Big Fish, Small Ponds: Large Banks In Rural Communities

In the wake of recent changes in bank regulations, large banks have been buying other large banks and smaller regional banks. Federal legislation—the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994—has permitted bank holding companies to buy banks and other holding companies located throughout the nation since the fall of 1995 and has permitted nationwide branching since June 1997. Prior to this legislation, state regulations set limits on bank branching and interstate banking.

Banking consolidation raises questions about the nature of banking services in rural areas. One reason for this concern is that the top managers of the large banks live and work in large urban areas, rather than the rural areas they now serve. Are they interested in providing banking services in rural communities? Can they compete successfully with the community banks located in rural communities? Are large banks becoming the dominant banking organizations in the rural areas where they have established offices? Are the rural offices of large banking organizations located primarily in areas with relatively high population densities, where they can serve relatively large numbers of customers from each office? Or do they also have offices in counties with low population densities?

Where Are the Large Banks?

In banking studies, various criteria are used for identifying large banking organizations. Several of the recent studies that examine the effects of banking consolidation on lending to small businesses identify large banking organizations as those with total assets in excess of $10 billion.1 This article, which uses deposit data, identifies large organizations as those with total deposits in excess of $10 billion.

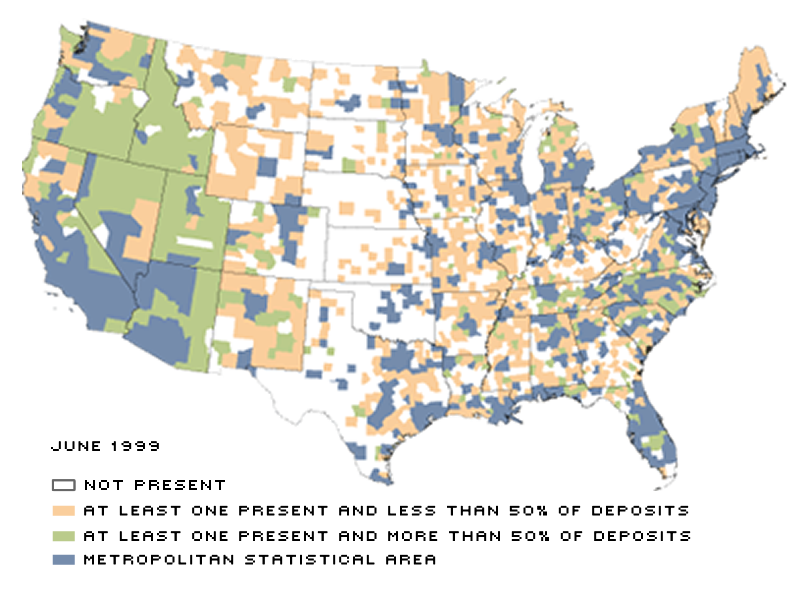

As the accompanying map shows, most residents of rural areas (counties located outside of metropolitan areas) live in counties where large banking organizations have offices. The rural counties where large organizations do not have offices are clustered in the middle of the nation: in Texas, Oklahoma, Kansas, Nebraska, South Dakota and North Dakota. Nevertheless, in each of these states, except Oklahoma, at least 40 percent of the residents of rural areas live in the counties where large organizations have offices.2

Large Banks Locate, But Don't Dominate, In Rural Areas

NOTES: Large banking organizations are those with total deposits of $10 billion or more. Except in the middle of the country, rural counties tend to be served by large banking organizations. In the Western states, large banks tend to dominate rural counties, which is not the case in the rest of the country.

SOURCE: Summary of Deposits data

Do the Large Banks Dominate?

It is not just the presence of large banks that determines their impact on rural communities, but also their shares of deposits at the banking offices in these communities. Are large banking organizations the dominant banks in the rural areas where they have offices? Or do the smaller community banking organizations attract substantial shares of deposits in the rural communities where large organizations have their offices? The map provides some perspective on these questions. The rural counties where large organizations account for half or more of local deposits are concentrated in the Western states. Typically, these states have permitted statewide branching for many years, and large banking organizations established large networks of branches in these states long before the recent legislation that permitted nationwide interstate banking. Therefore, to see the effects of this legislation, it's necessary to look at other regions of the nation.

In most of the rural counties outside of the Western states, large banking organizations account for less than half of the deposits in local banking offices.3 So far, then, the Riegle-Neal Act has not led to the domination of banking in rural counties by large organizations. The fact that large organizations have relatively large shares of deposits in the rural counties of the West, however, may portend larger shares at the offices of the large organizations in other regions in the future.

Effects of Population Density

The incentives for large banking organizations to operate offices in rural areas may depend upon the nature of economic activity in the rural areas. Some of the rural counties that are relatively remote from urban areas have few residents per square mile, whereas other rural areas have population densities close to that in some urban areas. If the minimum level of banking business necessary to be profitable is higher for branches of large banking organizations than for smaller banks, large organizations would tend to locate their offices in the rural areas with relatively high population densities. In that case, low population density would shield the local community banks from entry by large banking organizations.

To examine the association between the population density of rural counties and the presence of large banks, it is helpful to divide the states into two groups: those that permitted statewide branching in 1980 and those that prohibited statewide branching at that time. This division is necessary because, in states where banks have only recently been given freedom to establish branches where they wish, large organizations are likely to focus first on the rural counties with relatively high population densities. Therefore, looking at states that have permitted statewide branching for many years may provide more reliable information.

In the states that prohibited statewide branching in 1980, large organizations have offices in 95 percent of the rural counties with population densities in excess of 100 persons per square mile, but in only 26 percent of the counties with population densities below 25. A different pattern exists in the states that permitted statewide branching in 1980; large organizations have offices in all of the rural counties of these states that have more than 100 residents per square mile and in about two-thirds of the counties that have population densities less than 25. These observations indicate that low population density is not a barrier to entry by large banking organizations.

Will Small Banks Survive?

When large banking organizations are given freedom to establish offices wherever they wish, they have the interest and ability to provide banking services in rural communities, including those with relatively low population densities. In most of the rural counties where large organizations have offices, the large organizations as a group hold less than half of the deposits in the local banking offices. Large banks are more dominant in the rural counties of the states that have permitted statewide branching for many years. This contrast indicates that large banks will have a greater presence in rural areas in the future.

Endnotes

- Berger, Demstez and Strahan (1999). [back to text]

- Oklahoma's percentage was 12 as of June 1999. [back to text]

- See Gilbert (2000) for more details. [back to text]

References

Berger, Allen N., Rebecca S. Demsetz, and P.E. Strahan. "The Consolidation of the Financial Services Industry: Causes, Consequences, and Implications for the Future," Journal of Banking and Finance (February 1999), pp. 135-94.

Gilbert, R. Alton. "Nationwide Branch Banking and the Presence of Large Banks in Rural Areas," Review, Federal Reserve Bank of St. Louis (May/June 2000), pp. 13-28.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us