Jumbo CDs Play Tiny Role in Policing Risky Banks ... So Far

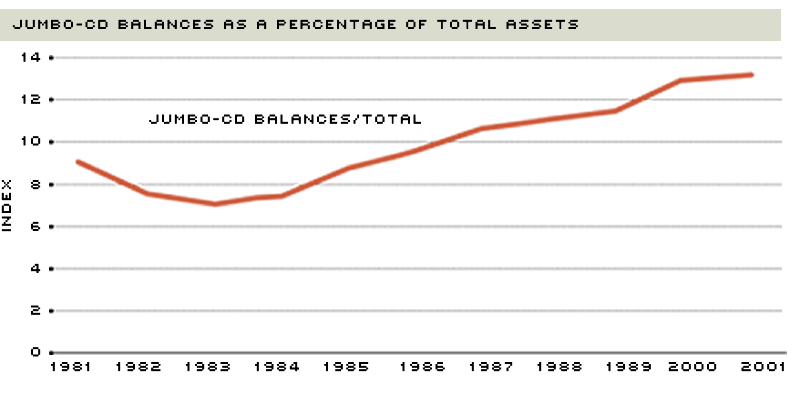

The Federal Deposit Insurance Corp. Improvement Act of 1991 (FDICIA) reformed U.S. banking regulation more than any other legislation since the 1930s. Among its many reforms, FDICIA changed the procedure for cleaning up bank failures. This change put holders of jumbo certificates of deposit (CDs)—time deposits with balances exceeding the $100,000 ceiling for deposit insurance coverage—at greater risk of loss in a failure. Depositors at risk should have responded by demanding higher interest payments or withdrawing their money from risky institutions. Paying more interest to satisfy current depositors or to secure new depositors should, in turn, have hurt bank profits. Community banks, in particular, should have felt the pinch because of their increasing reliance on jumbo-CD funding in the 1990s. (See figure.) But did any of these "should haves" actually result from FDICIA?

FDICIA: A New Law in Town

Congress passed FDICIA to make bankers and bank supervisors more aggressive about containing risk. In the decade preceding passage, U.S. depository institutions failed at rates unseen since the 1930s, imposing costs on taxpayers of nearly 3 percent of gross domestic product. FDICIA included "prompt corrective action," which mandated explicit supervisory responses to banks with deteriorating capital. FDICIA also introduced a risk-based premium system for deposit insurance, which forced risky institutions to pay more for coverage. Strict guidelines for supervisory action and stiff insurance premiums for risk-taking, it was thought, would help prevent a recurrence of the bank and thrift crisis of the 1980s.1

In addition, FDICIA contained "least-cost" failure resolution—a provision designed, in part, to wake up jumbo-CD holders to bank risk. Before 1991, the FDIC cleaned up most failures by offering cash to healthy banks to assume the liabilities of failed ones—in effect, shielding uninsured depositors against losses. The new law directed the FDIC to resolve failures in the least expensive fashion, meaning that jumbo-CD holders had to share in the losses. The post-FDICIA numbers point to heightened exposure. In the three years running up to the act—1988 through 1990—jumbo-CD holders suffered losses in only 15 percent of 597 bank failures. But from 1993 to 1995, uninsured depositors lost money in 82 percent of the 60 failures.

Community bankers have good reason to heed the concerns of jumbo-CD holders. Broadly speaking, community banks fund assets with core deposits (checking accounts, savings accounts and certificates of deposit under $100,000), jumbo CDs and owner-contributed capital. Jumbo CDs are the only deposit that is potentially sensitive to the risk of failure. More important, community banks turned increasingly to this funding source in the 1990s. By year-end 2001, these banks funded 13.1 percent of assets with jumbo CDs—up from 9.1 percent 10 years earlier, when FDICIA became law. Viewed another way, at year-end 2001 interest expense on jumbo CDs accounted for nearly 22 percent of community bank interest expense; 10 years earlier, jumbo-CD interest came to just under 14 percent of total interest expense. To post profits in today's increasingly competitive environment, community bankers must manage these funding costs carefully.

Just as banks must pay attention to their jumbo depositors, the holders of these CDs should keep an eye on their banks, given that any balances above $100,000 are vulnerable in a failure. If depositors note a greater chance of failure, they should demand higher interest payments or withdraw their funds—either way increasing costs and lowering profits for risky institutions. If large enough, the dip in profits might persuade bankers to scale back risk or dissuade them from taking risks in the first place, moves that would certainly meet with the approval of bank supervisors.2

Searching for FDICIA's Fingerprints

To test the "should haves," we estimated the impact of risk on jumbo-CD behavior following FDICIA and then calculated the "profit hit" implied by these estimates. We statistically modeled both yields and withdrawals—holding constant other factors, such as the general level of interest rates. To key on community banks, we looked only at institutions holding less than $500 million in assets.3 To capture overall risk, we relied on a probability-of-failure number generated by the Federal Reserve's bank surveillance tool.4 Following industry convention, we measured profitability with return on assets—defined as net income divided by average assets. Put simply, our approach involved applying the "cost of risky behavior" in a post-FDICIA window (1993-95) to the income statements of our sample banks in a pre-FDICIA window (1988-90). This approach controlled for the differences in capital requirements in the two periods.

Our evidence suggests that FDICIA did little to strengthen the link between risk and profits at community banks. Specifically, increases in failure risk did raise jumbo-CD yields and withdrawals in the post-FDICIA window. But this hike was very small, muting the impact on interest expense and profits. For example, if the average community bank in the pre-FDICIA era paid the post-FDICIA price for risky behavior, its return on assets would have dropped from 1.0742 percent to 1.0736 percent—only 0.06 basis points. A price this small is not likely to curb an appetite for risk.

One possible explanation for the weak link between risk and profits is the National Depositor Preference Act of 1993. This act required domestic depositors to be paid before foreign depositors after a failure and, thus, could have undermined the impact of least-cost resolution for institutions heavily reliant on foreign deposits. Domestic depositor preference does not explain our results because community bankers seldom tap the foreign market. Indeed, from 1993 to 1995, the community banks in our sample funded a scant 0.2 percent of assets with foreign deposits.5

A more likely explanation is the dramatic improvement in U.S. banking conditions in the 1990s. Least-cost resolution increased the likelihood that jumbo-CD holders will suffer losses in a failure, but—at the same time—booming economic conditions made failures much less common. In the 1980s, for example, 1,127 banks folded; in the 1990s, that number tumbled to 442. In the unprecedented expansion of the 1990s—an environment in which most banks posted record profits—it probably did not pay for jumbo-CD holders to monitor and discipline individual institutions. As a result, community banks did not see large jumps in funding costs—or large declines in profits—as risk increased.

So, Who Wears the Badge?

The change in failure resolutions mandated by FDICIA appears to have had little impact on the profits of risky community banks—so far. But in a softer economy—an economy in which failures are more common—uninsured depositors might show more interest in the risk of their bank. And this interest could very well translate into higher costs and lower profits for risky institutions. For the time being, however, bank supervisors will continue to take the lead in policing risk at community banks.

Community Banks Increase Reliance on Jumbo CDs

In recent years, community banks have increasingly turned to jumbo-CD funding. FDICIA forced these depositors to take a larger hit in failures, possibly boosting funding costs for risky institutions. [back to text]

Endnotes

- To learn more about FDICIA, see Benston and Kaufman (1998). [back to text]

- Indeed, some policy-makers argue that this type of market discipline can serve as a third pillar of bank supervision, along with capital requirements and on-site examination. Emmons, Gilbert and Vaughan (2001) provide an overview of this argument. [back to text]

- We employed the $500 million asset cutoff because the Financial Modernization Act of 1999 used this benchmark to define a community financial institution. For more details about the sample construction, the underlying data and the research strategy, see Hall, King, Meyer and Vaughan (2002). To obtain a copy, send an e-mail to mark.vaughan@stls.frb.org. [back to text]

- The Federal Reserve System's early warning model, the System for Estimating Examination Ratings (SEER), uses accounting ratios to estimate failure probability in the next 24 months. These ratios capture a bank's credit risk, liquidity risk and capital strength. To learn more about SEER, see Gilbert, Meyer and Vaughan (2002). [back to text]

- We explored other possible explanations, including measurement error arising from our use of accounting-based measures of CD yields and substitution by risky institutions of Federal Home Loan Bank advances or core deposits for jumbo CDs. These explanations did not account for the weak link between risk and profits. See Hall, King, Meyer and Vaughan (2002) for additional discussion. For more details on the National Depositor Preference Act of 1993, see Marino and Bennett (1999). [back to text]

References

Benston, George J. and Kaufman, George G. "Deposit Insurance Reform in the FDIC Improvement Act: The Experience to Date." Federal Reserve Bank of Chicago Economic Perspectives, Vol. 22, No. 2, Second Quarter 1998, pp. 2-20.

Emmons, William R.; Gilbert, R. Alton and Vaughan, Mark D. "Controlling Risk by Big Banks: Can Markets Help?" Federal Reserve Bank of St. Louis Regional Economist, October 2001, pp. 5-9.

Gilbert, R. Alton; Meyer, Andrew P. and Vaughan, Mark D. "Could a CAMELS Downgrade Model Improve Off-Site Surveillance?" Federal Reserve Bank of St. Louis Review, Vol. 84, No. 1, January/February 2002, pp. 47-63.

Hall, John R.; King, Thomas B; Meyer, Andrew P. and Vaughan, Mark D. "Did FDICIA Increase Funding Costs for Community Banks?" Supervisory Policy Analysis Working Paper 2002-2, Federal Reserve Bank of St. Louis, May 2002.

Marino, James A. and Bennett, Rosalind L. "The Consequences of National Deposi-tor Preference." FDIC Banking Review, Vol. 12, No. 2, 1999, pp.19-38.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us