The Curious Case of the U.S. Monetary Base

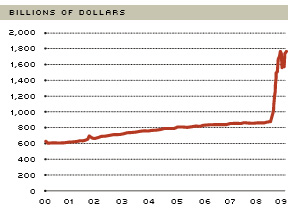

It is common for monetary policy actions to be gauged by their effect on short-term interest rates. The current stance of policy in the U.S. is associated with rates near zero, leaving further declines untenable. In this policy environment, it is useful to monitor alternative measures of the stance of monetary policy. Much recent attention has been focused on a measure called the "monetary base," which has risen sharply since the fall of 2008. (See Figure 1.) Should analysts and policymakers be concerned about this increase?

The monetary base is the narrowest measure of money used by economists. It consists of deposits held at the Federal Reserve by depository financial institutions (including commercial banks, savings banks and credit unions), plus all coin and currency held by households and businesses (including the depository institutions). These financial assets are used for "final" settlement of transactions in the economy—currency for hand-to-hand payment among persons and businesses, and deposits at the Fed for bank-to-bank settlement that is irrevocable (including check clearing and wire payments)—hence, the label of "base" (that is, basic) money.

In normal times, the monetary base increases and decreases roughly dollar-for-dollar with changes in the amount of assets held by the Fed. When the Fed buys an asset, such as a Treasury security, it writes a check drawn on itself. The recipient deposits the check at his or her bank, which sends the check to the Fed so that the check's amount may be credited to its Federal Reserve account. The funds at the Fed are valuable because they may be used to pay debts due, on behalf of customers, to other banks.

During the past year and a half, the Fed has introduced a number of programs to reduce stress in financial markets.1 These programs have greatly increased the amount of assets held by the Fed—and, in turn, the monetary base. Analysts and commentators are concerned that, unless the increases are reversed promptly when economic activity expands, inflation will accelerate. Such fears are reasonable because, as explained below, the aggregate amount of deposits held by banks at the Fed is not reduced by their lending and borrowing—hence, a few dollars' increase in the monetary base potentially can lead to the creation of large amounts of new credit.

Traditional Monetary Policy

The numerous new Fed programs have been labeled "nontraditional" monetary policy. But, in contrast, what is "traditional" policy? And what separates traditional policy from nontraditional policy?

Traditional monetary policy refers to the Fed's seeking to maintain an overnight interest rate (the federal funds rate) close to a desired target. Each day, the Fed nudges the federal funds rate toward a desired target by buying or selling Treasury securities. When the Fed buys a Treasury security, deposits at the Fed increase and, other things unchanged, the overnight interest rate falls; conversely, when it sells a security, other things equal, overnight interest rates rise. Each purchase or sale changes the size of the monetary base—but the daily changes have no effect on economic activity and are correctly ignored. Only when multiple changes accumulate into a large and persistent change in the monetary base does an impact arise on economic activity, both real output and inflation.

It is important to note that the Fed initiates these actions that change the size of the monetary base; households and firms (including financial firms), individually or as a group, cannot change the total amount of deposits that they, as a group, hold at the Fed. 2 To see this, suppose bank A makes a new loan by crediting $1 million to a customer's checking account. As the borrower spends the loan and the funds are deposited in other banks, bank A's deposit at the Fed will shrink because it must pay some of its deposits to the banks that have received the spent funds. The deposits at the Fed do not disappear, however; the deposits at the Fed move from bank A's deposit account to another bank's account, but the total quantity is neither increased nor decreased by the borrowing, spending and saving decisions made by households and firms (including banks).

Nontraditional Monetary Policy

Recently introduced Fed programs have been labeled nontraditional for several reasons. First, the overnight interest rate usually targeted by the Fed is near zero. Hence, the Fed's purchase and sale of securities must be judged by whether these actions reduce stress and improve credit conditions in individual financial markets, rather than by their impact on the economy as a whole. Second, whereas traditional policy involves buying and selling Treasury securities, nontraditional programs involve buying financial assets other than Treasury securities. These assets, necessarily, have greater default risk than Treasurys. By buying these assets, the Fed accepts some risk of default and losses, although the risk likely is small. Third, the assets in these nontraditional programs have been paid for with deposits at the Federal Reserve Bank of New York. Although the assets are nontraditional, their purchase with deposits at the Fed is very traditional. As usual, paying for purchased assets with deposits at the Fed causes increases in the monetary base dollar-for-dollar.

Increase in the Monetary Base

The table shows a simplified version of the Fed balance sheet for two weeks: the week ending Sept. 10, 2008, and the week ending Jan. 14, 2009. Liabilities include currency, deposits of depository institutions, the Treasury's deposit and capital. (The sum of the first two equals the monetary base.) Assets have been grouped into traditional (Treasurys and similar securities) and nontraditional (assets acquired under the new programs).3

During the four months ending January 2009, the Fed's nontraditional programs increased deposits at the Fed from $32 billion in the first half of September to $828 billion in the latter half of January.4 The monetary base doubled. (Currency increased, but by only a modest amount.)

Monetary Policy Implications of Nontraditional Programs

In several speeches, Fed Chairman Ben Bernanke has emphasized that nontraditional policy focuses on reducing stress in specific financial markets, that is, on credit easing. The focus is apparent in the types of securities purchased, including commercial paper, mortgage-backed securities and privately issued asset-backed securities.

Be this as it may, the programs nonetheless have greatly increased the monetary base—and portend, if not promptly reversed when economic activity revises, higher future inflation. When will confidence return to the economy, such that banks feel able to accurately assess the riskiness of loans and borrowers feel confident in their ability to repay? When confidence returns, will financial markets be roiled as the Fed reduces its assets and the monetary base? Finally, the Fed now has an additional policy instrument not previously available: the payment of interest on deposits at the Fed.5 Can it be used to forestall undesired increases in bank lending?

Recent increases in the monetary base are far greater than any previously in American history (even adjusted for the size of the economy), surely a "noble experiment" in policymaking. Will these policies be successful without accelerating inflation? The epitaph to this curious case of monetary base expansion is yet to be written.

Table 1

Federal Reserve Balance Sheet

Billions of Dollars

| Week Ending Jan. 14, 2009 | ||||

| Assets | Liabilities | |||

| Traditional Assets |

593

|

Federal Reserve Notes |

844

|

|

| Treasury Securities |

476

|

Bank Deposits |

828

|

|

| Other Traditional Assets |

117

|

Other Liabilities |

344

|

|

| Nontraditional Assets |

1,465

|

Capital Account |

42

|

|

| Total Assets |

2,058

|

Total Liabilities |

2,058

|

|

| Week Ending Sept. 10, 2008 | ||||

| Assets | Liabilities | |||

| Traditional Assets |

580

|

Federal Reserve Notes |

798

|

|

| Treasury Securities |

480

|

Bank Deposits |

32

|

|

| Other Traditional Assets |

103

|

Other Liabilities |

54

|

|

| Nontraditional Assets |

241

|

Capital Account |

40

|

|

| Total Assets |

924

|

Total Liabilities |

924

|

|

SOURCE: Federal Reserve Board H.4.1.

Endnotes

- A chronology of these programs is available at stlouisfed.org/financial-crisis. See also Aubuchon and Bernanke. [back to text]

- Again, the devil is in the details: The sentence is true if (when) the level of depository institutions' borrowing from the Fed does not change. [back to text]

- For more information on the impact of new programs on the Fed's balance sheet, see Gavin. [back to text,]

- Not all programs have increased deposits at Federal Reserve banks. The securities lending program, for example, does not affect deposits at Federal Reserve banks. Plus, some programs increase deposits at Federal Reserve banks via additional Fed lending (not by the purchase of assets), including the Term Auction Facility, increased discount window lending and swap lines with foreign central banks. [back to text]

- See Anderson. [back to text]

References

Anderson, Richard G. "Paying Interest on Deposits at Federal Reserve Banks." Federal Reserve Bank of St. Louis Economic Synopses, 2008, No. 30. See http://research.stlouisfed.org/publications/es/08/ES0830.pdf.

Aubuchon, Craig P. "The Fed's Response to the Credit Crunch." Federal Reserve Bank of

St. Louis Economic Synopses, 2009, No. 6. See http://research.stlouisfed.org/publications/es/09/ES0906.pdf.

Bernanke, Ben. "The Crisis and the Policy Response." Presented at the Stamp Lecture, London School of Economics, London, England, Jan. 13, 2009.

Gavin, William T. "More Money: Understanding Recent Changes in the Monetary Base." Federal Reserve Bank of St. Louis Review, March/April 2009. Vol. 91, No. 2, pp. 49-60.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us