Job Gains and Losses at Large and Small Firms during the Great Recession

Recessions are often characterized by tight credit conditions. As the financial sector contracts, firms may find themselves to be increasingly credit-constrained as they attempt to finance business activity, given less available and more costly loans. These credit difficulties transmit shocks in the financial markets into shocks to the real economy, a situation termed the financial accelerator.

Small firms are often the hardest hit during periods of tight credit, according to much of the literature. When credit conditions worsen, small businesses cannot rely on access to direct credit (issuance of equity, corporate bonds and commercial paper) and must cut back on their short-term debt and, subsequently, their business operations. Economists Mark Gertler and Simon Gilchrist found in 1994 that, during five periods of contractionary monetary policy (in 1968, 1974, 1978, 1979 and 1988), small manufacturing firms reduced their short-term debt by a greater percentage than did large firms. This pattern was also true in regard to sales and inventories of small firms relative to large firms.1 Along the same lines, economists Aysegül Sahin, Sagiri Kitao, Anna Cororaton and Sergiu Laiu found that during the Great Recession small firms lost a greater share of their total employment than large firms did.

On the Other Hand

However, some studies analyzing recent recessions question the view that employment in small establishments is more affected during recessions than that of large establishments. Economists Giuseppe Moscarini and Fabien Postel-Vinay conducted a study that looked at the 1990 and 2001 recessions and found that large firms were more adversely affected than small firms with regard to employment. Economists Marianna Kudlyak, David Price and Juan Sánchez, following the same methodology as Gertler and Gilchrist, also found that large firms suffered more during the latest recessions.

The recession following the 2008 financial crisis was unlike any other since the 1930s. Focusing on the effect of this recession, Kudlyak and Sánchez found that in about the third quarter of 2008 the short-term debt of large firms decreased relative to that of small firms. Furthermore, the sales of large firms contracted relative to those of small firms, the same relationship found for the 2001 recession. It is important to note that Kudlyak and Sánchez used a different data set than did ?ahin et al. and did not measure effects on employment, making a comparison between findings difficult.

Jobs Gained and Jobs Lost

Payroll employment growth, a statistic calculated by the U.S. Bureau of Labor Statistics (BLS), is often looked to as an important indicator of job growth. This statistic is a net sum of two opposing flows: jobs gained and jobs lost. Understanding these flows provides much more detailed information about the employment dynamics of the U.S. economy. For example, we often associate job losses with periods of economic contraction. However, even when employment growth is at its highest, there will always be individuals who quit or lose their jobs. These flows are estimated by the BLS in its Business Employment Dynamics (BED) set of statistics and are available by firm size, industry and sector. This article analyzes these flows to provide a different perspective on the recession's impact on small versus large firms.

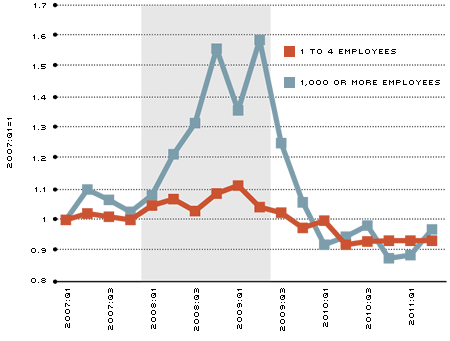

Figures 1 and 2 show the evolution of job gains and losses for very small and very large firms (four or fewer workers versus 1,000 or more workers). The difference is striking. Figure 1 shows that the rate of job loss for large firms was 35 percent higher on average during the recession than in 2007: Q1. In comparison, the rate of job loss for small firms was only 6 percent above the level in 2007:Q1. In particular, the peak rate of job loss measured for large firms, which occurred in 2009:Q2, was roughly 59 percent higher than in 2007:Q1. In contrast, the maximum rate of job loss for small firms reached only 11 percent higher than the prerecession value. Following the recession, the relative rates of job loss for both large and small firms dropped below their prerecession values; as of the middle of last year, these relative rates were roughly similar in value.

Rate of Job Loss by Firm Size

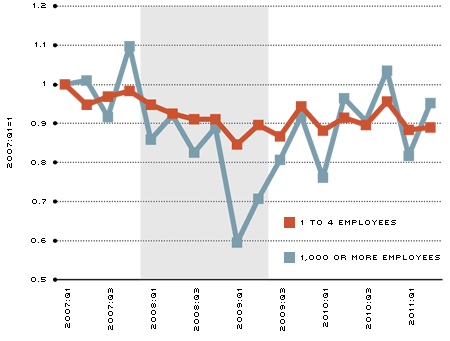

Rate of Job Gains by Firm Size

NOTE: All series are normalized such that their values are equal to 1 in 2007:Q1. The shaded area represents the period of the latest recession.

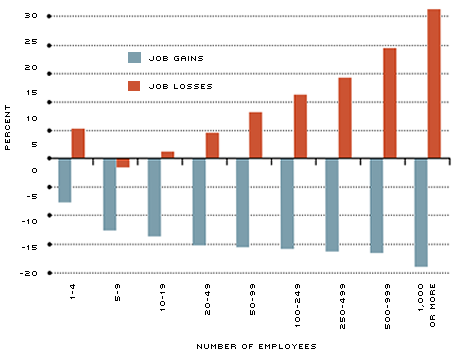

Change in Job Gains and Losses during the 2008-09 Recession Relative to 2006-07

SOURCE FOR ALL FIGURES: Bureau of Labor Statistics.

Figure 2 shows job gains over the same period. Small firms once again fared dramatically better during the recession. Averaged over the recession, the rate of hiring for small firms was about 10 percent lower than the prerecession rate. For large firms, the rate of hiring was on average 20 percent lower during the recession and reached its lowest point (41 percent lower) in 2009:Q1.

2 Percent vs. 18 Percent

The aforementioned analysis compares two extreme groups: very small and very large firms. But the finding generalizes to groups of other sizes. Figure 3 displays the percent change of the total jobs gained and lost over 2008-09 relative to the two-year period of 2006-07 for the nine size classifications found in the BED. For firms with 1,000 or more employees, the number of jobs lost was 26 percent higher than in the previous two years. For the four smallest size classifications, the average percent change in jobs lost was only 2 percent. For the four largest, it was 18 percent!

Lower rates of job gains during the recession exacerbated net employment growth, which was already on the decline due to the heightened rate of job loss. Firms with 1-4 employees had an 8 percent drop in jobs gained over the course of the recession; this decline is markedly better than the 19 percent decline that firms with at least 1,000 employees experienced.

The BED data on job flows clearly support the conclusion that large firms were hit harder by the recession than small firms were. For large firms, the rate of job loss increased dramatically and job gains continued at a much weaker rate. This is a surprising conclusion, as it runs counter to the widely held view that small firms suffer more during times of recession and tight credit conditions.2

Gertler and Gilchrist's findings are usually interpreted in the following way. Small firms suffer more than large firms during periods of tight credit because small firms depend more heavily on bank loans. As a consequence, small firms must contract more when banks reduce lending. The recent recession was preceded by one of the most severe financial crises the nation has ever seen. Perhaps the notion that a financial shock plays such a central role in affecting small firms needs to be reconsidered. Along these lines, ?ahin et al. turned to national survey evidence and found that only a few establishments cited financial conditions and interest rates as their main impediment during the recent recession. Alternatively, given that mainly large firms depend heavily on commercial paper, the sheer magnitude of this financial shock could have resulted in greater credit constraints for large firms because of the collapse in the corporate commercial paper market.3 Answers will hopefully come to light as more research occurs on this topic.

Endnotes

- Gertler and Gilchrist define small and large firms based on asset distribution, with small firms below the 30th percentile and large firms above it. [back to text]

- This is even more surprising as Sahin et al. also looked at the BED data for their study and found that small firms were worse off in the most recent recession in terms of the decline in their total employment. However, the numbers are relatively deceiving, as small firms have much greater job flows and a lower level of total employment. Thus, small firms did lose a greater share of their total employment during the recession, but they did so at a rate that deviated less from what is characteristic of those firms. [back to text]

- See Kacperczyk and Schnabl. [back to text]

References

Gertler, Mark; and Gilchrist, Simon. "Monetary Policy, Business Cycles, and the Behavior of Small Manufacturing Firms." Quarterly Journal of Economics, May 1994, Vol. 109,

No. 2, pp. 309-40.

Kacperczyk, Marcin; and Schnabl, Philipp. "When Safe Proved Risky: Commercial Paper during the Financial Crisis of 2007-2009." Journal of Economic Perspectives, Winter 2010, Vol. 24, No. 1, pp. 29-50.

Kudlyak, Marianna; Price, David A.; and Sánchez, Juan M. "The Responses of Small and Large Firms to Tight Credit Shocks: The Case of 2008 through the Lens of Gertler and Gilchrist (1994)." Federal Reserve Bank of Richmond: Economic Brief, October 2010, Vol. 10, No. 10, pp. 1-3.

Moscarini, Giuseppe; and Postel-Vinay, Fabien. "The Timing of Labor Market Expansions: New Facts and a New Hypothesis." In National Bureau of Economic Research Macroeconomics Annual 2008, editors Daron Acemoglu, Kenneth Rogoff and Michael Woodford, Vol. 23, pp. 1-52. Chicago: University of Chicago Press, 2009.

Sahin, Aysegül; Kitao, Sagiri; Cororaton, Anna; and Laiu, Sergiu. "Why Small Businesses Were Hit Harder by the Recent Recession." Federal Reserve Bank of New York: Current Issues in Economics and Finance, 2011, Vol. 17, No. 4, pp. 1-7.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us