The Microchip Flexes Its Muscle: Can It Compete with History's Best?

|

"We are witnessing nothing less than the rise of a digital economy and a new global medium that will be the single most important driver of business, economic and social change in the coming century."1 —Louis Gerstner Jr., chairman of IBM |

The U.S. economy has experienced more than 18 years of uninterrupted growth since the end of the 1981-82 recession. The lone blemish during this so-called Long Boom was a recession lasting just nine months, from July 1990 to March 1991. But what has so enthralled many economists is not the length of the boom but the acceleration in the economy's rate of productivity growth during the last half of the 1990s. Most economists who have attempted to explain the cause of this productivity boom point to the spate of innovations and technological advances associated with the microchip, which has spurred heavy investment in high-tech information and communications technology equipment and software. Many questions about the productivity boom remain, however:

- Why did it take so long to begin?

- How long will it last?

- Can public policy do anything to encourage productivity booms and lasting increases in economic growth?

Our current boom period appears similar to past eras of rapid technological progress and economic growth. In the late 19th and early 20th centuries, advances in the distribution and usage of electric power, new processes for making steel, development and application of the internal combustion engine, and expansion of the chemical industry and numerous other important sectors delivered impressive gains in manufacturing productivity and the standard of living. Like our current experience, however, a considerable delay occurred between the introduction of new technologies and measurable increases in aggregate productivity growth. Once productivity and economic growth began to accelerate, however, they remained high for several decades.

What can we learn from history that might be relevant for understanding our current productivity boom and for understanding whether public policy can play a constructive role in fostering sustained growth in living standards?

The Importance of Productivity Growth

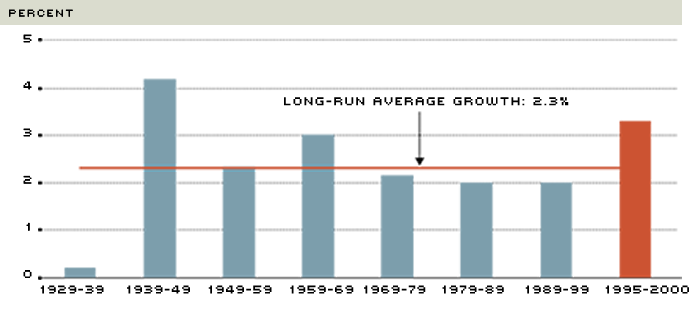

Economists and policy-makers pay so much attention to productivity growth for a simple reason: The more productive the nation's workforce becomes, the higher will be its citizens' standard of living. In the United States, per capita real gross domestic product rose by 2.2 percent per year on average from 1929 to 1994. (See below.) At this rate, the average American's living standard doubles about every 33 years. But if per capita GDP increases at a 3.4 percent annual rate—its growth from 1995 to 2000—then only 21 years would be needed for living standards to double. (See Figure 1.)

What causes productivity growth rates to speed up or slow down? Clearly, improvements in the quality of labor input, such as a more educated workforce, do. An increase in the quantity of capital per worker—known as capital deepening—also increases average labor productivity over time. In recent years, this phenomenon has been especially important, as sharp declines in the prices of computers, software and other information and communications technology equipment have caused businesses to dramatically ramp up their spending on such things.

Besides changes in measured labor and capital inputs, productivity can increase for other reasons. To capture these reasons, economists use the concept of total, or multi, factor productivity (TFP). In general, labor productivity growth—and, hence, growth of living standards—is a function of capital deepening and TFP growth.

Broadly, TFP growth is a measure of the economy's rate of innovation, or technical progress, over time. Though perhaps a nebulous concept to non-economists, technical progress can be thought of as the myriad improvements to standard of living arising from innovations that allow firms to produce new goods and services or to reduce the cost of existing goods and services. Some examples are:

- Medical advances that improve health care;

- More-powerful computers and improved software;

- Increased efficiencies associated with the Internet, such as e-commerce;

- Satellite- and land-based communications technologies that lower the cost of acquiring and disseminating information;

- Cars and airplanes that use less fuel; and

- More-efficient means of growing and producing food.

Historically, TFP growth has been an important cause of economic growth. To see this, consider the First Industrial Revolution, which occurred in Britain during the 18th and early 19th centuries, and the Second Industrial Revolution, which was centered in the United States at the end of the 19th century. Faster TFP growth explains more than 70 percent of the acceleration in British per capita income during the First Industrial Revolution, according to Northwestern University Professor Joel Mokyr. An examination of the Second Industrial Revolution also shows that aggregate output growth accelerated once the new technologies had become widely adopted in U.S. manufacturing and had precipitated a marked acceleration in TFP growth.

Economists now debate whether the computer revolution measures up to the great industrial revolutions of the past. If so, we may see a sustained acceleration in TFP growth as in past industrial revolutions. That the U.S. economy has stretched the bounds of growth previously thought unattainable a generation ago suggests that the microchip revolution has engendered some economy-wide benefits. Nonetheless, some reputable economists believe that previous episodes of innovation were much more significant and that the strong productivity growth of recent years is but a temporary phenomenon. The jury is still out. But since maintaining this prosperity for future generations is the overarching goal of public policy, policy-makers would like to have some insight into those forces driving the recent acceleration in labor productivity. Maybe something can be learned from the past.

Productivity Puzzles, Past and Present

Citing technological advances stemming from the microchip, some observers of recent economic developments have concluded that the U.S. economy has entered a new era. Federal Reserve Chairman Alan Greenspan, for example, said, "When historians look back at the latter half of the 1990s a decade or two hence, I suspect that they will conclude we are now living through a pivotal period in American economic history."2 Nonetheless, the rapid growth of U.S. productivity since 1995 has easily produced more questions than answers:

- Why did the productivity surge come about?

- If information technology is the story, why did productivity not accelerate sooner, when fundamental technological breakthroughs began to occur?

- Can the increase in productivity be sustained, or does the surge reflect temporary factors that will soon ebb?

- Can public policy play a role in promoting or sustaining high rates of productivity growth?

Historically, productivity booms have followed technological breakthroughs that had widespread commercial applications. The industrial revolutions of the 18th and 19th centuries were associated with the introduction of new general purpose technologies, such as the steam engine and electric power, which had numerous applications throughout the economy. The computer also appears to be a general purpose technology and an important source of the recent increase in productivity and economic growth.

Still, the computer is not a new technology. The first electronic digital computer was built before World War II, and the first microchips appeared in 1970. The fact that U.S. productivity growth did not begin to accelerate until about 1995 long puzzled economists. This puzzle led economist Robert Solow, a Nobel laureate, to quip that the impact of computer and information technology was observed "everywhere but in the productivity statistics."

Slowly but surely, the productivity puzzle is apparently being solved. A recent summary of economic research published by the International Monetary Fund suggests that approximately 1 percentage point of the increase in U.S. labor productivity growth during the past five years is due to structural—that is, permanent—forces, mainly the diffusion of information and communications technology equipment.3 More important, the evidence suggests that a significant portion of the faster rates of labor productivity growth stems from an acceleration in TFP growth.

The Steam Engine, the Dynamo…

In many ways, the absence of immediate productivity improvement with the advent of information processing technology was not unlike earlier experiences with general purpose technologies. As the pattern of growth during past industrial revolutions shows, technological diffusion must reach a critical level before widespread gains in manufacturing productivity occur.

The British Industrial Revolution brought the introduction of the steam engine, mechanization of textile manufacturing, bleaching and other chemical processes, the first locomotive engines and numerous other important inventions with broad commercial applications. The American Industrial Revolution brought important advances in the generation, distribution and application of electric power, the introduction of the internal combustion engine and major advances in chemistry, medicine and engineering. But in neither case did aggregate productivity growth respond immediately to technological progress. For example, at the height of the British Industrial Revolution (1760-1830) output per capita in the United Kingdom grew at less than 0.5 percent per year on average, about the same rate as during 1700-60, according to recent estimates. By comparison, per capita output increased at an average rate of nearly 2 percent per year from 1830-70.4

According to Mokyr, technological breakthroughs often require further developments—or microinventions to use Mokyr's term—to make them broadly applicable. For example, while Thomas Newcomen built the first successful steam engine in 1712, it was not until about 1765 that major improvements in the engine by James Watt made it suitable for factory use. Still-later improvements, which included the addition of a governor and rotary movement, made the steam engine a huge economic success in the 1800s.

A technological innovation from the American Industrial Revolution was the electric dynamo, or generator.5 The dynamo, like the steam engine, was a general purpose technology. As with the steam engine, decades elapsed between the introduction of reliable electric motors and their widespread use in industry. Some of the delay was accounted for by lags in the development of efficient means of electric power generation and by competition between direct and alternating current. High prices for electrical equipment and the fragmented structure of the electricity industry also contributed to the delay.

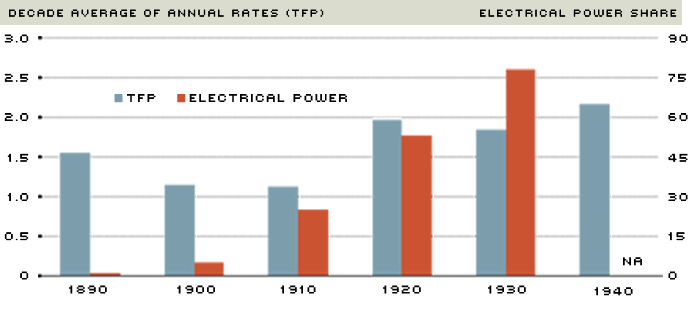

By the 1920s, electricity was the dominant source of power in U.S. manufacturing. Electrification enhanced productivity by affording greater flexibility and more efficient use of labor and capital in manufacturing. (See Figure 2.) For example, electrification enabled more use of continuous process techniques, such as the assembly line, which often reduced assembly time and waste. Efficiency was improved also by the wide adoption of "unit drive," i.e., the use of dedicated electric motors to power individual machines and tools, rather than a system of shafts and belts powered by a single engine. Unit drive brought savings through reduced energy usage, less wear and tear, and more flexible and efficient factory design. Electrification also enhanced productivity by improving factory lighting and safety.

'Old Economy Firms' Tackle Productivity

Boeing workers in Long Beach, Calif., build the C-17 military transport plane. Thanks, in part, to computer-assisted machine tools, the landing gear bulkhead of the plane can be assembled 15 times faster than before.

The hot former, such as this one headed for a Goodyear plant in Lawton, Okla., is expected to revolutionize tire manufacturing. The hot former is, in effect, a miniplant for making tires. Eventually, these laser-guided machines are expected to be installed next to auto assembly plants. Transportation and inventory carrying costs will practically be eliminated. Goodyear's Rick Vannan shows off his company's former.

…the Computer and the Laser

Some economists, such as Northwestern University Professor Robert Gordon, argue that the effects on society and the nation's standard of living from today's computer technologies pale in comparison to the impact of past innovations. While Gordon may be proved correct, evidence is accumulating that information and communications technologies are being used throughout the economy. Not only are New Economy startups using them to create products and services few conceived of a decade ago, but Old Economy industries are using these technologies to trim costs and boost profit margins. For example, Boeing now uses high-speed, computer-assisted machine tools to manufacture landing gear bulkheads for the C-17 military transport plane. Under the old technology, the bulkhead was made up of 72 parts and required 1,720 fasteners. Using the new technology, the bulkhead is comprised of just two parts and requires only 35 fasteners. The bulkhead can now be assembled 15 times faster than before.6 (See photo; top, right.)

The commercial application of lasers is also revolutionizing manufacturing, as well as distribution. The use of laser scanning machines in retailing to link the supply chain management process between the retail, wholesale and manufacturing levels, as pioneered by Wal-Mart, is the best-known example. Such developments may have permanently lowered the level of inventory buffer stocks in the U.S. economy. In the manufacturing process, one innovation that promises to revolutionize tire manufacturing is the hot former. Using a laser-guided machine, Goodyear's hot former will enable a dramatic reduction in the space needed to manufacture tires. Putting tire miniplants next to existing automotive manufacturing facilities will not only reduce the cost of manufacturing tires, but will cut transportation and inventory carrying costs.7 (See photo; bottom, right.)

In addition to improving manufacturing and inventory control processes, synergies between the Internet and high-tech equipment and software applications have spawned a burgeoning e-commerce industry. Today, goods and services ranging from airline tickets to CDs, from automobiles to clothes, can be purchased via online transactions. According to the U.S. Department of Commerce, the value of these e-sales increased 24 percent in 2000, from $20.8 billion in 1999 to $25.8 billion. (Traditional retail sales totaled $3.2 trillion in 2000.) Online transactions between firms are also increasing dramatically and comprise about 90 percent of all e-commerce. For example, using business-to-business (B2B) e-commerce applications, Toyota can order up to 11 different automobile frames from the Dana Corp., which can then ship them to Toyota within nine hours. According to the Census Bureau, combined e-commerce trade by manufacturers and wholesalers in 1999 totaled almost $625 billion, representing, respectively, 12 percent and 5 percent, of total shipments.8

These types of innovations, and future ones that might flow from them, hold considerable promise. Whether today's semiconductor-led innovations will result in a sustained increase in productivity comparable to the industrial application of electricity in the early 20th century remains to be seen. But in exploring the causes of past booms, we may shed light on what public policy can do to promote maximum long-term economic growth.

Old Lessons for New Economy Policy-Makers

During the industrial revolutions of the 18th and 19th centuries, the invention and application of new technologies were carried out by private individuals and firms without government subsidies or direction. Technologies that failed the market test were not saved by government bailouts or contracts. Nonetheless, the histories of the British Industrial Revolution and the American Industrial Revolution suggest that governments can have a powerful effect on a nation's economic growth.

Institutions Matter

Douglass North, a Nobel laureate economist at Washington University in St. Louis, and his co-author, Barry Weingast, argue that a nation's institutions, including its government, are crucial determinants of economic growth. Among the most important institutions is the rule of law, along with a commitment to enforce existing property rights. Secure property rights provide the freedom and incentive to take economic risks, to invest in new technologies and to look for ways to use economic resources more efficiently. They also reduce the cost of market transactions and limit uncertainties associated with arbitrary confiscation of property or incomplete enforcement of contracts.

By 1700, the United Kingdom had a representative parliament, an independent judiciary and a system of patents to protect the rights of inventors. Other countries were far behind. For example, no other European country enacted a patent law until 1791. The U.S. inherited English legal traditions and respect for property rights and, thereby, had similar mechanisms for promoting the invention and application of new technologies that are crucial for productivity growth and rising living standards.

Education May Matter

Educational achievement, particularly in math and science, often is cited as crucial for economic development. Although the United Kingdom did not have a superior educational system on the eve of its industrial revolution, economists who have looked at this issue across countries in modern times have found a positive statistical relationship between educational attainment and per capita income growth.9

The United States has a long history of supporting both public and private education. In the 19th century, federal assistance to education was largely in the form of land grants used to finance the establishment of public schools and colleges. The Morrill Act of 1862, for example, provided land grants for the establishment of colleges teaching "agricultural and mechanical arts," including engineering and other technical subjects. Gordon argues that basic and technical education enhanced the productivity of American labor and contributed to the accelerated pace of productivity growth that began in the 1920s.

Many economists also believe that government support of research and development activities can promote technological progress. For example, in a report titled "The Role of Government in a Digital Age," Stanford University Professor Joseph Stiglitz argues that the "proper role of government in today's economy is to serve as a warehouse of information and public data, and to support basic research and development."

Industrial Policy May Not Matter

The governments of all developed countries provide at least some direct support of domestic industry. Numerous countries have adopted formal industrial policies that provide direct subsidies or other means of promoting specific technologies or industries. Even the United States has a small program, the Advanced Technology Program, that subsidizes high-tech research by private companies. The histories of the British and American governments during the First and Second industrial revolutions show, however, that direct government sponsorship of new technologies is not required for technological progress and economic growth to occur. Modern examples of industrial policies in Europe, Asia and especially in post-war communist countries also offer scant evidence that government direction can produce higher sustainable growth of living standards than can free enterprise.

What sets the United States apart? Paul Romer, a leading growth economist at Stanford University, notes that "the United States has maintained a regulatory and financial system that makes it easy to create new companies, raise capital and start new businesses. We also tolerate failure." By contrast, the European approach "has focused on what they call ‘national champions,' which they identify as a few big firms whose monopoly positions they try to protect. That really goes in all the wrong directions. What the Europeans really should be doing is thinking about the process that brings new entrants into the market."10

Is the Past a Prologue?

A look back at episodes of rapid growth in productivity and in living standards finds that growth stems from the invention, development and application of new technologies that enable the more efficient production of goods and services. Clusters of major technological breakthroughs and countless smaller inventions and innovations characterized the British and American industrial revolutions. These episodes produced rapid, though not immediate, acceleration of productivity and economic growth. Whether the productivity surge of the past five years will continue remains to be seen. But if the so-called computer revolution has permanently altered the growth path of the U.S. economy, it also appears to have opened up old debates about how government policies can encourage economic growth and rising living standards over time.

Changes in U.S. Living Standards Over Time

NOTE: 10-Year annualized growth rate of per capita real GDP.

The growth of U.S. living standards during the past five years has been unusually brisk—a percentage point faster than the long-run average.

Electrification Boosts Productivity

This chart shows the relationship between the share of electrical power used in U.S. industry and average annual TFP (Total Factor Productivity) growth. By the 1920s, electricity provided more than 50 percent of the mechanical power in American industry. The switch to electricity from water and steam power helped bring about a sharp increase in TFP growth, which was interrupted only briefly by the Great Depression of the 1930s.

SOURCE: David (1991)

Endnotes

- See http://www.house.gov/jec_democrats/documents/106th/ hearings/gerstner61499.htm. [back to text]

- Greenspan (2000). [back to text]

- See IMF (2000), Table 2.1. [back to text]

- N. F. R. Crafts. British Economic Growth During the Industrial Revolution. New York: Oxford University Press, 1985. [back to text]

- See David (1991). [back to text]

- See Duesterberg (2000). [back to text]

- See Aeppel (2001). [back to text]

- See Mesenbourg (2001). [back to text]

- See Barro and Sala-i-Martin (1995). [back to text]

- See Romer (1997). [back to text]

References

Aeppel, Timothy. "Mounting Pressure: Under Glare of Recall, Tire Makers are Giving New Technology a Spin," The Wall Street Journal, March 23, 2001.

Barro, Robert J. and Xavier Sala-i-Martin. Economic Growth. New York: McGraw-Hill, 1995.

David, Paul A. "Computer and the Dynamo: The Modern Productivity Paradox in a Not-too-Distant Mirror," in Technology and Productivity: The Challenge for Economic Policy. Paris: Organization for Economic Cooperation and Development, 1991.

Duesterberg, Thomas J. "Manufacturing in the Era of the New Economy: Evidence for Sustainable Productivity Gains," Speaking Out on Critical Issues, Manufacturers Alliance, December 21, 2000.

Greenspan, Alan. "The Revolution in Information Technology," speech delivered to the Boston College Conference on The New Economy, March 6, 2000.

Gordon, Robert J. "Does the ‘New Economy' Measure up to the Great Inventions of the Past?" Journal of Economic Perspectives, Fall 2000, pp. 49-74.

International Monetary Fund. "Current Issues in the World Economy: Productivity and IT Growth in the Advanced Economies," World Economic Outlook, October 2000, Chapter 2.

Mesenbourg, Thomas L. "Measuring the Digital Economy," United States Bureau of the Census (2001), http://www.census.gov/econ/estats/papers/umdigital.pdf.

Mokyr, Joel. "Editor's Introduction: The New Economic History and the Industrial Revolution," in Joel Mokyr, ed. The British Industrial Revolution: An Economic Perspective. Second edition. Boulder: Westview Press, 1999, pp. 1-127.

_________. "The Second Industrial Revolution, 1870-1914." Northwestern University Department of Economics working paper, August 1998.

North, Douglass C. and Barry R. Weingast. "Constitutions and Commitment: The Evolution of Institutions Governing Public Choice in Seventeenth-Century England," Journal of Economic History, December 1989, pp. 804-32.

Romer, Paul M. Interview in Strategy and Business, Booz-Allen and Hamilton (First Quarter 1997).

Stiglitz, Joseph E., Peter R. Orszag and Jonathan M. Orszag. "The Role of Government in a Digital Age." Report commissioned by the Computer & Communications Industry Association (October 2000).

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us