Critiquing the Consumer Price Index

The Senate Finance Committee released a report late last year that claims the consumer price index (CPI) overstates the actual rate of price inflation by a little more than 1 percentage point a year. This report was the product of the Advisory Commission to Study the Consumer Price Index, chaired by Stanford University Professor Michael Boskin.1 Although economists have known for quite some time that the CPI overstates inflation, and thus changes in the cost of living, the report put an old issue back on the front burner: What can the Bureau of Labor Statistics (BLS) do to improve the best known measure of inflation?

The Nuts and Bolts of the CPI

Many people, including Federal Reserve policymakers, view monthly movements in the CPI as a reasonable proxy for changes in the economy's aggregate price level—otherwise known as the inflation rate. This is because the CPI attempts to aggregate a large number of individual prices into a single quantity known as an index number. For example, the BLS collects data on a monthly and bimonthly basis from a "market basket" of about 95,000 goods and services—everything from calculators to CAT scanners. The BLS then ultimately groups these prices into seven major expenditure categories, which are then combined into one number.2

According to economic theory, a price index should be able to measure a change in the cost of maintaining a fixed, or constant, standard of living over time. The basic idea underlying the construction of the CPI is to determine what percentage of specific goods and services—known as weights—the typical consumer purchases each month.3 The BLS does this based on results from the Consumer Expenditure Survey (CES). To gauge how these prices change over time, the CPI holds the weights constant until the next CES is completed, which is about every 10 years. For example, the current CPI uses weights from the 1982-84 CES.

In addition to an inflation gauge, the CPI attempts to measure changes in the cost of living for a large number of people. According to the BLS, the incomes of about 80 million people are adjusted annually based on changes in the CPI. These include recipients of Social Security payments and food stamps, as well as workers covered under collective bargaining agreements. Many public- and private sector wages and pensions are also adjusted this way. By the same token, the IRS uses the CPI to adjust income tax brackets. Clearly, then, an accurate measure of the CPI is crucial for a variety of reasons.

The Boskin Commission Report

In January 1995 testimony before Congress, Federal Reserve Chairman Alan Greenspan caused a stir by arguing that the CPI overstates changes in the cost of living by 0.5 to 1.5 percentage points a year. It was against the backdrop of Chairman Greenspan's testimony that the Senate Finance Committee commissioned the group of economists headed by Professor Boskin to study the issue.

The commission identified four types of biases that, in its view, cause the CPI to overstate changes in the cost of living by about 1.1 percentage points per year.4 The first is substitution bias, which occurs when consumers substitute between types of goods and services when relative prices change. A fixed market basket measure like the CPI assumes that, contrary to standard economic theory, consumers do not substitute Big Macs for Whoppers when the price of one rises relative to the other. In the commission's view, substitution bias accounts for almost 40 percent, or 0.4 percentage points, of the total bias.

The second shortcoming is called new product bias. This occurs when new goods and services are introduced into the economy but are not incorporated into the fixed market basket of the CPI until much later. For example, computers were not incorporated until 1987, and cellular phones will not be added until 1998. A further problem is that a large part of the price declines for many of these new goods occur over the early stages of the product cycle, when they have not yet been included in the CPI.

Related to the new product bias is the problem of quality bias. New and improved products often cost more because of their enhanced features. In theory, however, such improvements should not count as a net price increase to the consumer. Examples that improve living standards include new medical procedures and more energy-efficient central air conditioners. While difficult, accounting for this quality change is nevertheless necessary. The BLS reports that the price index for new cars would have increased by 80 percent more than it actually did from 1967 to 1994 had it made no quality adjustments to the series. Together, the new product and quality biases amount to 0.6 percentage points of the total bias, according to the commission.5

The final type of bias identified is called outlet bias, which occurs because discount stores like Sam's and Wal-Mart tend to sell goods at prices lower than department stores. Thus, if a discount store sells Good X for $100, while the department store sampled by BLS sells the same good for $110, an upward bias will occur if the discount store price is not also included in the sample. In sum, outlet bias is of lesser importance in the commission's view, amounting to just 0.1 percentage points of the total.

What Should Be Done?

The Advisory Commission has recommended that the BLS make the CPI into a true cost of living index by—in essence—following what the Department of Commerce did with the National Income and Product Accounts in January 1996. Previously, the price measures used to calculate real GDP and its components were based on fixed weights like the CPI. Now, however, they are computed using expenditure shares, or weights, that change roughly every other year, rather than every 10 years like the CPI.

Although the BLS agrees with many of the commission's recommendations, Commissioner Katherine Abraham says that to do as the commission suggests, the BLS would require expenditure share data that is not available without more frequent Consumer Expenditure Surveys.

Nonetheless, the BLS is currently publishing an experimental "geometric mean" CPI index that is designed to remove the "lower level" substitution bias noted by the Boskin Commission. Briefly, there are two types of substitution bias, upper and lower level. Lower level bias occurs, for example, because the CPI cannot account for consumer substitution between two brands of ice cream when the price of one changes. Upper level bias, on the other hand, occurs because the CPI cannot account for substitution across expenditure categories—like ice cream and sherbet. When all is said and done, the BLS expects the experimental index to increase by about 0.25 percentage points a year less than the CPI.

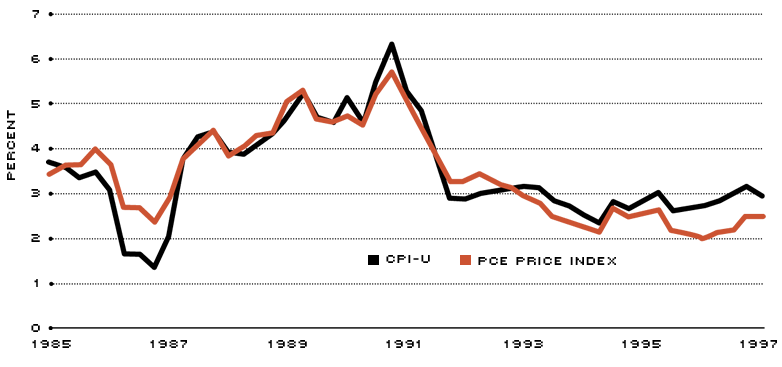

Perhaps a better estimate of consumer price inflation can be derived from the monthly personal consumption expenditures (PCE) price index published by the Commerce Department. This price index is used to convert the GDP's current-dollar value of consumer spending into an inflation-adjusted measure. Although the PCE price index employs existing CPI components, it is—in principle—free of upper level substitution bias. As the figure below indicates, although the two measures increased at roughly the same rate between 1985 and 1992, the PCE deflator has since increased at a much slower pace—2.44 percent a year versus 2.85 percent for the CPI. According to BLS economists, most of this difference is due to the way the PCE index is computed.

Consumer Price Inflation as Measured by the CPI and the PCE Price Index

NOTE: Data represents percentage changes from four quarters earlier.

SOURCE: Bureau of Labor Statistics

Despite its faults, the CPI is well known—both in terms of how it is constructed and its popularity as an income escalator. These attributes, while important, should not deter policymakers from obtaining the best estimates possible under the dual constraints of data availability and economic knowledge.

Endnotes

- The other commission members were Ellen Dulberger of IBM, Robert Gordon of Northwestern University, and Zvi Griliches and Dale Jorgenson of Harvard University. [back to text]

- These seven categories, along with their current expenditure shares, are: housing (41.2 percent), food and beverages (17.5 percent), transportation (17.1 percent), medical care (7.3 percent), apparel and upkeep (5.3 percent), entertainment (4.4 percent), and other (7.1 percent). In all, commodities comprise about 43 percent of the total, while services comprise the remainder. [back to text]

- The CPI measure referred to in this article is the CPI for all urban consumers (CPI-U), which covers about 80 percent of the population. [back to text]

- The commission also reported that the "plausible range" of the total yearly bias could be as little as 0.8 percentage points or as much as 1.6 percentage points. [back to text]

- Not everyone who has studied the issue agrees with this assessment. See Hulten (1997). [back to text]

References

Abraham, Katherine G. "Testimony before the Senate Finance Committee," February 11, 1997.

Boskin, Michael J. "Toward a More Accurate Measure of the Cost of Living," Final report from the Advisory Commission to Study the Consumer Price Index, United States Senate Finance Committee. December 4, 1996.

Hulten, Charles. "Quality Change in the CPI: Some Missing Links," Review, Federal Reserve Bank of St. Louis (forthcoming).

Moulton, Brent R. "Bias in the Consumer Price Index: What Is the Evidence?" Journal of Economic Perspectives (Fall 1996), pp. 159-77.

U.S. Department of Labor. BLS Handbook of Methods. Bureau of Labor Statistics, Bulletin 2414 (September 1992).

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us