Commodity Price Gains: Speculation vs. Fundamentals

This spring, Wal-Mart CEO Bill Simon readied shoppers for what he termed "serious" inflation: "We're seeing cost increases starting to come through at a pretty rapid rate."1

At the top of the list of cost-related pressures on prices of final goods are gains in underlying commodity prices. Commodities—such as cotton, rubber, food, petroleum and metals—are the raw materials from which all final goods begin. For many businesses, commodities represent the second-largest driver of variable cost, next to labor. Steep, sustained increases in the cost of commodities materially affect the viability of businesses and even industries; often, these price increases must be passed through to consumers.

The heavy reliance of businesses on commodities is illustrated by the story of John Anton, founder and owner of Anton Sport, a wholesaler of athletic apparel in Tempe, Ariz. Anton, who normally keeps on hand 30 boxes of cotton T-shirts as inventory, was reported this February by The Wall Street Journal to be sitting on 2,500 boxes of cotton T-shirts, funded via a $300,000 loan.2 The impetus? A 90 percent increase in the price of cotton over 2010.

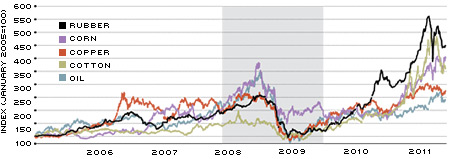

Currently, commodity prices are making headlines as much for the size of the price increases as for the simultaneity of price hikes across all types of commodities. Figure 1 reveals that, prior to the global recession, upward price trends took hold in a variety of commodities. The financial crisis and ensuing recession induced an acute decline from the 2008 peak in prices. But beginning in 2009, the prices of all types of commodities began to rise once again at astronomical rates.

Recent Commodity Price Growth

SOURCES: The Wall Street Journal and Bloomberg.

NOTE: The shaded area indicates the recession, as dated by the National Bureau of Economic Research.

This synchronization of price movements across a range of commodities has fostered, in part, the assertion that the commodity price boom is a bubble, driven primarily by near-zero interest rates and excessive speculation in commodity futures markets.

The counter argument is that market fundamentals—supply and demand for

the commodities themselves—can fully explain the price gains. Ultimately, understanding the sources of the price gains is essential for determining the proper policy response, if any.

Arguments for Market Fundamentals

In the absence of "irrational exuberance," the price of any good or asset should be driven by supply and demand. On both the supply and demand side of commodities, there is no shortage of shocks to explain, at least in part, recent price gains.

Negative Supply Shocks

For crops and many other commodities, annual production is largely at the discretion of Mother Nature. With respect to agricultural commodities, a combination of bad breaks from Mother Nature and stock-to-use ratios at already historic lows seems to explain much of the price increases.

Pre-existing stocks are a key source of stability in commodity markets. When stocks are low relative to use, the market is less able to absorb pressures from supply disruptions or unexpected demand; the resulting pressure on prices is much stronger. A survey of commodities characterized by rising prices uncovers many stock-to-use ratios at historic lows.

In a report on the pre-recession spike in food prices, the Food and Agriculture Organization of the United Nations (FAO) identified numerous reasons why stock levels have been falling by an average rate of 3.4 percent per year since the mid-1990s.3 Reasons included declines in the reserves held by public institutions, development of other less costly instruments of risk management, increases in the number of countries able to export, and improvements in information and transportation technologies. Further, the FAO found strong evidence that lower stock levels at the beginning of the marketing season were associated with higher prices throughout the season, implying initial conditions in "tight" markets matter.

Compounding this effect is further empirical evidence that the price impact of low stocks becomes magnified when stocks reach critically low levels.

For all of these reasons, low stocks in food and other crops mean that the weather disruptions faced in 2010 were all that much more significant. For example, the 47 percent increase in wheat prices in 2010 was largely attributable to drought in Russia and China and to floods in Canada and Australia. High cotton prices can be traced, in part, to floods in China (the largest producer) and Pakistan (the fourth-largest producer).

In many cases, the high prices in one market have spilled into other markets because of the competition between crops for the same land and growing resources. Farmers are choosing to grow the crops that are in shortest supply with the highest prices, often introducing shortages in other displaced crops.

With respect to nonagricultural commodities, the challenge of suppliers is less a result of temporary negative shocks than it is a result of rapidly expanding global demand.

Growing Demand

The convergence in income between developing and advanced countries represents a significant driver of demand growth for commodities: Representative of the trend, more than 90 percent of the increased demand for agricultural commodities over recent years has originated in developing countries.

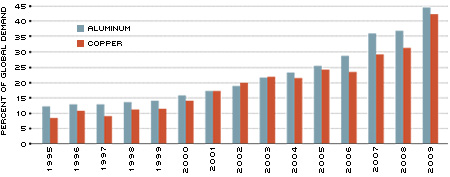

For commodities such as metals, this additional demand can take time to fully accommodate. Figure 2 reveals the incredible pace at which demand for metals like aluminum and copper has grown in the two most populous emerging countries: China and India. This huge demand growth is a major contributor to the International Copper Study Group's findings that worldwide demand for refined copper exceeded worldwide supply by 480,000 tons over the first nine months of 2010.4 The mismatch between supply and demand has unsurprisingly taken a large toll on inventories, cutting them by more than half, from 1.1 million tons in 2001 to 412,000 tons by September 2010.

Growth in Demand for Metals from China and India

SOURCE: International Monetary Fund (2010).

Continued strong growth in emerging countries, complemented by economic recovery in the United States, Japan and Europe, is expected to continue to put upward pressure on prices of metals. According to Bloomberg News, 13 of 14 industry analysts who were surveyed expected a copper shortage this year.

While exploration and investment in mining operations are under way, much time and money will be required before new mines are operational. In the words of U.S. Geological Survey specialist Daniel Edelstein, "Mines aren't just like factories, where you just flip a switch."

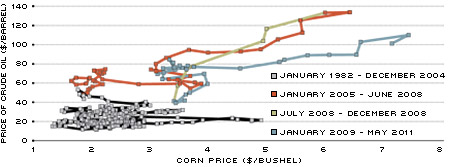

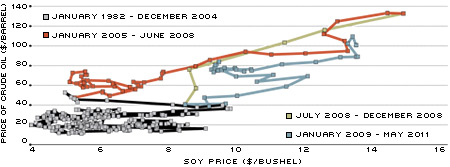

With respect to agricultural markets, the FAO is correct to point out that increased demand due to population and income growth is largely predictable. Biofuels, however, are cited as a new and persistent shock to food demand.5 Figure 3 reveals an unmistakable recent shift in the relationship between oil prices and the price of popular biofuel crops, such as corn (for ethanol) and soy (for biodiesel). The enormous size of energy markets compared with agricultural markets means that energy-related demand is capable of absorbing near-limitless amounts of surplus crops, effectively placing a floor below food prices. While great for farmers, this is unwelcome news for the impoverished and malnourished populations of the world. The effect of biofuels is also not limited to crops used in their production. Biofuel production represents an alternative use of land, which affects all agricultural products.

Co-Movement between Oil and Corn Prices

Co-Movement between Oil and Soy Prices

SOURCE: The Wall Street Journal.

The outlook in oil markets, which drives demand for biofuels, is not particularly promising either. According to a recent report from the International Monetary Fund, oil demand in emerging markets is quickly catching up to demand in advanced countries after years of significantly lower consumption rates by the former.6 Compounding this situation, production constraints in current exporting countries are starting to bind, as oil fields have reached maturity. One source of relief may come in the form of shale oil, in which the United States is rich. But extraction from shale will not become sustainable until the price of oil promises to stay above $80-105 a barrel.7

Overall, there is no doubt that fundamental shocks to supply and demand in commodities, both transitory and persistent, can account for significant price pressures in these markets. Some, however, remain unconvinced that these fundamental shocks are enough to explain the entirety of price increases. Instead, they place some blame on a bubble in commodity prices.

Arguments for a Bubble

An asset bubble is characterized by prices detached from fundamentals, instead driven by the anticipation of profiting from higher prices tomorrow.

Commodity markets, however, do not meet the usual theoretical criteria for a bubble. Arguments for a speculative bubble focus primarily on one market-place for commodities: the futures market. Commodity futures markets are where both commercial and noncommercial traders can buy and sell standardized contracts for delivery of a specified quantity of goods at a specified date in the future. These contracts are short-term instruments that have few constraints on short-selling (betting on price decreases) and that are easy to arbitrage (profit risk-free from mispricing). In contrast, theory holds that bubbles are limited to markets such as real estate, where the good in question has a long lifespan, is hard to sell before you own, and buying and selling is costly in terms of time and money.

Still, some believe that a bubble is forming in commodities due to either expansionary U.S. monetary policy and/or record flows of investment funds into commodity futures. These possibilities warrant careful consideration.

The Role of Expansionary U.S. Monetary Policy

The primary means by which expansionary monetary policy influences commodity prices is by decreasing the cost of holding inventories. Anton, the apparel wholesaler, provides a good example. One component of the cost of holding inventory is the prevailing interest rate. Expanding inventory means borrowing money, as in the case of Anton, or sacrificing the return that one could earn from investing the money. Near-zero interest rates, as currently exist in the United States, significantly decrease the cost of holding inventory and, thus, increase demand for commodities. In this context, inventory buildups, such as Anton's, can be interpreted as symptomatic of overly loose monetary policy. Broad declines in aggregate commodity inventories, however, cast doubt on the current importance of this effect.

The quotation of international commodity prices in dollars opens a second means for U.S. monetary policy in particular to influence commodity prices. When the dollar depreciates, goods priced in dollars become more affordable to foreign consumers, all else equal leading them to increase consumption and bid up the prices on these goods. This argument is countered, however, by the observation that commodity prices rose significantly over recent years regardless of the currency quoted in.

The rather recent argument that has been put forth is that historically low U.S. interest rates have increased commodity prices by driving investment funds into other markets, including the financial markets of emerging countries, to seek higher returns. The evidence, however, is founded mostly on correlation and largely lacks a credible transmission mechanism. Completing the theory of how an inflow of capital to emerging markets inflates commodity prices requires a link between the inflow of foreign investment and a broad expansion in emerging market credit. Ultimately, the banking systems of the developing countries receiving the influxes of capital must transmit the funds into the general economy. But the skepticism that developing countries like Brazil, Thailand and Indonesia have shown toward much of the capital inflows, labeling the funds as "hot money" seeking short-term returns, places uncertainty over the extent that capital inflows are funding bid-ups in commodity prices among developing countries.

The impact of increased speculation in commodity futures markets, perhaps exacerbated by low traditional investment returns, has been an area of intense research in recent years, however.

The Potential Costs of Excessive Speculation

Just as well-documented as the large gains in commodity prices prior to the recession is the contemporaneous large influx of capital into the commodity markets, namely in long-only index funds.8 According to Barclay's, index fund investment in commodities increased from $90 billion in early 2006 to just under $200 billion by the end of 2007. The proposed link between large flows of capital into commodity markets and increases in current prices appeals to common sense: Speculative demand for commodity-based assets increases demand for the underlying commodity, increasing its price. A second practically founded rationale for why excessive speculation must have played a role in rising commodity prices is embodied by a U.S. Senate committee staff report in 2006: "The traditional forces of supply and demand cannot fully account for [energy price] increases." 9

Despite these straightforward propositions, however, the true impact of speculative inflows on underlying commodity prices remains debatable. A technical report prepared for the Organisation for Economic Co-operation and Development (OECD) offers a useful examination of the research done on both sides.10 In particular, the authors pointed out both logical and factual inconsistencies within the argument for a speculation-induced bubble in commodity prices. Logical inconsistencies include a tenuous link between speculative inflows and demand for the underlying commodity and doubt over the extent that index fund investors could artificially increase futures and cash prices while only participating in the futures market and not the spot market, where commodities are sold for immediate delivery. Factual inconsistencies are numerous. For example, inventories should have risen between 2006 and 2008 according to the bubble theory, but they actually fell. Other reasons for discounting this theory include:

- arbitraging index-fund buying is fairly easy due to its predictable nature,

- commodity prices rose in markets with and without index funds,

- speculation was not excessive after accounting for hedging demand, and

- price impacts across markets were not consistent for the same level of index

fund activity.

In addition to their own analysis, the authors of the OECD report reviewed four studies supporting a pre-recession commodity bubble and five studies discounting a bubble. The authors concluded that "the weight of the evidence at this point in time clearly tilts in favor of the argument that index funds did not cause a bubble in commodity futures prices." Of the studies supporting a bubble, they write, "These studies are subject to a number of important criticisms that limit the degree of confidence one can place in their results." Still, the OECD report contains an important caveat regarding the markets most often linked to a speculative bubble: "The evidence is weaker in the two energy markets studied because of considerable uncertainty about the degree to which the available data actually reflect index trader positions in these markets."

Sorting out the bubble arguments has extremely important policy implications going forward.

Are Policy Responses Required in Commodity Markets?

The most important thing to remember with respect to commodity markets is that they are volatile. The traditional decision of central banks to focus on core inflation, which excludes food and energy, is easy to understand in the context of recent movement in rubber markets.

During 2010, the price of rubber increased by 114 percent. The run-up in the price was largely attributed to bad weather, low stocks and growing demand from China's automobile industry. Around the end of 2010, many investors remained bullish on rubber prices due to expectations of continuing strong demand. Indeed, the real price of rubber reached a historic peak in the middle of this February. Yet only a month removed from that peak, the price fell more than 30 percent in a matter of weeks, and the Thai government was discussing price supports for rubber. The price drop was due to uncertainty over global demand, stemming first from unrest in the Middle East and, subsequently, the earthquake and resulting tsunami in Japan and their uncertain effects on the demand for rubber tires from Japanese carmakers like Toyota, Honda and Nissan. This drop was then followed by a 23 percent increase in the price over the second half of March as Thailand, the largest producer of rubber, ultimately intervened to buy up domestic rubber supplies and support prices, while simultaneously telling farmers to restrict supplies in an effort to bid prices back up.

Not only are large movements in commodity prices common, but they are often linked to inherently unpredictable events. Just in the past few months, cotton prices fell by 25 percent and oil had its largest one-day drop in two years. To try to design policy around commodity prices would require abrupt about-faces and would detract from a central bank's goal of bringing stability to markets.

More pertinent questions with respect to commodity markets are:

- Is strong regulation in futures markets needed?

- Are large subsidies on biofuels good policy?

- Should U.S. monetary policy take into consideration global economic conditions?

Some countries, like India, have already begun to regulate commodity futures markets; other countries, including the United States, have debated the issue. Both those who believe in a speculative commodity bubble and those who do not can agree that properly functioning commodity futures markets are integral to the real economy because they allow those who do not wish to hold the risk of future price movements to sell that risk to willing parties. The OECD report provides a reminder that index fund investors are an important source of liquidity and of risk absorption for these markets. Pushing such investors out of the market could result in huge costs, which must be weighed against the evidence that their activity is hindering, and not enhancing, the proper functioning of these markets.

With respect to biofuels, potential negative effects, such as reversing a 30-year downward trend in real food prices, are of particular relevance because these markets are currently highly dependent on government subsidies. Brazil's ethanol from sugar cane is the only biofuel whose production is viable without government subsidies. In the United States, subsidies on ethanol increase the price that processors can afford to pay for corn and break even (a function of oil prices) by $63 per ton. This compares with an average price of corn in 2005 (predating heavy investments in biofuel) of $75 per ton and a price of $163 per ton that processors can already afford to pay and break even given crude oil prices of $100 per barrel.

Government support of the industry is motivated by benefits, such as energy independence and a reduction in the environmental impact, that accrue to society but cannot be internalized by processors. But recent life-cycle analysis of biofuels—an analysis that takes into account the extra land needed to grow crops and the production process—raises questions about the environmental benefits. The question is whether there may be less-costly and more-efficient ways to achieve the same policy goals. The long-run success of biofuels is likely to hinge on the development of second-generation fuels, which can make use of more parts of the crop, as well as biofuels based on highly efficient algae.

The final question regarding the consideration of global economic conditions in U.S. monetary policy debate will require much more convincing evidence before a firm conclusion can be reached. If expansionary U.S. monetary policy is transmitted globally to economies in danger of overheating, which in turn bids up commodity prices and, hence, increases price levels back at home, then U.S. monetary policy should care about output gaps around the world. At the same time, the mere correlation of commodity price increases with loose U.S. monetary policy, without any convincing empirical evidence or theoretical mechanisms for this avenue, is not enough to determine that U.S. policy decisions should factor in economic conditions from Latin America to Europe, from Asia to Africa.

Ultimately, the greatest lesson from recent trends in commodity prices may be the reminder that economics is founded on the assumption of a world with unlimited wants and limited resources. A world with a growing population and ever-increasing income parity implies a world with ever-increasing competition for resources.

Endnotes

- See O'Donell. [back to text]

- See Pleven and Wirz. [back to text]

- See Food and Agriculture Organization of the United Nations (2009). [back to text]

- See Davis. [back to text]

- See Food and Agriculture Organization of the United Nations (2008). [back to text]

- See International Monetary Fund (2011). [back to text]

- See Engemann and Owyang. [back to text]

- "Long-only" refers to the fact that these index funds make only buy and sell decisions and do not short futures contracts. [back to text]

- See Senate Report 109-65. [back to text]

- See Irwin and Sanders. [back to text]

References

Davis, Tony. "As Copper Price Booms, 'Bust' is a Scary Thought." Arizona Daily Star, Jan. 2, 2011.

Engemann, Kristie M.; and Owyang, Michael T. "Unconventional Oil Production: Stuck in a Rock and a Hard Place." The Federal Reserve Bank of St. Louis' The Regional Economist, July 2010, Vol. 18, No. 3, pp. 14-15.

Food and Agriculture Organization of the United Nations. The State of Food and Agriculture 2008. Rome: Food and Agriculture Organization of the United Nations, 2008.

Food and Agriculture Organization of the United Nations. "The State of Agricultural Commodity Markets: High Food Prices and the Food Crisis—Experiences and Lessons Learned." 2009.

International Monetary Fund. "World Economic Outlook, April 2011. Tensions from the Two-Speed Recovery: Unemployment, Commodities, and Capital Flows."

International Monetary Fund. "Regional Economic Outlook, October 2010. Asia and Pacific: Consolidating the Recovery and Building Sustainable Growth."

Irwin, Scott H.; and Sanders, Dwight R. "The Impact of Index and Swap Funds in Commodity Markets." A technical report prepared for the Organisation for Economic Co-operation and Development, June 2010.

O'Donnell, Jayne. "Wal-Mart CEO Bill Simon Expects Inflation." USA Today, April 1, 2011.

Pleven, Liam; and Wirz, Matt. "Companies Stock Up as Commodities Prices Rise." The Wall Street Journal, Feb. 3, 2011.

Senate Report 109-65, "The Role of Market Speculation in Rising Oil and Gas Prices: A Need to Put the Cop Back on the Beat." Staff report prepared by the Permanent Subcommittee on Investigations of the Committee on Homeland Security and Governmental Affairs, U.S. Senate, June 27, 2006.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us