Learning the Lessons of History: The Federal Reserve and the Payments System

—Federal Reserve Board Chairman Alan Greenspan, Oct. 20, 1987

The day after the stock market crash in October 1987, the Federal Reserve announced that it would lend freely to banks—which it did for a brief period—so that they would have enough funds available to make quick loans to brokerage houses that needed them. If the Fed hadn't acted in this manner, a panic could have ensued, causing a drain on funds at banks, which could have reverberated throughout the economy.

The Fed's swift action in 1987 illustrates one of the more dramatic ways the central bank can prevent a market aberration from becoming a crisis in the banking and payments systems. In contrast, about 65 years ago, the Fed's slow response to the banking system's crises is now widely considered to be the overriding cause of the Great Depression.1 By floundering in its response, the Fed not only exacerbated a severe economic downturn, but also failed to achieve its Congressional mandate "to furnish an elastic currency."

Preserving Public Confidence

"To furnish an elastic currency" essentially means that the Federal Reserve is responsible for ensuring that there are sufficient reserves—cash in bank vaults and bank deposits at the Fed—to satisfy the flow of transactions in the American economy. By including this clause in the Federal Reserve Act of 1913, the drafters sought to provide stability to the nation's payments system and to preserve the public's confidence in it.

The Fed accomplishes these goals in part by providing stability to the nation's banking system, which is tantamount to supporting the payments system because all payments—except those made with cash or through barter—eventually pass through the banking system. The Fed regularly promotes and preserves public confidence in both of these systems in several ways: by engaging in bank supervision and regulation, by providing certain payment services itself, by assuming credit risk in the course of settling interbank liabilities and, in times of crisis, by acting as a bank for banks.

Protecting the Payments System

All noncash payments pass through the banking system at some point in the settlement process. Hence, deposits at banks play an integral role in the clearing of transactions. Declines in the levels of deposits translate into fewer reserves with which to settle transactions. Furthermore, the failure of one bank to settle its payments can ripple throughout the banking system, causing the reversal of many transactions. As Gerald Corrigan, former president of the New York Fed, has stated, "A serious credit problem at any of the large users of the [payments] systems has the potential to disrupt the system as a whole...to trigger the feared chain reaction."2

As part of its daily operations, the Fed reduces the chance of such ripple effects by clearing transactions like checks through adjustments to the accounts banks keep with it (called reserve accounts). The Fed assumes some credit risk associated with nonpayment because it generally credits the receiving bank's reserve account, thereby finalizing payment, before it collects from the paying bank. By assuming this risk, the Fed promotes confidence in the current, credit-based payments system and protects its smooth operation. Any loss of faith in this system would result in more cash-based and fewer credit-based transactions, thereby reducing efficiency in payment mechanisms and increasing the costs of transactions.3

Despite these efforts, unanticipated market circumstances could cause the ripple effect described by Corrigan, thereby requiring a more drastic response from the Fed. If, for example, a bank failure were to cause a run on banks because of consumers' fears about the safety of their bank deposits, the Fed would be able to preserve confidence in the banking system, protect the payments system and avert a systemic crisis by supplying the needed liquidity to banks; that is, it would become the lender of last resort.

The Lender of Last Resort

When a bank is required to keep only a fraction of its transaction account deposits as reserves, and when these deposits are convertible into cash on demand, it could, at any given time, find itself without enough cash in its vault to meet customer demands. Alternatively, a bank could discover that it does not have enough reserves on hand to settle its daily transactions. In either event, the bank is usually able to borrow funds from the money market to overcome the temporary cash shortfall.

What if, however, many banks find themselves short of reserves at the same time? And what if the public, upon learning that banks are illiquid, decides en masse to convert its deposits into cash? This could signal the start of a systemic crisis, during which banks' demand for reserves increases dramatically. The money market, however, might not be able to satisfy this unexpectedly sharp increase in the demand for reserves. In such a situation, the lender of last resort—because it is the ultimate source of liquidity for the financial system—is the only institution that can supply the additional reserves necessary to finance the entire banking system's liquidity needs on demand.

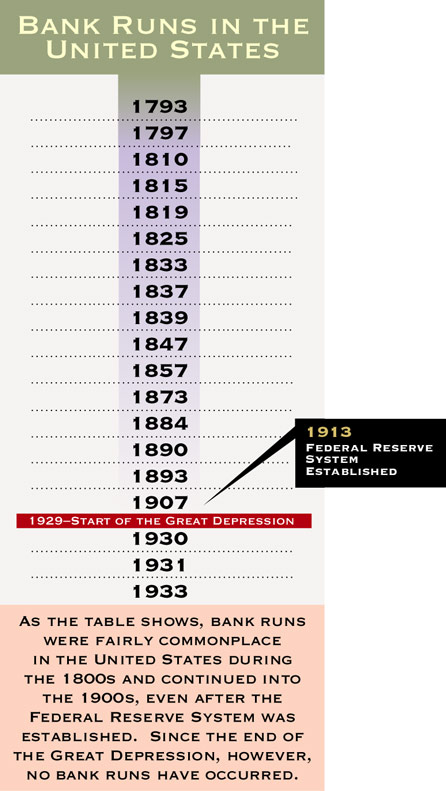

Consequently, many economists have argued that the primary role of the lender of last resort is stopping a particular crisis from evolving into a systemic crisis.4 Individual banks may fail—it is not the lender of last resort's responsibility to bail out insolvent banks—but the economy won't because the actions of the lender of last resort, if properly taken, reassure the public and financial markets that the liquidity needed to settle transactions and convert deposits into cash will be available. (See table above.) Without this infusion of reserves, the stock of money would decline as deposits are converted into cash, which might lead to interruptions in payments and, ultimately, a decline in real economic activity.

To succeed in this role in times of crisis, the lender of last resort must not behave like a regular bank by calling in loans or restricting convertibility of deposits into cash. Instead, it must assist the entire financial system and "expand its [currency] issue and loans at the very time the banker is contracting."5 Therefore, a public, rather than private, institution is better suited for the job because it is more likely to act against market impulses in times of crisis. In the 19th century, for example, private clearinghouses—establishments maintained by banks for settling mutual claims and accounts—served as limited lenders of last resort during crises. At times they were successful, but often their actions were too late or too discriminate.6

Which public institution, then, is best suited to be the lender of last resort? A nation's central bank, because it is generally the monopoly provider of the economy's currency. In other words, when only the central bank issues bank notes, as is the case in the United States, it alone has the ability to increase their availability to the financial system, thus giving it the role of lender of last resort.

A Smooth Operation

Safeguarding the smooth operation of the payments system, therefore, falls under the purview of the central bank. As the monopoly provider of legal tender, it is in a unique position to saturate the market with reserves should the demand for them increase substantially and unexpectedly because of a market shock—for example, a stock market crash—or a bank failure. Stemming a crisis often requires immediate action by the lender of last resort. In taking such action, the central bank provides stability to and reinforces the public's confidence in the payments system. Should the public lose this confidence, the system could unravel, leaving in its wake a much less efficient and more costly means of transacting. Thus, furnishing an elastic currency is more than just a Congressional mandate, it's a fundamental role the Fed must play for our money-based economy to function properly.

Endnotes

- See Friedman and Schwartz (1963), Chapter 7, or Wheelock (1992) for more details and other references. [back to text]

- Flannery (1988) discusses the ripple effect. [back to text]

- For example, buying a house or car with cash is less efficient than writing a check because of the costs associated with obtaining, storing and transporting the cash. [back to text]

- See, for example, Solow (1982) and Humphrey (1989). [back to text]

- See Humphrey (1989) for a discussion of the actions the lender of last resort should take during a financial crisis. [back to text]

- Timberlake (1984) and Dwyer and Gilbert (1989) discuss the attempts by clearinghouse associations to act as lenders of last resort. Many economists and historians have argued that during the Panic of 1907, the late response of the New York Clearing House, as well as its early denial of assistance to a trust company that was not one of its members, fueled the panic. The panic was the impetus for the creation of the Federal Reserve System. See, for example, Friedman and Schwartz (1963), pp. 156-68, for an account of the Panic of 1907. [back to text]

References

Dwyer, Gerald P., and R. Alton Gilbert. "Bank Runs and Private Remedies," Federal Reserve Bank of St. Louis Review (May/June 1989), pp. 43-61.

Flannery, Mark J. "Payments System Risk and Public Policy." In William S. Haraf and Rose M. Kushmeider (eds.), Restructuring Banking and Financial Services in America. Washington, D.C.: American Enterprise Institute for Public Policy Research (1988), pp. 261-87.

Friedman, Milton, and Anna Jacobson Schwartz. A Monetary History of the United States 1867-1960. Princeton, N.J.: Princeton University Press (1963).

Humphrey, Thomas M. "Lender of Last Resort: The Concept in History." Federal Reserve Bank of Richmond Economic Review (March/April 1989), pp. 8-16.

Schwartz, Anna J. "Financial Stability and the Federal Safety Net." In William S. Haraf and Rose M. Kushmeider (eds.), Restructuring Banking and Financial Services in America. Washington, D.C.: American Enterprise Institute for Public Policy Research (1988), pp. 34-62.

Solow, Robert M. "On the Lender of Last Resort." In Charles P. Kindleberger and Jean-Pierre Laffargue (eds.), Financial Crises: Theory, History, and Policy. Cambridge: Cambridge University Press (1982), pp. 237-48.

Timberlake, Richard H., Jr. "The Central Banking Role of Clearinghouse Associations," Journal of Money, Credit,and Banking (February 1984), pp. 1-15.

Wheelock, David C. "Monetary Policy in the Great Depression: What the Fed Did, and Why." Federal Reserve Bank of St. Louis Review (March/April 1992), pp. 3-28.

Views expressed in Regional Economist are not necessarily those of the St. Louis Fed or Federal Reserve System.

For the latest insights from our economists and other St. Louis Fed experts, visit On the Economy and subscribe.

Email Us