An Oasis of Prosperity: Solely An American Phenomenon?

U.S. economic performance has been remarkable the past few years. Real GDP growth—the broadest measure of economic performance—has exceeded 3 percent for 11 of the past 14 quarters. Inflation, which did so much to damage long-term growth prospects in the 1970s and early 1980s, has apparently been brought to heel. This heartening performance stands in marked contrast to that of other regions, particularly Europe, Japan, parts of East Asia and Latin America. In light of these differences, it is not surprising to hear Fed Chairman Alan Greenspan call the U.S. economy an "oasis of prosperity."

Some analysts believe that the United States stands out because recent technological advancements—particularly those associated with the computer industry—have allowed for real GDP growth beyond which most economists thought possible. This is the "New Paradigm" story. But if new technologies have transformed the U.S. economy, why have they not performed similar miracles in other major industrialized economies?

Leader of the Pack

The current U.S. economic expansion, in which real GDP growth has averaged more than 3 percent a year, is now 81/2 years old, making it the longest peacetime expansion in recorded U.S. history. Although this compares favorably to the 3.8 percent growth registered during the 1982-90 expansion—which, at 92 months, was the second-longest peacetime expansion—it falls well short of the 4.9 percent growth seen during the 1961-69 expansion, which lasted a record 106 months during the Vietnam War.

There are two key points to be made about recent economic performance in the United States. First, output growth during the last three years has been particularly strong, while inflation has fallen to a rate that some consider near zero when properly measured. U.S. real GDP grew at almost a 4 percent annual rate from 1995 to 1998, while the inflation rate averaged about 1.5 percent. Buoyed by strong output growth, the civilian unemployment rate fell to a nearly 30-year low of 4.4 percent during the fourth quarter of 1998. During this same three-year period, labor productivity growth accelerated markedly. This performance not only compares favorably to that in 1960-73 when the United States—and indeed much of the developed world—enjoyed strong productivity growth, but stands apart from the 1973-95 period, when relatively weak productivity growth prevailed.

The second important point is that U.S. economic performance since 1995 has been substantially better than that of most other industrialized countries. U.S. real GDP growth during the past three years was more than a percentage point faster than Europe's and more than triple Japan's. The average European unemployment rate, moreover, remained quite high, falling from 10.6 percent in 1995 to 9.7 percent in 1998. In Japan, weaker-than-average growth caused the unemployment rate to rise from 3.2 percent in 1995 to 4.1 percent by 1998. In terms of inflation, the U.S. and European experiences are comparable, while in Japan, prices have actually fallen slightly since 1995.

Although U.S. economic performance during the last three years is only moderately worse than the high-productivity growth period of 1960-73, this does not appear to be the case in Europe and Japan. These regions experienced much better inflation performance during the past three years than in the earlier periods, although recent real GDP growth in Europe was only slightly better than 1973-95 and remains much weaker than 1960-73. In Japan, though, the three years ending in 1998 were the weakest on record. The turnaround in Japanese fortunes is, put simply, stunning. While still a relatively short period from which to draw firm conclusions, the disparity of this performance has many economists and public policy-makers wondering whether there has been a structural improvement in the U.S. economy.

A New and Improved U.S. Economy?

In the United States, evidence from the last three years seems consistent with an economywide increase in firms' efficiency in delivering goods and services. Many believe these efficiency gains stem from technological innovations related to the computer chip, the microprocessor, the satellite, or the laser. From a production standpoint, these increased efficiencies have improved productivity and profit margins through, for example, better inventory management processes and better and cheaper materials (plastics, synthetics and alloys). These innovations may have also boosted worker productivity through improvements in medicine, telecommunications and the Internet.

But such innovations are widely used in other advanced countries—and even not-so-advanced countries. For example, computer-assisted design software employed by DaimlerChrysler or Boeing in the United States is being used by Airbus in Europe, Toyota in Japan and Hyundai in Korea. Why, then, is the New Paradigm not discussed in these countries?

One explanation is that the U.S. economy has performed much better than those in Europe and Japan, rivaling the high-productivity period from the early 1960s to early 1970s. Another explanation is that the New Paradigm does not exist. Adherents of this view believe that the recent experience of strong growth, low inflation and increased productivity in the United States is merely the residual of a strong cyclical expansion buttressed by favorable developments like low oil prices, falling computer prices and the advent of HMOs, which have dramatically lowered health care costs. Many leading economists remain unconvinced that the United States is undergoing a productivity revolution.1 Still, given the proliferation of these new technologies and their applications, the view that long-term U.S. growth prospects have improved seems to be gaining a grudging acceptance in many quarters.2

When discussing changes in the growth of living standards, economists tend to focus on the amount of output each worker produces (GDP per capita, or per worker).3 From 1948 to 1998, output per worker increased at an annual rate of 1.6 percent. At this rate, U.S. living standards would double about every 45 years. Since 1995, however, real GDP per worker has increased at a 2.4 percent annual rate.4 If this remarkable pace could be maintained indefinitely, U.S. living standards would double essentially every generation (30 years). Clearly, small changes in growth rates matter a great deal.

Accounting for Growth

According to economists, two basic things cause an economy to grow over time: First, more output comes from increased amounts of inputs (labor and capital); and second—and more important—improvements are made in the way in which inputs are transformed into outputs.5 The latter involves such improvements as a better-educated work force and a better production process. Since labor is the dominant factor in the production of goods and services, economists say that increases in living standards depend significantly on labor intensity and labor productivity.

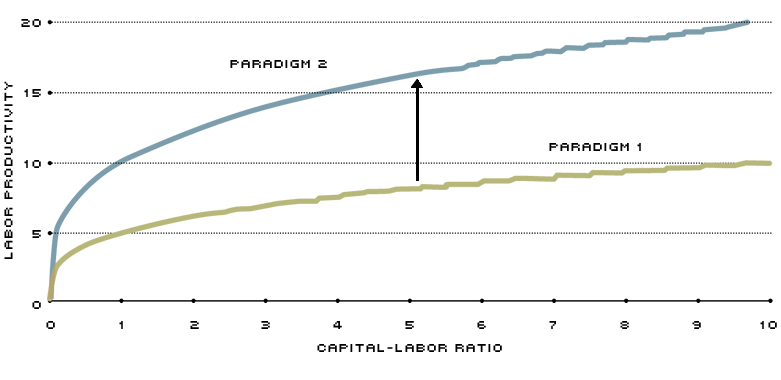

Labor intensity is mostly a function of how many people are entering the labor force and the number of hours they are working. Labor productivity is influenced by numerous factors, including the amount of capital goods—such as heavy equipment, machinery, computers or medical devices—each worker has at his disposal, the technology embedded within that capital, and the knowledge each worker possesses (which is also known as human capital). In essence, as "An Economic Illustration of the New Paradigm" illustrates, increases in the growth of labor productivity depend importantly on the growth of multi-factor productivity (MFP), which is also referred to as the economy's rate of technological change.

Increases in multifactor productivity depend on many factors. Among them are improvements or innovations that are embodied in labor and capital inputs. These include: medical advancements that improve health care, more powerful computers and improved software, more fuel efficient cars and airplanes, and a more efficient means of growing and producing food. Another way MFP increases is through disembodied changes, which affect the quality of labor and capital inputs in a more general manner. Disembodied changes might include increased efficiencies associated with the Internet, such as commerce, satellite technology, or improvements in the economy's infrastructure that facilitate or improve the distribution of goods and services.

Leaving Them in the Dust?

Factors that boost an economy's long-run growth prospects are generally available to firms and citizens of almost every country if they are willing to pay for it. Indeed, many Japanese and European manufacturers have been at the forefront in developing and using these new technologies.6 As the accompanying table shows, growth rates of per capita real GDP, labor productivity, multifactor productivity, the capital-labor ratio and business-sector employment for the United States, France, Germany, Japan and the United Kingdom go a long way toward explaining why the New Paradigm is mostly an American phenomenon.

The Components of Economic Growth

Percent changes at compound annual rates

| Per Capita Real GDP | Labor Productivity | Multifactor Productivity | Capital-Labor Ratio | Labor Input (Employment) | ||

|---|---|---|---|---|---|---|

| United States | 1960-73 1973-95 1995-97 |

2.7 1.3 3.0 |

2.6 0.7 1.7 |

1.9 0.4 1.4 |

2.2 0.9 0.7 |

1.7 1.9 2.4 |

| France | 1960-73 1973-95 1995-97 |

4.4 1.5 1.4 |

5.3 2.4 2.0 |

3.7 1.4 1.4 |

4.6 3.1 2.0 |

0.5 –0.1 0.0 |

| Germany | 1960-73 1973-95 1995-97 |

3.7 1.9 1.5 |

4.5 1.6 3.3 |

2.6 0.9 2.3 |

6.0 2.4 3.3 |

–0.1 1.0 –1.2 |

| Japan | 1960-73 1973-95 1995-97 |

8.4 2.5 2.1 |

8.4 2.3 2.5 |

5.6 1.1 1.7 |

11.0 5.0 3.2 |

1.3 0.9 0.8 |

| United Kingdom | 1960-73 1973-95 1995-97 |

2.6 1.6 2.5 |

4.0 1.9 1.2 |

3.3 1.5 1.0 |

2.3 1.5 0.7 |

–0.5 0.4 1.9 |

NOTE: Per capita real GDP data are measured at 1990 price levels and exchange rates and in U.S. dollars. Labor and productivity data begin in 1965 for France and 1962 for Japan. Labor and multifactor productivity data begin in 1962 for the United Kingdom, while labor employment data begin in 1961. U.K. labor and multifactor data go through 1996 only.

SOURCE: Organization for Economic Cooperation and Development (OECD)

As the first column of the table shows, growth of per capita real GDP in the United States during 1995-97 was generally much faster than in the other countries listed. U.S. per capita growth during this period even exceeded the relatively high productivity years of 1960-73. Similarly, per capita growth rates for France, Germany and Japan, while much higher than the U.S. rates between 1960-73, also slowed markedly from 1973 to 1995. Unlike the United States, however, these countries' per capita growth rates continued to slow between 1995 and 1997. The U.K. experience parallels the U.S. one.

Not surprisingly, weaker growth rates of per capita output since 1973 reflect a marked slowing in the growth of labor productivity. In the United States, for example, productivity growth slowed from 2.6 percent a year between 1960 and 1973 to 0.7 percent a year from 1973 to 1995. Since 1995, however, it has rebounded. Japan and Germany also saw an acceleration in labor productivity growth since 1995, while France and the United Kingdom saw their rates slip further. Although 1998 brought another stellar increase in the United States—2.2 percent in the nonfarm business sector according to the Bureau of Economic Analysis—U.S. labor productivity growth still remains below that of France, Germany and Japan.

Recall that a shift in the economy's aggregate production function will occur when there is an acceleration in the growth of MFP that boosts labor productivity growth. Consistent with the New Paradigm hypothesis, a significant portion of faster U.S. labor productivity growth since 1995 reflects the rapid growth of MFP—nearly a percentage point faster than the 1973-95 period. Except for the United Kingdom, however, U.S. MFP growth rates remain below the other remaining countries. Thus, while growth of U.S. technological progress the last few years is finally within shouting distance of many other industrialized countries, U.S. MFP growth rates do not stand out.

Institutional Factors

The acceleration in U.S. multifactor productivity growth since 1995 suggests that the sharp upswing in U.S. investment rates in computers and other information processing equipment is finally paying dividends economywide. Adding to this optimism is the fact that output growth in the hard-to-measure services sector, which makes up roughly two-thirds of total output, is undoubtedly understated.7 Of course, three years of data is hardly long enough to know whether this is a temporary spurt resulting from the strong cyclical expansion or a true increase in the trend growth rate.

Another reason to counsel against rampant optimism is that the U.S. capital-labor ratio has grown more slowly since 1960. All other things equal, increases in a country's capital stock boosts workers' productivity. Although each of the five countries saw significant slowing in the growth of its capital labor ratio between 1973 and 1995, firms in France, Germany and Japan still managed to add to their capital stocks at rates that far outstripped their counterparts in the United Kingdom and the United States. This may be changing. Since 1991, U.S. and U.K. real gross capital spending on equipment and structures as a share of real GDP, have risen briskly, while those of France, Germany and Japan have tapered off.8

But, as the final column of the table indicates, capital-labor ratios in France, Germany and Japan have grown faster than those in the United States and the United Kingdom because these three countries have had very little, if any, employment growth for 25 to 30 years. Accordingly, in contrast with most other industrialized countries, much of the output growth in the United States since 1960 has come about through increases in labor intensity.

With U.S. labor productivity growth still lagging behind most of its major competitors, analysts must look at other explanations for why the New Paradigm is largely an American phenomenon. One explanation appears to be attributed to better labor market performance. Structural unemployment rates in Europe—that is, unemployment due to labor market rigidities, rather than temporary, cyclical factors—were about 10 percent, or double that of the United States, in 1997. Unlike firms in the United States, European firms cannot readily add or subtract workers from the labor force in response to cyclical disturbances or mergers. Instead, firms in these countries generally substitute capital for labor. Thus, it is no surprise that labor participation rates in the United States have grown steadily since the early 1960s, while those in France and Germany have changed hardly at all since about 1970. This labor market rigidity also helps explain why their labor productivity rates have been much higher than the United States.

Another reason the New Paradigm tends to be solely an American discussion is that the U.S. economic climate is thought to be more conducive to innovations in, for example, the information-processing and biotechnology fields. These include the ability of firms to merge and consolidate, which, in many respects reflects much less government intervention in labor markets. Also helping to spur innovations and enhance an economy's overall efficiency is a regulatory system that effectively balances the costs and benefits of government intervention in the private sector, such as those related to environmental quality.

In the United States, for instance, some believe that the upswing in mergers since the mid- to late-1980s, the proliferation of Wal-Marts and other large retail outlets, the development of Silicon Valley, and the recent upsurge in biotechnology research applications have all increased the economy's rate of technological progress through the process of "creative destruction."9 Although difficult to quantify empirically, the cumulative gains from these institutional advantages are increasingly difficult to dismiss. Indeed, policy-makers in Japan and Europe appear to be moving in this direction. In Japan, for example, Prime Minister Obuchi recently proposed that his government undertake a study to address its long-term competitiveness; in Europe, meanwhile, ongoing labor market reforms have yielded a spate of mergers in banking, telecommunications and retailing.

Because of higher multifactor productivity growth rates and greater investment in capital goods, most of the United States' major economic competitors have faster labor productivity growth rates. If anything, then, the New Paradigm should be talked about in these countries. At the same time, however, poorly performing European labor markets and other impediments to business formulation and entrepreneurship impose costs not experienced in the United States. According to the International Monetary Fund, reducing the average European unemployment rate from its 11 percent rate in 1998 to around 5 percent, would, under reasonable assumptions, boost real GDP by 4 percent.10 In dollar terms, that would amount to an extra $302 billion in output—or about $2,200 per worker in 1998.

In a nutshell, then, the New Paradigm talk in the United States owes much to the strength and durability of the current economic expansion. And while the nation's labor productivity growth has accelerated recently because of increased rates of technological change, the fact remains that U.S. productivity growth has generally lagged behind most other large industrialized economies. Regardless, it appears that the New Economy is largely an American discussion because of various impediments that have hampered employment growth in Europe and Japan for the past 25 years or so. Thus, while hard to quantify in some respects, the business climate in the United States appears much more conducive to the productivity-enhancing forces of entrepreneurship and innovation—the hallmarks of the New Paradigm talk.

Endnotes

- See Jorgenson (1999) or Blinder and Quandt (1997). [back to text]

- See Poole (1999), Dean (1999) or Sichel (1999). [back to text]

- In 1998, each U.S. worker produced about $54,900 worth of output, which is a 2.8 percent rise from a year earlier. [back to text]

- As calculated here, GDP per worker is real GDP in dollar terms divided by the number of people in the civilian labor force. [back to text]

- The discussion in this section follows Auerbach and Kotlikoff (1998). [back to text]

- See Womack, Jones and Roos (1991). [back to text]

- See Boskin and Jorgenson (1997). [back to text]

- The U.S. gross investment rate rose from about 15.5 percent in 1991 to about 19.5 percent in 1998 and is now roughly equal to France's and Germany's, which have each declined about 3 percentage points over the same period. Japan's fixed investment rate in 1998 (28.5 percent)—although the lowest in about a dozen years—still exceeded the U.S. rate by about a third. [back to text]

- See Becker (1998). [back to text]

- See IMF (1999). [back to text]

- In technical terms, an economy's total output is assumed to be a function of labor, capital and the rate of technological progress. The Cobb-Douglas production function can be algebraically manipulated to yield the following expression: y = Akβ, where y is GDP per worker (labor productivity), k is the capital-labor ratio, and A is the level of multifactor productivity (the technology factor). [back to text]

References

Auerbach, Alan J., and Laurence J. Kotlikoff. Macroeconomics: An Integrated Approach (Cambridge, Mass.: The MIT Press, 1998).

Becker, Gary S. "Make the World Safe for Creative Destruction," Economic Viewpoint, Business Week (February 23, 1998), p. 20.

Blinder, Alan S. and Richard E. Quandt. "Waiting for Godot: Information Technology and the Productivity Miracle," Center for Economic Policy Studies, Princeton University, Working Paper No. 42 (May 1997).

Boskin, Michael J. and Dale W. Jorgenson. "Implications of Overstating Inflation for Indexing Government Programs and Understanding Economic Progress," American Economic Review (May 1997), pp. 89-93.

Dean, Edwin. "The Accuracy of the BLS Productivity Measures," Monthly Labor Review (February 1999), pp. 24-34.

Jorgenson, Dale W. and Kevin J. Stiroh. "Information Technology and Growth," American Economic Review (forthcoming, May 1999).

International Monetary Fund. "Chronic Unemployment in the Euro Area: Causes and Cures," World Economic Outlook: Part II (April 20, 1999).

Poole, William. "A St. Louis Fed Perspective on Long-Term Economic Growth," Remarks before the National Association of Manufacturers Board of Directors Meeting, April 16, 1999.

Sichel, Daniel E. "Computers and Aggregate Economic Growth: An Update," Business Economics (April 1999), pp. 18-24.

Womack, James P., Daniel T. Jones, and Daniel Roos. The Machine That Changed The World (New York, NY: HarperPerennial, 1991).

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us