Cartels: Breaking Up Ain't Hard to Do

When the Organization of Petroleum Exporting Countries (OPEC) met in March of this year, the 11 member countries and four nonmember countries agreed to curtail oil production by 2.1 billion barrels a day to try to stem falling oil prices.1 This reduction occurred on the heels of a 3 million barrel daily production cut that took effect July 1998. By the end of March, the market price of a barrel of West Texas Intermediate had risen to $14.66 from $12.01 a month earlier. In April, it rose further—to $17.34 a barrel—and then hit $17.70 in May.

More significantly, the March one-month futures price—the price contracted to today that will be paid for the product in one month—jumped to $16.76 a barrel from $12.27 in February. By April, the one-month futures price hit $18.66. Clearly, expectations were for sharply rising oil prices in the near future. At the same time, the March and April six-month futures prices also rose, but not as much. For instance, the April six-month futures price (for oil delivery in October) was $17.37 a barrel. By May, however, the six-month futures price (for oil delivery in November) had fallen to $16.59 a barrel. Thus, by May, traders had already anticipated that the rising prices would not only come back down a bit by October, but would fall even further by November. Why had traders expected this slowdown and eventual turnaround in rising oil prices when OPEC had clearly stated that it was cutting back production?

Their Cheatin' Hearts

One likely explanation for the traders' expectations is that they believed one or more OPEC members would cheat on the agreement. In this case, cheating would mean that a country produced more barrels of oil each day than its assigned amount to grab a larger share of the profit. This classic economics problem occurs whenever a group of individuals, firms or, even nations, decides to act together (collude) to achieve a certain market outcome. For example, think for a moment about the U.S. airline industry, which has about eight major carriers dominating the skies. Several years ago, in an attempt to tame wildly fluctuating airfares and simplify pricing schemes, one carrier decided to eliminate most of its airfare categories, particularly discount tickets.2 In a type of collusive agreement, most of the other major carriers also eliminated their myriad airfares, leaving passengers with fewer price options.3 The period was short-lived, however, when some of the financially weaker carriers, seeking to raise cash quickly, broke rank and cheated. These carriers slashed prices and reintroduced different airfare categories, thereby increasing their profits. Almost immediately, the other airlines followed suit, which launched a new price war.

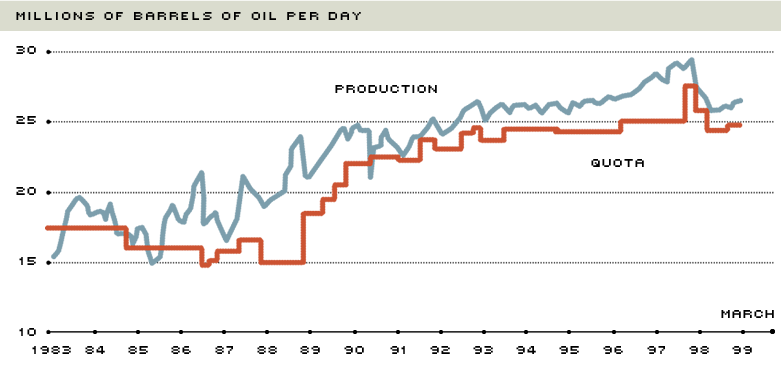

OPEC members have behaved similarly, as the accompanying chart shows. Since March 1983, when quotas were first assigned to members, OPEC's actual production levels have almost always been greater than its target levels, meaning that countries have been selling more oil than they're supposed to (in other words, they've been cheating). Just as with the airlines' informal arrangement, it seems that OPEC also has trouble enforcing its agreements. Why is cheating so rampant in the organization? And since it's so widespread, why do the countries (firms) bother to collude at all?

OPEC Production and Quotas Blowing the Tops off of Oil Caps

SOURCE: Energy Information Administration, Department of Energy

E Pluribus Unum

Firms (countries) collude to maximize industry profits. When the collusion is explicit—that is, arranged through formal agreements—it is called a cartel. Cartels are, essentially, multifirm monopolies. "Multifirm monopolies"— isn't that a contradiction? Most readers know that a monopoly is a firm that is the only supplier of a product that has no close substitutes. Cartels, on the other hand, are made up of at least two, and often several, firms; thus, they cannot be monopolies. Cartels can, however, act as monopolies.

Economists and market observers realize that monopolies have market power because they are the sole providers of particular goods or services. Monopolies have market power because they can directly affect the market price of their products by altering their production levels. In the classic example, a profit-maximizing monopoly produces less output at a higher price than firms producing the same product in a competitive market. For instance, when John D. Rockefeller built his oil empire in the late 19th century by driving competitors out of business and taking control of supply and distribution lines, he was able to extract high prices by restricting supply. And since his was basically the only game in town, buyers had no choice but to pay Rockefeller's price. Such market power easily translates into a large profit. In fact, a monopoly's profit is the largest amount that can be gained. No other type of market structure can do better. "It's good to be King," so to speak.

Owners of firms that produce essentially the same product—for example, countries pumping crude oil—also realize that they could collectively earn more profit if their industry were a monopoly. Since there is more than one firm, however, a true monopoly cannot exist. But the owners also realize that they need only act as if they were one firm, so that their group effectively becomes the industry—the only place to buy this particular good or service. Thus, they can agree to form a cartel, which will act as a monopoly, restrict output, and, hence, extract a monopoly profit to be divided among the cartel's members.

How the profit is divided among cartel members is one of the group's primary decisions. To be equitable, a cartel will normally base the profit split on each firm's share of the group's total output. To realize this total profit, the cartel has to produce the same level of output a profit-maximizing monopolist would.

As an illustration, suppose that the only three firms making staplers decide to form a cartel, which then determines that the group's profit-maximizing level of output is 120 staplers. By selling 120 staplers, the cartel will earn a $600 profit. If the three firms produce staplers at the same cost, each will produce 40 and presumably receive one-third of the profit ($200). But if their production costs differ, the profit won't be evenly split. In fact, assume Firm 1 has low production costs, Firm 2 has medium costs, and Firm 3 has high costs. In this scenario, then, Firm 1 will produce most of the staplers, say 60, because of its low production costs; Firm 2 will produce somewhat fewer staplers, say 40; and Firm 3, with its high production costs, will produce the fewest staplers, only 20. Consequently, Firm 1 will receive half of the cartel's profit ($300) because it is producing half of the output; Firm 2 will receive one-third of the profit ($200); and Firm 3 will receive one-sixth of the profit ($100).

Meanwhile, each firm also recognizes that it can grab a slightly larger chunk of the profit by selling more staplers than its allotment, even though by doing so, it will reduce the cartel's profit overall. (Since the cartel has already chosen the group's profit-maximizing level of output, any deviation from this level—up or down—must reduce total profit.) Still, if a firm in the cartel believes that the other firms will stick to their assigned output quotas, it can make a quick buck by cheating. The renegade firm, however, will lose profits down the road because its cheating will reduce the product's market price. The firm isn't too bothered, though, because future profits aren't worth as much as those earned today. So it cheats, causing the cartel (or collusive agreement) to crumble, as happened in the airline example.

Using History as a Guide

Why, then, do traders believe that oil prices will stabilize and, perhaps, even come back down after the initial upward shock? Because economic theory, experience with other cartels and collusive agreements, and OPEC's own history all point to member nations cheating on their quotas. Members might not be as inclined to cheat, however, if they truly believe that the low price for a barrel of oil on the world market is worse for them than sticking to the quota. The market seems to be betting, however, that economic realities will—in the end—force history to repeat itself.

Endnotes

- Current OPEC members are (in order of output): Saudi Arabia, Iran, Venezuela, Iraq, United Arab Emirates, Nigeria, Kuwait, Indonesia, Libya, Algeria and Qatar. Iraq's production, however, has been under U.N. control since the end of the Gulf War and, hence, is not subject to the OPEC agreement. Non-OPEC members that also agreed to cut production are Russia, Mexico, Norway and Oman. [back to text]

- See Ziemba (1992). [back to text]

- The antitrust laws of the United States and many other countries prohibit firms from engaging in collusive behavior. [back to text]

References

Griffin, James M., and Weiwen Xiong. "The Incentive to Cheat: An Empirical Analysis of OPEC," Journal of Law and Economics (October 1997), pp. 289-316.

Ibrahim, Youssef M. "Cheap Oil Focuses Mind," The New York Times (March, 28, 1999).

__________. "Oil Countries Approve World Cutback of 3%," The New York Times (March 24, 1999).

__________. "Rarely for OPEC, Oil and Politics Did Mix," The New York Times (March 25, 1999).

Zagorin, Adam. "OPEC Talks Tough Again," Time (March 22, 1999).

Ziemba, Stanley. "Wave of Discounts Rattles Effort to Simplify Air Fares," Chicago Tribune (April 21, 1992).

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us