.

QE does not directly impact future short-term rates, but it may signal to markets that economic conditions are worse than previously thought and that, as a result, low short-term rates will be warranted for longer than expected. Moreover, the central bank can use QE to signal its commitment to hold interest rates down for longer than previously believed or to meet a stated inflation rate target. Effects on future short-term rate expectations are generally referred to as the signaling channel.

QE may also directly impact term and/or risk premiums. If investors demand a premium for holding 10-year Treasuries over five-year Treasuries, then this premium should depend in part on the relative supplies of 10-year and five-year Treasuries. If the Fed purchases 10-year Treasuries, removing them from the market, investors should require a smaller premium to hold the reduced quantity of 10-year Treasuries in their portfolio. Effects on premiums, or relative asset prices, are referred to as the portfolio balance channel. Note that influencing relative asset prices, e.g., long-term rates versus short-term rates, depends crucially on imperfect asset substitutability. If investors are indifferent between five-year and 10-year Treasuries, then their yields will remain identical regardless of relative supplies.2

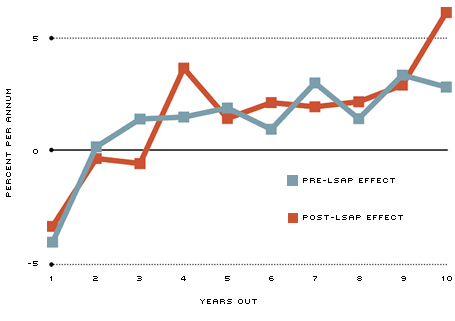

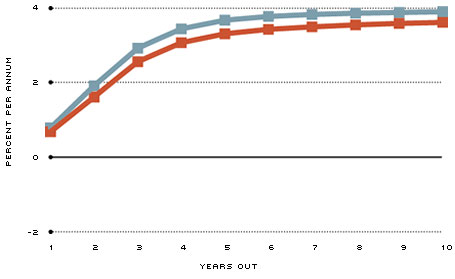

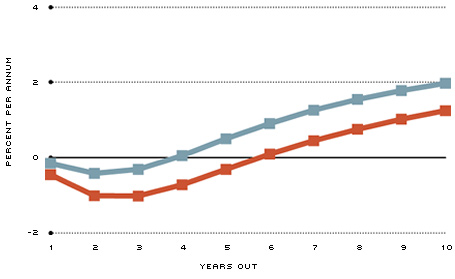

Figure 3: Term Premium

SOURCES: Bloomberg and Federal Reserve Board.

NOTE: The figure shows the expected path of inflation and average expected overnight interest rates, as well as the forward term premiums on U.S. Treasuries, both before and after the LSAP announcement effect. Expected inflation is measured from inflation swaps. The expected interest rate path and term premiums are decomposed from fitted zero-coupon U.S. Treasuries using the methodology of Kim and Wright.

So, by which of these channels, if any, did QE1 affect long-term real interest rates? The figure shows annual expected inflation rates, annual average expected overnight rates and annual term premiums up to 10 years into the future.3 Pre-LSAP levels were measured on Nov. 24, 2008, the day prior to the first LSAP announcement. Post-LSAP levels were derived by subtracting from the pre-LSAP levels the estimated LSAP effect.4 For example, investors on Nov. 24, 2008, expected that in the sixth year out (i.e., 2014) the annual inflation rate would be 1 percent and the average overnight interest rate would be 3.75 percent, and they demanded a 1 percent return premium (or a 4.75 percent return) to extend a one-year loan from Nov. 24, 2013, to Nov. 24, 2014.

The figure indicates that most of the effect on long-term yields was achieved by lowering term premiums. At 10 years out, the expected future overnight interest rate was only marginally lower than before, but the term premium for holding interest rate risk from years nine to 10 (or Nov. 24, 2017, to Nov. 24, 2018) was nearly 75 basis points lower. The effects on expected inflation are mixed and more difficult to interpret.5

What Is the Lesson?

Work by researchers at the Federal Reserve Bank of New York and Bank of England confirms the interpretation of the figure: Lower term premiums accounted for up to 70 percent of U.S. and U.K. QE effects on long-term interest rates.6 Federal Reserve Bank of St. Louis research adds more support for portfolio rebalancing by noting that, in addition to affecting domestic rates, U.S. large-scale asset purchases also significantly lowered foreign long-term interest rates.7 And while researchers at the Federal Reserve Bank of San Francisco prefer a different term-structure model for decomposing bond yields, they still obtain a point estimate that the portfolio balance channel accounted for half of the LSAP's effects.8

The major lesson learned is that financial frictions, e.g., imperfect asset substitutability, provide a meaningful avenue for monetary policy to influence long-term real interest rates, regardless of the short-term interest rate target.

Endnotes

- See Gagnon et al. [back to text]

- For example, at zero nominal interest rates, short-term government debt is essentially a perfect substitute for currency; so, swapping the two will have no effect on the relative price of short-term debt. [back to text]

- The premium on government-issued and -backed debt is almost entirely attributable to the term premium, given the relatively negligible risk of government default. [back to text]

- The LSAP effect is measured as the sum of one-day changes around the eight announcements identified by Gagnon et al. as importantly shaping LSAP expectations. See Neely for a discussion of the event study methodology. [back to text]

- On Dec. 1, 2008, and Dec. 16, 2008, there was news in addition to the LSAP that likely influenced expectations. The National Bureau of Economic Research officially declared a recession, and the FOMC added language to the FOMC statement that interest rates would be low "for some time," respectively. On March 18, 2009, "some time" was changed to "an extended period." [back to text]

- See Gagnon et al. and Joyce et al., respectively. [back to text]

- See Neely. [back to text]

- See Bauer and Rudebusch. [back to text]

References

Bauer, Michael; and Rudebusch, Glenn. "Signals from Unconventional Monetary Policy." Federal Reserve Bank of San Francisco Economic Letter, November 2011.

Gagnon, Joseph; Raskin, Matthew; Remache, Julie; and Sack, Brian. "Large-Scale Asset Purchases by the Federal Reserve: Did They Work?" Federal Reserve Bank of New York Economic Policy Review, May 2011, Vol. 17 No. 1, pp. 41-59.

Joyce, Michael; Lasaosa, Ana; Stevens, Ibrahim; and Tong, Matthew. "The Financial Market Impact of Quantitative Easing." Bank of England Working Paper No. 393, August 2010.

Kim, Don H.; and Wright, Jonathan H. "An Arbitrage-Free Three-Factor Term Structure Model and the Recent Behavior of Long-Term Yields and Distant-Horizon Forward Rates." Federal Reserve Board Working Paper 2005-33, August 2005.

Neely, Christopher. "The Large-Scale Asset Purchases Had Large International Effects." Federal Reserve Bank of St. Louis Working Paper 2010-018D, April 2012.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us